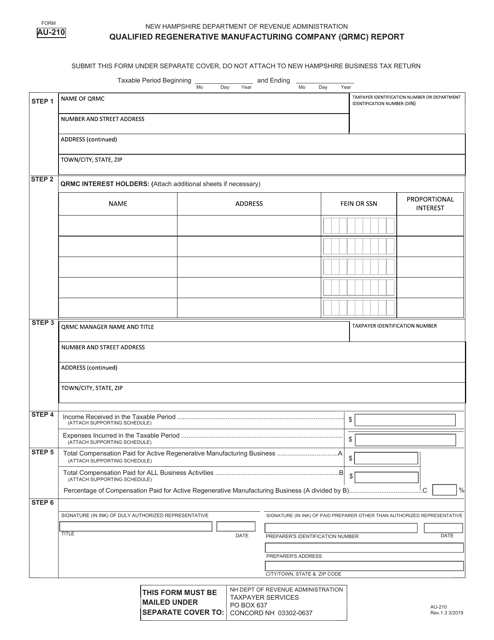

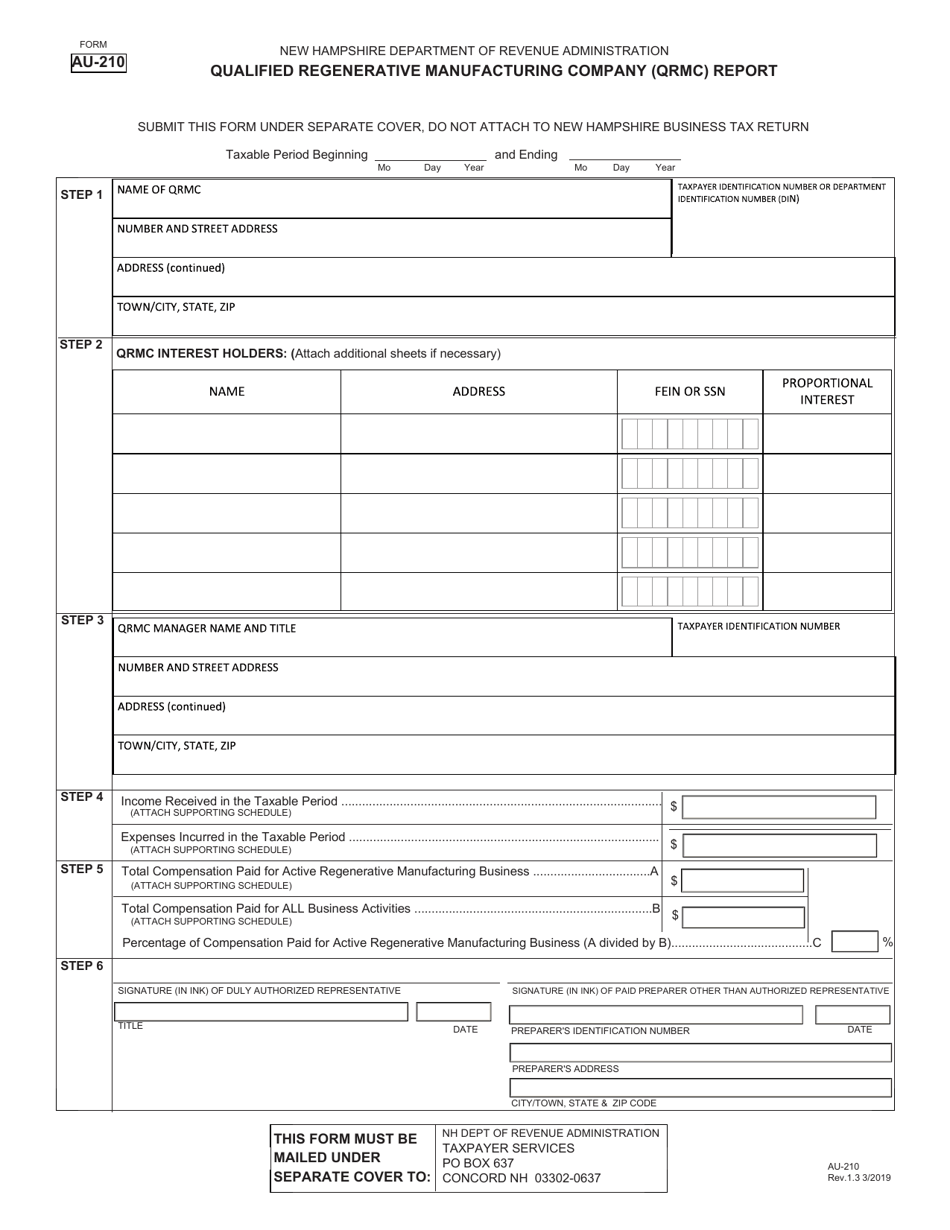

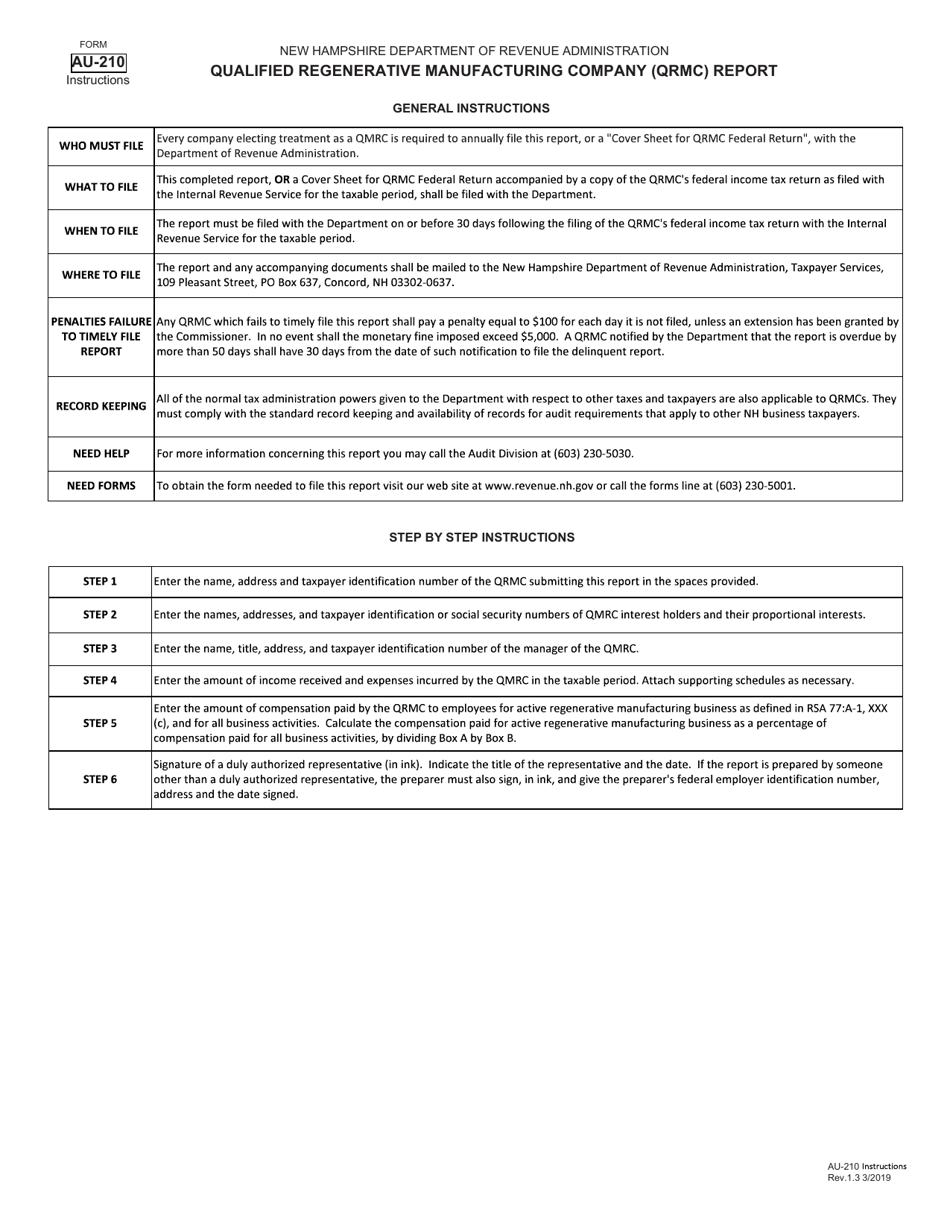

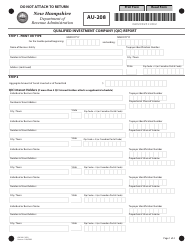

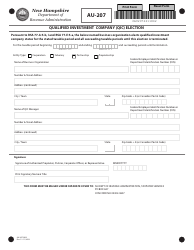

Form AU-210 Qualified Regenerative Manufacturing Company (Qrmc) Report - New Hampshire

What Is Form AU-210?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is AU-210?

A: AU-210 is a form used for reporting Qualified Regenerative Manufacturing Companies (QRMCs).

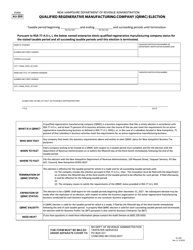

Q: What is a Qualified Regenerative Manufacturing Company (QRMC)?

A: A Qualified Regenerative Manufacturing Company (QRMC) is a company that engages in regenerative manufacturing activities and meets certain criteria.

Q: What is regenerative manufacturing?

A: Regenerative manufacturing is a process that involves the creation or repair of biological tissues, organs, or other structures using advanced technologies such as 3D printing or tissue engineering.

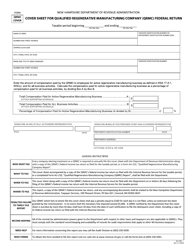

Q: Why is the AU-210 form important?

A: The AU-210 form is important as it allows QRMCs to report their activities and seek qualification status in order to avail certain benefits and incentives.

Q: What benefits and incentives are available to QRMCs?

A: QRMCs may be eligible for tax credits, grants, and other incentives provided by the state of New Hampshire to promote regenerative manufacturing.

Q: Who is eligible to fill out the AU-210 form?

A: Companies engaged in regenerative manufacturing activities in the state of New Hampshire may be eligible to fill out the AU-210 form.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AU-210 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.