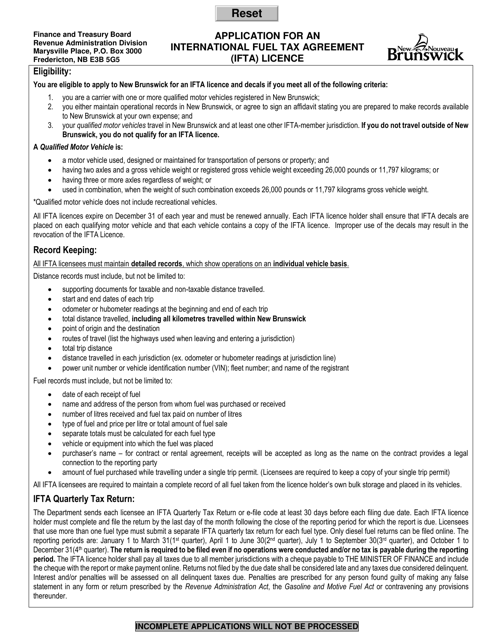

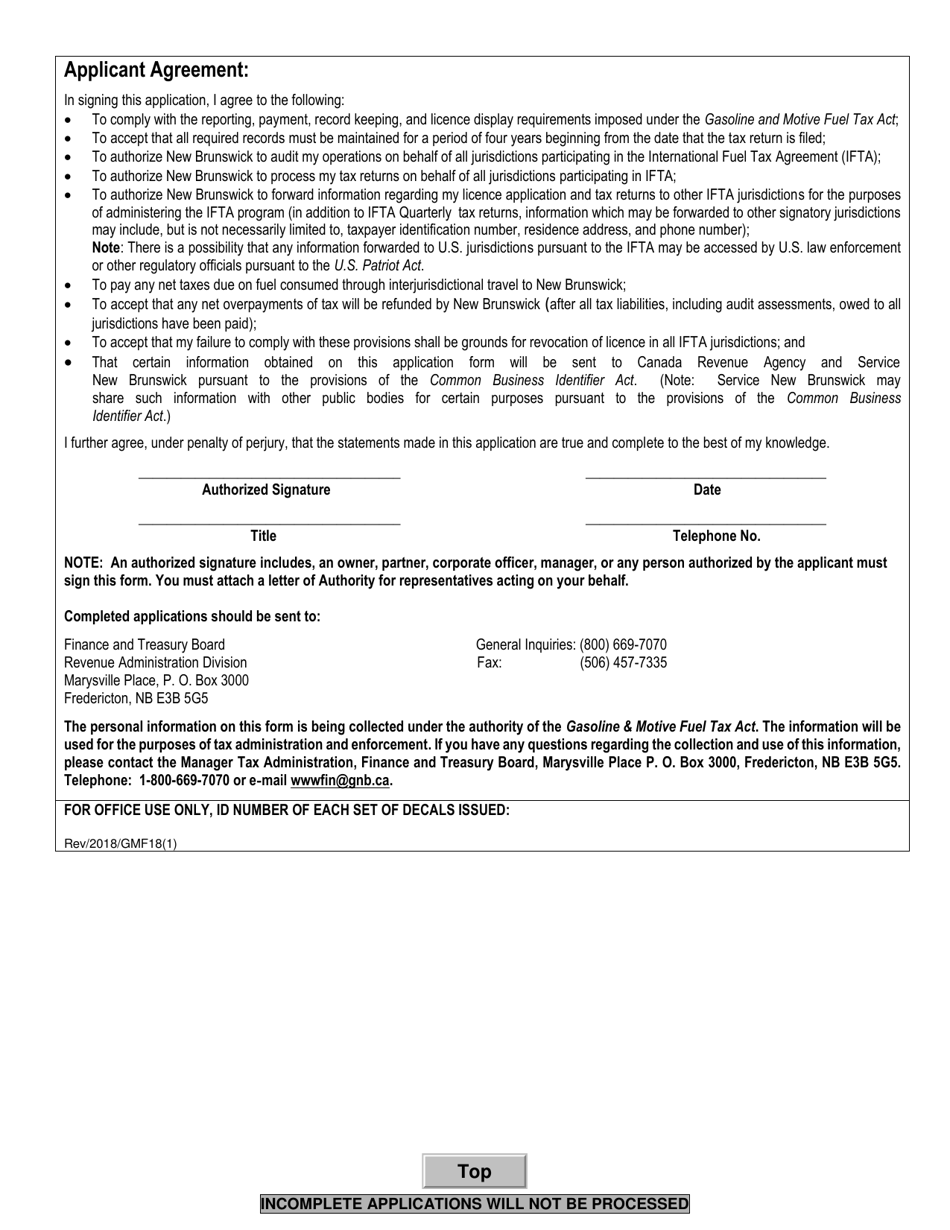

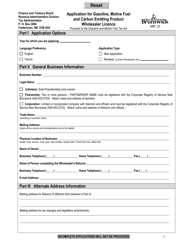

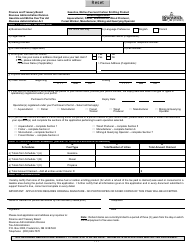

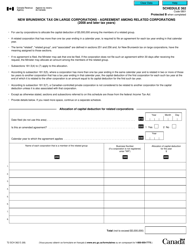

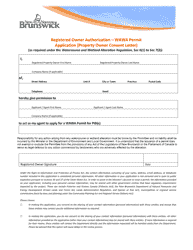

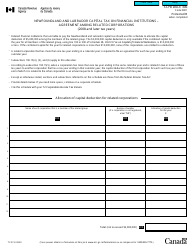

Application for an International Fuel Tax Agreement (Ifta) Licence - New Brunswick, Canada

