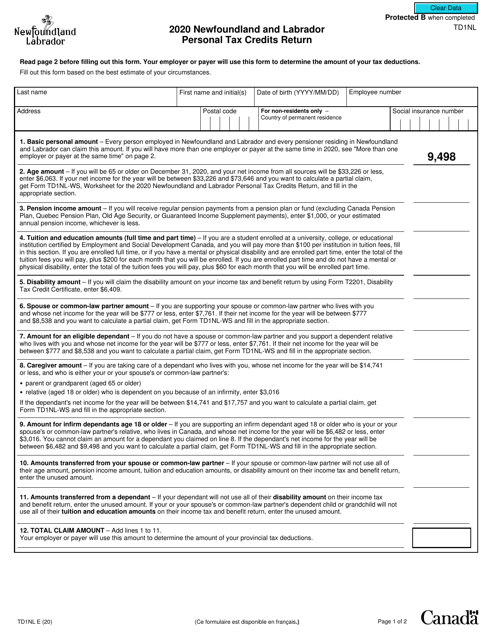

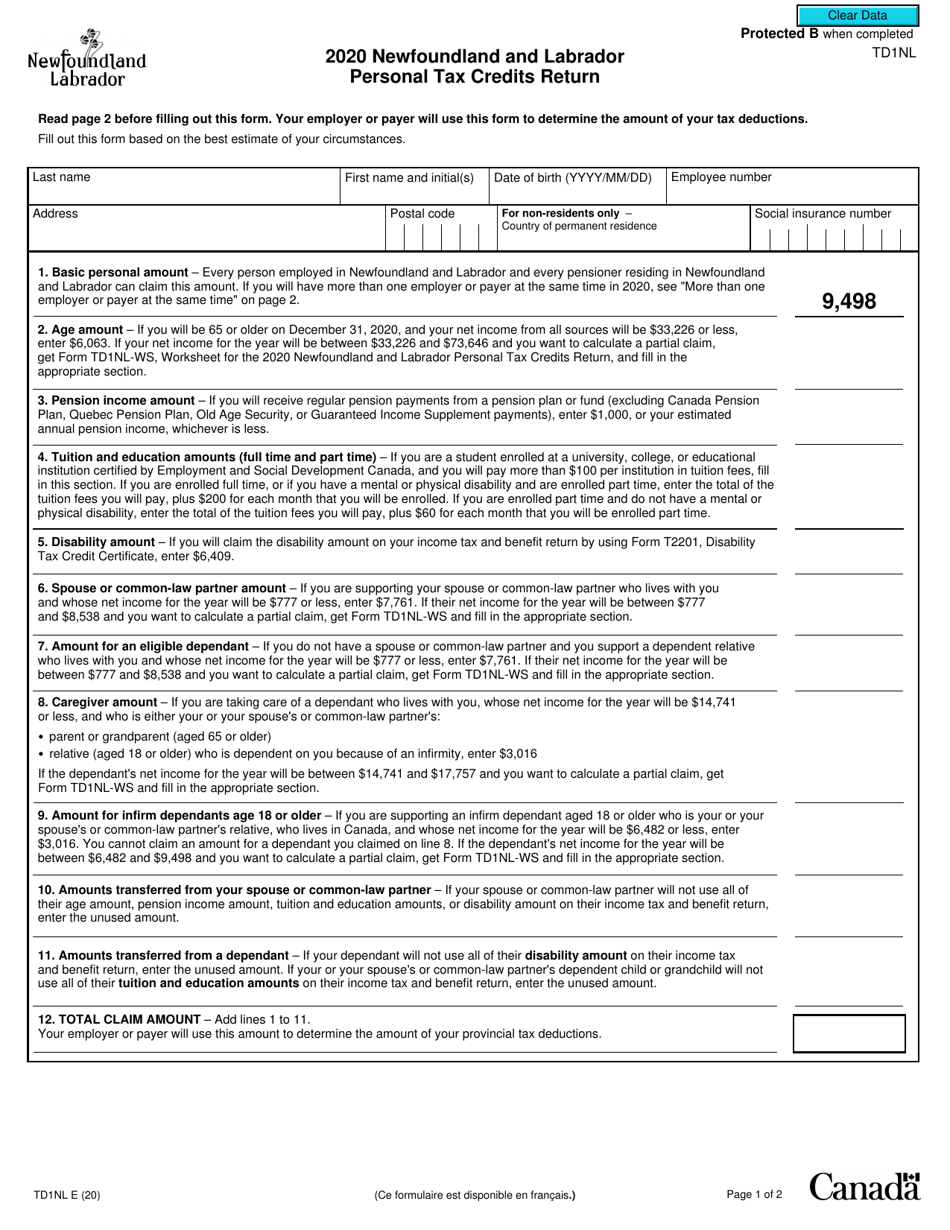

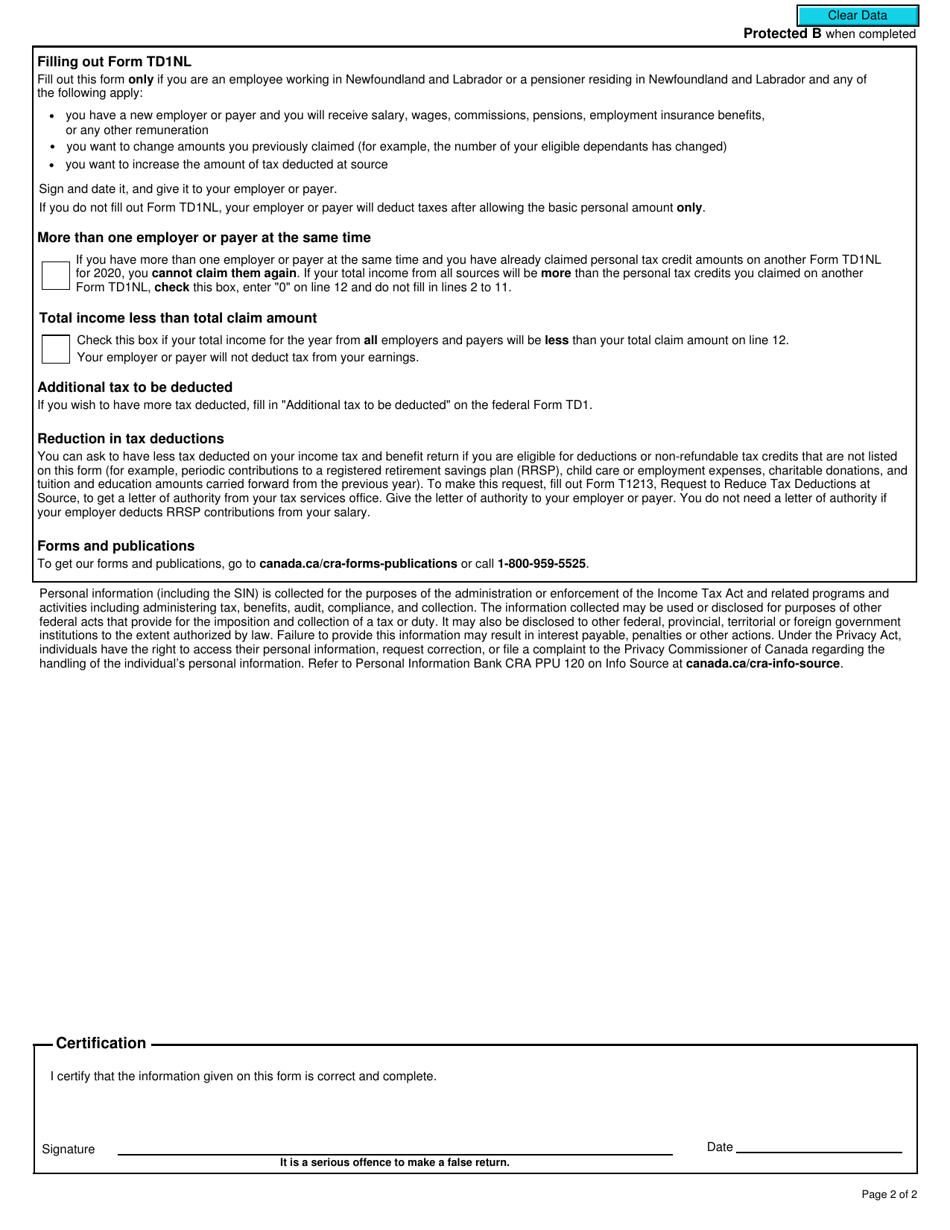

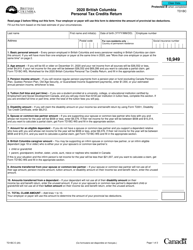

Form TD1NL Newfoundland and Labrador Personal Tax Credits Return - Newfoundland and Labrador, Canada

Form TD1NL is the Newfoundland and Labrador Personal Tax Credits Return, which is used by individuals in Newfoundland and Labrador, Canada, to declare their personal tax credits. It is used to determine the amount of income tax that should be deducted from their paychecks or other types of income.

An individual who is resident in Newfoundland and Labrador, Canada, and wants to claim tax credits specific to the province would file the Form TD1NL Newfoundland and Labrador Personal Tax Credits Return.

FAQ

Q: What is Form TD1NL?

A: Form TD1NL is the Newfoundland and Labrador Personal Tax Credits Return.

Q: What is the purpose of Form TD1NL?

A: The purpose of Form TD1NL is to claim personal tax credits in Newfoundland and Labrador.

Q: Who needs to fill out Form TD1NL?

A: Residents of Newfoundland and Labrador who want to claim personal tax credits need to fill out Form TD1NL.

Q: What information is required on Form TD1NL?

A: Form TD1NL requires information about your personal tax credits, such as the Basic Personal Amount, spousal amount, and child care expenses.

Q: When should I submit Form TD1NL?

A: You should submit Form TD1NL to your employer or payer when you start a new job or when your tax situation changes.