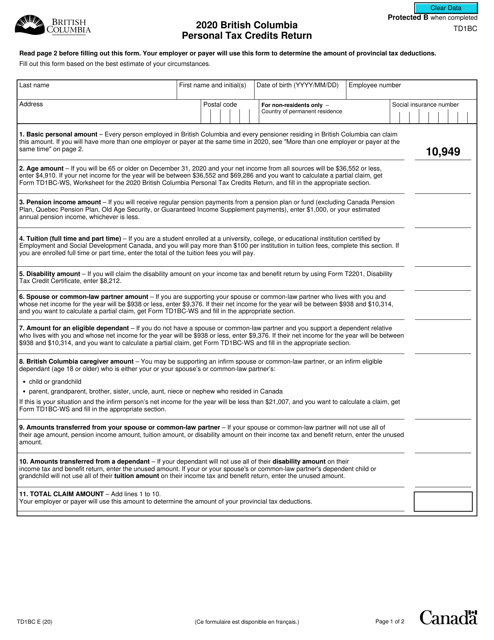

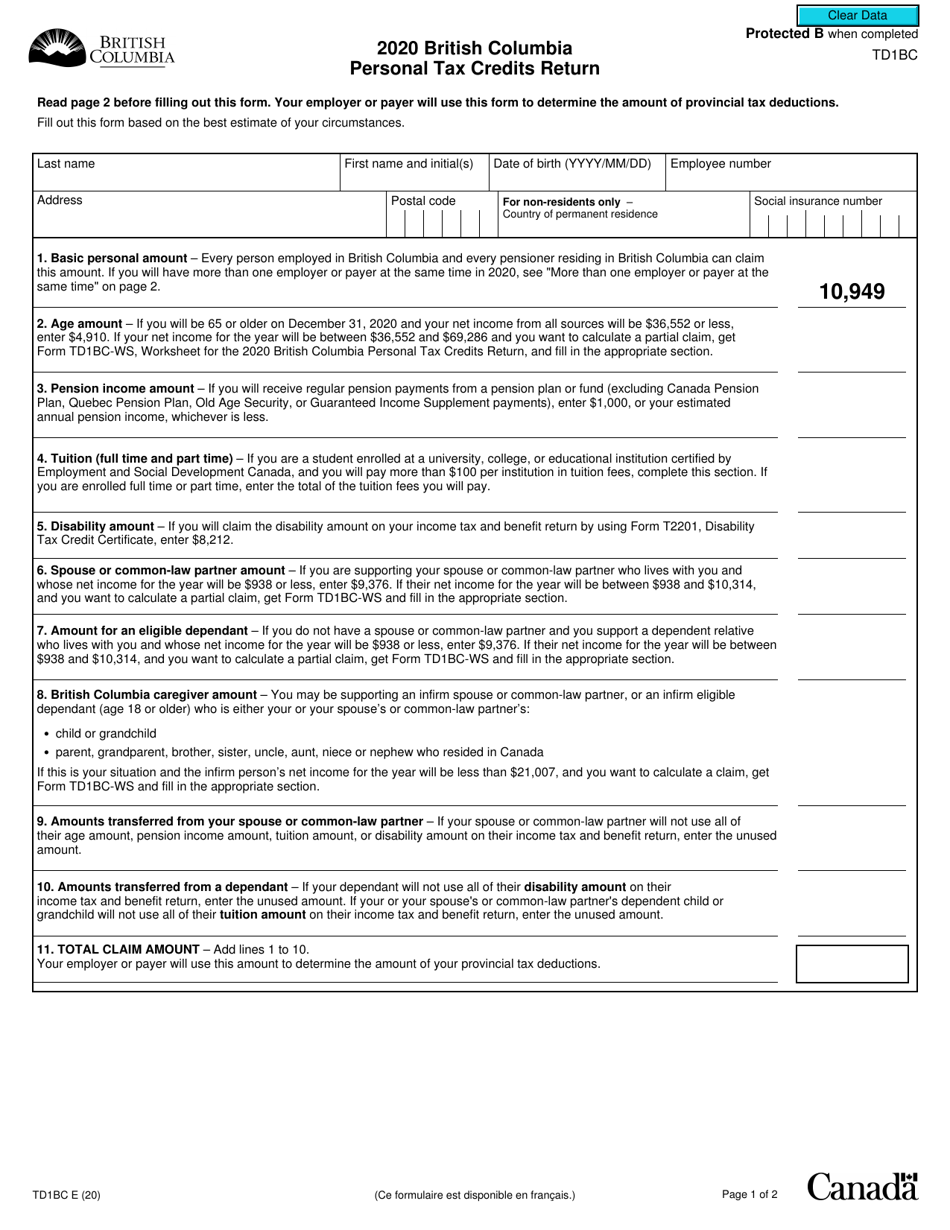

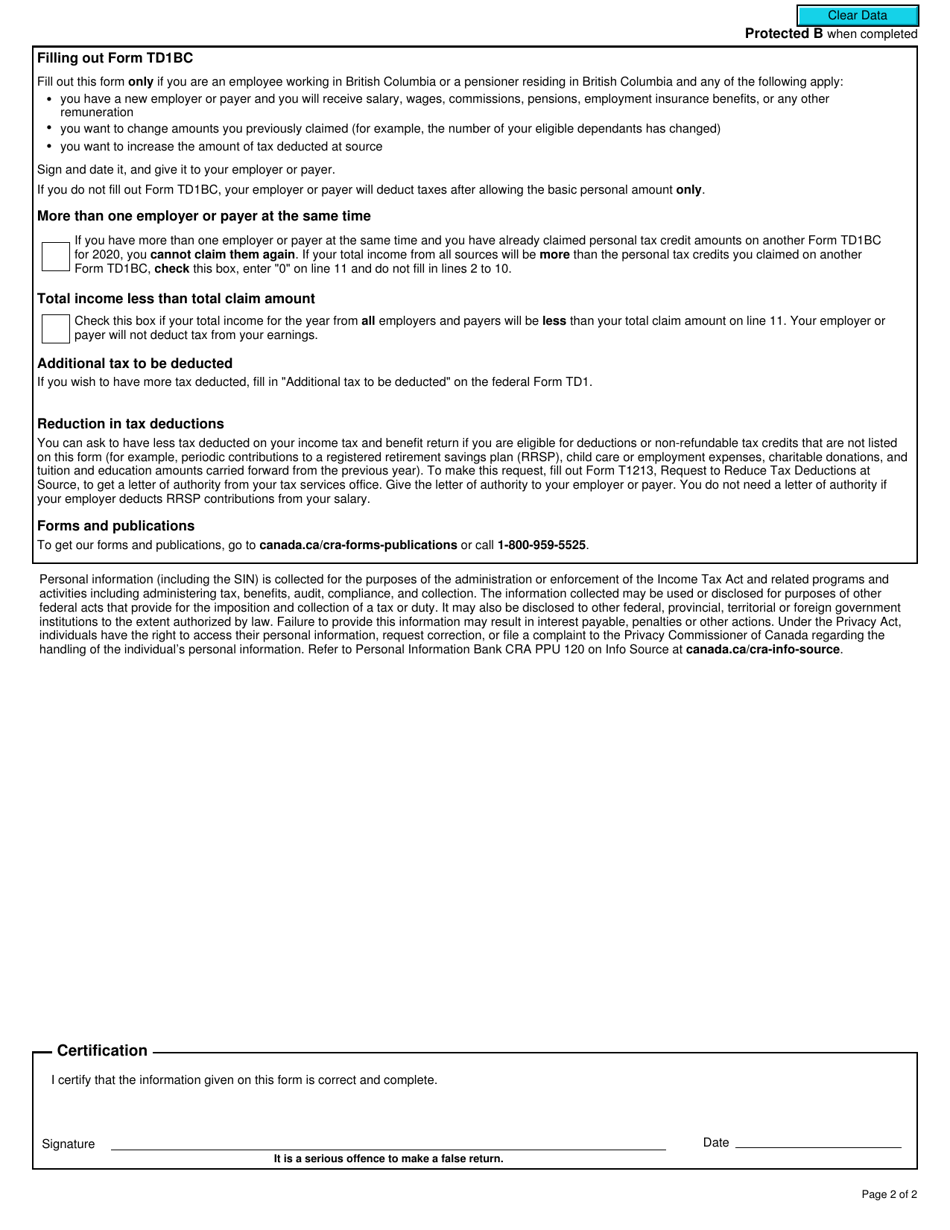

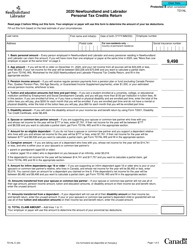

Form TD1BC British Columbia Personal Tax Credits Return - British Columbia, Canada

Form TD1BC is the British Columbia Personal Tax Credits Return. It is used in British Columbia, Canada to determine the amount of provincial tax that should be deducted from an individual's income. This form helps employees specify any additional tax credits or deductions they may be eligible for, which can reduce their tax liability.

The Form TD1BC British Columbia Personal Tax Credits Return is filed by individuals who are residents of British Columbia, Canada.

FAQ

Q: What is Form TD1BC?

A: Form TD1BC is the British Columbia Personal Tax Credits Return.

Q: Who should fill out Form TD1BC?

A: Residents of British Columbia, Canada should fill out Form TD1BC.

Q: What is the purpose of Form TD1BC?

A: The purpose of Form TD1BC is to determine the amount of provincial personal tax credits you can claim.

Q: Do I have to fill out Form TD1BC every year?

A: Yes, if you are a resident of British Columbia, you should fill out Form TD1BC every year.

Q: What information do I need to fill out Form TD1BC?

A: You will need your social insurance number, your employment income information, and any other applicable tax credits or deductions.

Q: Can I claim both federal and provincial tax credits on Form TD1BC?

A: Yes, you can claim both federal and provincial tax credits on Form TD1BC.

Q: When should I submit Form TD1BC?

A: You should submit Form TD1BC to your employer as soon as possible, preferably before you start your employment or receive your first pay.

Q: Can I make changes to my Form TD1BC throughout the year?

A: Yes, if your circumstances change, you can submit a new Form TD1BC to your employer to update your personal tax credits.

Q: Who can I contact if I have questions about Form TD1BC?

A: You can contact the Canada Revenue Agency (CRA) for questions about Form TD1BC.