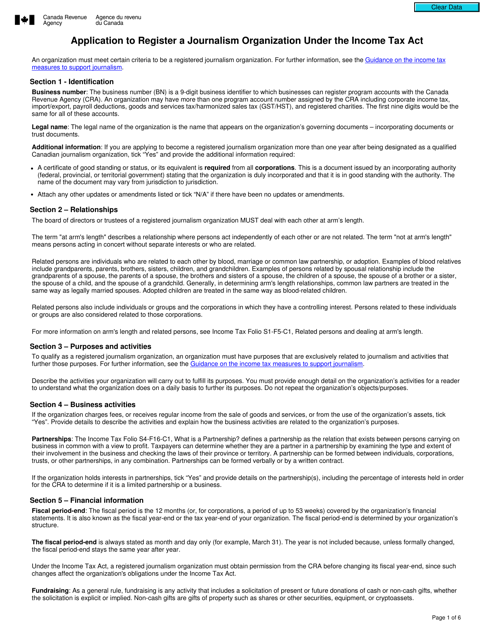

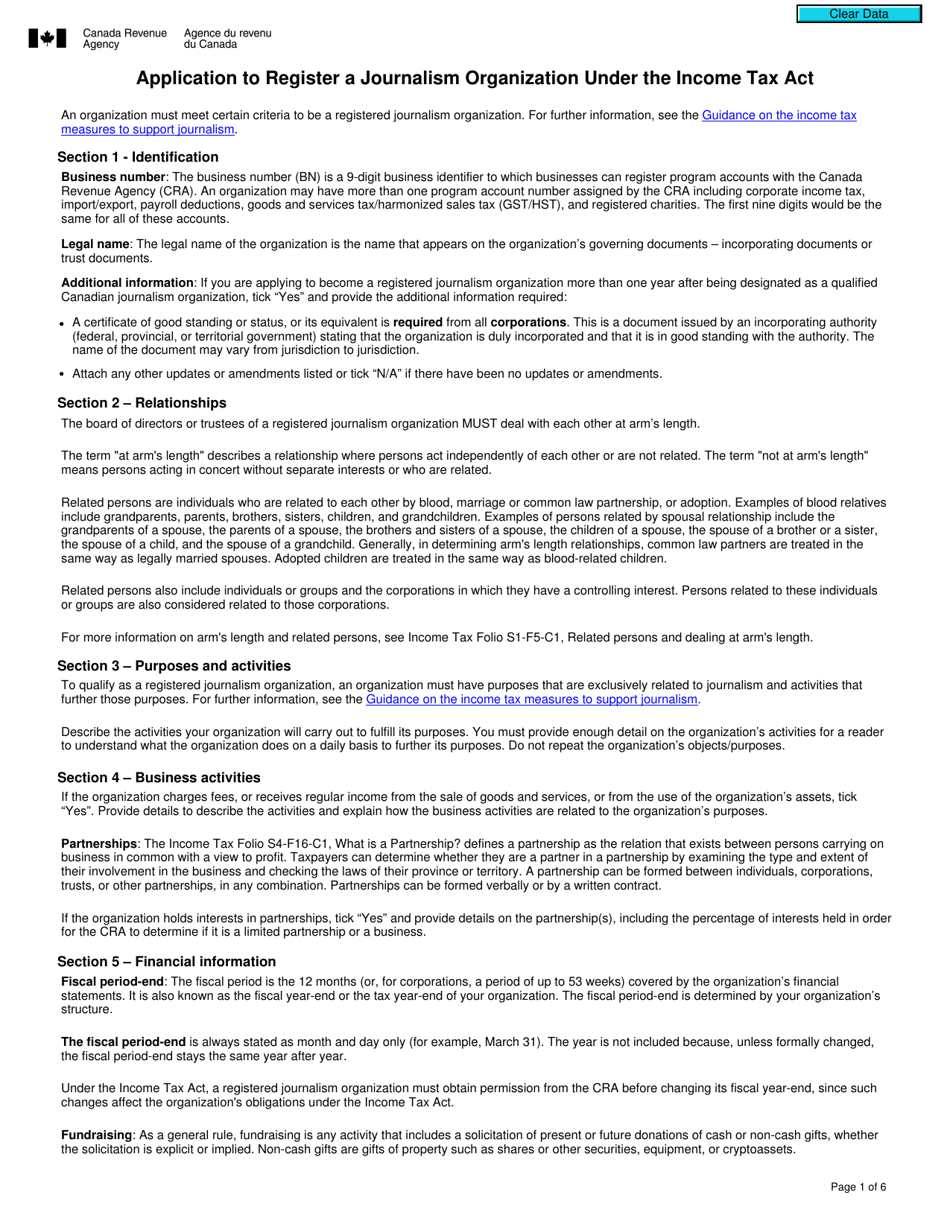

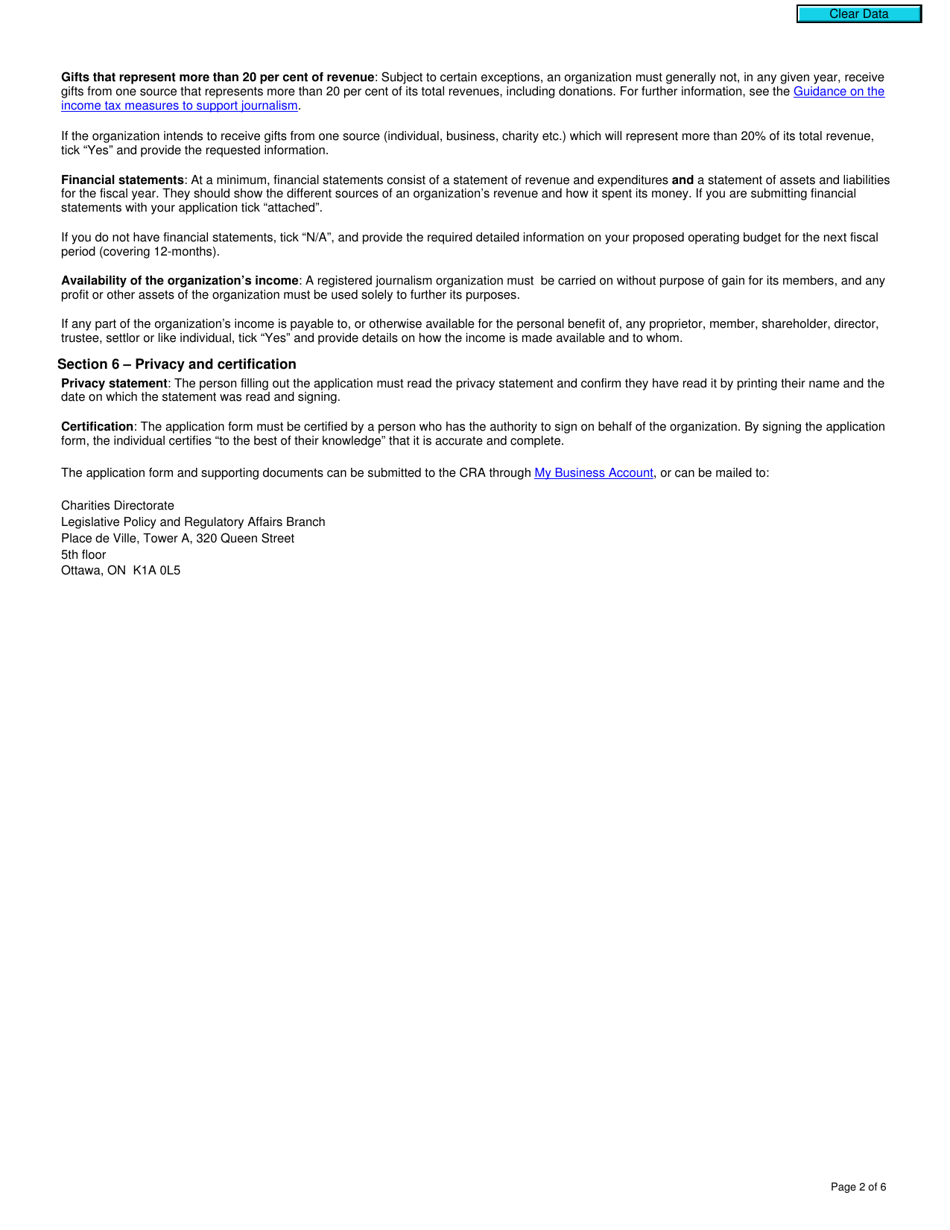

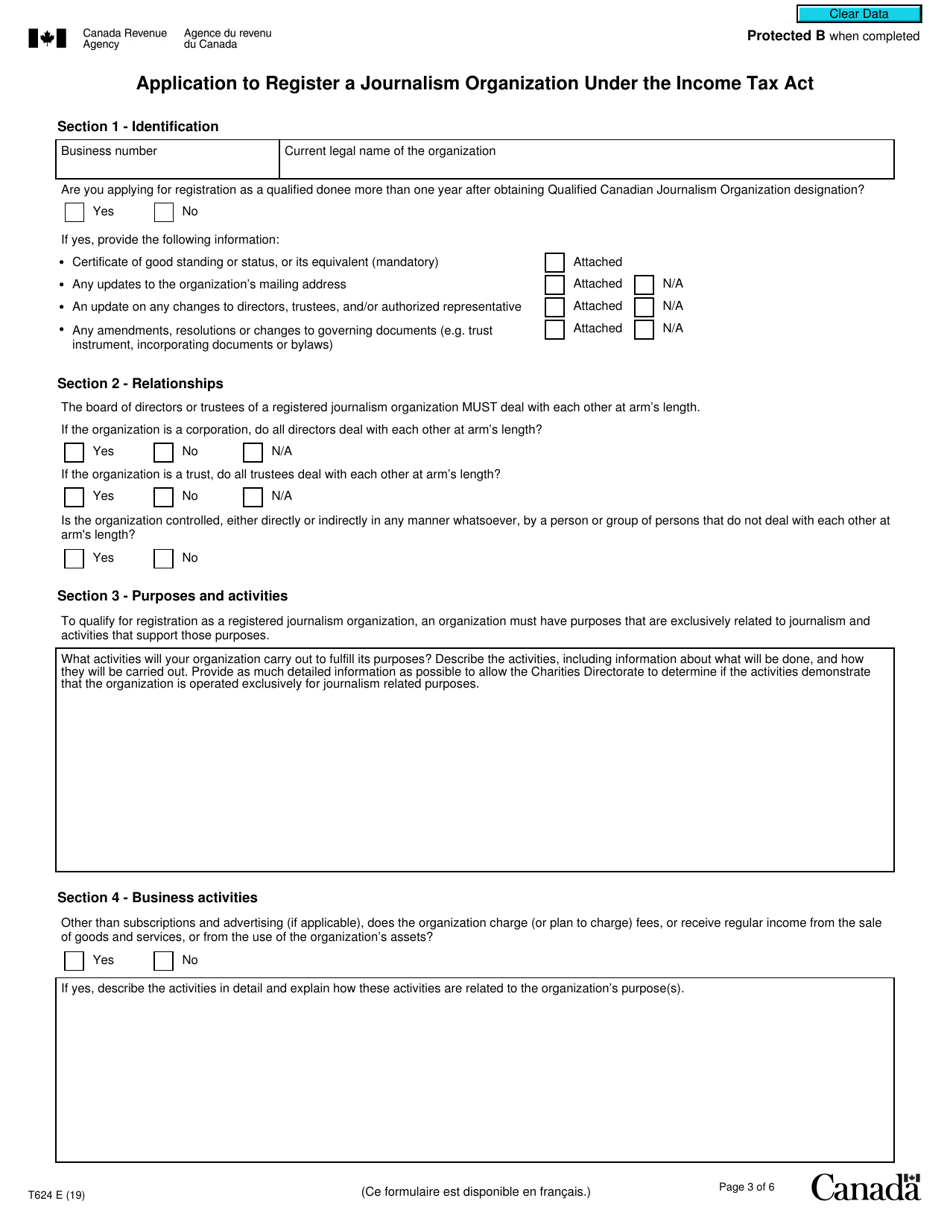

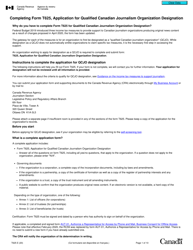

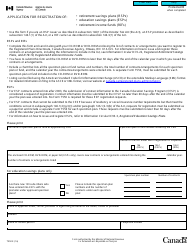

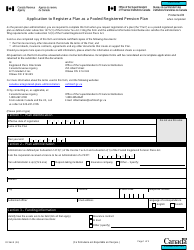

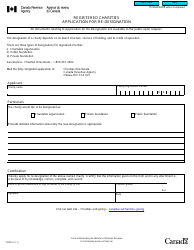

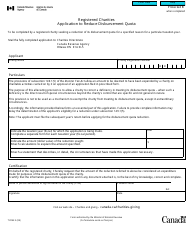

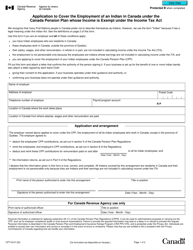

Form T624 Application to Register a Journalism Organization Under the Income Tax Act - Canada

