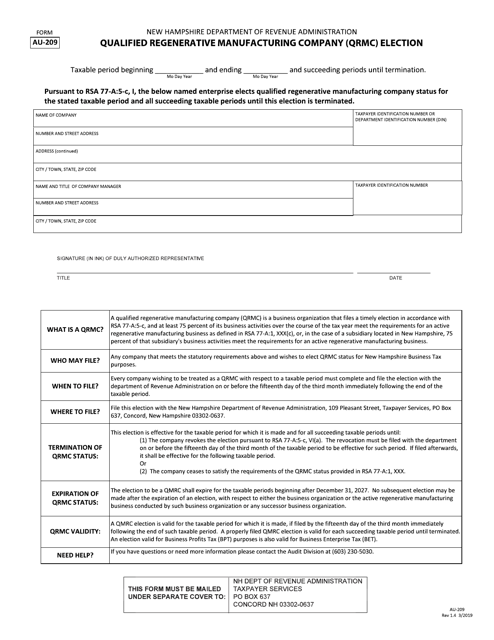

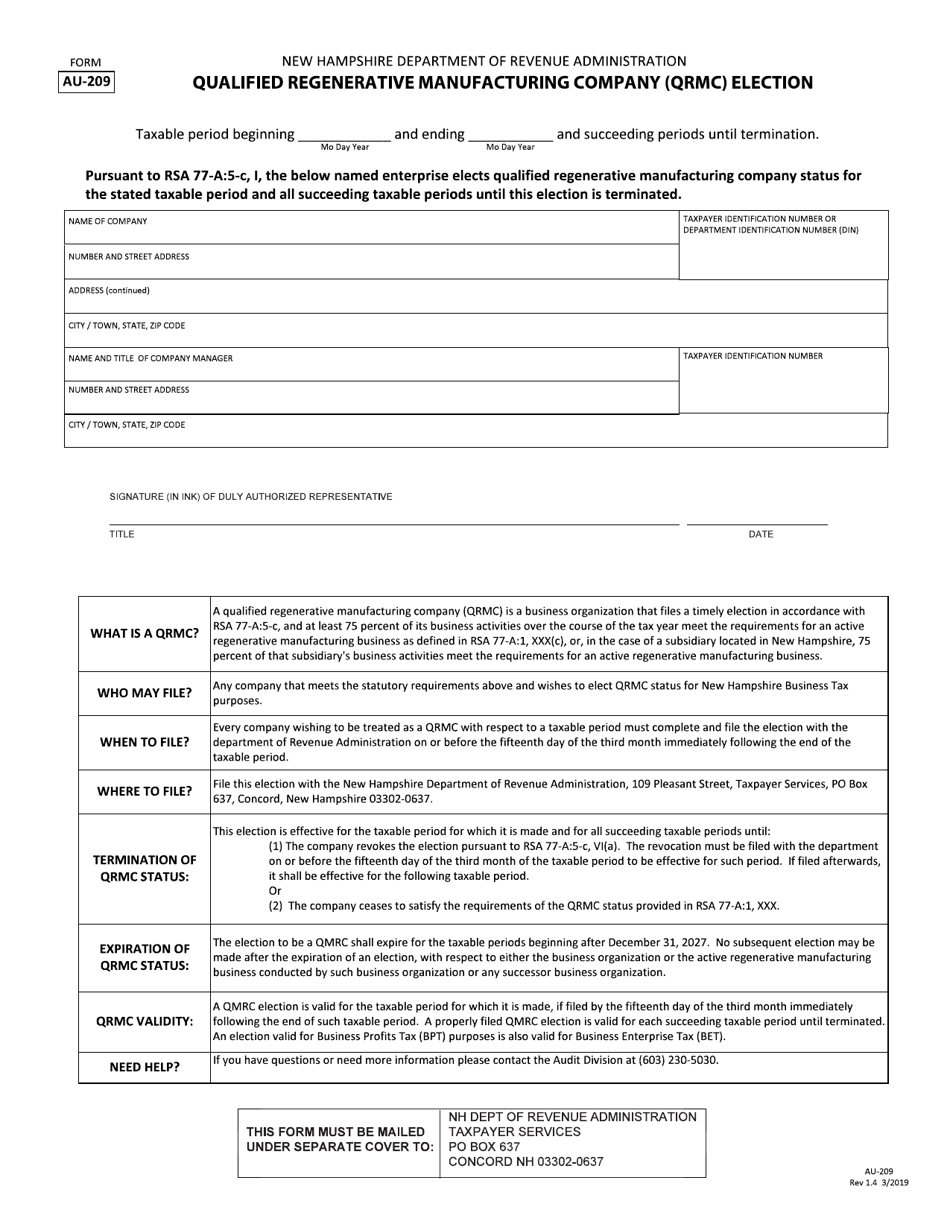

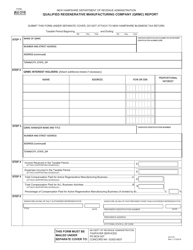

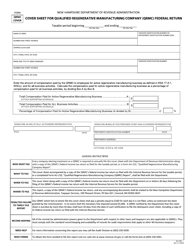

Form AU-209 Qualified Regenerative Manufacturing Company (Qrmc) Election - New Hampshire

What Is Form AU-209?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is AU-209 Qualified Regenerative Manufacturing Company (Qrmc) Election?

A: It is a form used in New Hampshire for electing to be a Qualified Regenerative Manufacturing Company (Qrmc).

Q: What is a Qualified Regenerative Manufacturing Company (Qrmc)?

A: A Qualified Regenerative Manufacturing Company (Qrmc) is a company that engages in certain manufacturing activities and meets certain criteria to receive tax benefits in New Hampshire.

Q: What is the purpose of the AU-209 form?

A: The purpose of the AU-209 form is to notify the state of New Hampshire that a company is electing to be a Qualified Regenerative Manufacturing Company (Qrmc) and to provide relevant information for tax benefits.

Q: Who needs to fill out the AU-209 form?

A: Companies in New Hampshire that meet the criteria for a Qualified Regenerative Manufacturing Company (Qrmc) and wish to receive tax benefits need to fill out the AU-209 form.

Q: What are the tax benefits of being a Qualified Regenerative Manufacturing Company (Qrmc)?

A: Qualified Regenerative Manufacturing Companies (Qrmcs) in New Hampshire may be eligible for various tax benefits, such as property tax exemptions and tax credits.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AU-209 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.