This version of the form is not currently in use and is provided for reference only. Download this version of

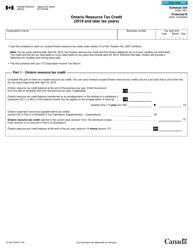

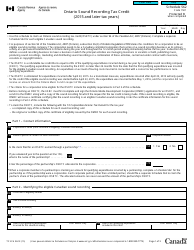

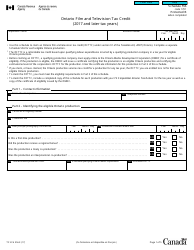

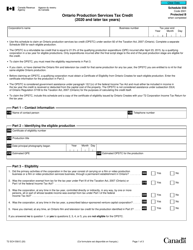

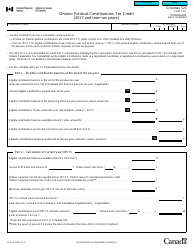

Form CT23 (2494A) Schedule 113

for the current year.

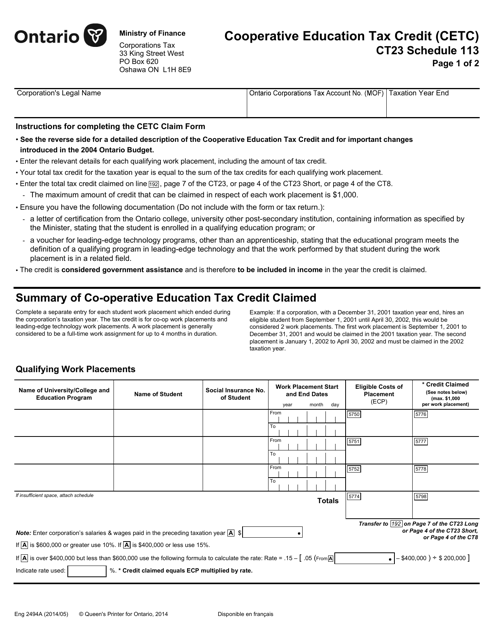

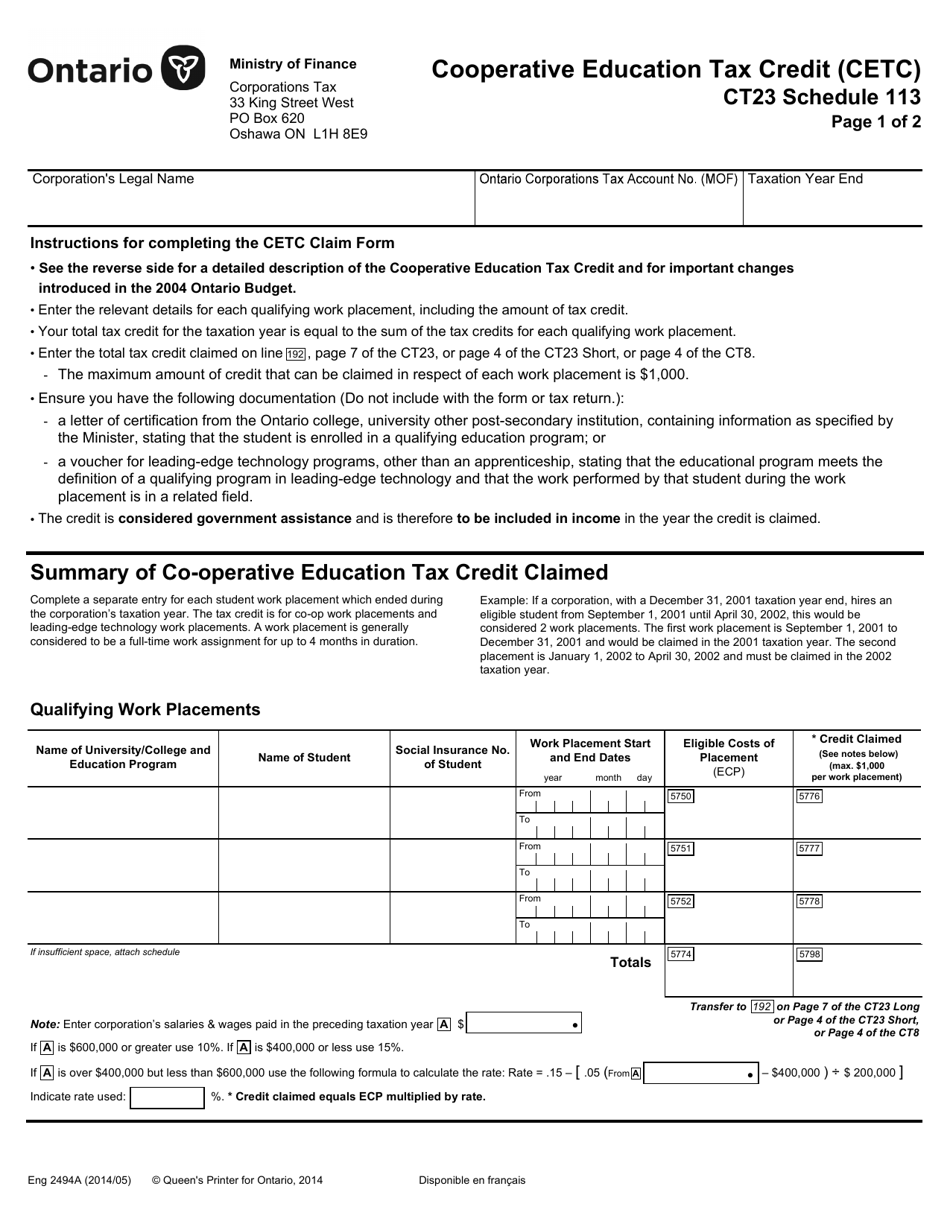

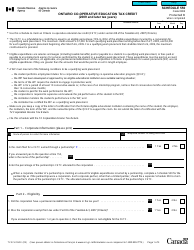

Form CT23 (2494A) Schedule 113 Co-operative Education Tax Credit (Cetc) - Ontario, Canada