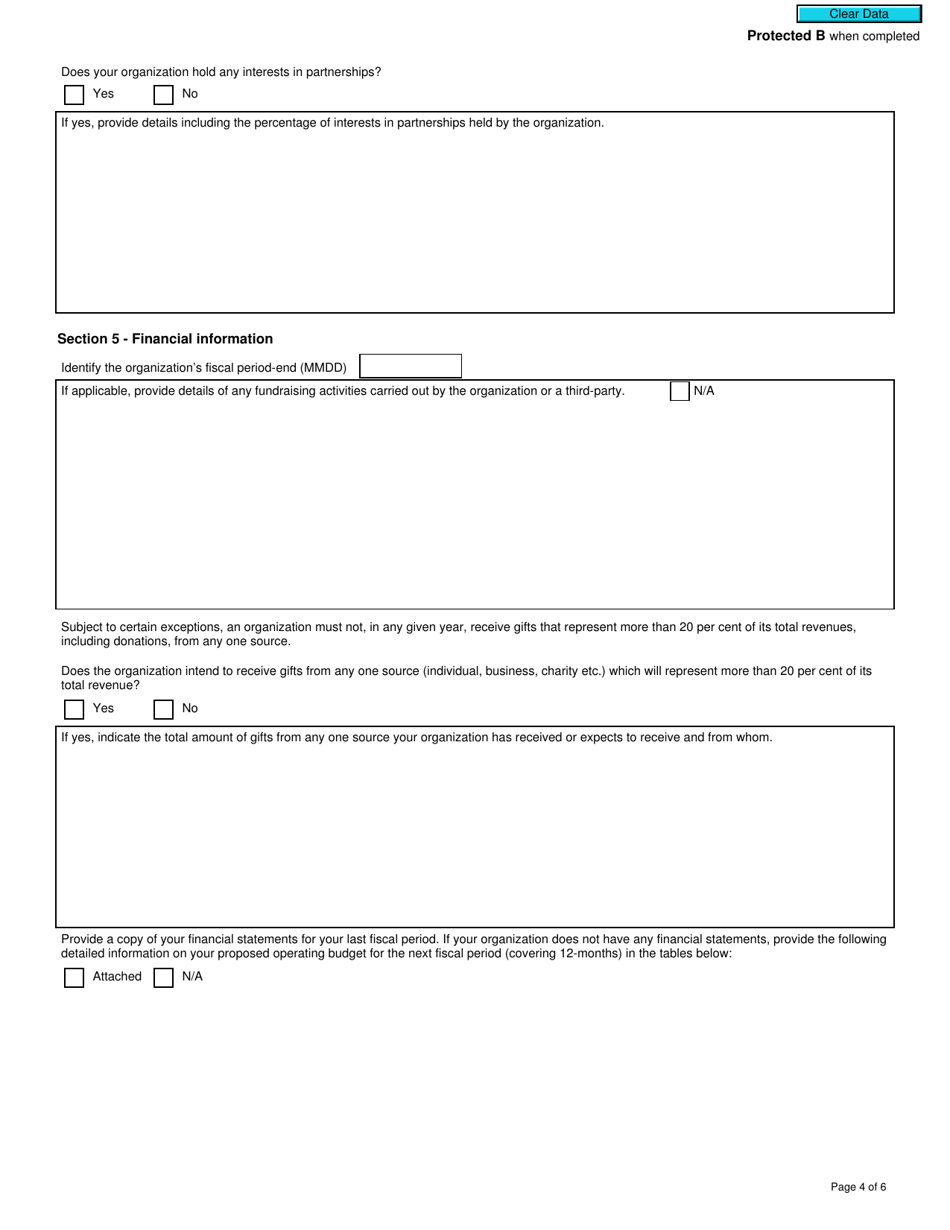

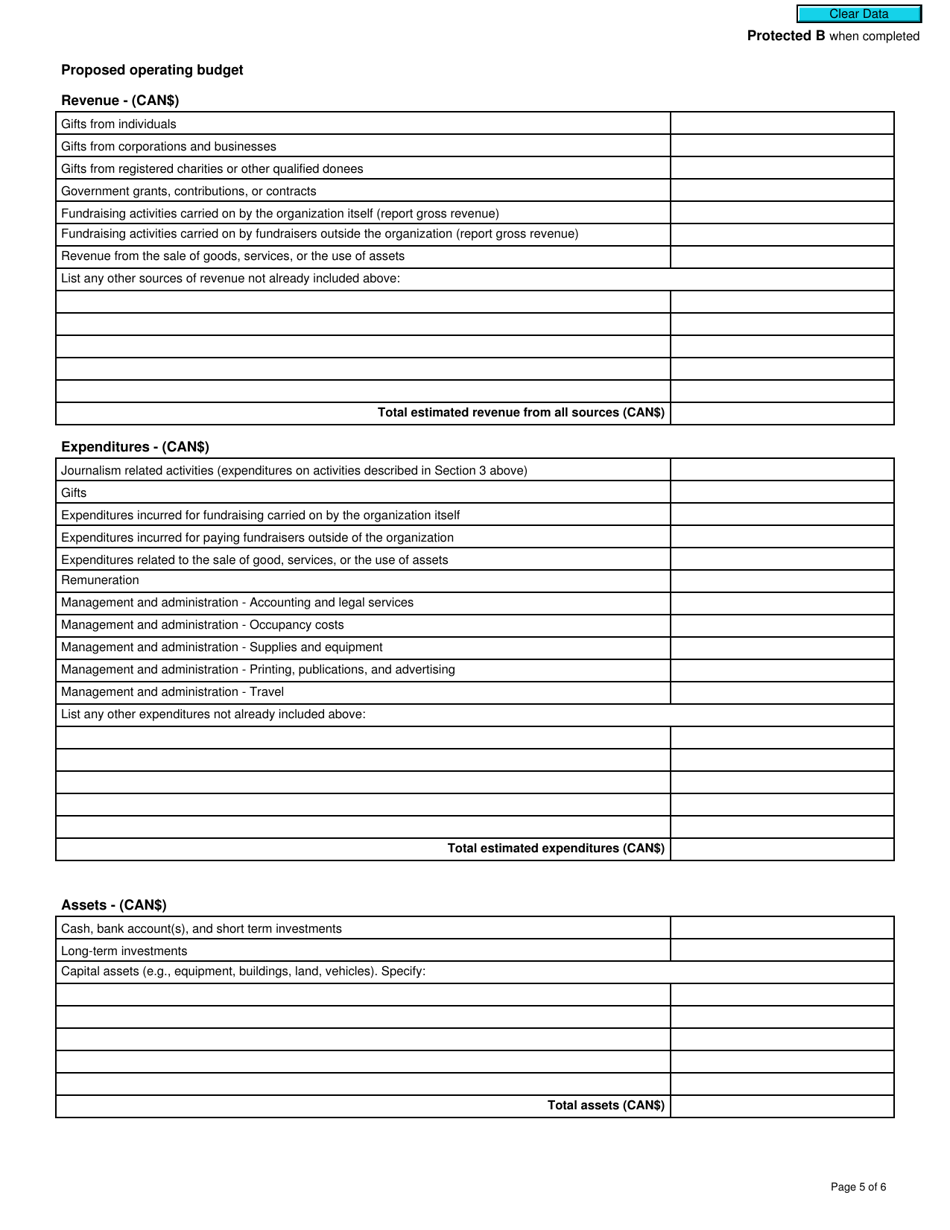

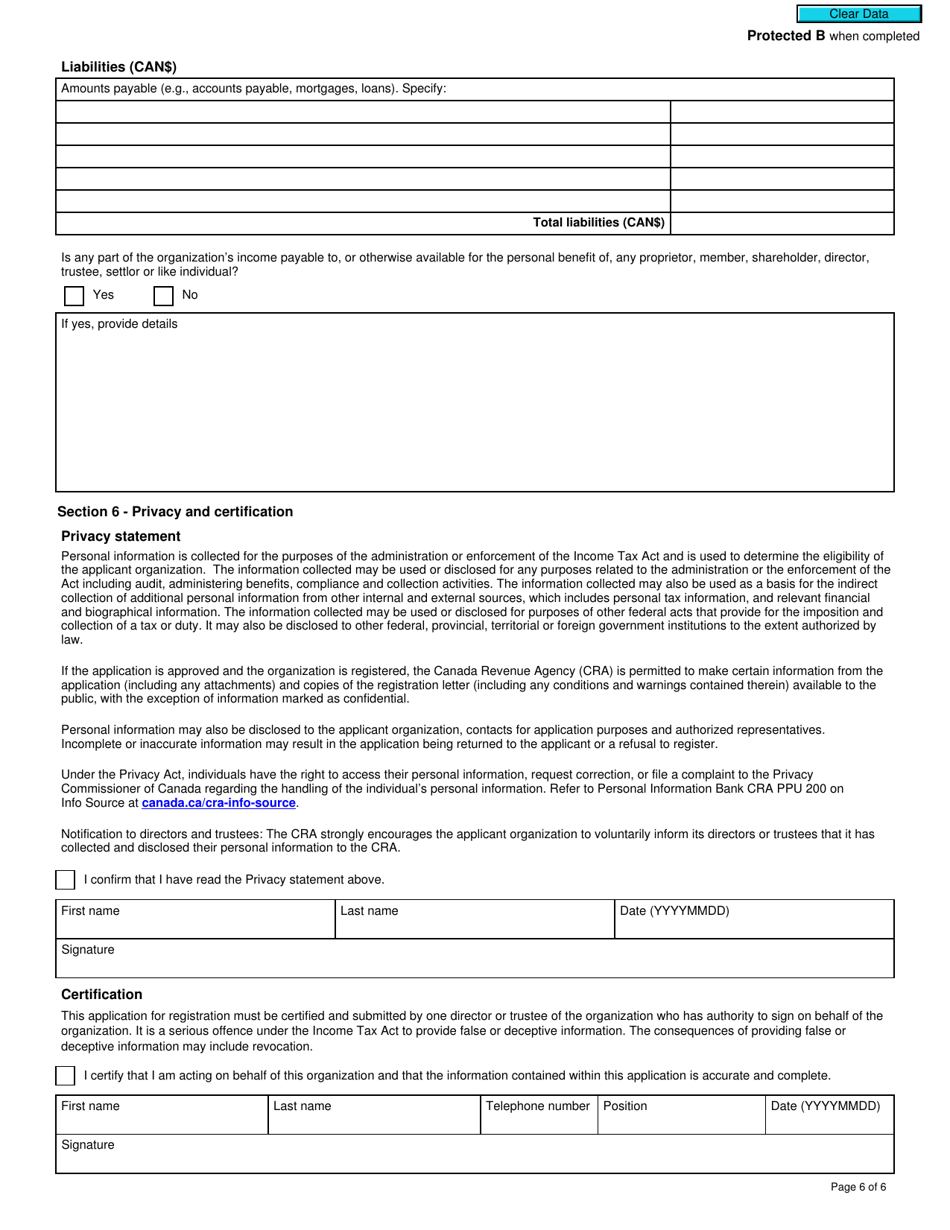

Form T624 - Application to Register a Journalism Organization Under the Income Tax Act is used in Canada to apply for the registration of a journalism organization under the specific provisions of the Income Tax Act. This registration allows the organization to qualify for certain tax benefits and exemptions.

The Form T624 Application to Register a Journalism Organization Under the Income Tax Act - Canada is filed by the journalism organization itself.

FAQ

Q: What is Form T624?

A: Form T624 is an application to register a journalism organization under the Income Tax Act in Canada.

