This version of the form is not currently in use and is provided for reference only. Download this version of

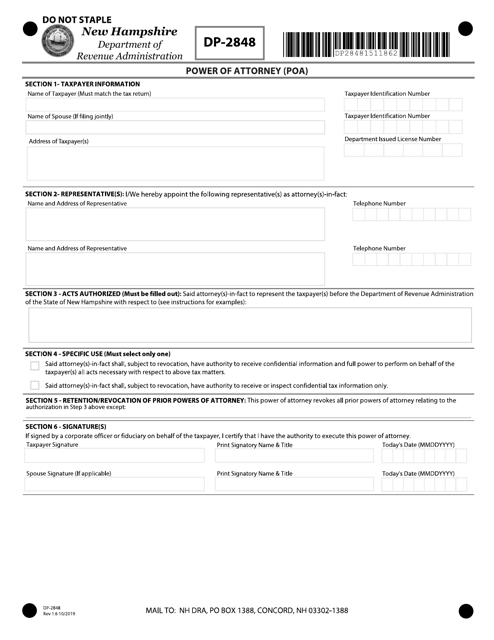

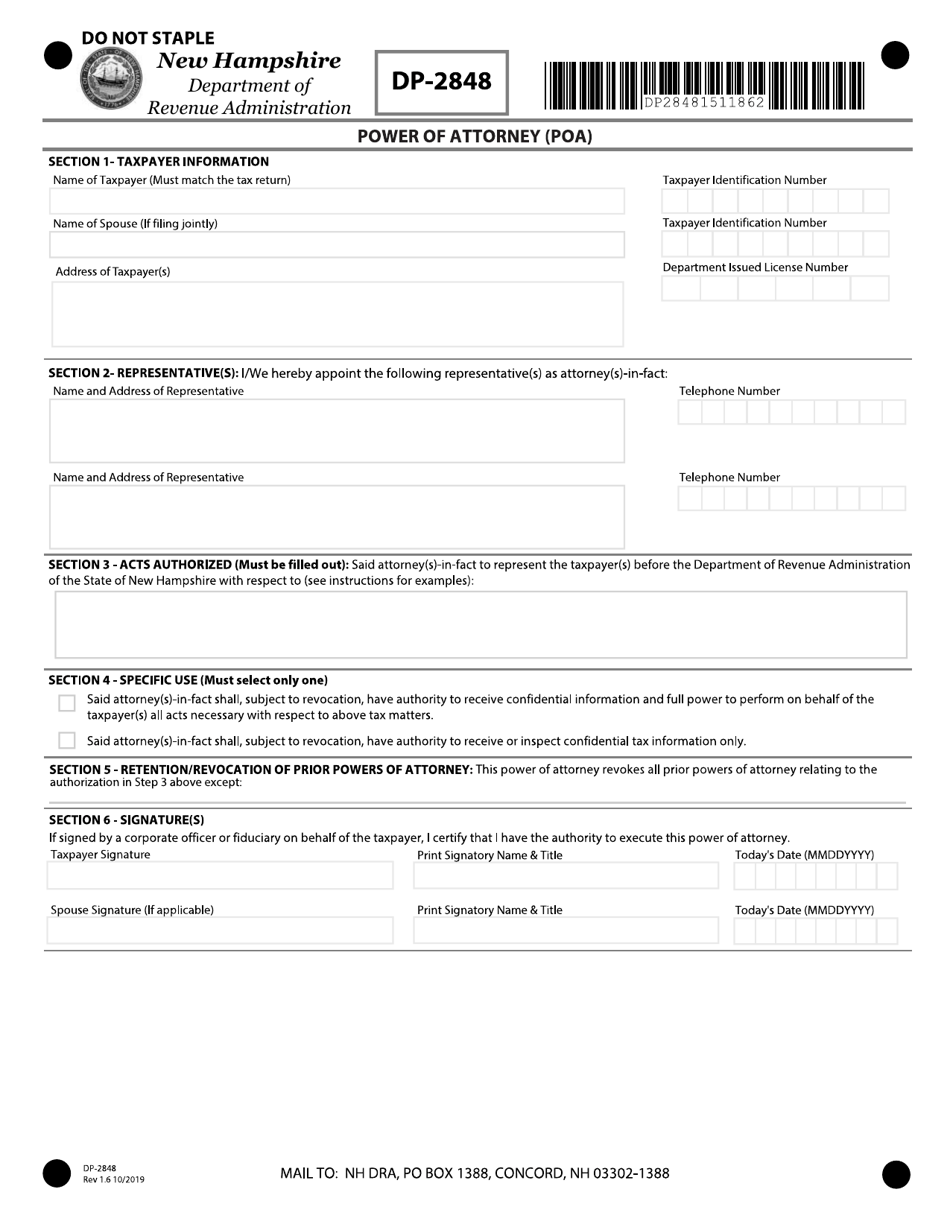

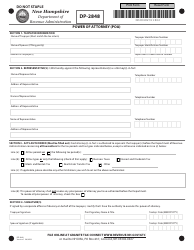

Form DP-2848

for the current year.

