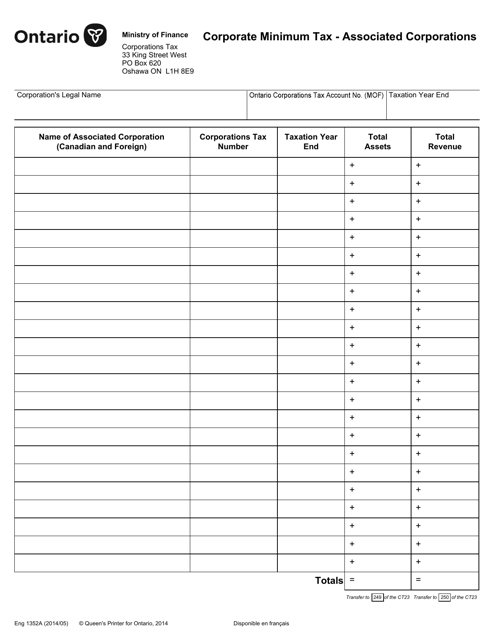

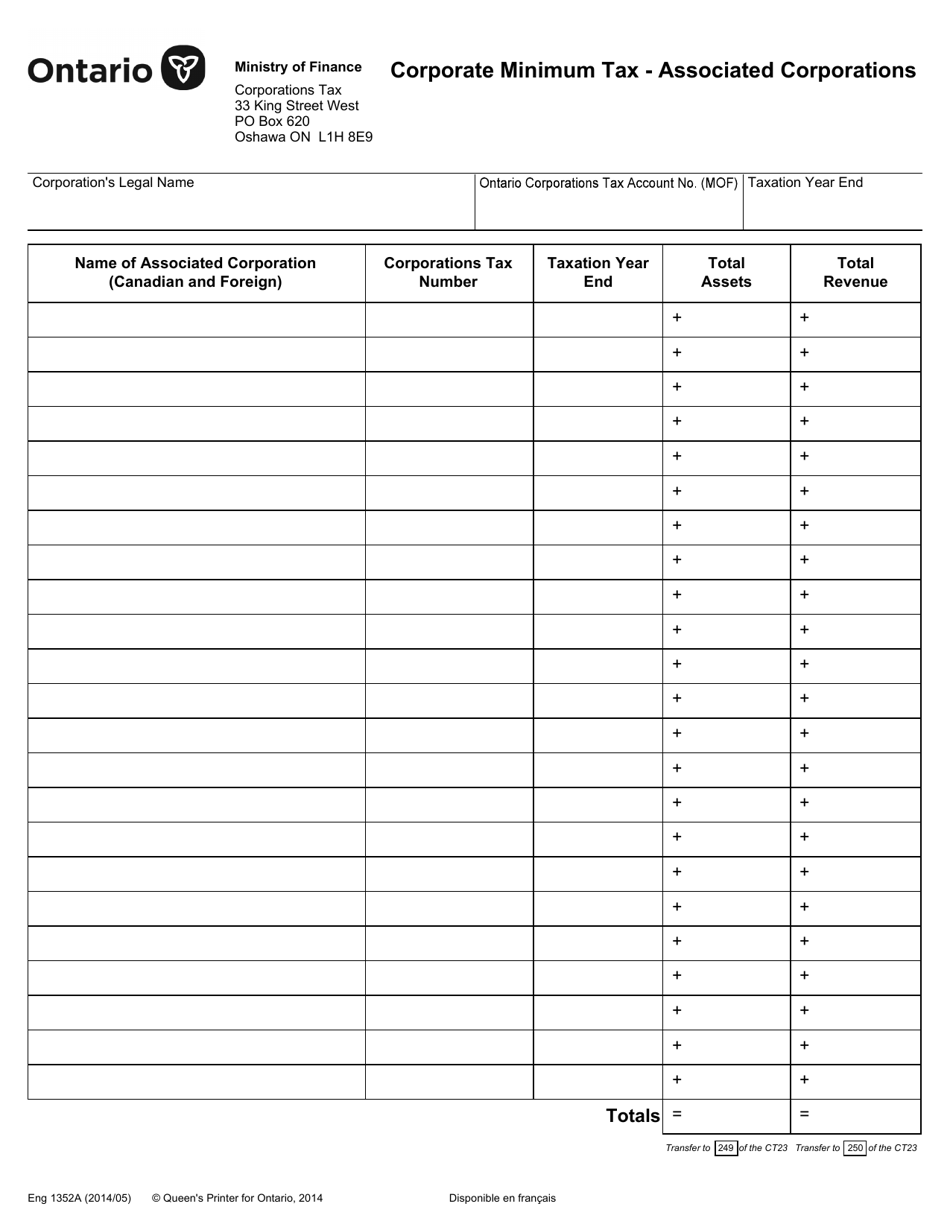

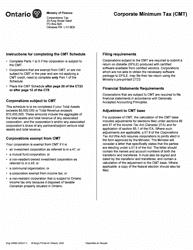

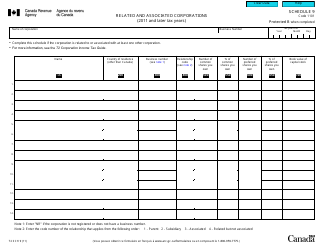

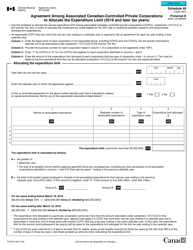

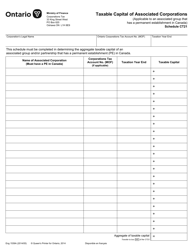

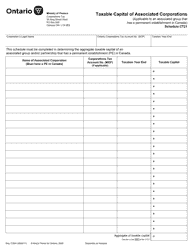

Form 1352A Corporate Minimum Tax-Associated Corporations - Ontario, Canada

Form 1352A Corporate Minimum Tax-Associated Corporations is used in Ontario, Canada to calculate and report the corporate minimum tax for associated corporations. It helps determine the minimum amount of tax that these corporations are required to pay.

FAQ

Q: What is Form 1352A?

A: Form 1352A is a tax form related to corporate minimum tax for associated corporations in Ontario, Canada.

Q: Who is required to file Form 1352A?

A: Associated corporations in Ontario, Canada are required to file Form 1352A if they are subject to the corporate minimum tax.

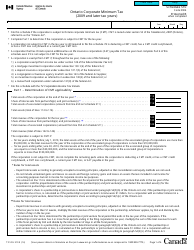

