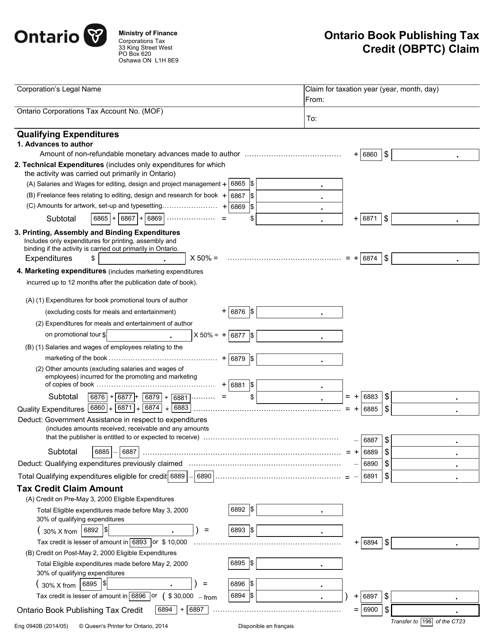

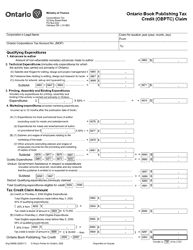

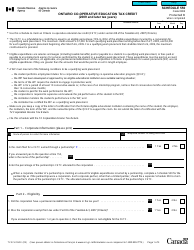

Form 013-0940B Ontario Book Publishig Tax Credit (Obptc) Claim - Ontario, Canada

Form 013-0940B is used to claim the Ontario Book Publishing Tax Credit (OBPTC) in Ontario, Canada. This tax credit is specifically for book publishers in Ontario and provides financial support to eligible publishers in order to promote the growth and development of the book publishing industry in Ontario.

The Form 013-0940B Ontario Book Publishing Tax Credit (OBPTC) claim is filed by book publishing companies operating in Ontario, Canada.

FAQ

Q: What is Form 013-0940B?

A: Form 013-0940B is the Ontario Book Publishing Tax Credit (OBPTC) Claim form.

Q: What is the Ontario Book Publishing Tax Credit (OBPTC)?

A: The Ontario Book Publishing Tax Credit (OBPTC) is a tax credit available to eligible book publishers in Ontario, Canada.

Q: Who can claim the Ontario Book Publishing Tax Credit?

A: Eligible book publishers in Ontario, Canada can claim the Ontario Book Publishing Tax Credit.

Q: How do I claim the Ontario Book Publishing Tax Credit?

A: To claim the Ontario Book Publishing Tax Credit, you need to fill out and submit Form 013-0940B.

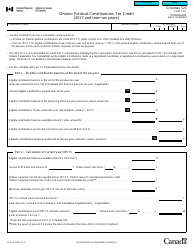

Q: What expenses are eligible for the Ontario Book Publishing Tax Credit?

A: Eligible expenses for the Ontario Book Publishing Tax Credit include certain book publishing expenses incurred in Ontario, such as editorial, design, and publicity costs.

Q: What is the deadline for filing the Ontario Book Publishing Tax Credit claim?

A: The deadline for filing the Ontario Book Publishing Tax Credit claim is generally 12 months after the end of the taxation year.

Q: What documents do I need to submit with the Ontario Book Publishing Tax Credit claim?

A: You may need to submit supporting documents such as book publishing contracts, invoices, and financial statements with your Ontario Book Publishing Tax Credit claim.

Q: Is the Ontario Book Publishing Tax Credit refundable?

A: No, the Ontario Book Publishing Tax Credit is not refundable. It can only be used to offset your Ontario corporate income tax liability.