Form DP-2848 Power of Attorney (Poa) - New Hampshire

What Is Form DP-2848?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

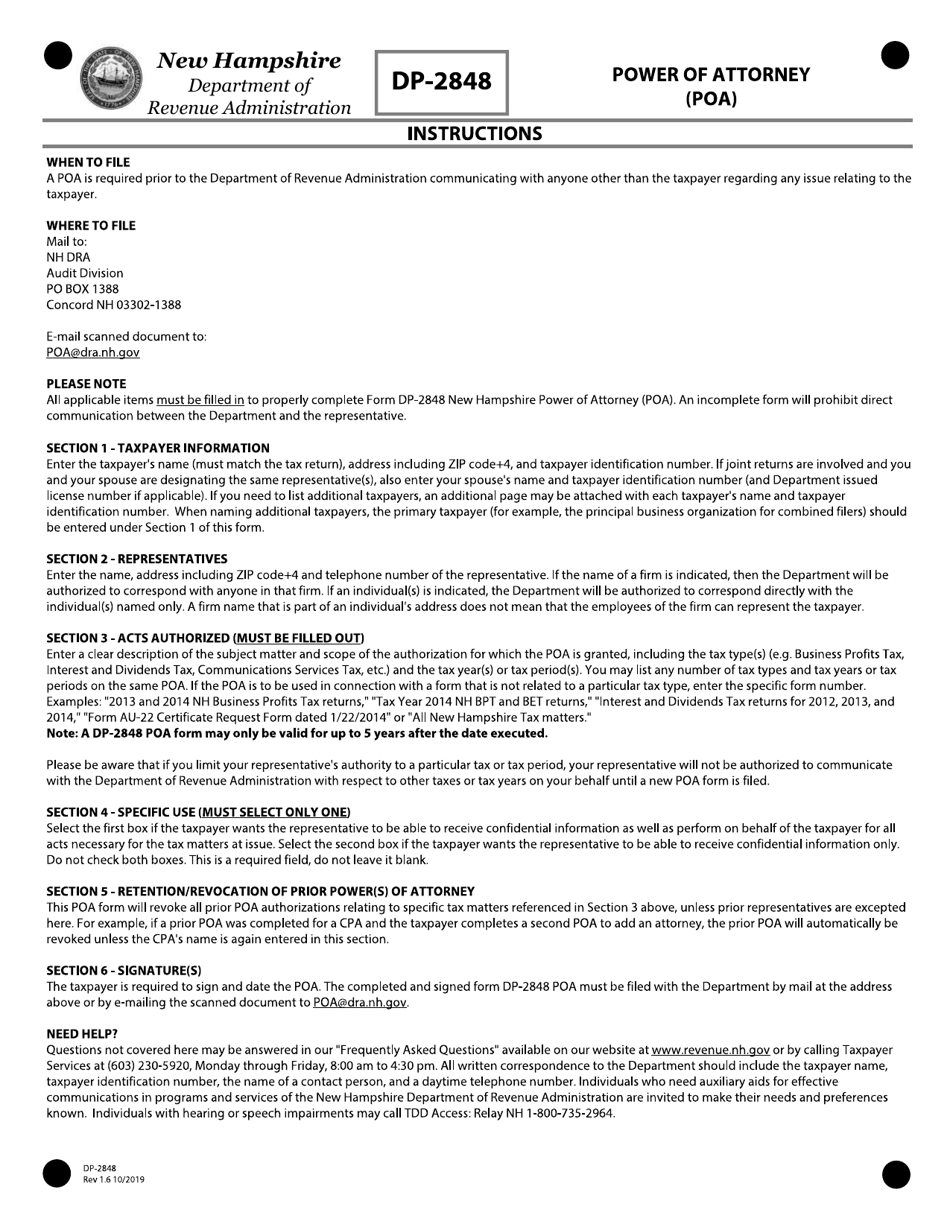

Q: What is Form DP-2848?

A: Form DP-2848 is a Power of Attorney (POA) form used in the state of New Hampshire.

Q: What is a Power of Attorney?

A: A Power of Attorney is a legal document that allows someone (the agent or attorney-in-fact) to act on behalf of another person (the principal) for various financial and legal matters.

Q: Who can use Form DP-2848?

A: Form DP-2848 can be used by individuals in New Hampshire who want to grant someone else the authority to handle their financial and legal affairs.

Q: What types of powers can be granted with Form DP-2848?

A: Form DP-2848 allows for the grant of general or specific powers, including the ability to sign tax returns, enter into agreements, and handle banking and financial matters.

Q: Do I need to have a lawyer to fill out Form DP-2848?

A: While it is not required to have a lawyer, it is recommended to consult with an attorney when filling out Form DP-2848 to ensure all legal requirements are met.

Q: Do I need to file Form DP-2848 with any government agency?

A: Form DP-2848 does not need to be filed with any government agency. It is a document that should be kept by the principal and provided to the agent as needed.

Q: Can I revoke a Power of Attorney granted through Form DP-2848?

A: Yes, a Power of Attorney can be revoked at any time by the principal. A written revocation should be prepared and delivered to the agent and any relevant parties.

Q: What happens if the agent abuses their power under Form DP-2848?

A: If an agent abuses their power under Form DP-2848, they can be subject to legal consequences and may be held liable for any damages caused.

Q: How long is Form DP-2848 valid for?

A: The validity of Form DP-2848 depends on the specific terms outlined in the document. It can be limited to a specific time period or remain in effect until it is revoked or the principal becomes incapacitated.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-2848 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.