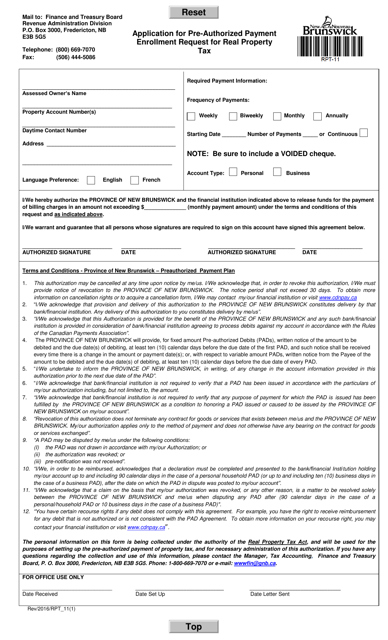

Form RPT-11 Application for Pre-authorized Payment Enrollment Request for Real Property Tax - New Brunswick, Canada

Form RPT-11, Application for Pre-authorized Payment EnrollmentRequest forReal Property Tax, is used in New Brunswick, Canada for individuals to enroll in a pre-authorized payment plan for their real property taxes. By completing this form, taxpayers can authorize the government to automatically withdraw payments from their bank accounts on a regular basis to cover their property tax obligations. This simplifies the payment process and helps taxpayers manage their tax obligations more effectively.

The property owners or their authorized representatives file the Form RPT-11 Application for Pre-authorized Payment Enrollment Request for Real Property Tax in New Brunswick, Canada.

FAQ

Q: What is Form RPT-11?

A: Form RPT-11 is an application for pre-authorized payment enrollment request for real property tax in New Brunswick, Canada.

Q: What is the purpose of Form RPT-11?

A: The purpose of Form RPT-11 is to apply for pre-authorized payment enrollment for real property tax in New Brunswick.

Q: Who needs to fill out Form RPT-11?

A: Property owners in New Brunswick who wish to enroll in pre-authorized payment for their real property tax need to fill out Form RPT-11.

Q: What information is required on Form RPT-11?

A: Form RPT-11 requires information such as property owner's name, address, property identification number, banking information, and authorization for pre-authorized payment.

Q: Is there a deadline to submit Form RPT-11?

A: The deadline to submit Form RPT-11 for pre-authorized payment enrollment may vary, so it is recommended to check with the tax department in New Brunswick.

Q: What are the benefits of enrolling in pre-authorized payment for real property tax?

A: Enrolling in pre-authorized payment for real property tax offers benefits such as convenience, automatic payments, and avoiding late payment penalties.

Q: Can I cancel my pre-authorized payment enrollment for real property tax?

A: Yes, you can cancel your pre-authorized payment enrollment for real property tax by contacting the tax department in New Brunswick.