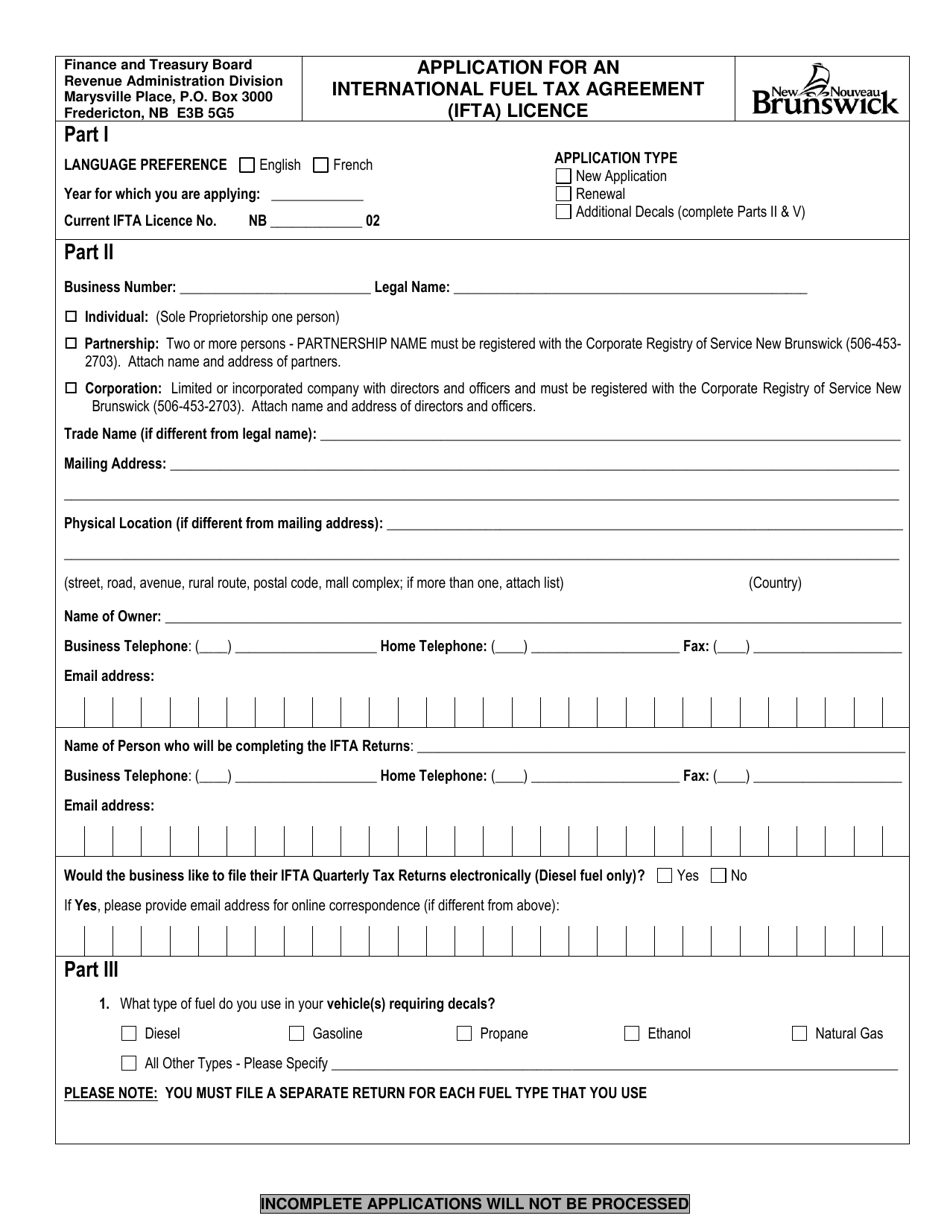

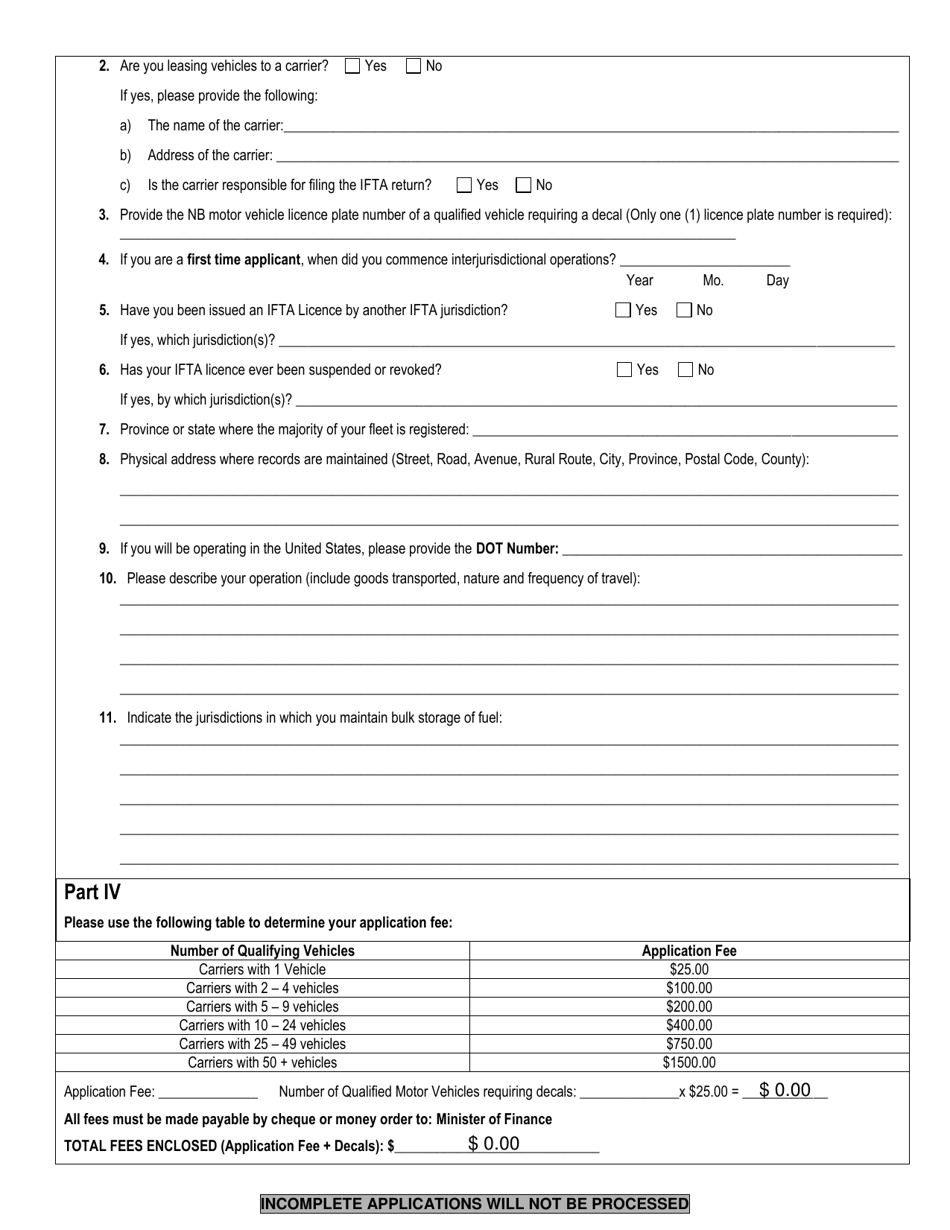

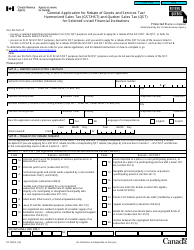

The Application for an International Fuel Tax Agreement (IFTA) License in New Brunswick, Canada is used to apply for a license that allows commercial motor carriers to report and pay taxes on fuel used in multiple jurisdictions in Canada and the United States. This license facilitates the tracking and payment of fuel taxes for cross-border operations.

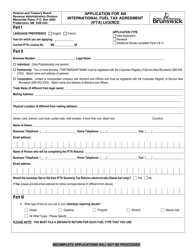

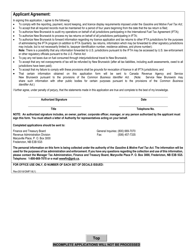

The application for an International Fuel Tax Agreement (IFTA) license in New Brunswick, Canada is filed by the carrier or registrant (the trucking company or individual) who operates motor vehicles in multiple jurisdictions and wants to report and pay fuel taxes in a simplified way.

FAQ

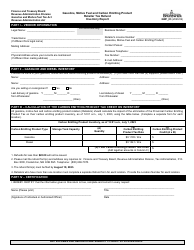

Q: What is an International Fuel Tax Agreement (IFTA) licence?

A: An IFTA licence is a permit that allows qualified vehicles to travel across multiple jurisdictions and pay taxes on fuel usage.

Q: Why do I need an IFTA licence in New Brunswick, Canada?

A: If you operate qualified vehicles that travel on interjurisdictional routes in New Brunswick, Canada, you need an IFTA licence to comply with tax reporting requirements.

