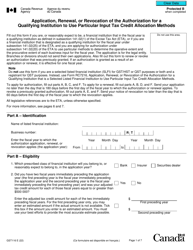

This version of the form is not currently in use and is provided for reference only. Download this version of

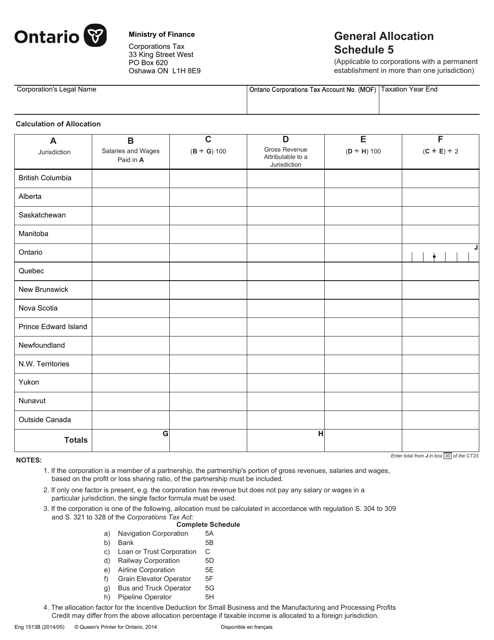

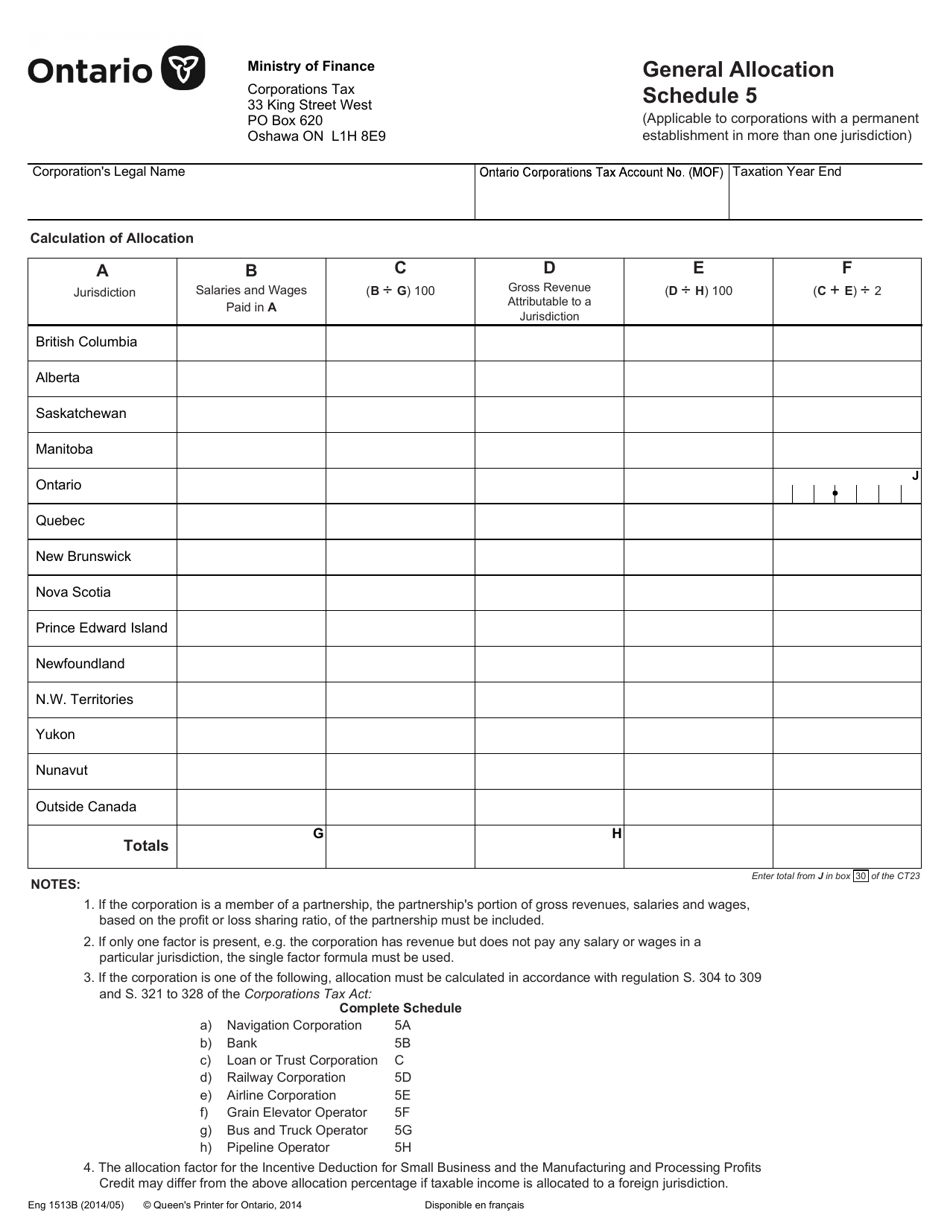

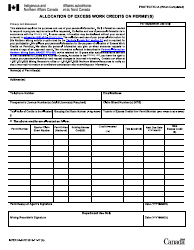

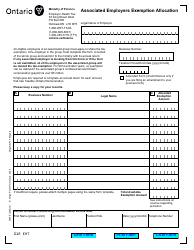

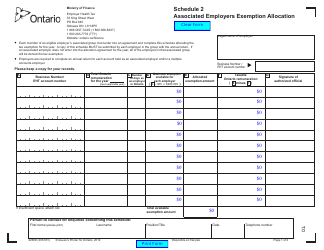

Form 1513B Schedule 5

for the current year.

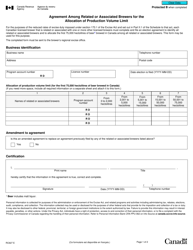

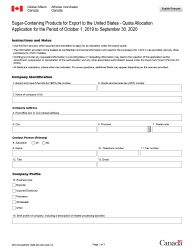

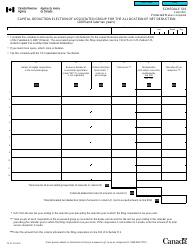

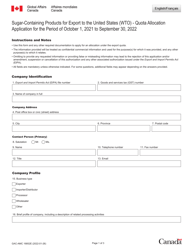

Form 1513B Schedule 5 General Allocation - Ontario, Canada

Form 1513B Schedule 5 General Allocation - Ontario, Canada is a tax form that is used to allocate general deductions and credits for residents of Ontario, Canada. It helps determine the amount of deductions and credits that can be claimed on your tax return.

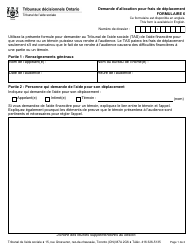

In Canada, the Form 1513B Schedule 5 General Allocation is filed by businesses or individuals operating in Ontario, Canada.

FAQ

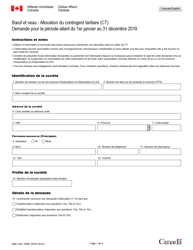

Q: What is Form 1513B?

A: Form 1513B is a tax form used in Ontario, Canada.

Q: What is Schedule 5?

A: Schedule 5 is a section of Form 1513B that deals with general allocation.

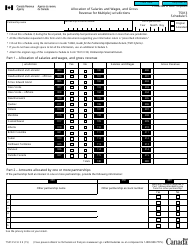

Q: What is general allocation?

A: General allocation refers to the distribution of resources or funds in a fair and equitable manner.

Q: Who uses Form 1513B Schedule 5?

A: Individuals and businesses in Ontario, Canada who need to report and allocate resources or funds.

Q: What is the purpose of Form 1513B Schedule 5?

A: The purpose of Form 1513B Schedule 5 is to ensure fair and transparent allocation of resources or funds in Ontario, Canada.