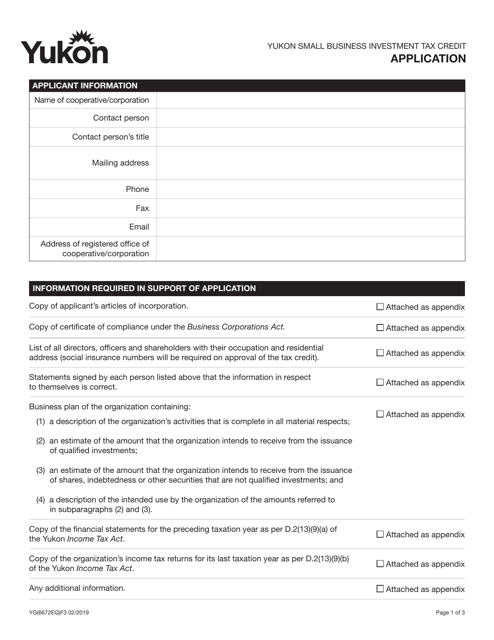

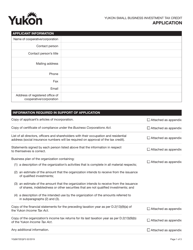

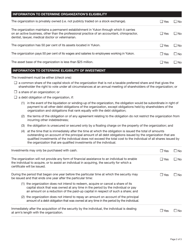

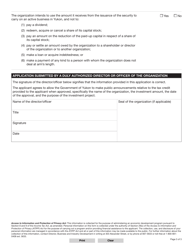

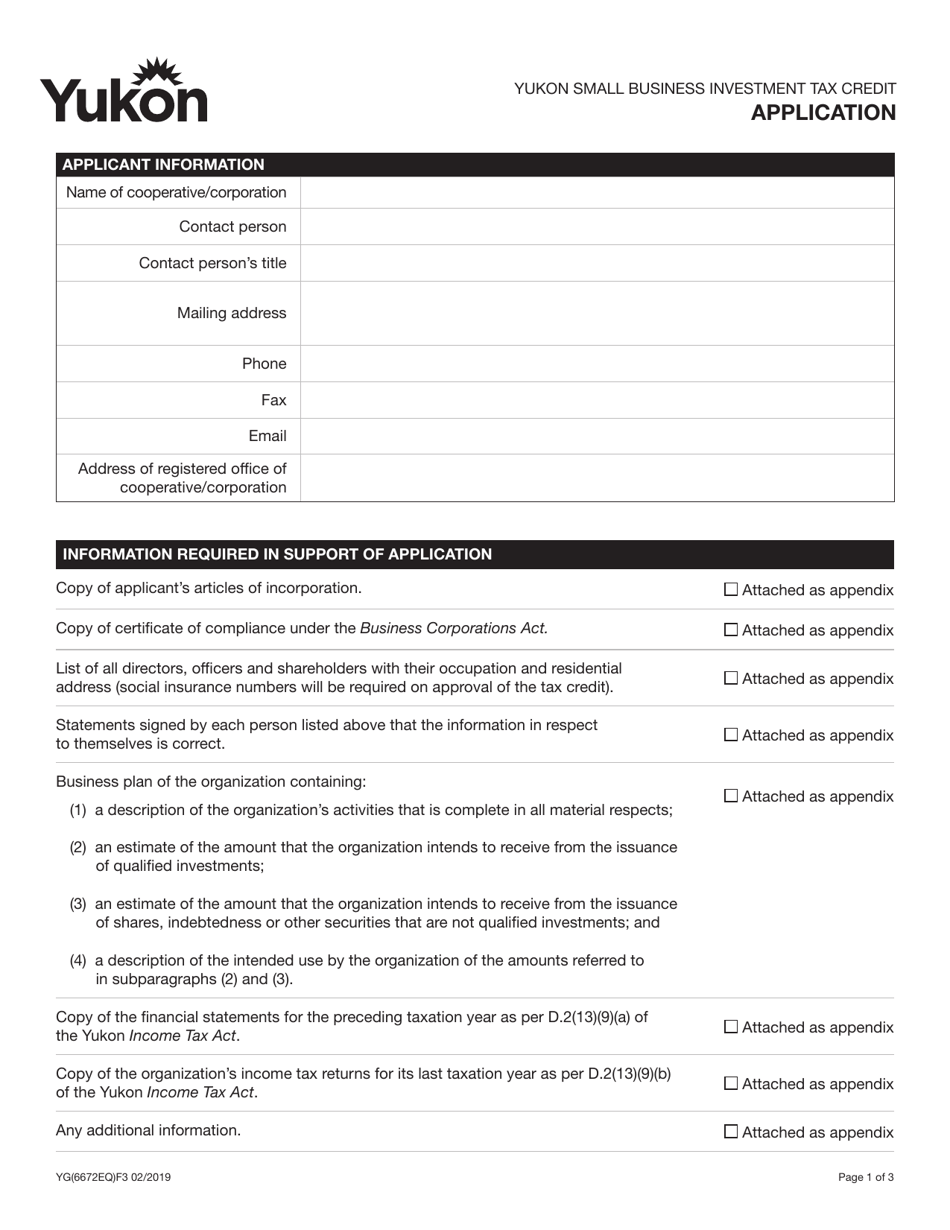

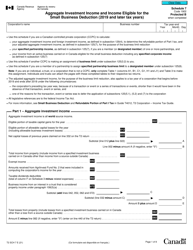

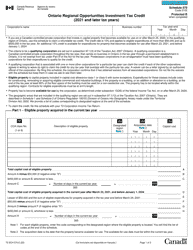

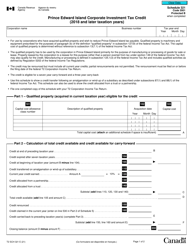

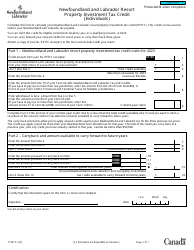

Form YG6672 Yukon Small Business Investment Tax Credit Application - Yukon, Canada

Form YG6672 Yukon Small Business Investment Tax Credit Application is used for claiming the small business investment tax credit in Yukon, Canada. This tax credit is available to eligible small businesses that have made qualified investments in certain designated industries in Yukon. The purpose of this form is to apply for the tax credit and provide the necessary information and documentation to support the claim.

The Form YG6672 Yukon Small Business Investment Tax Credit Application in Yukon, Canada is filed by small business owners or investors who are applying for the small business investment tax credit.

FAQ

Q: What is the YG6672 Yukon Small Business Investment Tax Credit Application?

A: The YG6672 Yukon Small Business Investment Tax Credit Application is a form used by small businesses in Yukon, Canada to apply for a tax credit on their investments.

