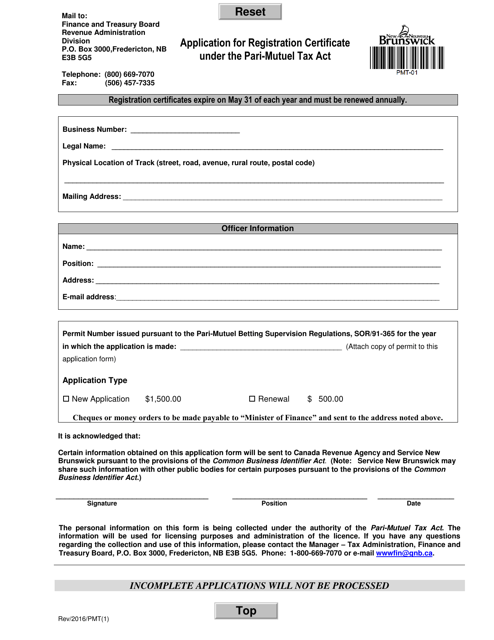

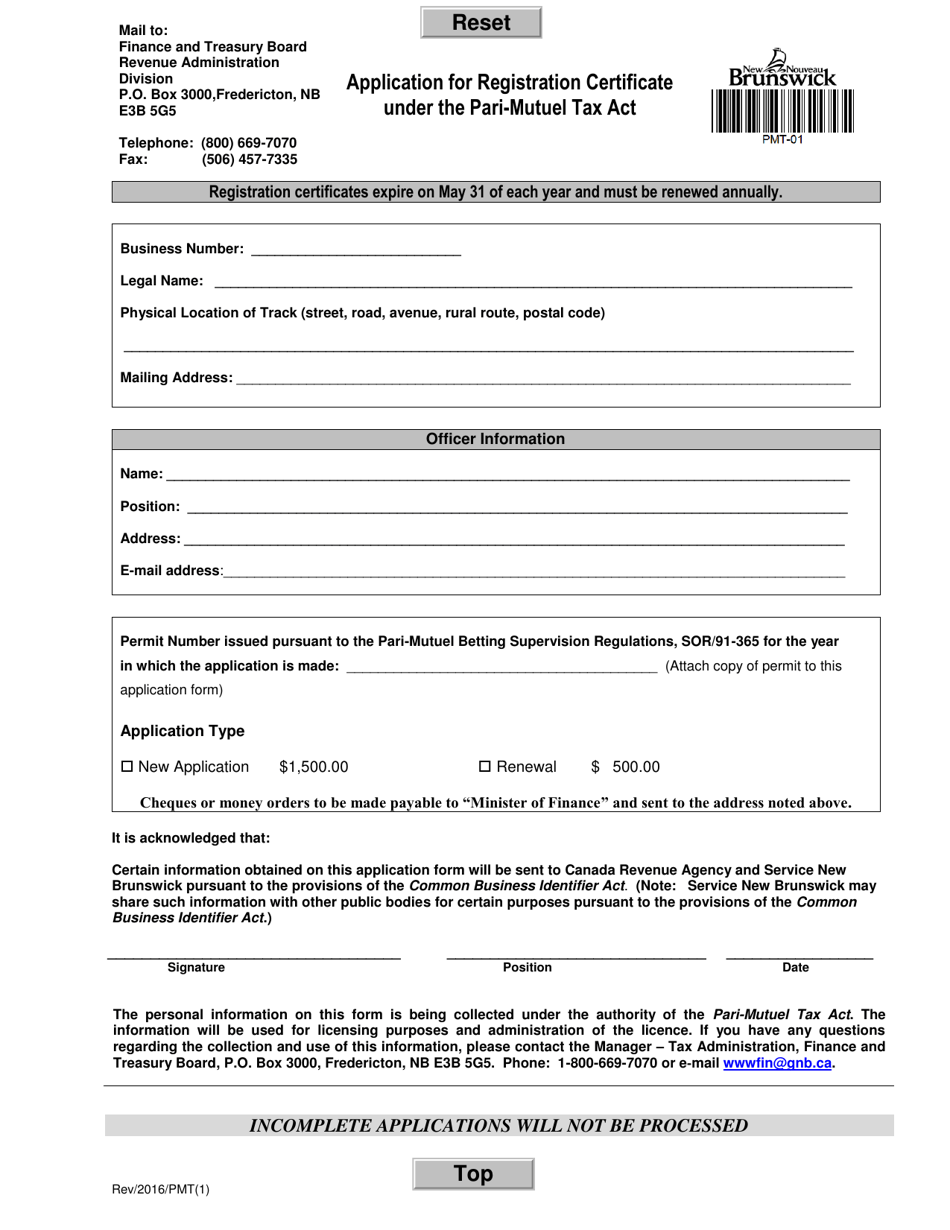

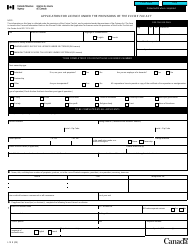

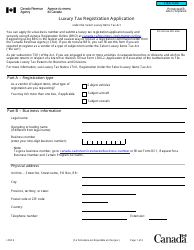

Form PMT-01 Application for Registration Certificate Under the Pari-Mutuel Tax Act - New Brunswick, Canada

Form PMT-01 Application for Registration Certificate Under the Pari-Mutuel Tax Act in New Brunswick, Canada is used to apply for a registration certificate for the purpose of conducting pari-mutuel betting activities in the province.

The Form PMT-01 Application for Registration Certificate Under the Pari-Mutuel Tax Act in New Brunswick, Canada is filed by organizations involved in pari-mutuel betting activities.

FAQ

Q: What is the PMT-01 form?

A: The PMT-01 form is an application form for a Registration Certificate under the Pari-Mutuel Tax Act in New Brunswick, Canada.

Q: What is the Pari-Mutuel Tax Act?

A: The Pari-Mutuel Tax Act is a law in New Brunswick, Canada that governs the betting on horse racing and other forms of pari-mutuel wagering.

Q: Who needs to fill out the PMT-01 form?

A: Any individual or organization that wishes to obtain a Registration Certificate for pari-mutuel wagering in New Brunswick needs to fill out the PMT-01 form.

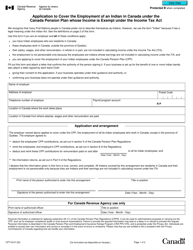

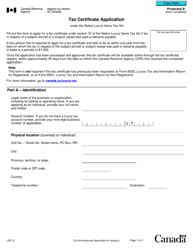

Q: What is a Registration Certificate?

A: A Registration Certificate is a document issued by the government of New Brunswick that allows an individual or organization to legally conduct pari-mutuel wagering activities.

Q: Are there any fees associated with the PMT-01 application?

A: Yes, there are fees associated with the PMT-01 application. The specific fees can be found on the application form or obtained from the New Brunswick Gaming Control Commission.

Q: What are the requirements to fill out the PMT-01 form?

A: The specific requirements to fill out the PMT-01 form can be found on the form itself or obtained from the New Brunswick Gaming Control Commission.

Q: Is the PMT-01 form only for horse racing?

A: No, the PMT-01 form is not only for horse racing. It is also for other forms of pari-mutuel wagering, subject to the Pari-Mutuel Tax Act in New Brunswick, Canada.