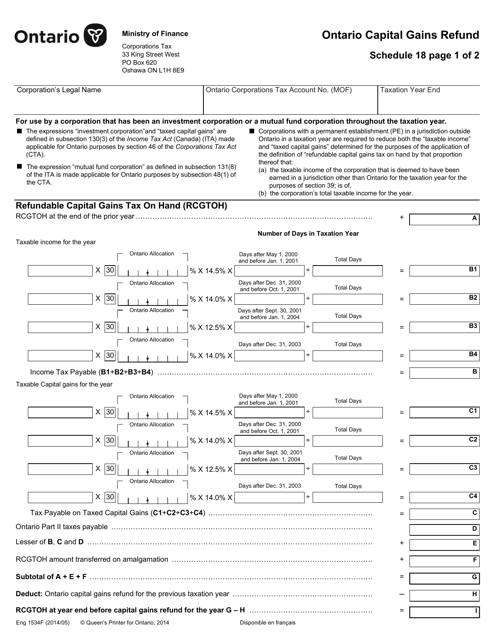

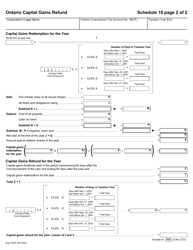

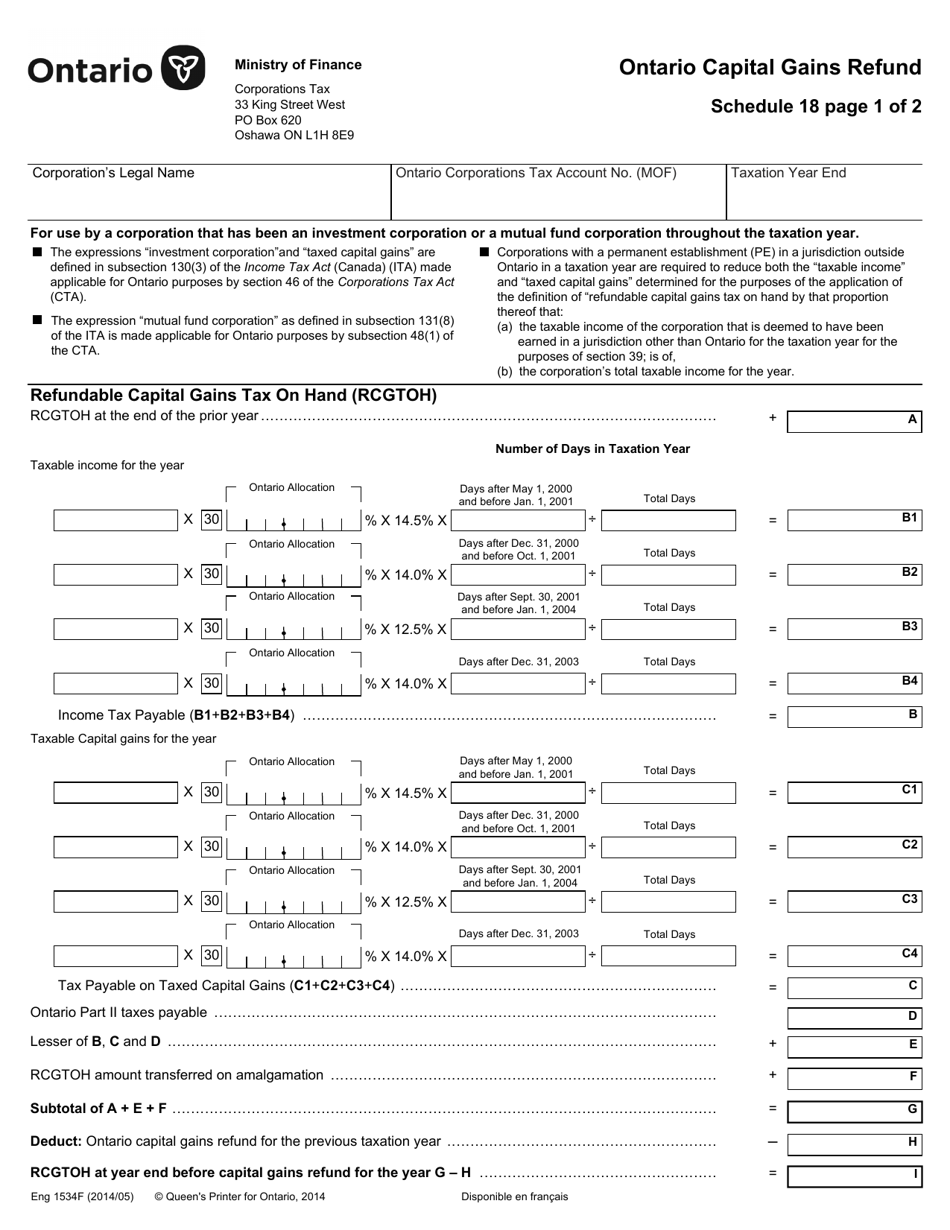

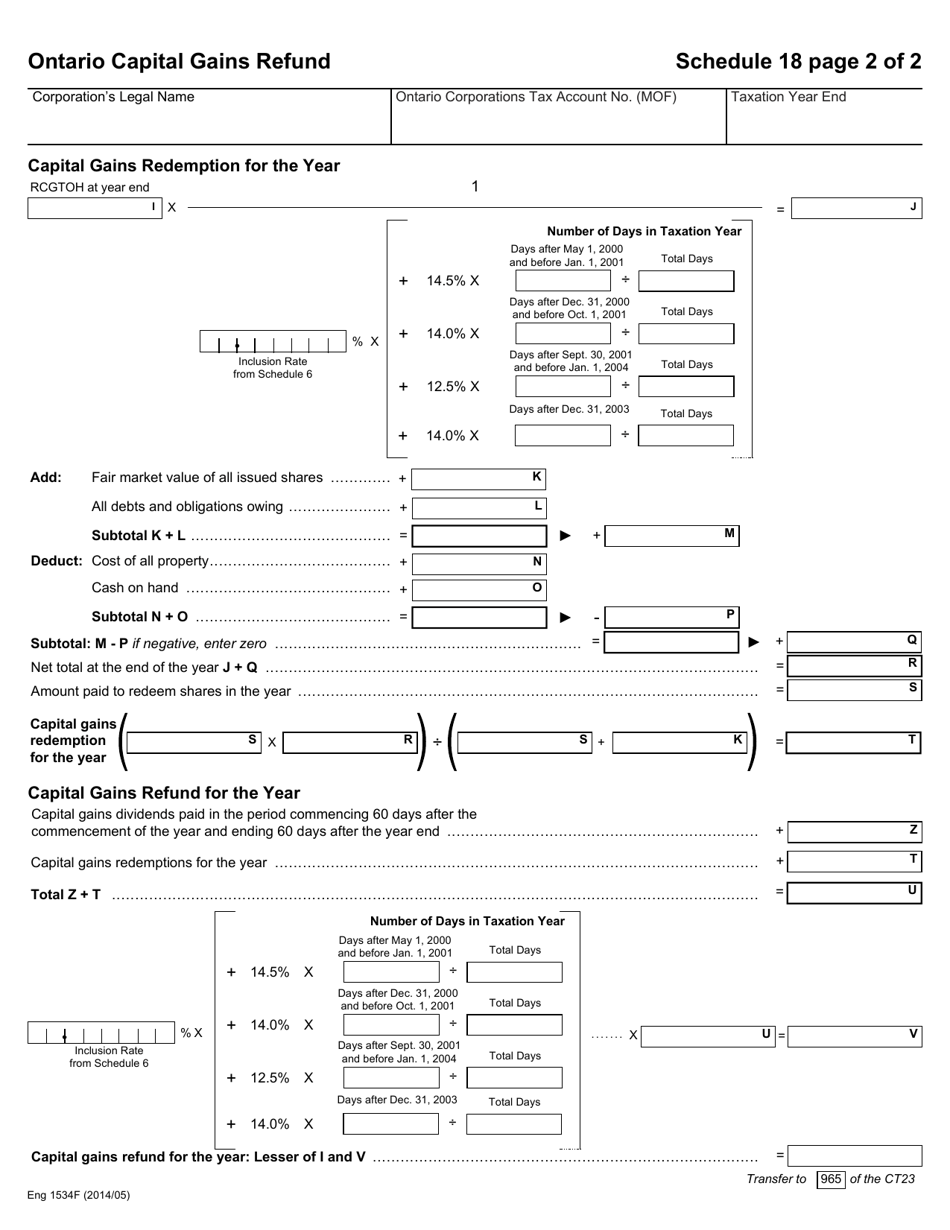

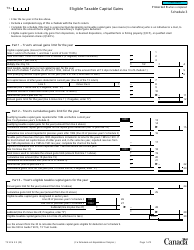

Form 1534F Schedule 18 Ontario Capital Gains Refund - Ontario, Canada

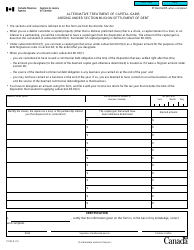

Form 1534F Schedule 18 is used in Ontario, Canada to claim a capital gains refund. It helps individuals or corporations calculate and report their eligibility for a refund on capital gains tax paid in Ontario.

The Form 1534F Schedule 18 Ontario Capital Gains Refund in Ontario, Canada is typically filed by individuals who are claiming a refund for capital gains tax.

FAQ

Q: What is Form 1534F?

A: Form 1534F is the Schedule 18 Ontario Capital Gains Refund form in Ontario, Canada.

Q: What is Schedule 18?

A: Schedule 18 is a form used in Ontario, Canada, to claim a capital gains refund.

Q: Who can file Form 1534F?

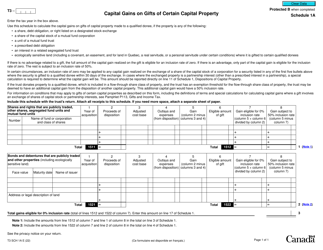

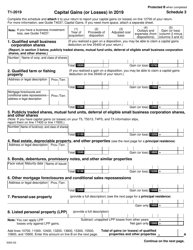

A: Form 1534F can be filed by Canadian taxpayers who are residents of Ontario and have realized a capital gain on the disposition of eligible small business corporation shares.

Q: What is a capital gains refund?

A: A capital gains refund is a refund of a portion of the taxes paid on capital gains.

Q: What are eligible small business corporation shares?

A: Eligible small business corporation shares are shares of a small business corporation that meets certain criteria set by the Ontario government.

Q: When is Form 1534F due?

A: Form 1534F is typically due on the same day as your personal income tax return, which is April 30th for most individuals.

Q: Is Form 1534F mandatory?

A: Form 1534F is not mandatory, but if you have realized a capital gain on the disposition of eligible small business corporation shares, filing this form will allow you to claim a capital gains refund.

Q: What should I do if I have additional questions about Form 1534F?

A: If you have additional questions about Form 1534F, it is recommended to contact the Ontario Ministry of Finance or consult with a tax professional.