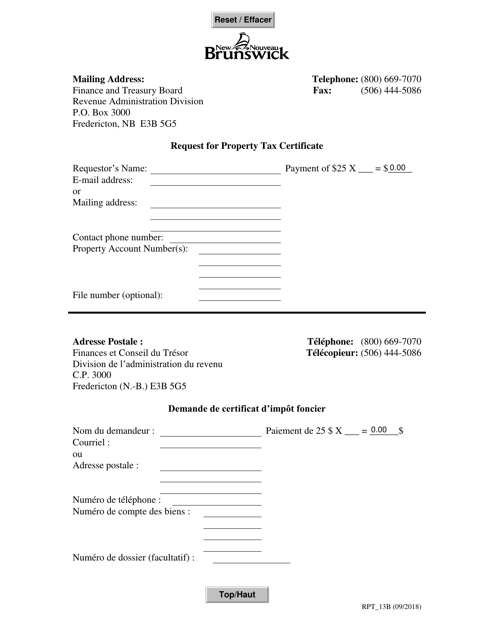

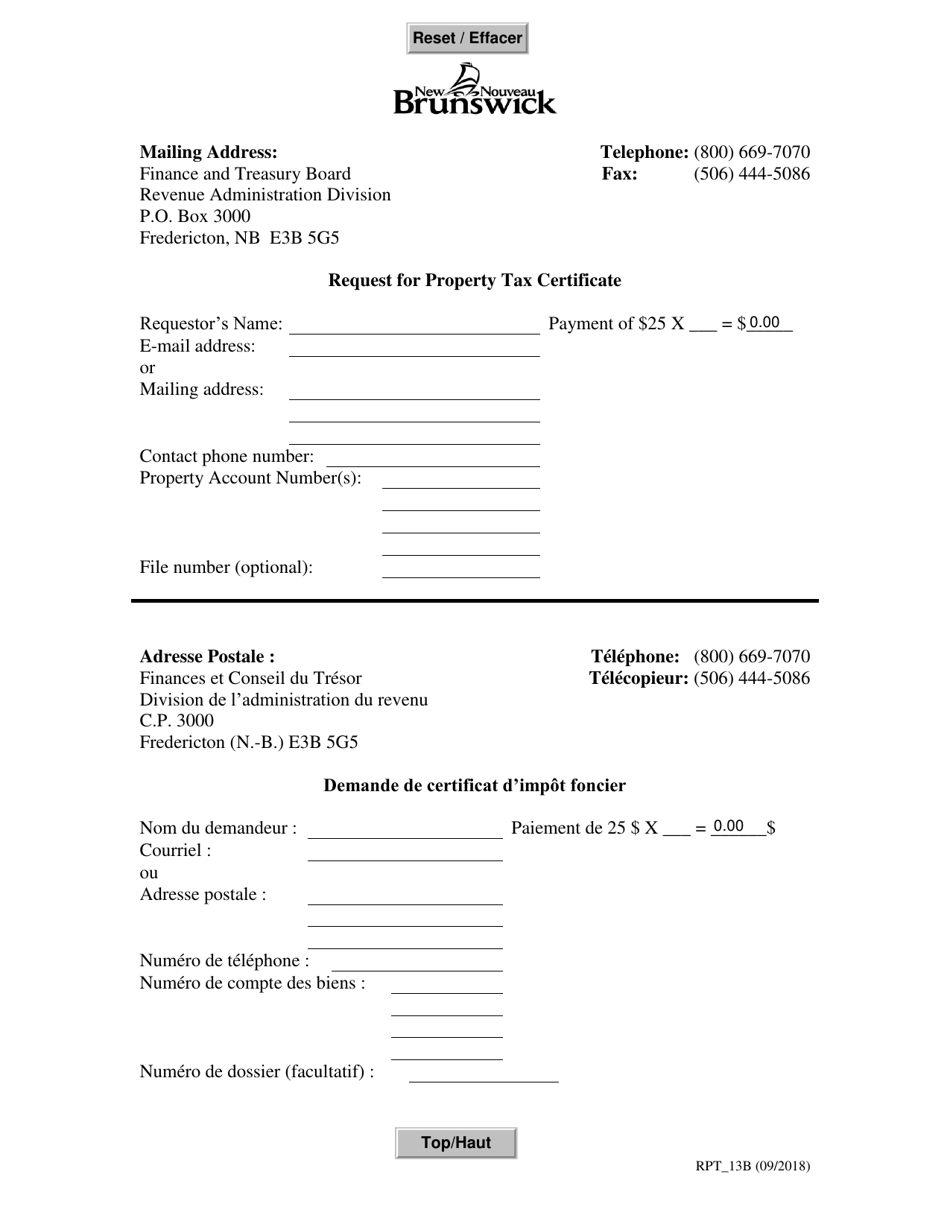

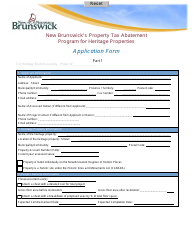

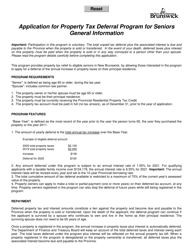

Form RPT_13B Request for Property Tax Certificate - New Brunswick, Canada

The Form RPT_13B Request for Property Tax Certificate in New Brunswick, Canada is used to request a certificate that provides information regarding the property tax status of a specific property.

The Form RPT_13B Request for Property Tax Certificate in New Brunswick, Canada is usually filed by the property owner or their authorized representative.

FAQ

Q: What is Form RPT_13B?

A: Form RPT_13B is a request for a Property Tax Certificate in New Brunswick, Canada.

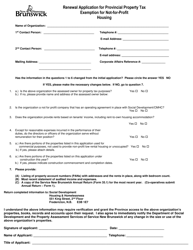

Q: What is a Property Tax Certificate?

A: A Property Tax Certificate is a document that provides information about the property's tax status and any outstanding taxes.

Q: Why do I need a Property Tax Certificate?

A: You may need a Property Tax Certificate when buying or selling a property to verify the tax status and any outstanding taxes.

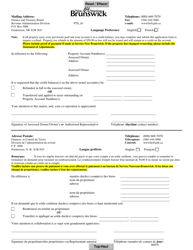

Q: How can I obtain a Property Tax Certificate?

A: To obtain a Property Tax Certificate, you need to fill out Form RPT_13B and submit it to the appropriate agency in New Brunswick, Canada.

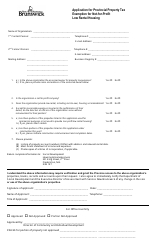

Q: Is there a fee for obtaining a Property Tax Certificate?

A: Yes, there is usually a fee associated with obtaining a Property Tax Certificate. The fee may vary depending on the jurisdiction.

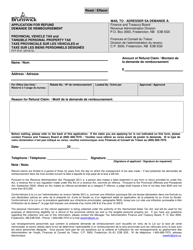

Q: How long does it take to receive a Property Tax Certificate?

A: The processing time for a Property Tax Certificate can vary depending on the agency and workload. It is recommended to inquire about the processing time when submitting the form.

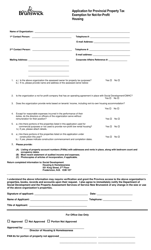

Q: What information do I need to provide on Form RPT_13B?

A: You will typically need to provide information such as the property address, owner's name, and any relevant account or folio numbers.

Q: Can a Property Tax Certificate be obtained for any property in New Brunswick?

A: Yes, a Property Tax Certificate can be obtained for any property in New Brunswick, whether it is residential, commercial, or vacant land.