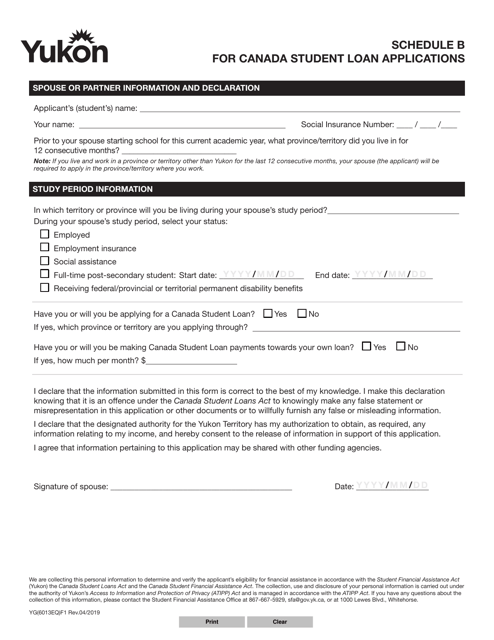

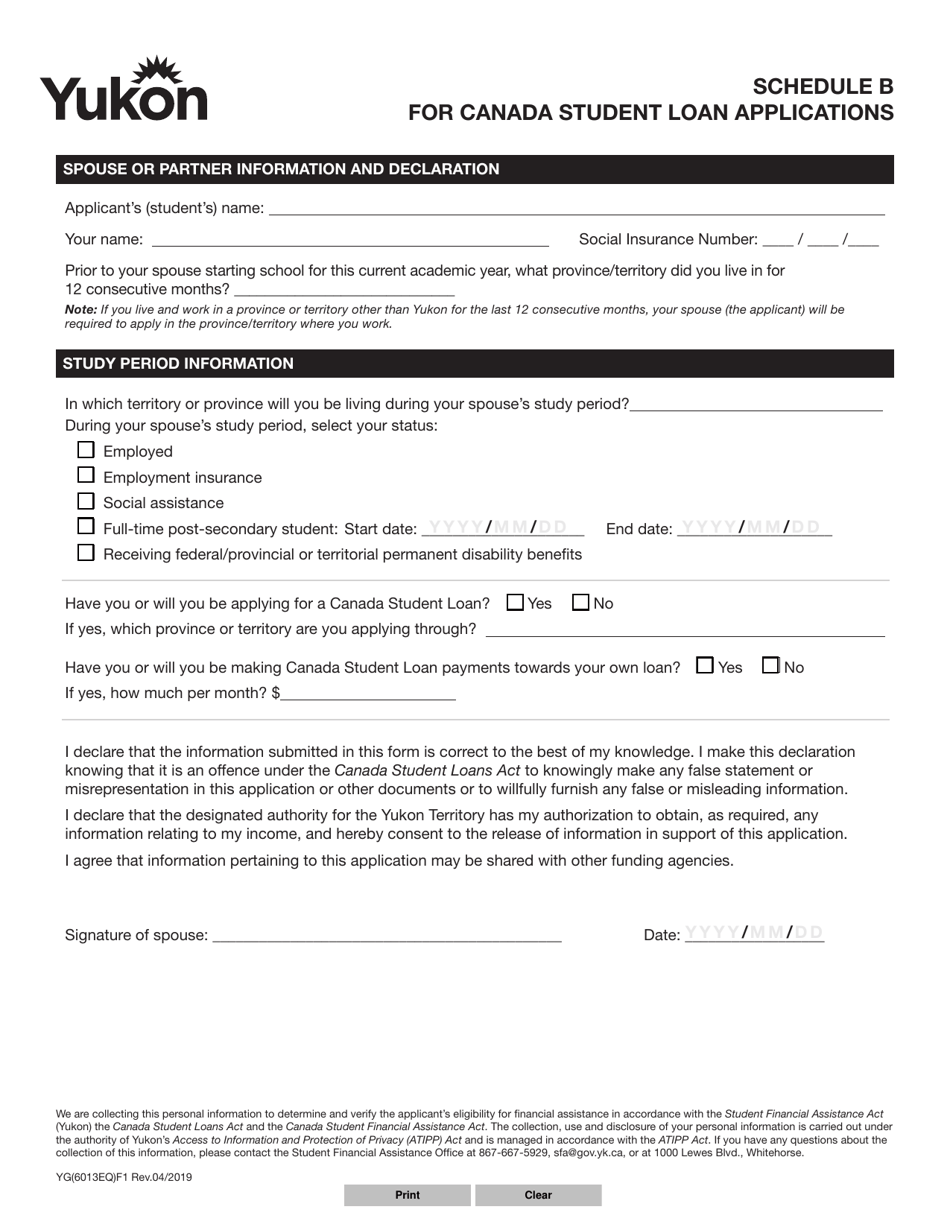

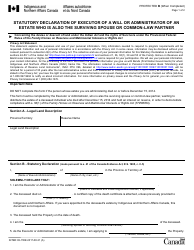

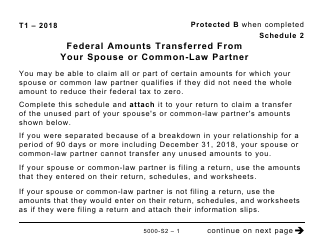

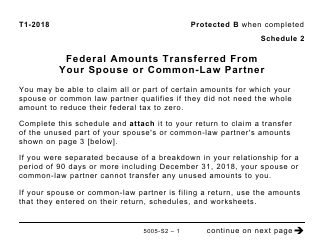

Form YG6013 Schedule B Spouse or Partner Information and Declaration - Yukon, Canada

Form YG6013 Schedule B is used in Yukon, Canada to provide information about a spouse or partner for various purposes, such as tax or government benefit applications. It includes details about their personal information, residency, and declaration of accuracy.

The Form YG6013 Schedule B Spouse or Partner Information and Declaration in Yukon, Canada is typically filed by the taxpayer's spouse or partner.

FAQ

Q: What is Form YG6013?

A: Form YG6013 is the Schedule B Spouse or Partner Information and Declaration form in Yukon, Canada.

Q: What is the purpose of Form YG6013?

A: The purpose of Form YG6013 is to provide information about your spouse or partner for tax purposes in Yukon, Canada.

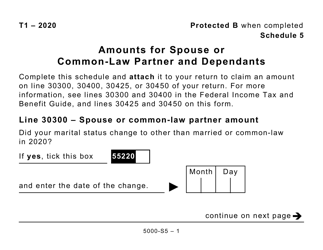

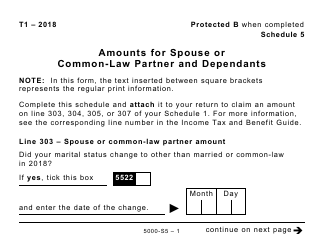

Q: Who needs to fill out Form YG6013?

A: You need to fill out Form YG6013 if you have a spouse or partner and you are filing taxes in Yukon, Canada.

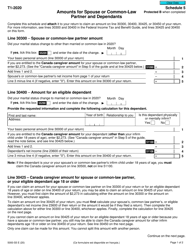

Q: What information is required in Form YG6013?

A: Form YG6013 requires you to provide personal information about your spouse or partner, including their name, social insurance number, and income details.

Q: Is Form YG6013 specific to Yukon, Canada?

A: Yes, Form YG6013 is specific to Yukon, Canada, and is used for tax purposes in the province.

Q: Do I need to include any supporting documents with Form YG6013?

A: No, you do not need to include any supporting documents with Form YG6013. However, it is important to keep all relevant documents for your records in case of an audit.

Q: What happens if I don't fill out Form YG6013?

A: If you have a spouse or partner and do not fill out Form YG6013, it may result in delays or errors in the processing of your tax return in Yukon, Canada.