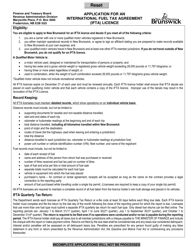

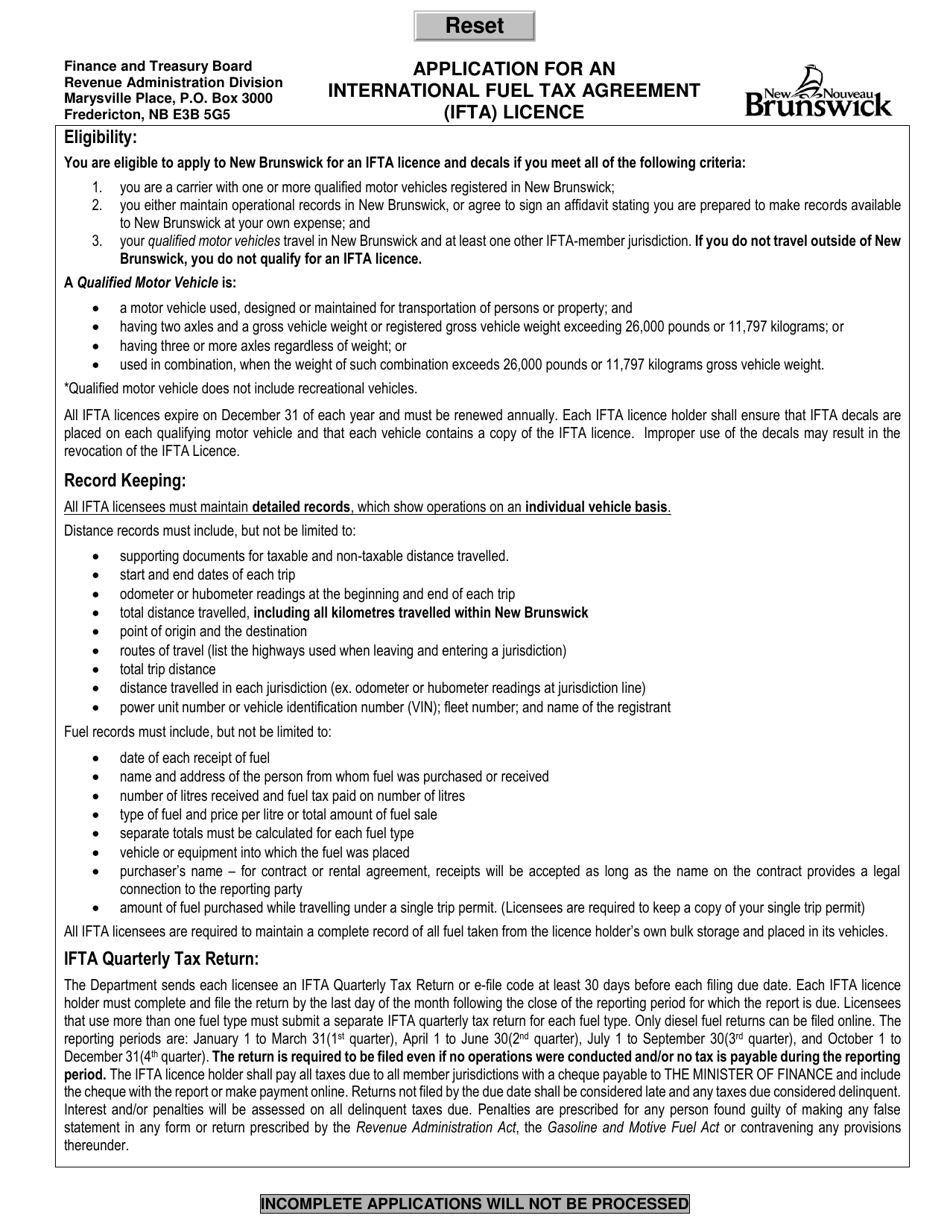

Q: What are the qualifications for obtaining an IFTA licence in New Brunswick, Canada?

A: To qualify for an IFTA licence in New Brunswick, Canada, you must meet certain criteria such as having a registered business and operating qualified vehicles.

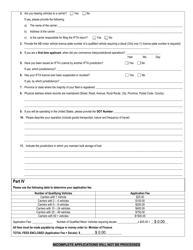

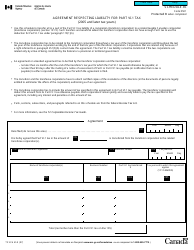

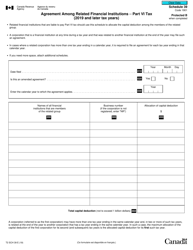

Q: What are the reporting requirements for an IFTA licence in New Brunswick, Canada?

A: As an IFTA licence holder in New Brunswick, Canada, you are required to file quarterly tax returns and maintain accurate records of fuel usage.

Q: Can I transfer my IFTA licence from another jurisdiction to New Brunswick, Canada?

A: Yes, you can transfer your IFTA licence from another jurisdiction to New Brunswick, Canada by completing the appropriate transfer application.

Q: Are there any penalties for non-compliance with IFTA requirements in New Brunswick, Canada?

A: Yes, there are penalties for non-compliance with IFTA requirements in New Brunswick, Canada. Penalties can include fines, penalties, and revocation of the IFTA licence.