This version of the form is not currently in use and is provided for reference only. Download this version of

Form B401

for the current year.

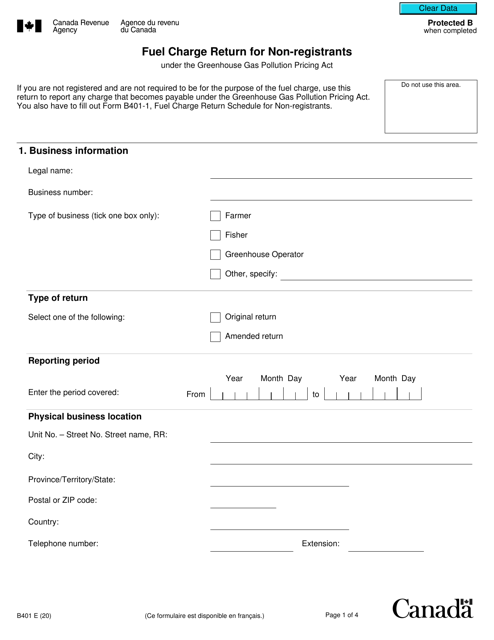

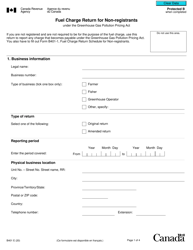

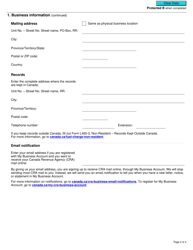

