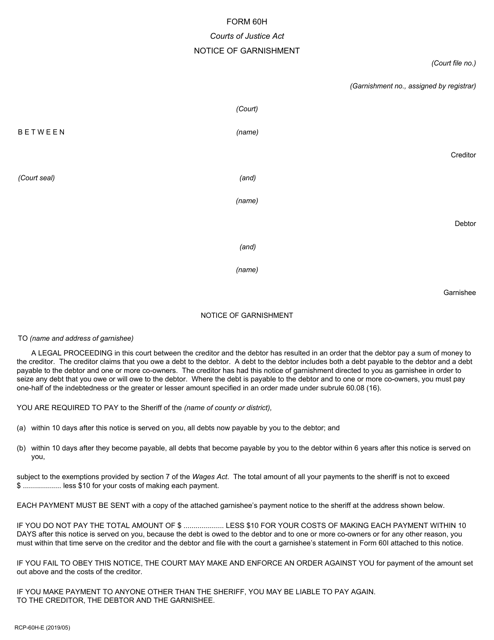

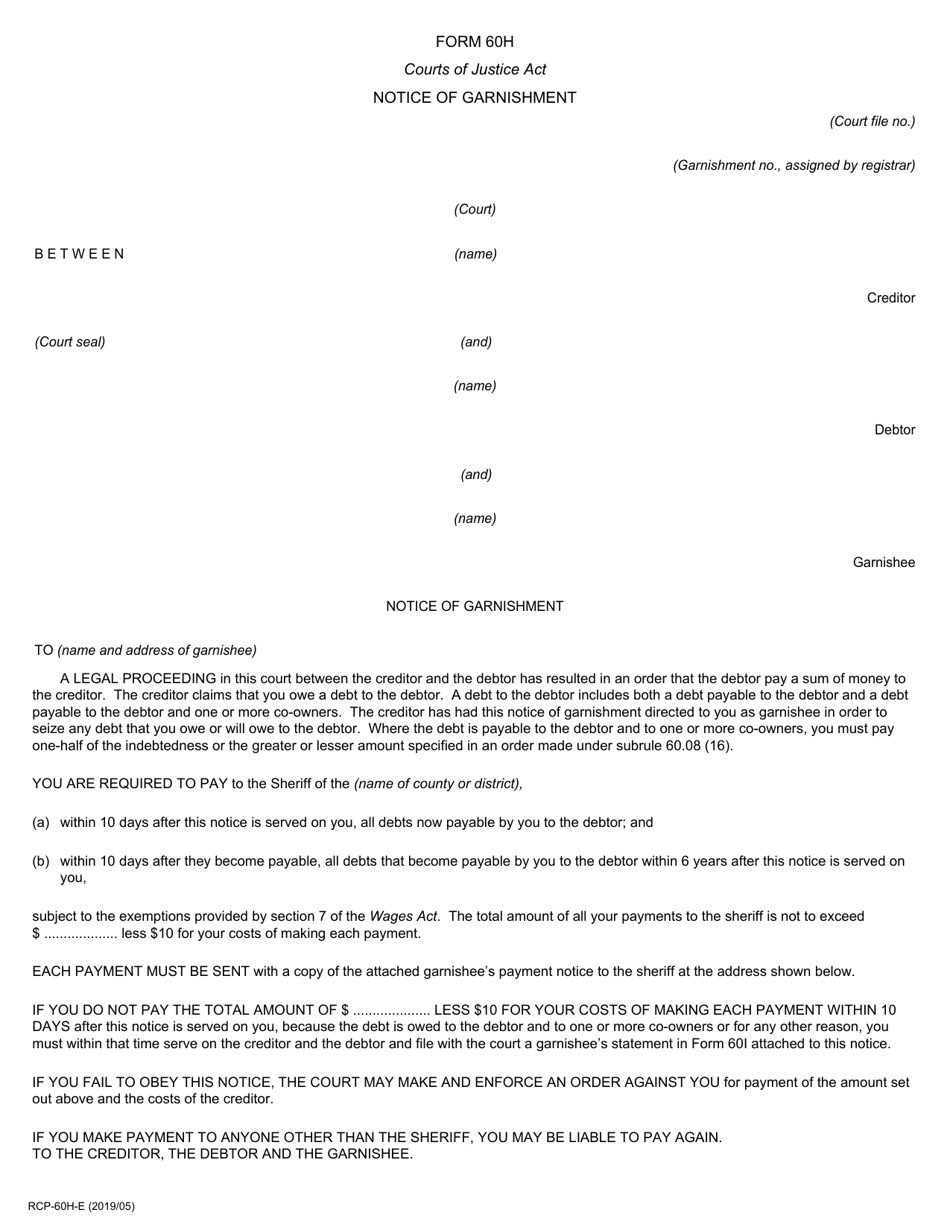

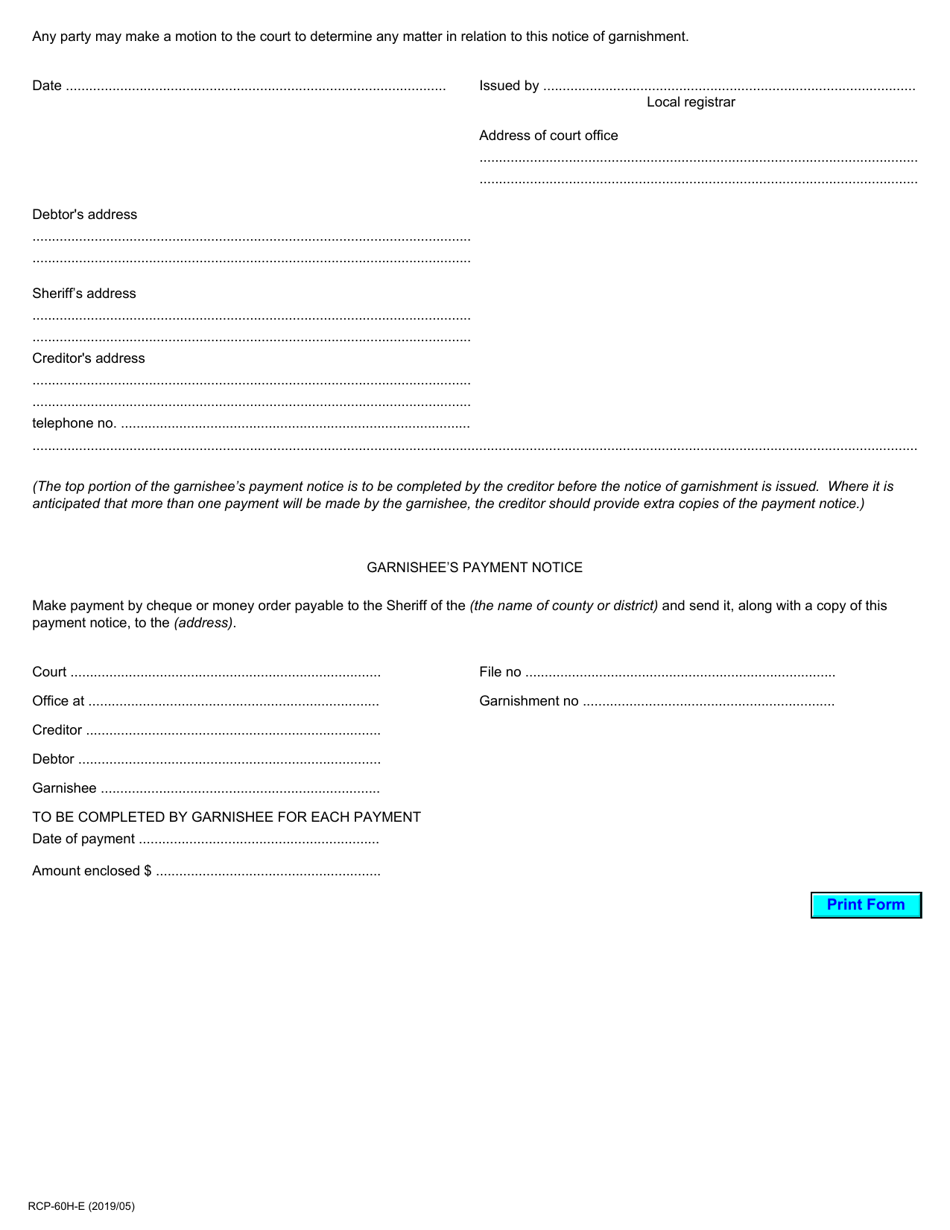

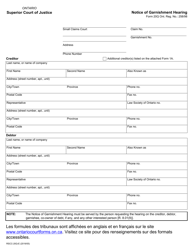

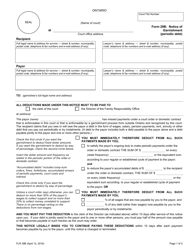

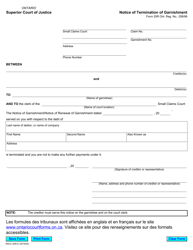

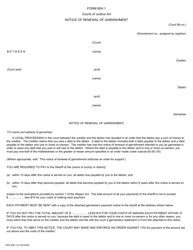

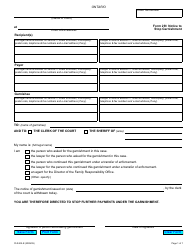

Form 60H Notice of Garnishment - Ontario, Canada

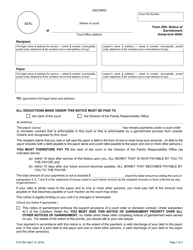

Form 60H Notice of Garnishment in Ontario, Canada is used by creditors to notify your employer or other third parties to withhold a portion of your wages or other income to pay off a debt that you owe.

In Ontario, Canada, the Form 60H Notice of Garnishment is typically filed by the judgment creditor.

FAQ

Q: What is a Form 60H?

A: Form 60H is a Notice of Garnishment used in Ontario, Canada.

