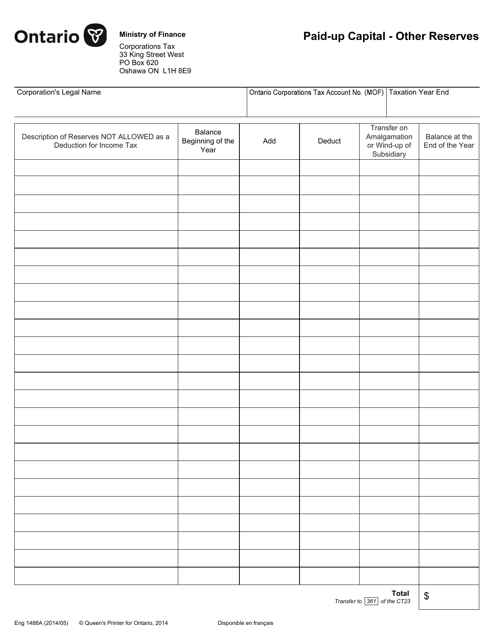

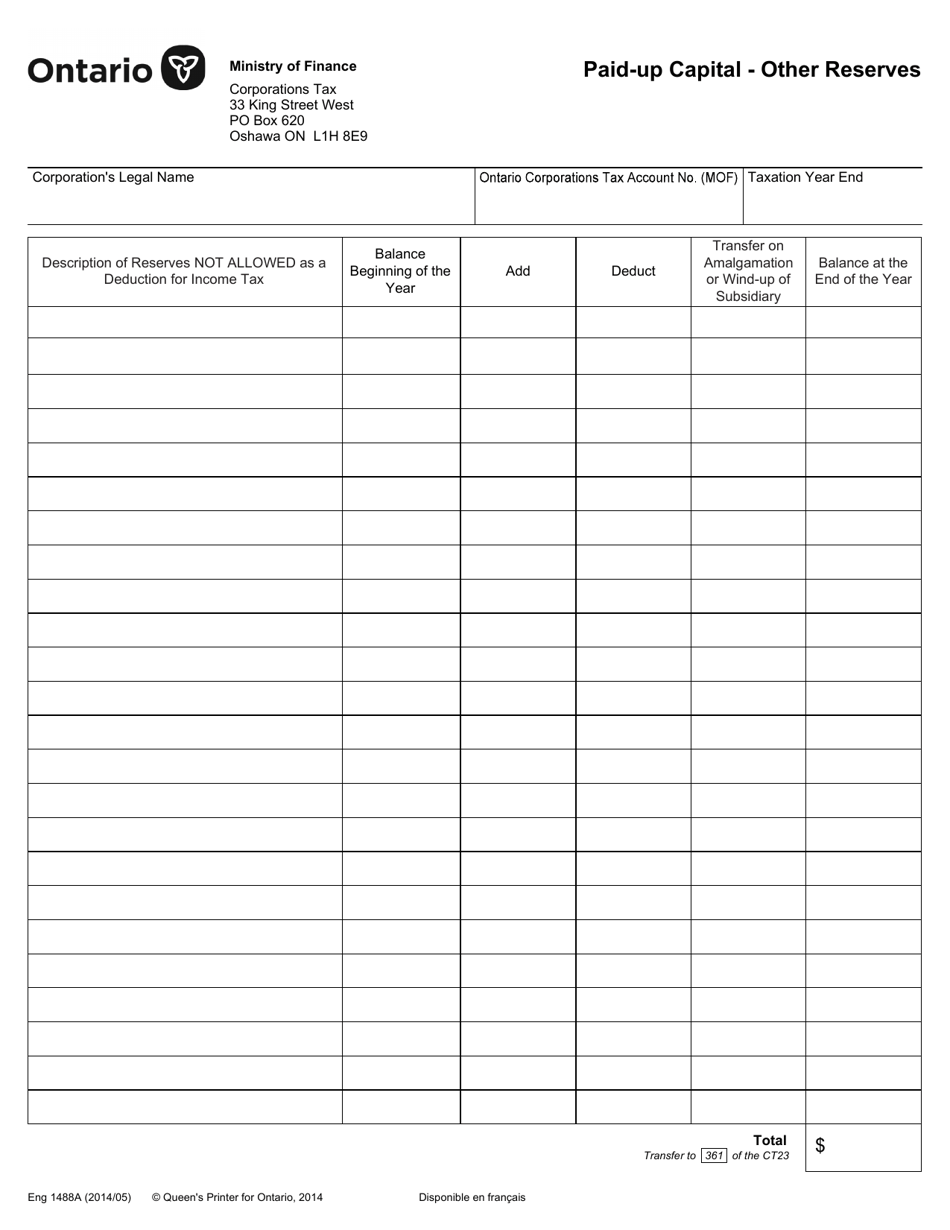

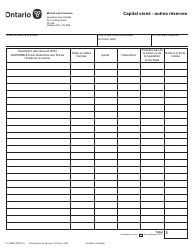

Form 1488A Paid-Up Capital - Other Reserves - Ontario, Canada

Form 1488A Paid-Up Capital - Other Reserves is a document used in Ontario, Canada to report information about the paid-up capital and other reserves of a corporation. It is used for regulatory and tax purposes.

The Form 1488A Paid-Up Capital - Other Reserves in Ontario, Canada is typically filed by corporations that need to report their paid-up capital and other reserves as required by the Ontario Business Corporations Act.

FAQ

Q: What is Form 1488A?

A: Form 1488A is a document used to report the paid-up capital and other reserves of a company in Ontario, Canada.

Q: What is paid-up capital?

A: Paid-up capital refers to the amount of money that has been invested in a company by its shareholders.

Q: What are other reserves?

A: Other reserves are funds that a company sets aside for specific purposes, such as future investments or contingencies.

Q: Why is it important to report paid-up capital and other reserves?

A: Reporting paid-up capital and other reserves is important for financial transparency and compliance with regulatory requirements in Ontario, Canada.

Q: Who needs to file Form 1488A?

A: Companies operating in Ontario, Canada are required to file Form 1488A to report their paid-up capital and other reserves.

Q: What information is required to complete Form 1488A?

A: To complete Form 1488A, you will need information about the company's paid-up capital, other reserves, and any changes that occurred during the reporting period.

Q: When is the deadline for filing Form 1488A?

A: The deadline for filing Form 1488A varies depending on the company's fiscal year-end. It is typically due within six months after the fiscal year-end.

Q: What happens if I don't file Form 1488A on time?

A: Failing to file Form 1488A on time may result in penalties and fines imposed by the Ontario Ministry of Finance.

Q: Are there any fees associated with filing Form 1488A?

A: As of the time of this document, there are no fees associated with filing Form 1488A in Ontario, Canada.