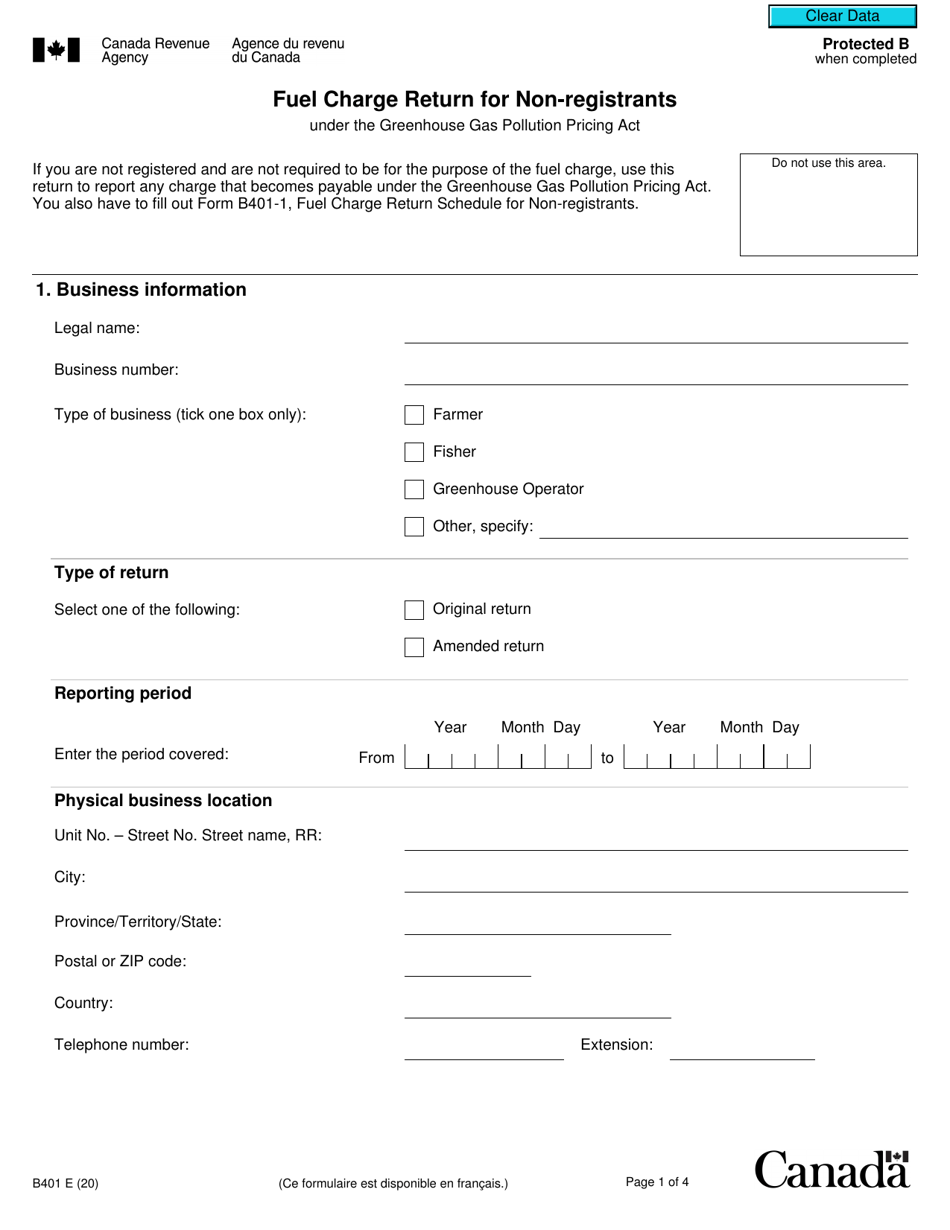

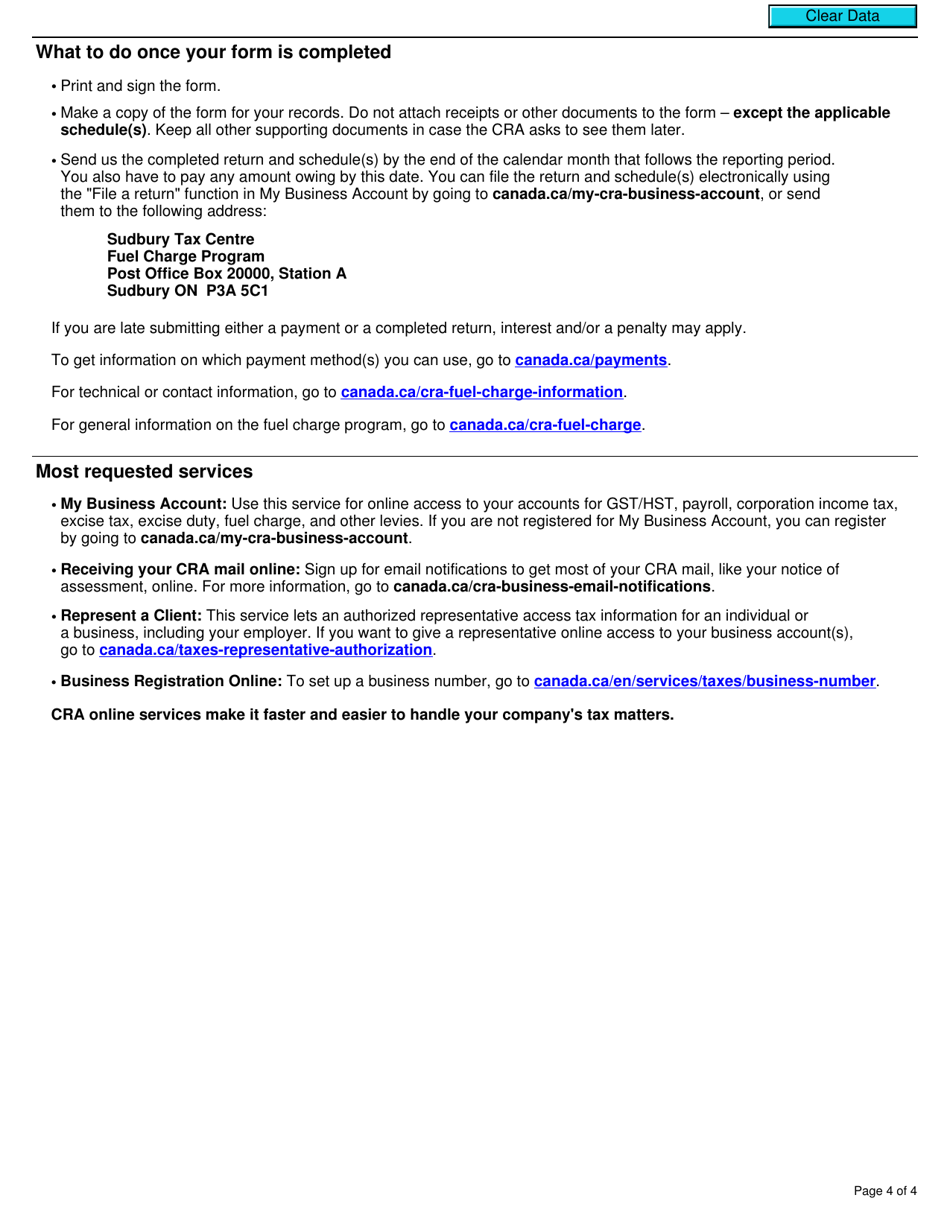

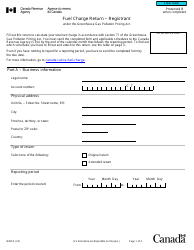

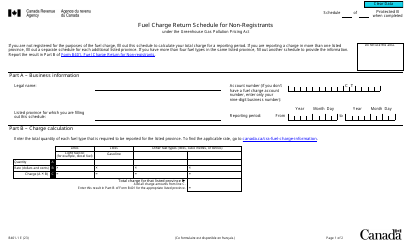

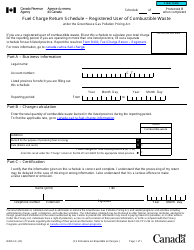

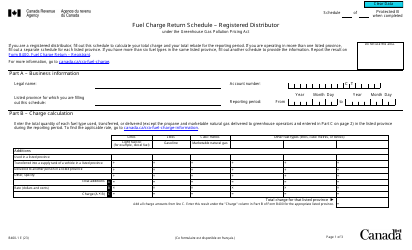

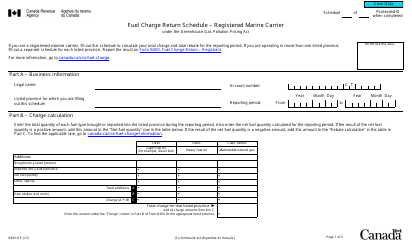

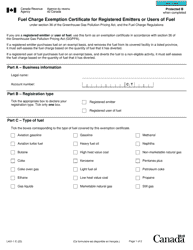

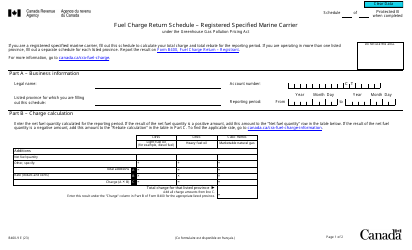

Form B401 Fuel Charge Return for Non-registrants Under the Greenhouse Gas Pollution Pricing Act - Canada

