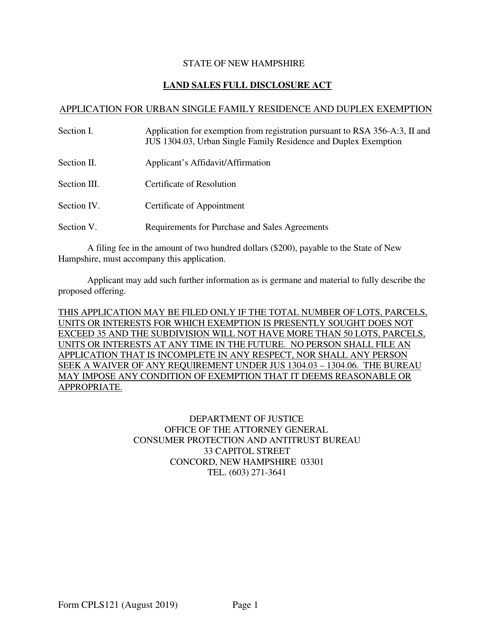

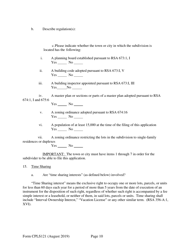

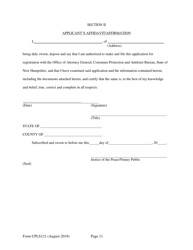

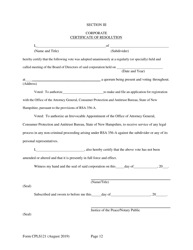

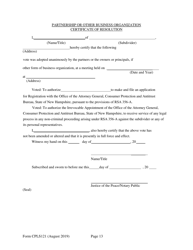

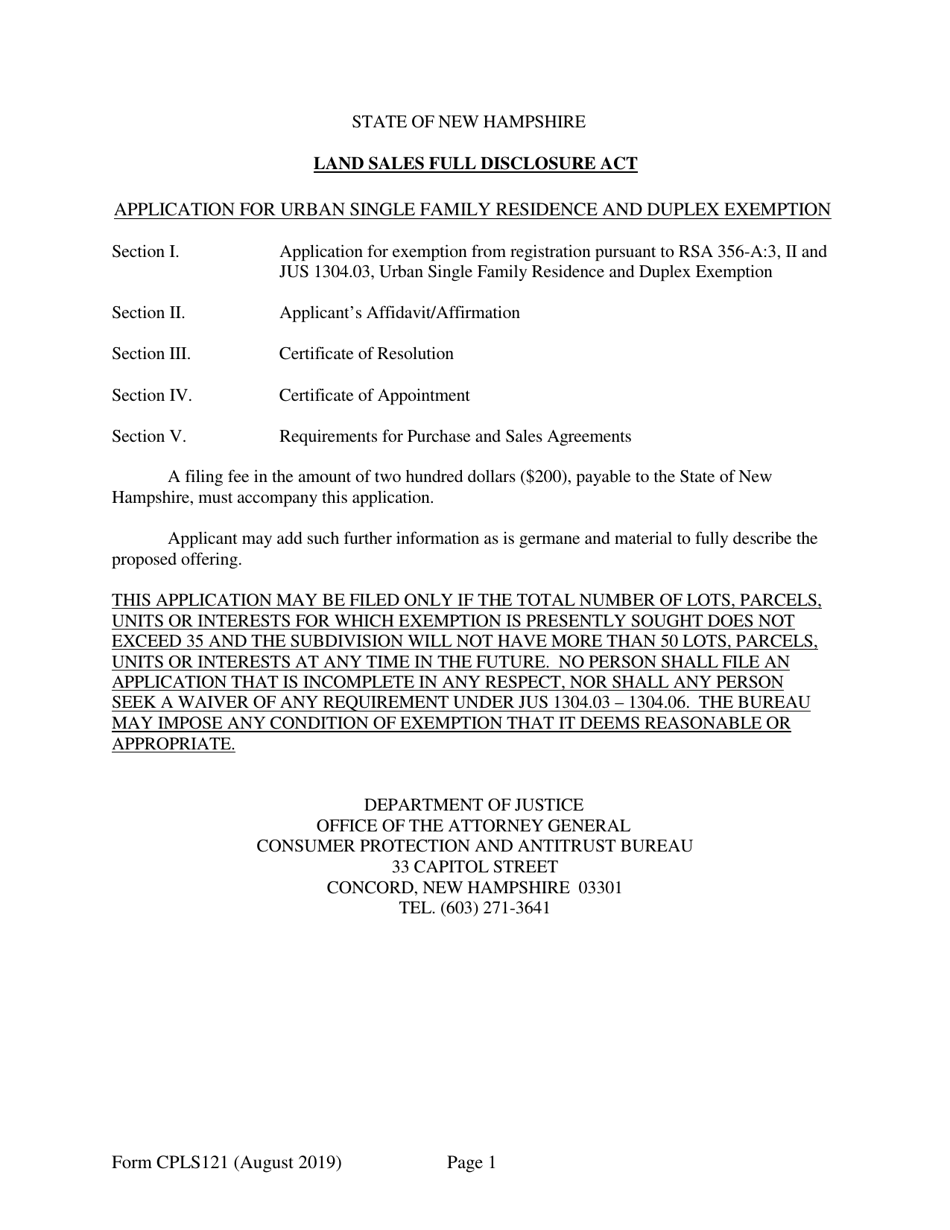

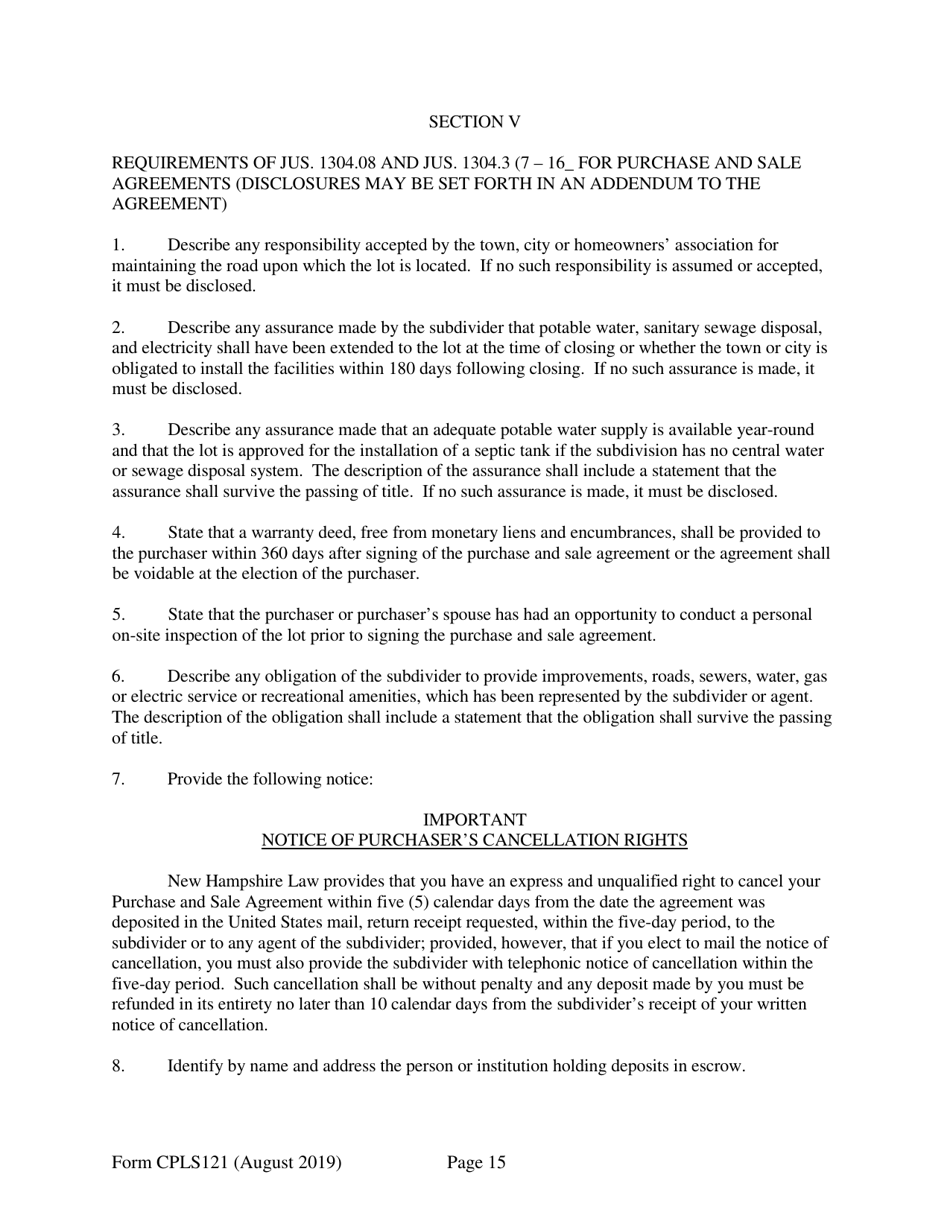

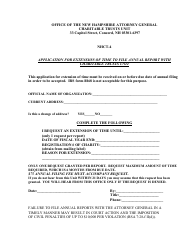

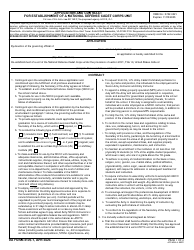

Form CPLS121 Application for 25 Unit Exemption - New Hampshire

What Is Form CPLS121?

This is a legal form that was released by the New Hampshire Department of Justice - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CPLS121?

A: CPLS121 is the form for applying for a 25-unit exemption in New Hampshire.

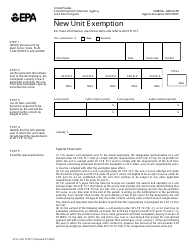

Q: What is a 25-unit exemption?

A: A 25-unit exemption is a type of property tax exemption for rental units in New Hampshire.

Q: How do I apply for a 25-unit exemption?

A: You can apply for a 25-unit exemption by filling out the CPLS121 application form.

