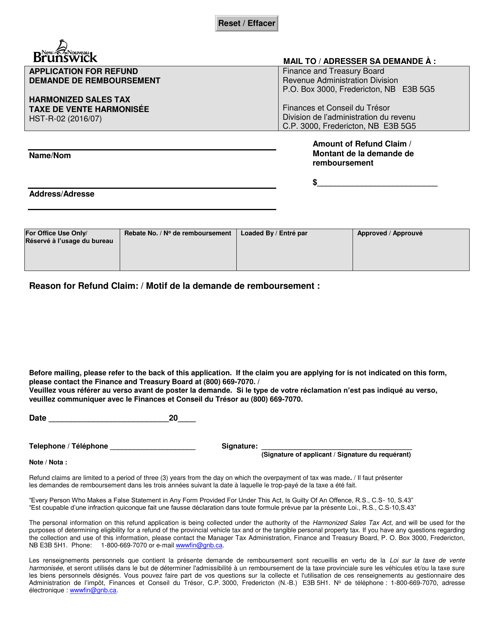

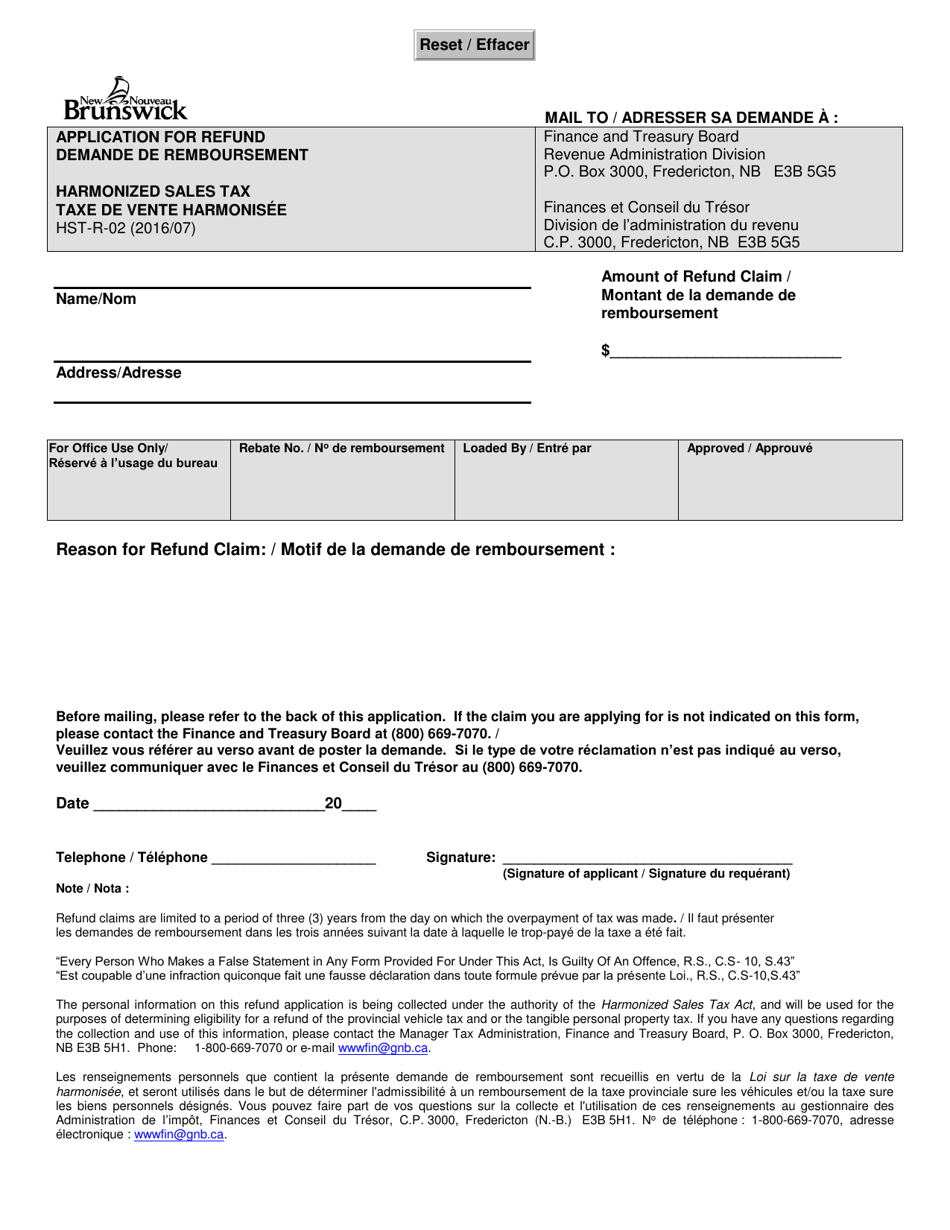

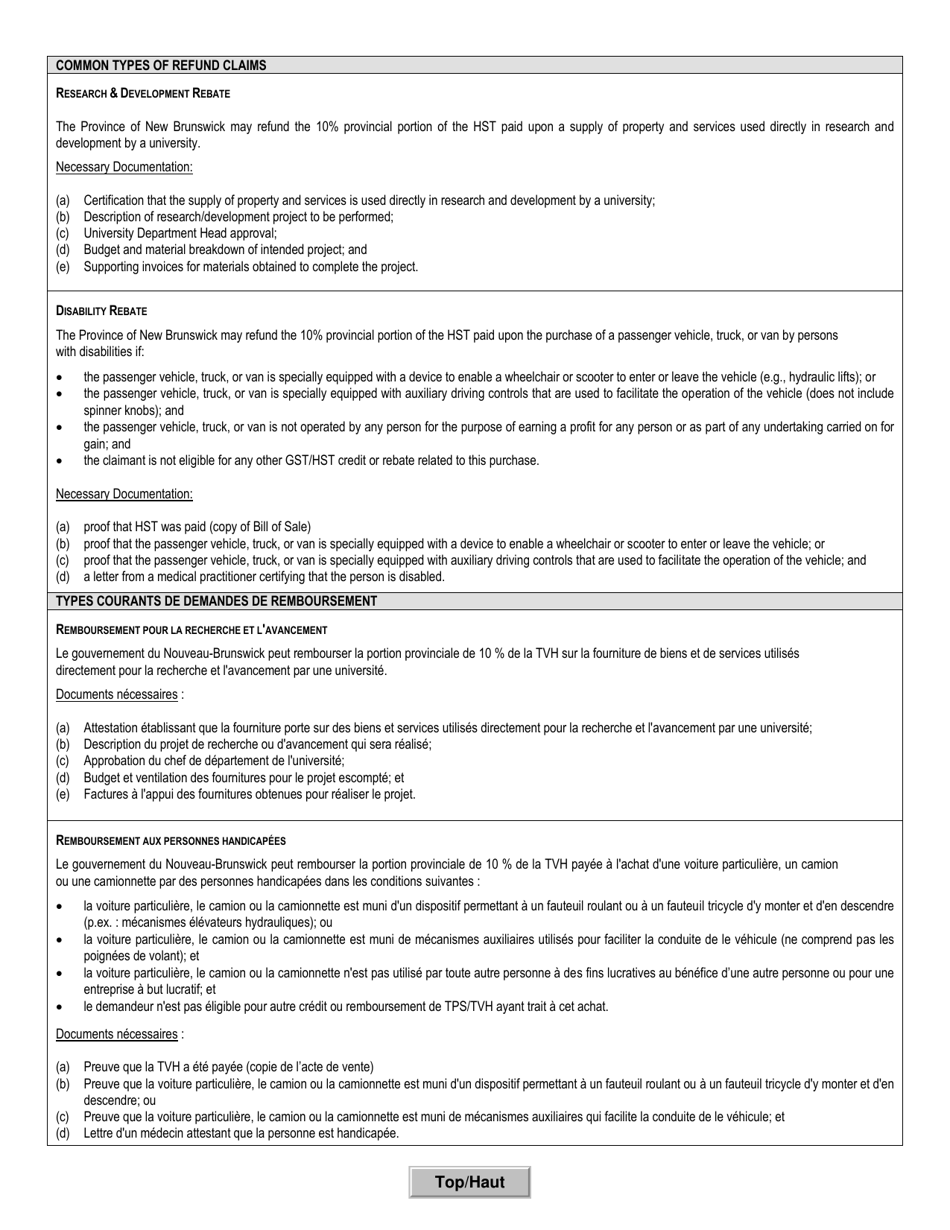

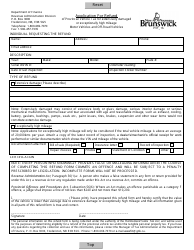

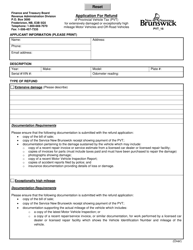

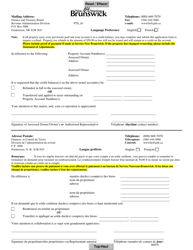

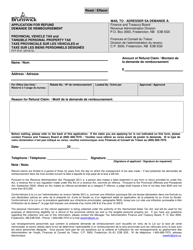

Form HST-R-02 Application for Refund - Harmonized Sales Tax - New Brunswick, Canada (English / French)

Form HST-R-02 Application for Refund - Harmonized Sales Tax - New Brunswick, Canada (English/French) is used to apply for a refund of the Harmonized Sales Tax (HST) in the province of New Brunswick. This form is available in both English and French.

The Form HST-R-02 Application for Refund - Harmonized Sales Tax - New Brunswick, Canada (English/French) can be filed by individuals or businesses who are eligible for a refund of the Harmonized Sales Tax in New Brunswick, Canada.

FAQ

Q: What is Form HST-R-02?

A: Form HST-R-02 is an application for a refund of Harmonized Sales Tax (HST) in New Brunswick, Canada.

Q: Who can use Form HST-R-02?

A: Any individual or business that paid HST in New Brunswick can use Form HST-R-02 to apply for a refund.

