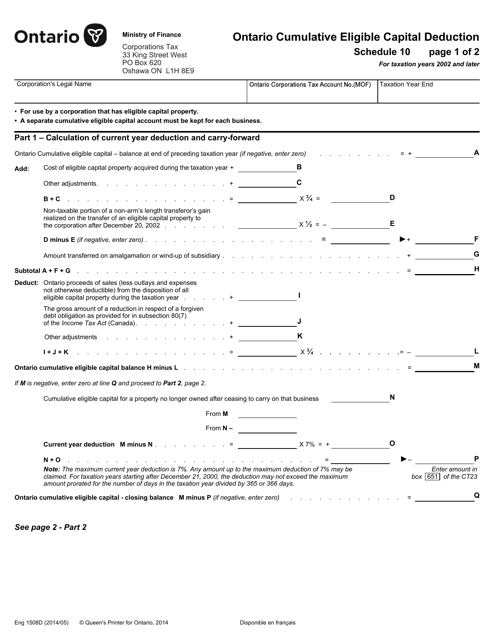

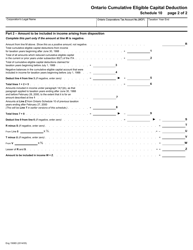

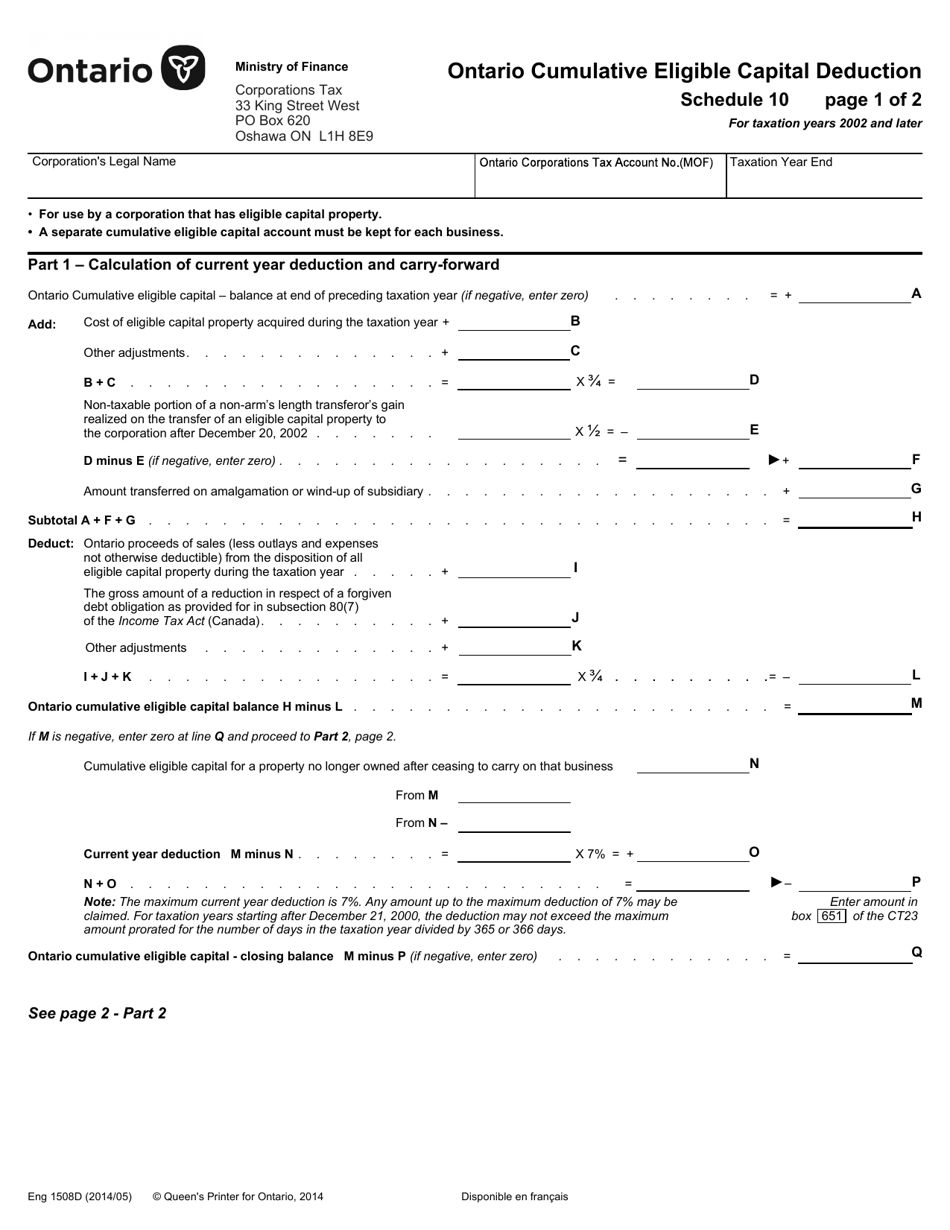

This version of the form is not currently in use and is provided for reference only. Download this version of