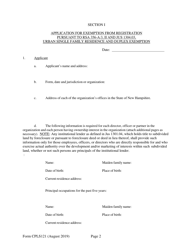

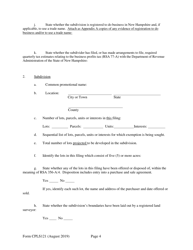

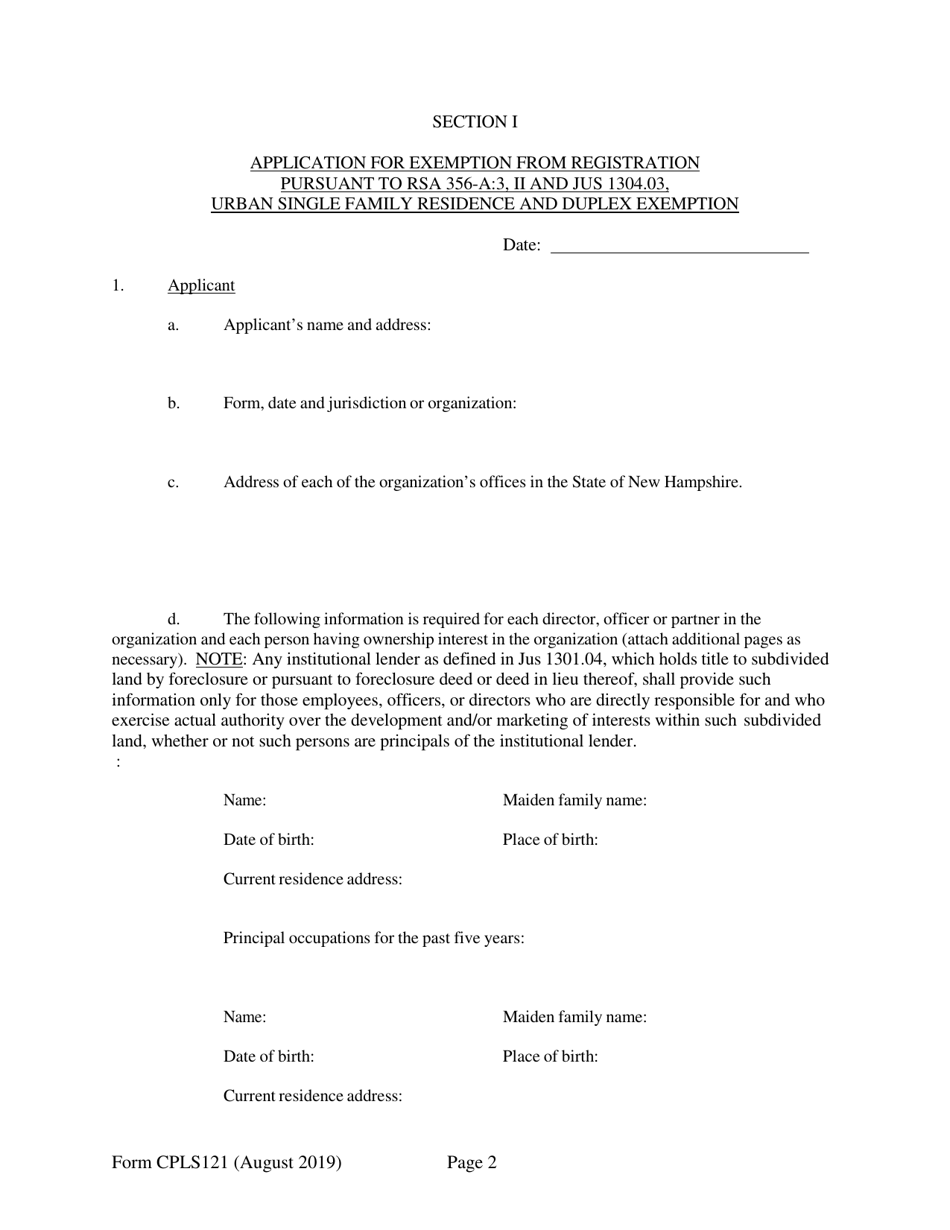

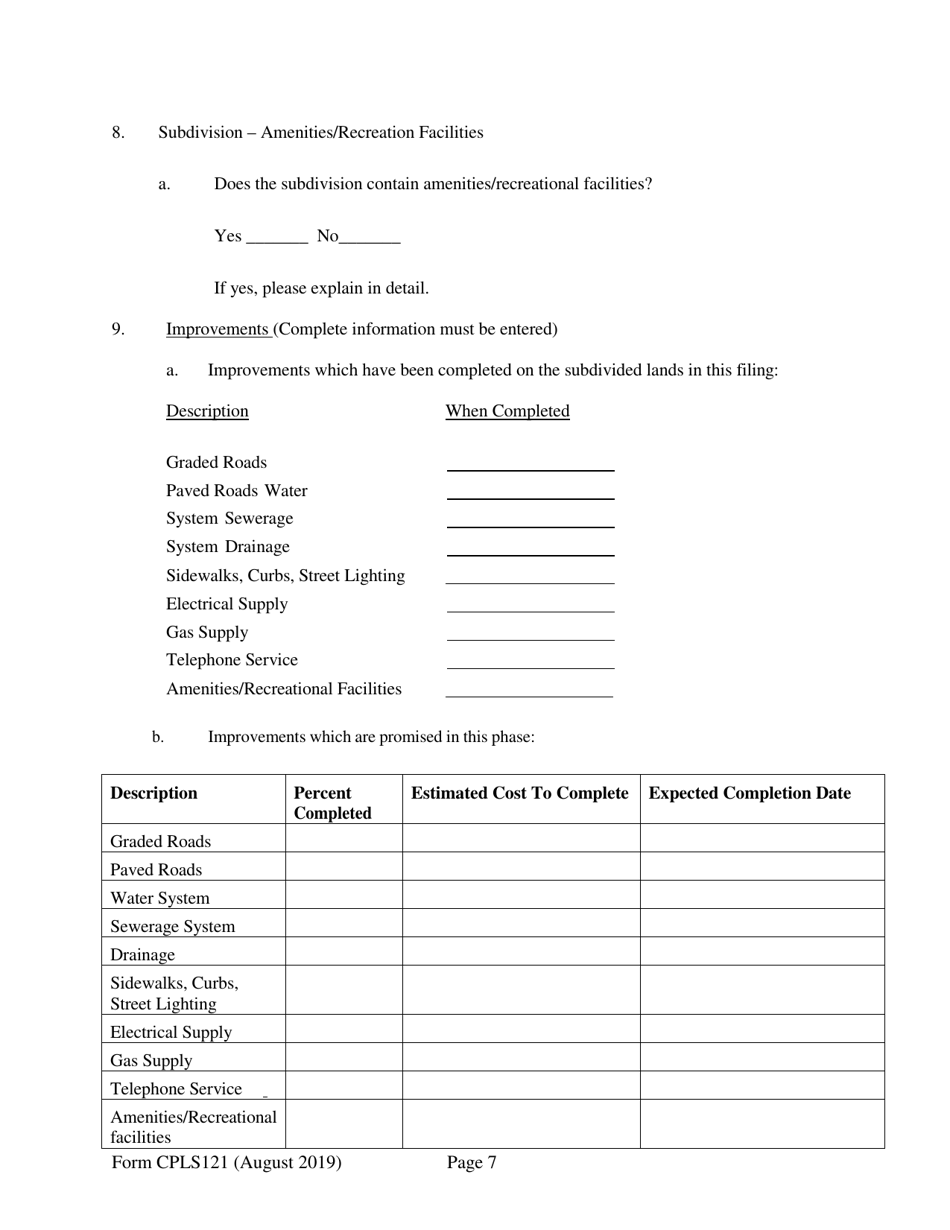