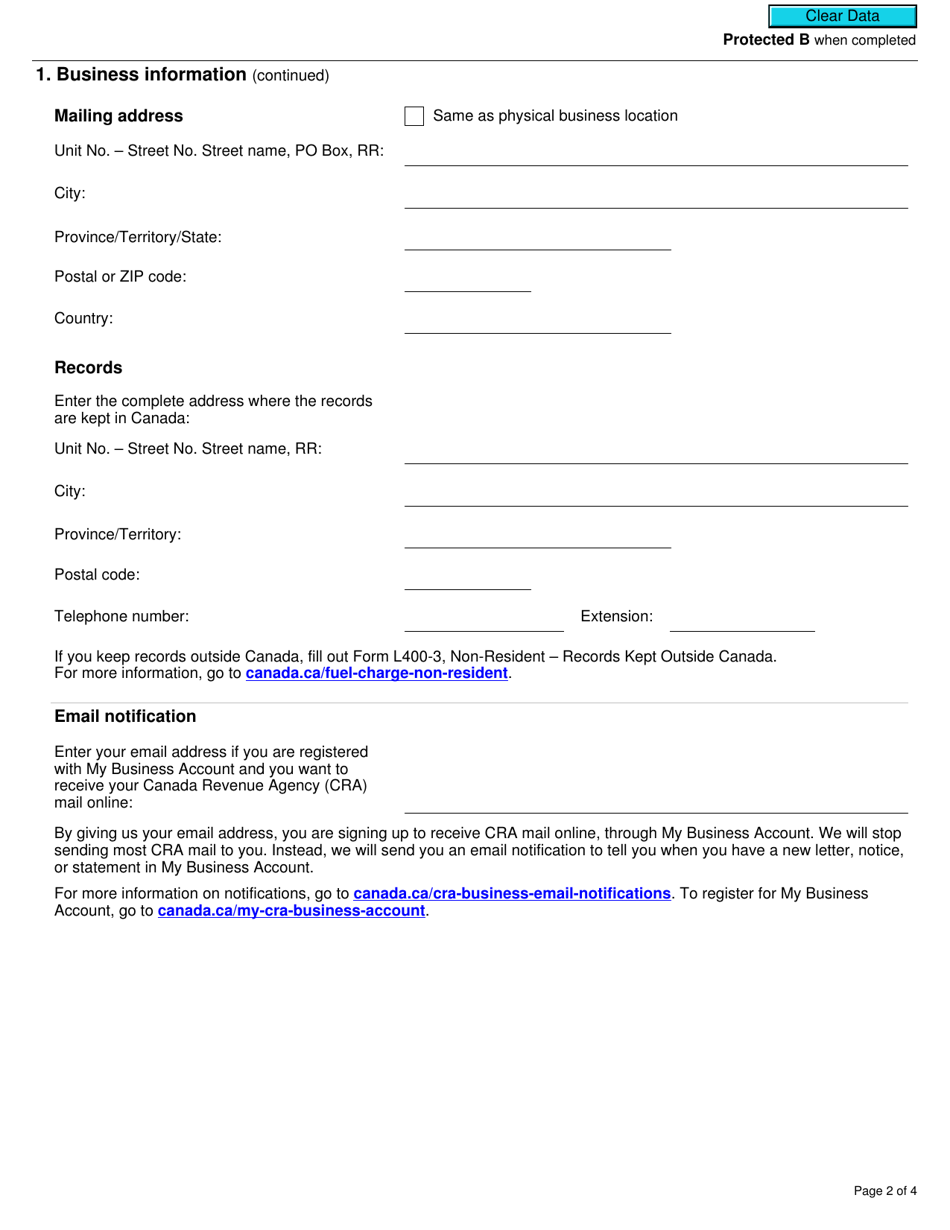

Form B401 Fuel Charge Return for Non-registrants Under the Greenhouse Gas Pollution Pricing Act - Canada is used to report and remit fuel charges for individuals or businesses who are not required to register under the Greenhouse Gas Pollution Pricing Act in Canada.

The Form B401 Fuel Charge Return for non-registrants under the Greenhouse Gas Pollution Pricing Act in Canada is filed by individuals or businesses that are not registered for the fuel charge program.

FAQ

Q: What is Form B401?

A: Form B401 is a fuel charge return for non-registrants under the Greenhouse Gas Pollution Pricing Act in Canada.

Q: Who needs to file Form B401?

A: Non-registrants under the Greenhouse Gas Pollution Pricing Act in Canada need to file Form B401.

Q: What is the purpose of Form B401?