Q: Who needs to file Form T624?

A: Journalism organizations in Canada that want to be recognized as a qualified donee.

Q: What is a qualified donee?

A: A qualified donee is a registered charity, registered Canadian amateur athletic association, or registered national arts service organization.

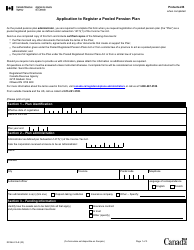

Q: What are the requirements for eligibility?

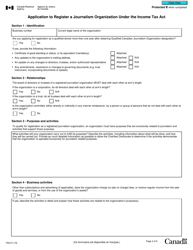

A: To be eligible for registration, the organization must primarily carry on journalism activities and meet other specific criteria outlined in the Income Tax Act.

Q: What information do I need to provide in Form T624?

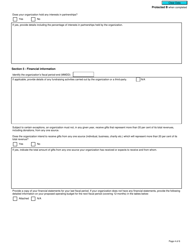

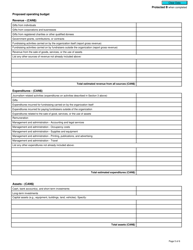

A: You need to provide information about the organization, its activities, governance, and financial details.

Q: Are there any filing fees for Form T624?

A: No, there are no filing fees for Form T624.

Q: How long does it take to process the application?

A: Processing times may vary, but the CRA aims to process applications within 60 days of receipt.

Q: What happens after the registration is approved?

A: Once approved, the organization will receive a registered charity number and will be eligible for certain tax benefits and exemptions.