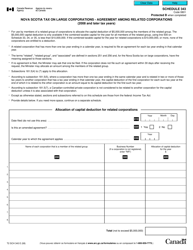

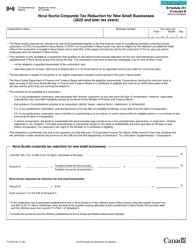

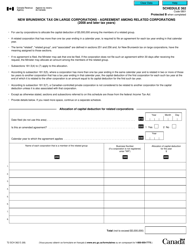

Q: What is the corporate minimum tax?

A: The corporate minimum tax is a tax imposed on associated corporations in Ontario, Canada to ensure they pay a minimum level of tax regardless of their taxable income.

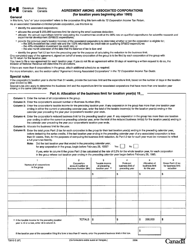

Q: What are associated corporations?

A: Associated corporations are corporations that are closely linked through ownership or control.

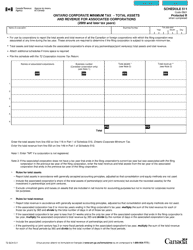

Q: How is the corporate minimum tax calculated?

A: The corporate minimum tax is calculated based on the assets and the gross revenue of the associated corporations.

Q: When is the deadline to file Form 1352A?

A: The deadline to file Form 1352A is usually the same as the corporate tax returnfiling deadline, which is six months after the end of the corporation's fiscal year.