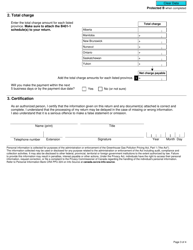

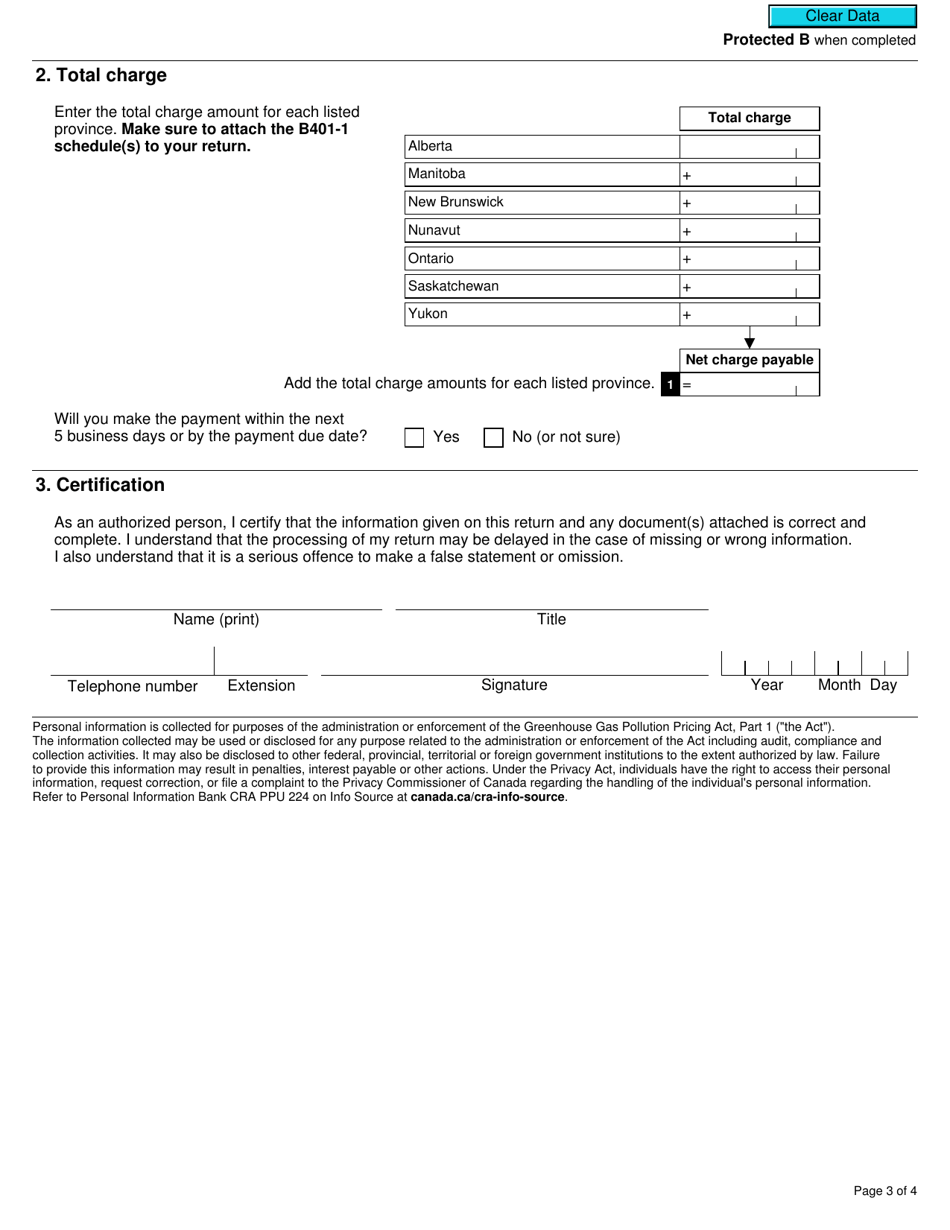

A: The purpose of Form B401 is to report and remit the fuel charge liability for non-registrants.

Q: What is the Greenhouse Gas Pollution Pricing Act?

A: The Greenhouse Gas Pollution Pricing Act is a federal law in Canada that imposes a charge on fossil fuels.

Q: When is the deadline for filing Form B401?

A: The deadline for filing Form B401 is determined by the CRA and may vary.

Q: Do I need to pay any fees when filing Form B401?

A: Yes, non-registrants are required to pay the fuel charge liability when filing Form B401.

Q: Are there any penalties for not filing Form B401?

A: Yes, failure to file Form B401 or failure to pay the required fuel charge liability may result in penalties and interest.

Q: What information do I need to provide on Form B401?

A: You need to provide information about your fuel purchases and the fuel charge liability owed on Form B401.