Q: What is the purpose of Form HST-R-02?

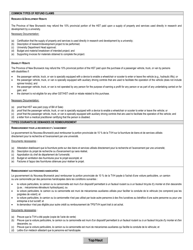

A: The purpose of Form HST-R-02 is to request a refund of HST paid on eligible purchases in New Brunswick.

Q: Is Form HST-R-02 available in both English and French?

A: Yes, Form HST-R-02 is available in both English and French.

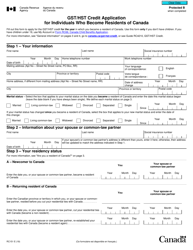

Q: What information do I need to provide on Form HST-R-02?

A: You need to provide your personal or business information, details of the HST paid, and supporting documentation.

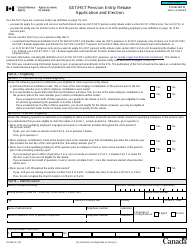

Q: Is there a deadline to submit Form HST-R-02?

A: Yes, Form HST-R-02 must be submitted within four years from the end of the reporting period in which the HST was paid.

Q: How long does it take to process Form HST-R-02?

A: The processing time for Form HST-R-02 may vary, but it generally takes a few weeks to several months.

Q: Can I claim a refund of HST for previous years using Form HST-R-02?

A: No, Form HST-R-02 is only for claiming refunds for the current reporting period and the three previous reporting periods.