This version of the form is not currently in use and is provided for reference only. Download this version of

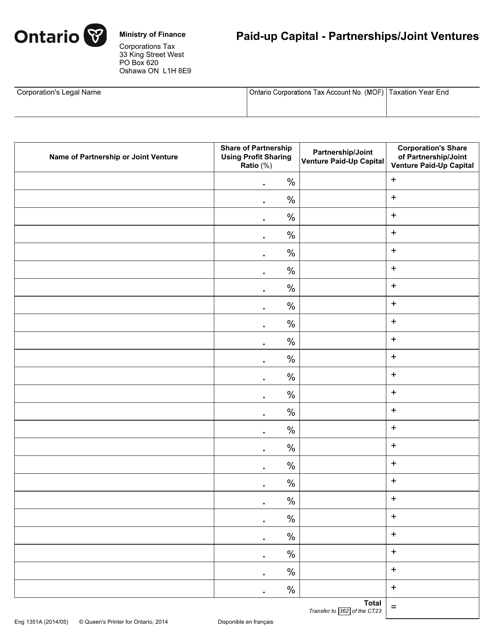

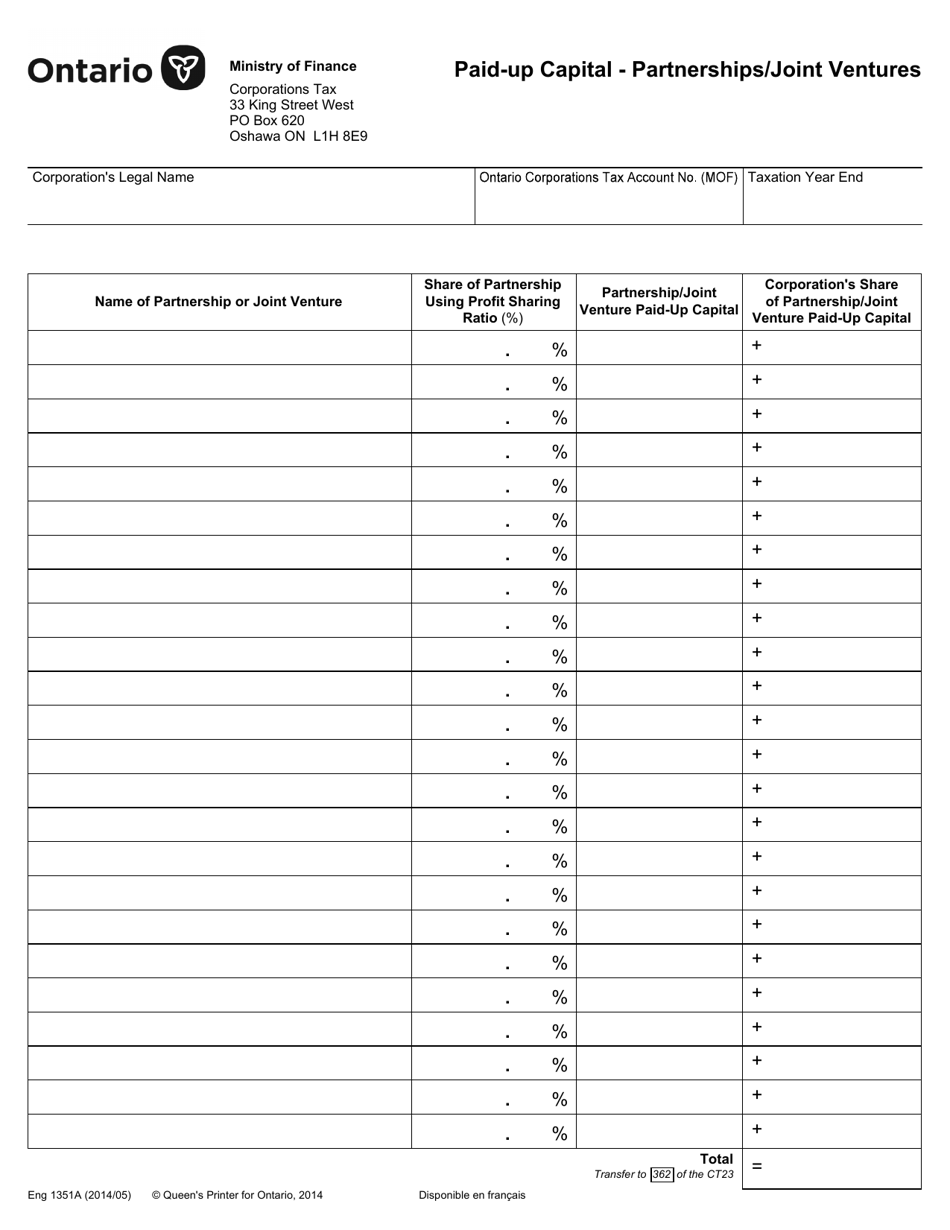

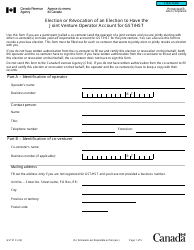

Form 1351A

for the current year.

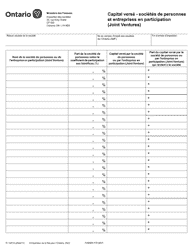

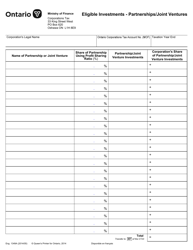

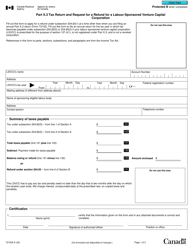

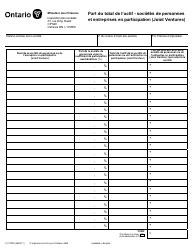

Form 1351A Paid-Up Capital - Partnerships / Joint Ventures - Ontario, Canada

Form 1351A Paid-Up Capital - Partnerships/Joint Ventures is used in Ontario, Canada to report the paid-up capital of partnerships and joint ventures. It provides information about the amount of capital invested in the business by the partners or participants.

FAQ

Q: What is Form 1351A?

A: Form 1351A is a form used for reporting paid-up capital for partnerships and joint ventures in Ontario, Canada.

Q: Who needs to file Form 1351A?

A: Partnerships and joint ventures in Ontario, Canada need to file Form 1351A.

Q: What is paid-up capital?

A: Paid-up capital refers to the total amount of capital invested in a corporation by its shareholders.

Q: Why is it important to report paid-up capital?

A: Reporting paid-up capital is important for tax purposes and determining a corporation's financial health.