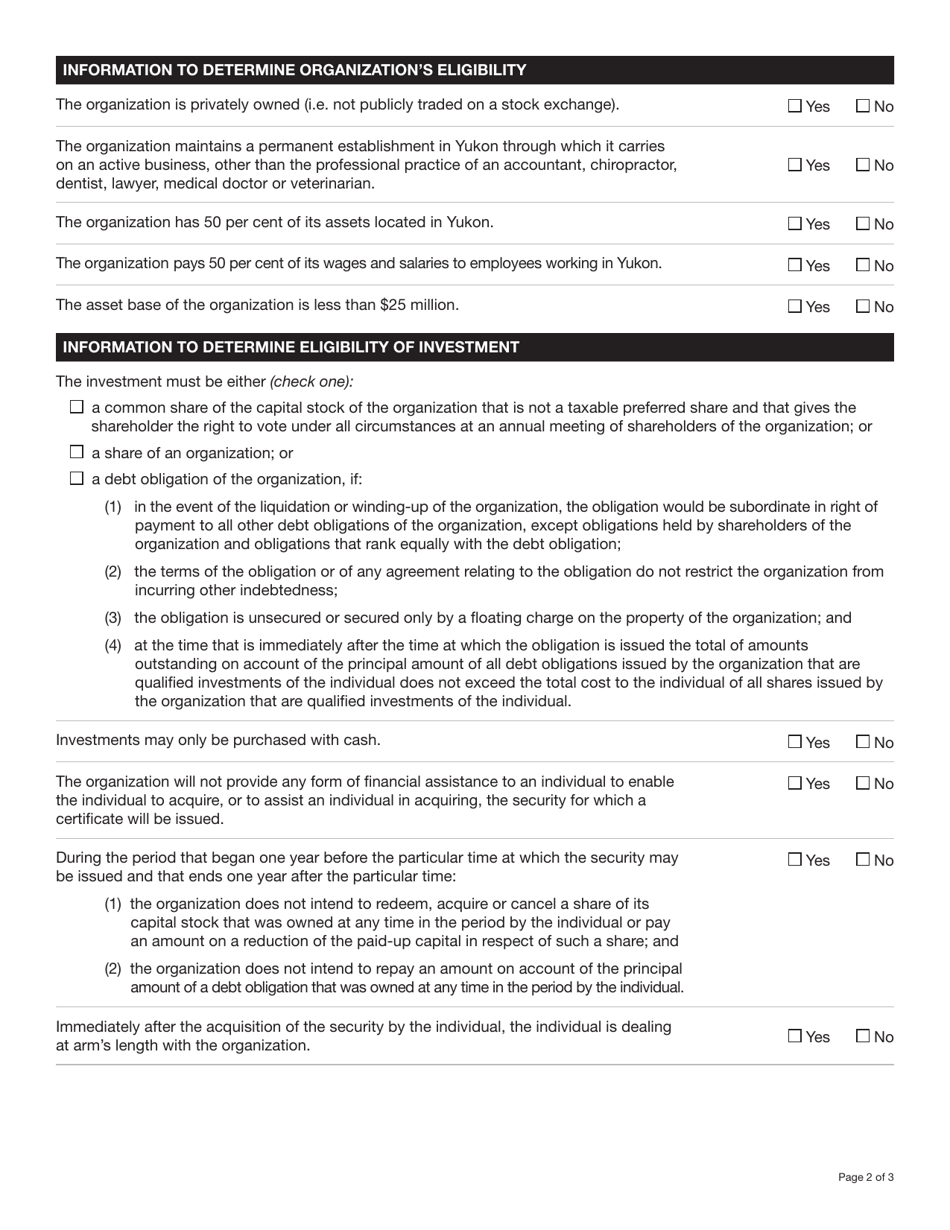

Q: Who is eligible to apply for the YG6672 Yukon Small Business Investment Tax Credit?

A: Small businesses operating in Yukon, Canada are eligible to apply for the YG6672 Yukon Small Business Investment Tax Credit.

Q: What is the purpose of the YG6672 Yukon Small Business Investment Tax Credit?

