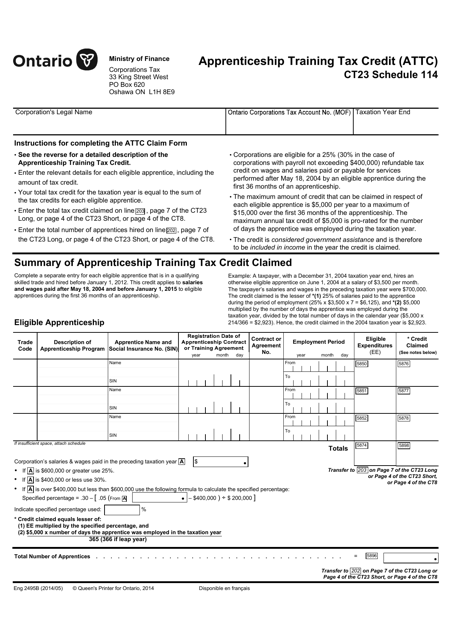

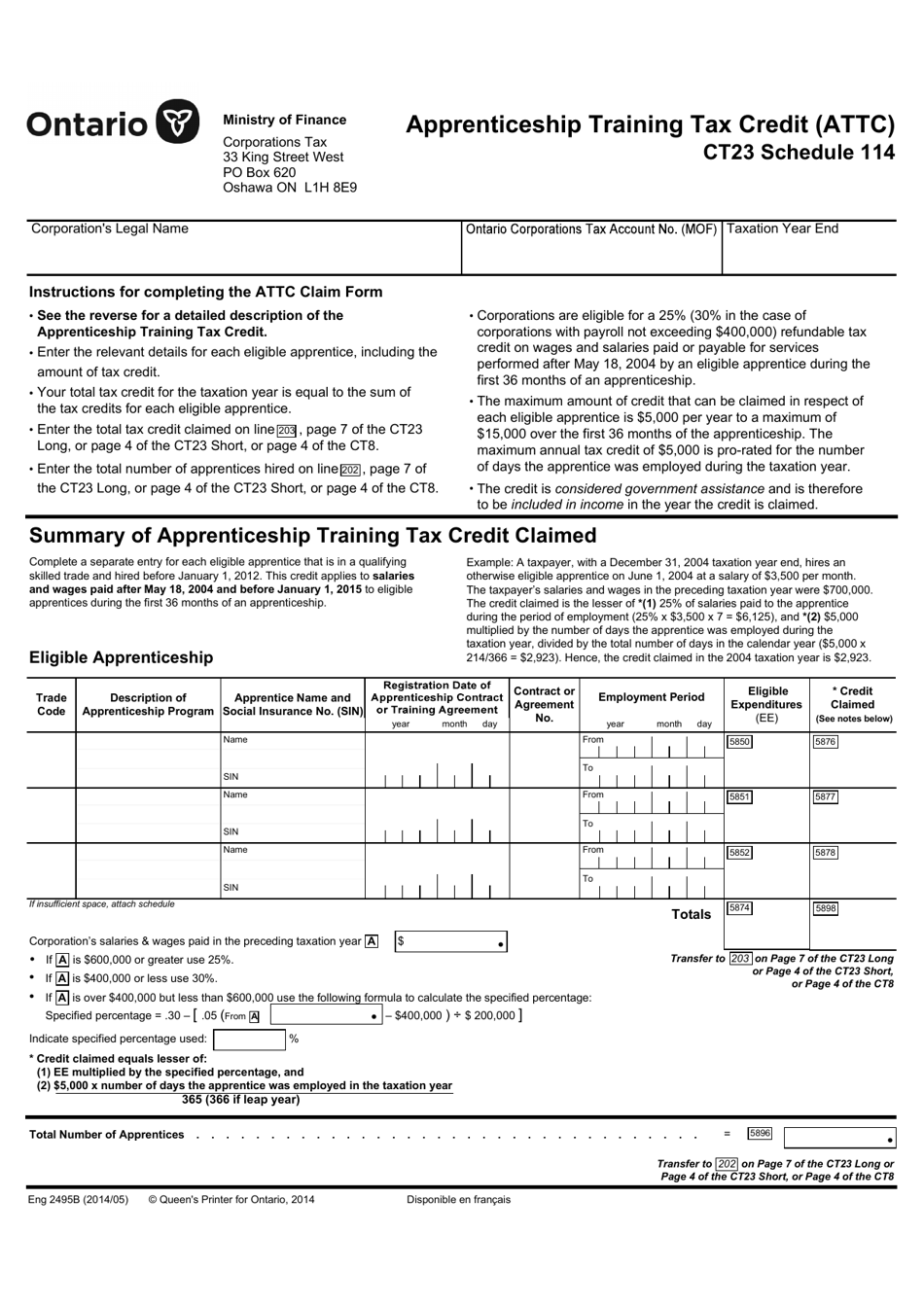

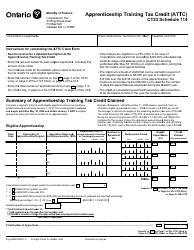

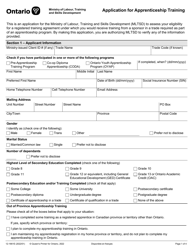

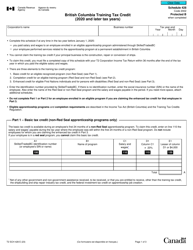

Form CT23 (2495B) Schedule 114 Apprenticeship Training Tax Credit (Attc) - Ontario, Canada

Form CT23 (2495B) Schedule 114 Apprenticeship Training Tax Credit (ATTC) in Ontario, Canada is used to claim the tax credit for eligible expenses related to apprenticeship training. This credit is available to corporations, partnerships, and individuals who employ apprentices in Ontario.

The Form CT23 (2495B) Schedule 114 Apprenticeship Training Tax Credit (Attc) in Ontario, Canada is filed by businesses or corporations that are eligible for this tax credit.

FAQ

Q: What is Form CT23 (2495B)?

A: Form CT23 (2495B) is a schedule used in Ontario, Canada for claiming the Apprenticeship Training Tax Credit (ATTC).

Q: What is the Apprenticeship Training Tax Credit (ATTC)?

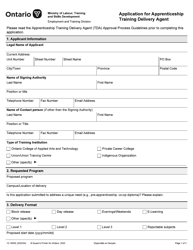

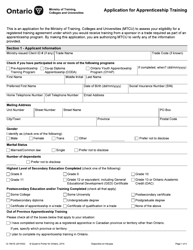

A: The Apprenticeship Training Tax Credit (ATTC) is a tax credit program in Ontario, Canada that provides incentives to businesses for hiring and training eligible apprentices.

Q: What is Schedule 114?

A: Schedule 114 is a specific section of Form CT23 (2495B) that is used to calculate and claim the Apprenticeship Training Tax Credit (ATTC).

Q: How does the Apprenticeship Training Tax Credit (ATTC) work?

A: The ATTC provides eligible businesses with a tax credit equal to a percentage of eligible expenditures incurred in relation to eligible apprenticeship training programs.

Q: Who is eligible for the Apprenticeship Training Tax Credit (ATTC)?

A: Eligible businesses in Ontario, Canada that hire and train eligible apprentices may qualify for the ATTC.

Q: What are eligible expenditures for the ATTC?

A: Eligible expenditures for the ATTC may include costs for salaries, wages, and certain training expenses related to eligible apprentices.

Q: How can businesses claim the ATTC?

A: Businesses must complete and submit Form CT23 (2495B) Schedule 114 along with their annual tax return in order to claim the ATTC.

Q: Are there any deadlines for claiming the ATTC?

A: Yes, businesses must generally file their tax return and claim the ATTC within 18 months of the end of the taxation year for which the credit is being claimed.