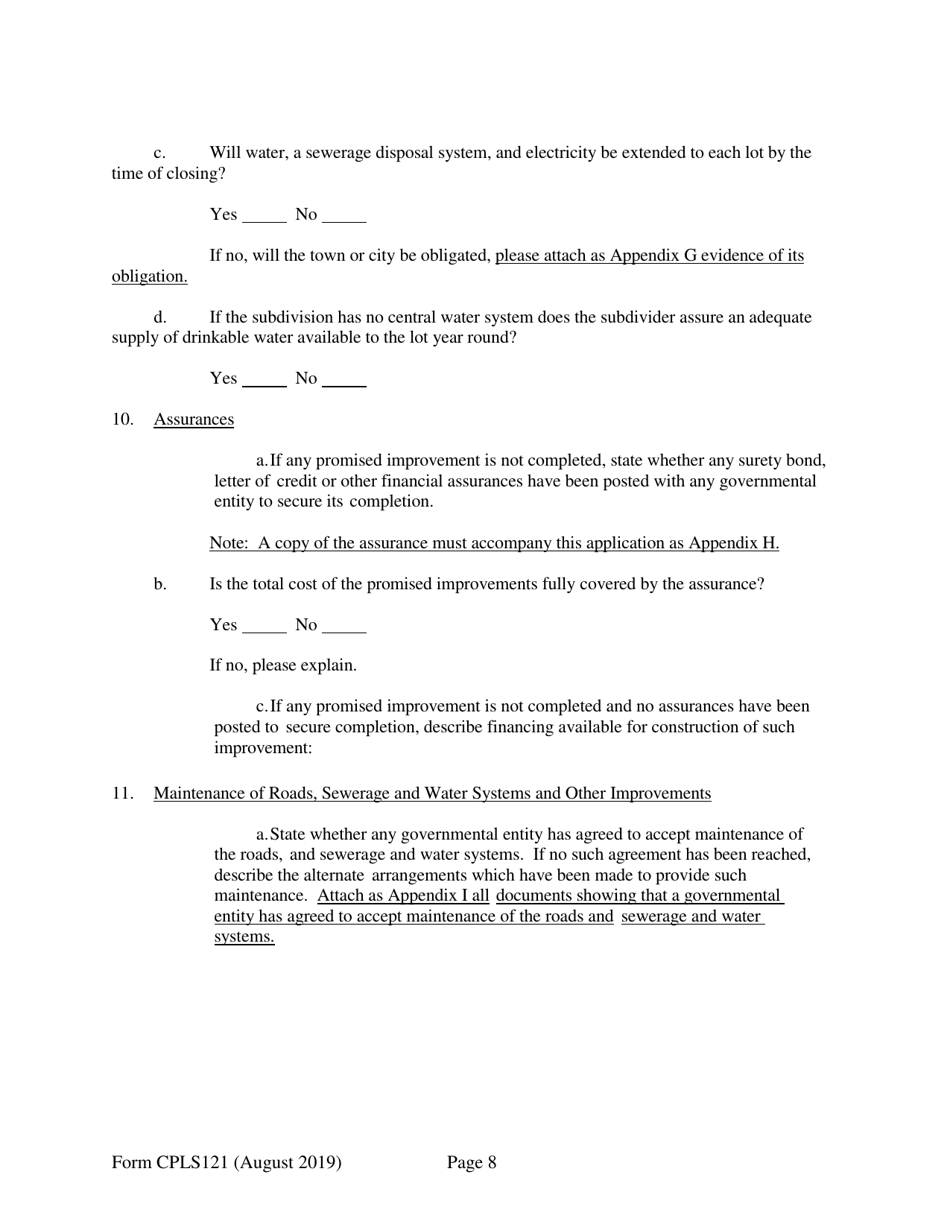

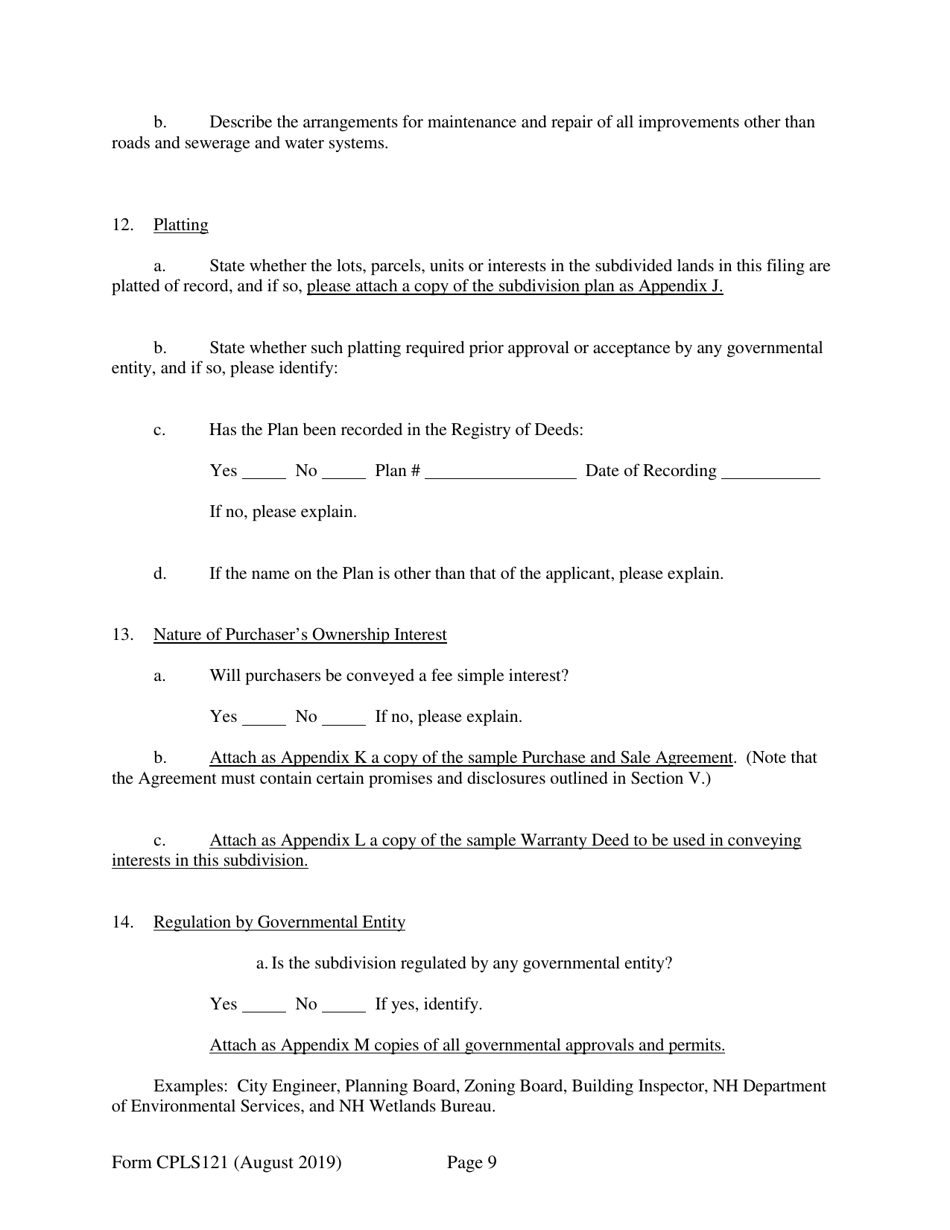

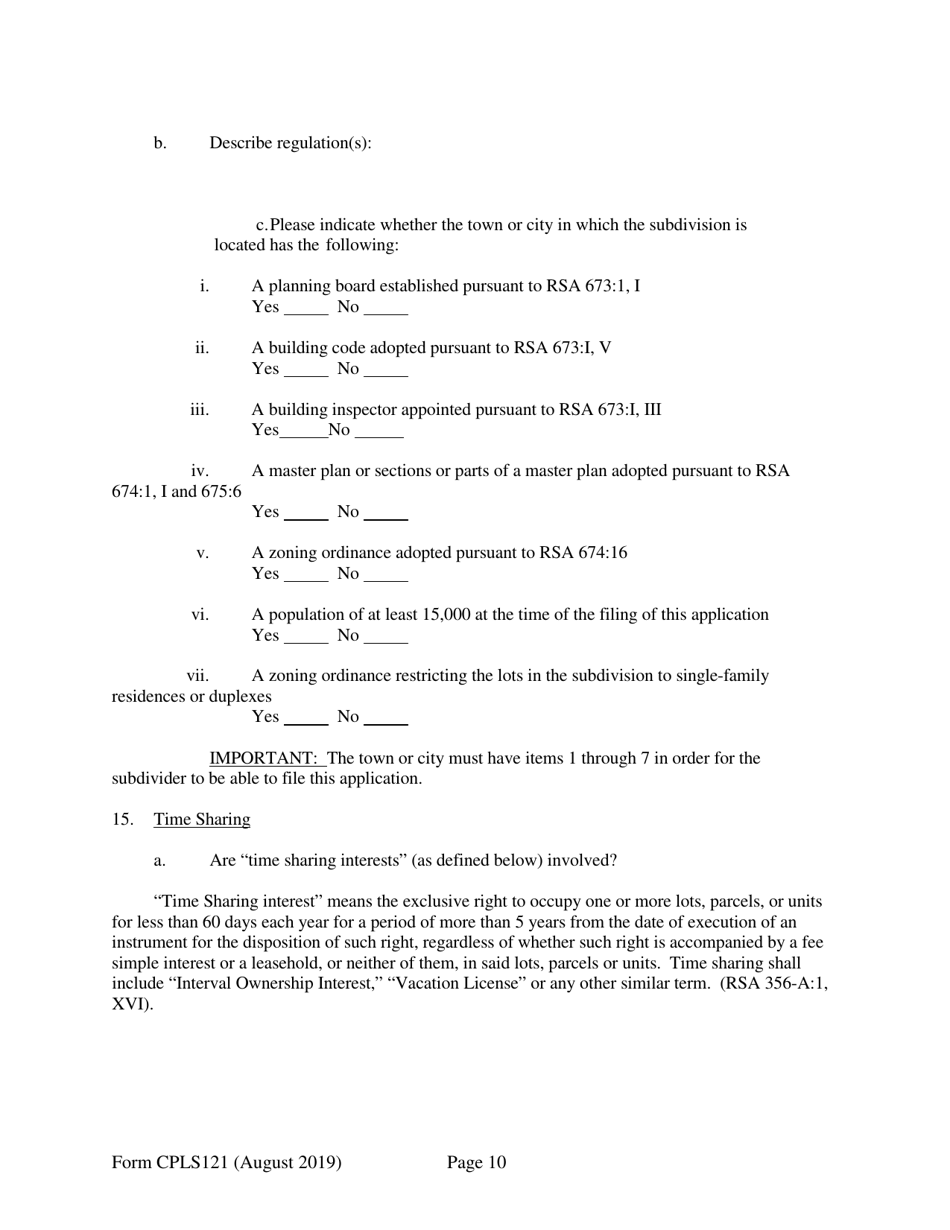

Q: What information do I need to provide on the CPLS121 application?

A: You will need to provide information about your rental units, including the number of units and their locations.

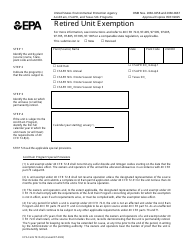

Q: Is there a fee for applying for a 25-unit exemption?

A: There is no fee for applying for a 25-unit exemption in New Hampshire.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the New Hampshire Department of Justice;

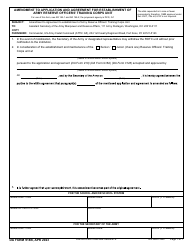

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CPLS121 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Justice.