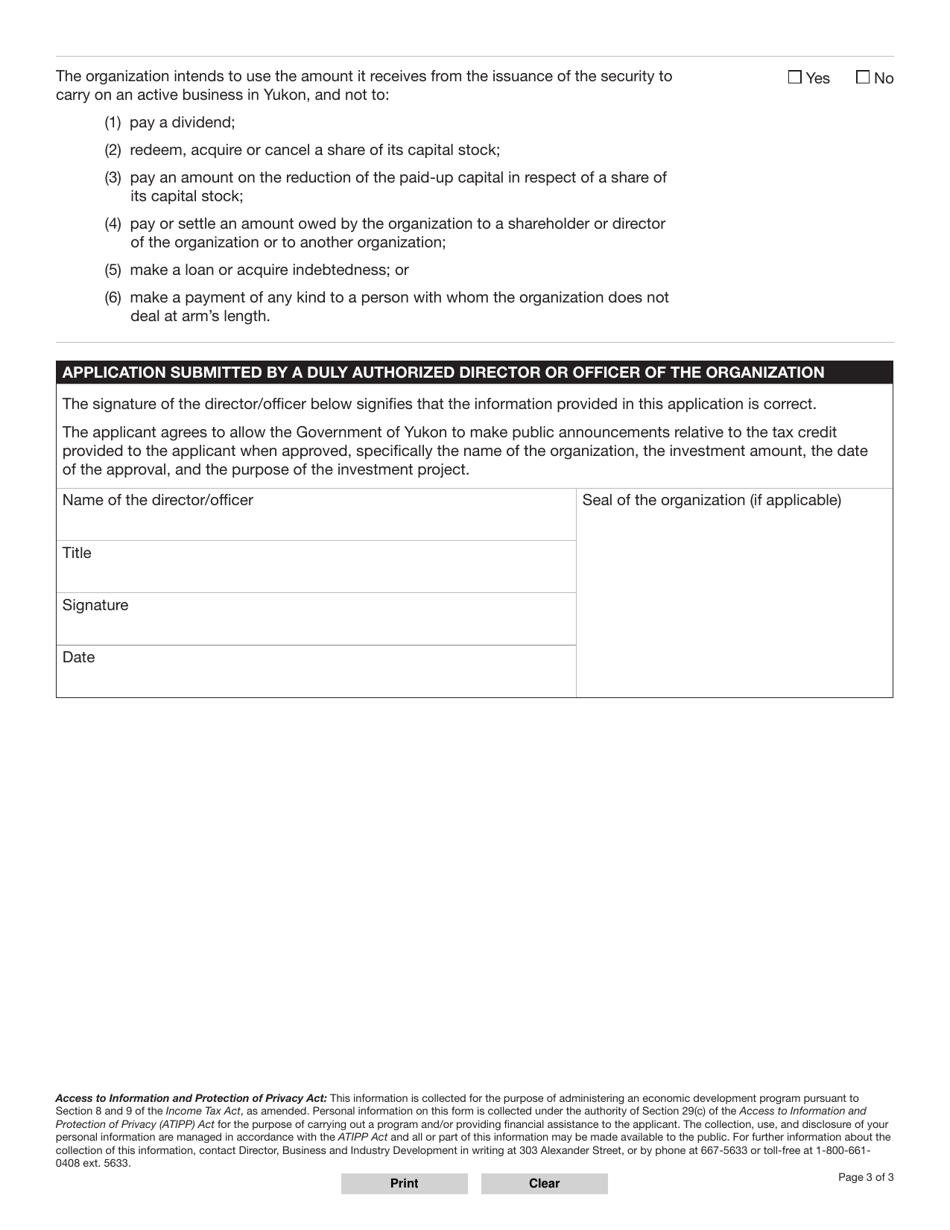

A: The purpose of the YG6672 Yukon Small Business Investment Tax Credit is to encourage investment in small businesses in Yukon by providing a tax credit on qualifying investments.

Q: What types of investments qualify for the YG6672 Yukon Small Business Investment Tax Credit?

A: Investments made in eligible small businesses in Yukon, such as equity investments or loans, may qualify for the YG6672 Yukon Small Business Investment Tax Credit.

Q: How much tax credit can a business receive through the YG6672 Yukon Small Business Investment Tax Credit?

A: The amount of the tax credit through the YG6672 Yukon Small Business Investment Tax Credit can vary, but generally it is a percentage of the investment made in the eligible small business.

Q: Is there a deadline to submit the YG6672 Yukon Small Business Investment Tax Credit Application?

A: Yes, there is usually a deadline to submit the YG6672 Yukon Small Business Investment Tax Credit Application. It is important to check the specific deadline for each year's application.

Q: What documentation is required when submitting the YG6672 Yukon Small Business Investment Tax Credit Application?

A: The YG6672 Yukon Small Business Investment Tax Credit Application usually requires supporting documentation such as proof of investment, financial statements, and other relevant business information.

Q: Can I appeal if my YG6672 Yukon Small Business Investment Tax Credit Application is denied?

A: Yes, you can usually appeal if your YG6672 Yukon Small Business Investment Tax Credit Application is denied. Contact the Yukon government's tax department for more information on the appeals process.

Q: Are there any restrictions or limitations on the YG6672 Yukon Small Business Investment Tax Credit?

A: Yes, there may be restrictions or limitations on the YG6672 Yukon Small Business Investment Tax Credit. It is important to review the application form and any associated guidelines for more details.