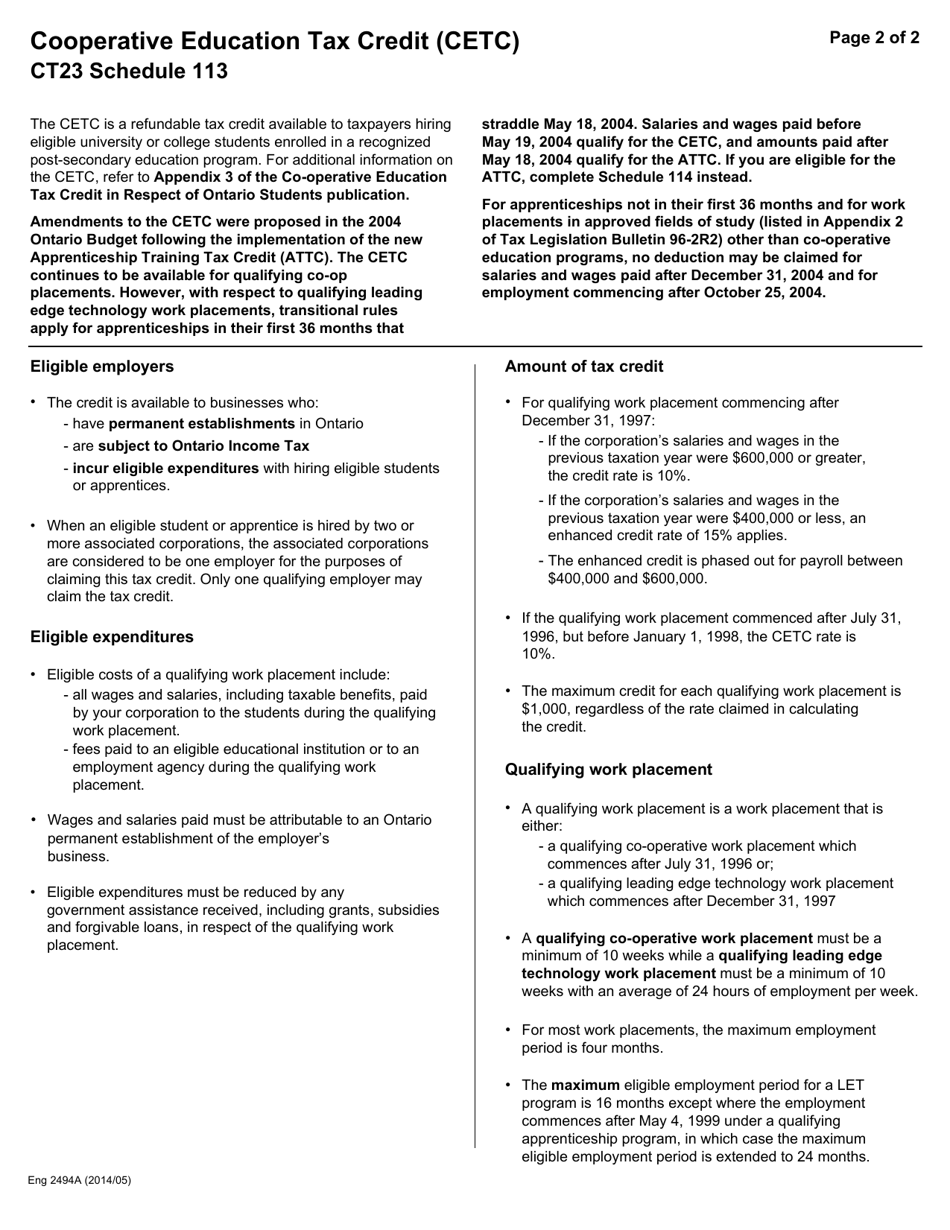

Form CT23 (2494A) Schedule 113 Co-operative Education Tax Credit (CETC) in Ontario, Canada is used to claim the Co-operative Education Tax Credit. This tax credit is designed to encourage businesses in Ontario to hire students enrolled in qualifying co-operative education programs. It provides financial incentives to employers who provide work placements for students, helping them gain valuable work experience while studying.

The employer files the Form CT23 (2494A) Schedule 113 Co-operative Education Tax Credit (CETC) in Ontario, Canada.

FAQ

Q: What is Form CT23 (2494A) Schedule 113?

A: Form CT23 (2494A) Schedule 113 is a tax form used in Ontario, Canada to claim the Co-operative Education Tax Credit (CETC).

Q: What is the Co-operative Education Tax Credit (CETC)?

A: The Co-operative Education Tax Credit (CETC) is a tax credit available in Ontario, Canada for businesses that hire co-op students from recognized post-secondary institutions.

Q: Who is eligible to claim the Co-operative Education Tax Credit (CETC)?

A: Businesses in Ontario, Canada that hire co-op students from recognized post-secondary institutions are eligible to claim the Co-operative Education Tax Credit (CETC).

Q: How much is the Co-operative Education Tax Credit (CETC)?

A: The Co-operative Education Tax Credit (CETC) is calculated as 25% of eligible expenditures made to hire co-op students, up to a maximum of $3,000 per student per work placement.

Q: What expenses can be claimed under the Co-operative Education Tax Credit (CETC)?

A: Eligible expenditures that can be claimed under the Co-operative Education Tax Credit (CETC) include salaries, wages, and taxable benefits paid to co-op students.

Q: How do I claim the Co-operative Education Tax Credit (CETC)?

A: To claim the Co-operative Education Tax Credit (CETC), businesses need to complete and submit Form CT23 (2494A) Schedule 113 along with their corporate income tax return in Ontario, Canada.