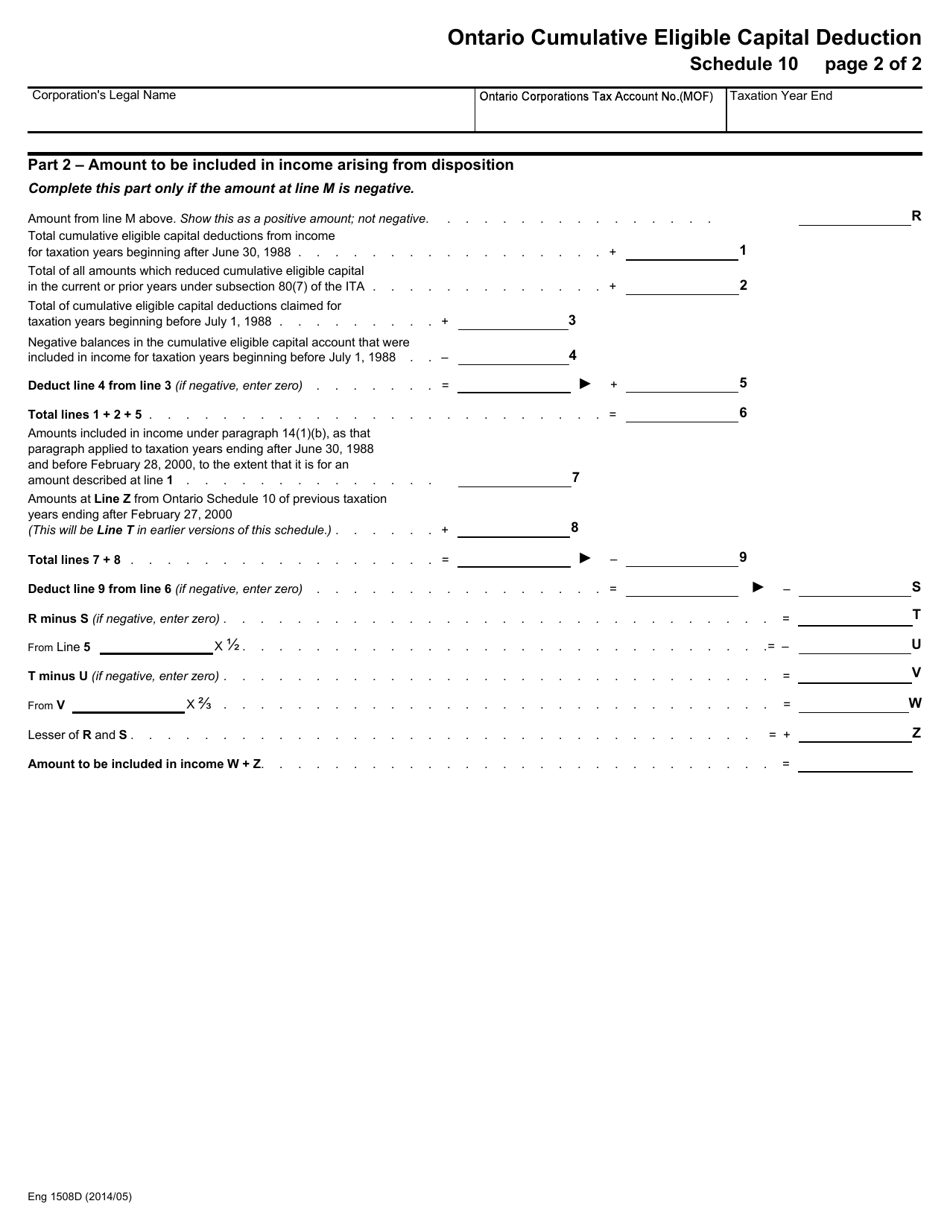

Form 1508D Schedule 10

for the current year.

Form 1508D Schedule 10 Ontario Cumulative Eligible Capital Deduction - Ontario, Canada

The Form 1508D Schedule 10 Ontario Cumulative Eligible Capital Deduction is filed by corporations in Ontario, Canada.

FAQ

Q: What is Form 1508D Schedule 10?

A: Form 1508D Schedule 10 is a tax form used in Ontario, Canada to calculate the Cumulative Eligible Capital Deduction.

Q: What is the Cumulative Eligible Capital Deduction?

A: The Cumulative Eligible Capital Deduction is a deduction that businesses in Ontario can claim on their taxes for eligible capital expenses.

Q: Who is eligible to claim the Cumulative Eligible Capital Deduction?

A: Businesses that have made eligible capital expenditures in Ontario may be eligible to claim this deduction.

Q: What are eligible capital expenditures?

A: Eligible capital expenditures include the cost of acquiring certain types of property, such as patents, trademarks, licenses, and franchises.

Q: Why is Form 1508D Schedule 10 important?

A: Form 1508D Schedule 10 is important because it allows businesses in Ontario to calculate and claim the Cumulative Eligible Capital Deduction, reducing their taxable income.

Q: How do I fill out Form 1508D Schedule 10?

A: You should refer to the instructions provided with the form to correctly fill out the required information and calculate the deduction.