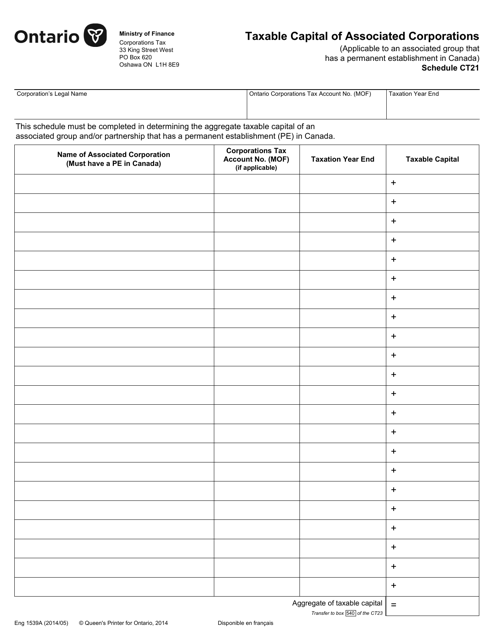

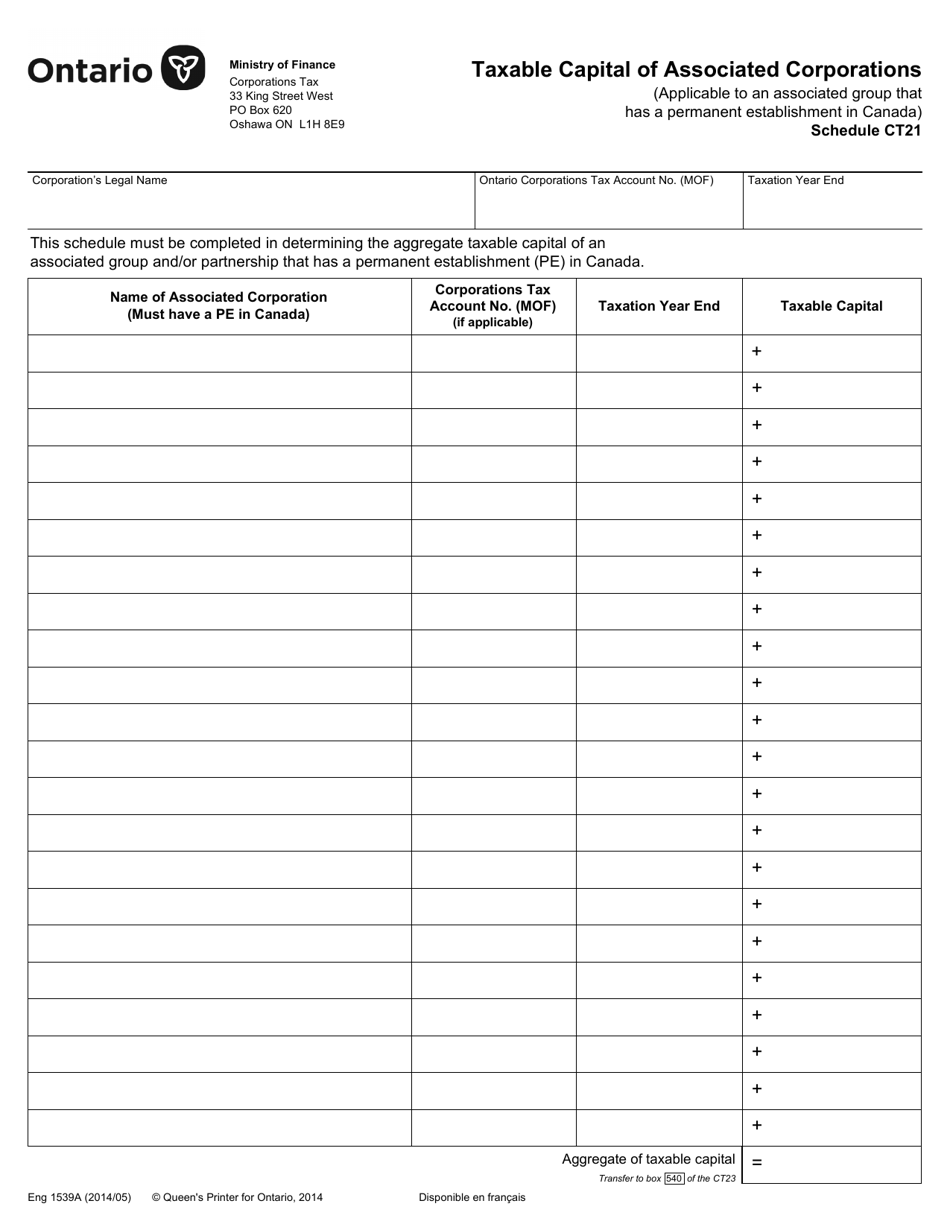

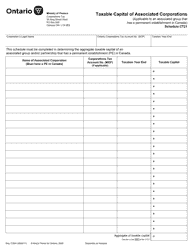

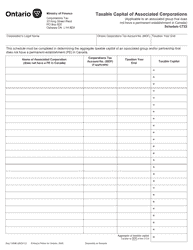

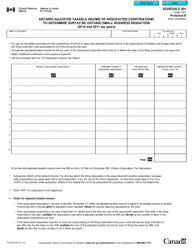

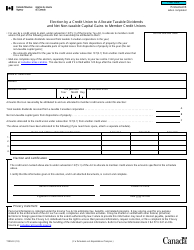

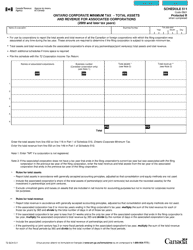

Form 1539 Schedule CT21 Taxable Capital of Associated Corporations - Ontario, Canada

Form 1539 Schedule CT21 is used in Ontario, Canada to calculate the taxable capital of associated corporations for tax purposes. It helps determine the amount of taxes owed by these corporations.

The Form 1539 Schedule CT21 "Taxable Capital of Associated Corporations" in Ontario, Canada is filed by corporations that are associated with each other for tax purposes.

FAQ

Q: What is Form 1539 Schedule CT21?

A: Form 1539 Schedule CT21 is a tax form used in Ontario, Canada to report the taxable capital of associated corporations.

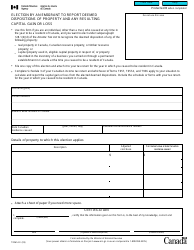

Q: What is taxable capital?

A: Taxable capital refers to the value of assets that a corporation can use to generate income, minus any tax-deductible liabilities.

Q: What are associated corporations?

A: Associated corporations are corporations that are related to each other through common ownership or control.

Q: Why is it important to report taxable capital?

A: Reporting taxable capital is important for calculating certain taxes and determining a corporation's financial standing.

Q: Who needs to file Form 1539 Schedule CT21?

A: Corporations in Ontario, Canada that have associated corporations and meet certain criteria are required to file Form 1539 Schedule CT21.