Q: What is a Notice of Garnishment?

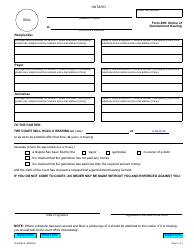

A: A Notice of Garnishment is a legal document used to inform a person or entity that their wages, bank accounts, or other assets may be subject to garnishment to satisfy a debt.

Q: When is Form 60H used?

A: Form 60H is used when a creditor wants to garnish the wages of a debtor in Ontario, Canada.

Q: Who can issue a Form 60H?

A: A Form 60H can be issued by a creditor or their representative, such as a lawyer or collection agency.

Q: What information is included in a Form 60H?

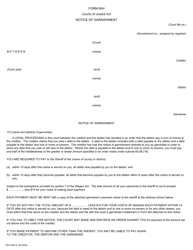

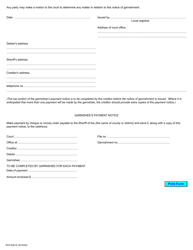

A: A Form 60H typically includes details about the creditor, debtor, amount owed, and instructions for the garnishee (person or entity holding the debtor's assets).

Q: What should a recipient do upon receiving a Form 60H?

A: Upon receiving a Form 60H, the recipient should carefully review the document, seek legal advice if needed, and comply with the instructions outlined.

Q: What happens if a recipient ignores or fails to respond to a Form 60H?

A: If a recipient ignores or fails to respond to a Form 60H, their wages or assets may be garnished without further notice.

Q: Are there any exemptions to garnishment in Ontario, Canada?

A: Yes, there are certain exemptions to garnishment in Ontario, such as a portion of wages being exempted based on the debtor's income level.

Q: Can a Form 60H be contested?

A: Yes, a Form 60H can be contested if there are valid grounds, such as a mistake in the amount owed, a dispute over the debt, or a violation of legal procedures.