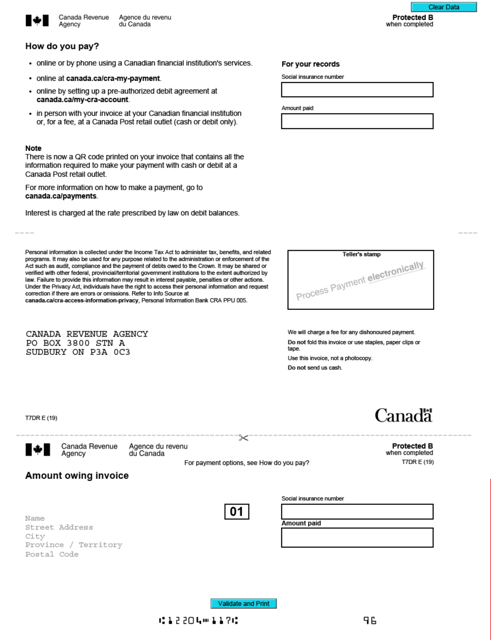

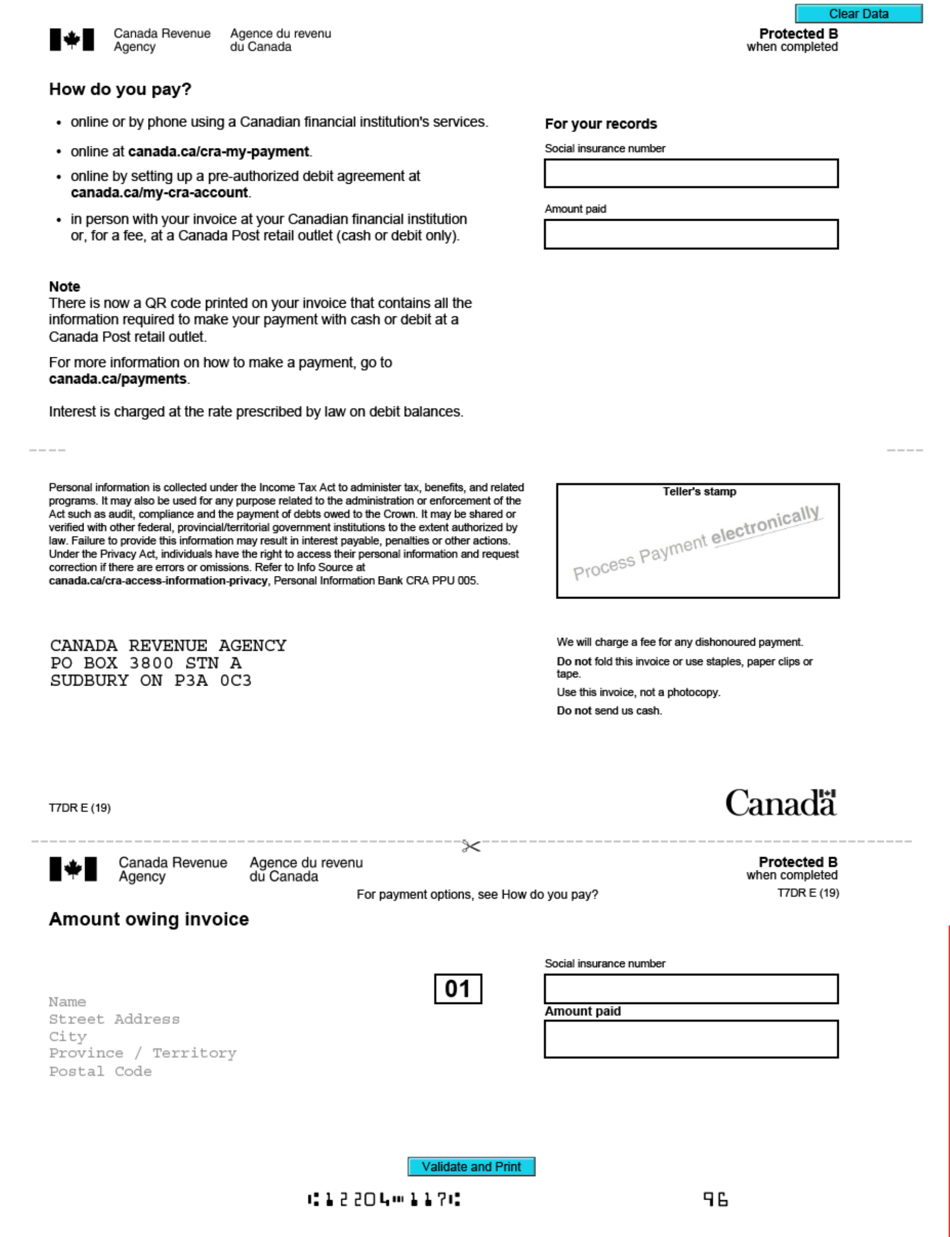

Form T7DR Amount Owing Remittance Voucher - Canada

The Form T7DR Amount Owing Remittance Voucher in Canada is used to remit the payment of outstanding amounts to the Canada Revenue Agency (CRA). It is typically used by businesses and organizations to settle any unpaid tax balances.

The Form T7DR Amount Owing Remittance Voucher in Canada is filed by the individual or business that has a tax amount owing to the Canada Revenue Agency (CRA).

FAQ

Q: What is a T7DR form?

A: The T7DR form is the Amount Owing Remittance Voucher in Canada.

Q: What is the purpose of the T7DR form?

A: The T7DR form is used to remit payment for amounts owing to the Canada Revenue Agency (CRA).

Q: What information is required on the T7DR form?

A: The T7DR form requires you to provide your name, address, amount owing, and payment details.

Q: When is the T7DR form due?

A: The due date for the T7DR form depends on the specific tax obligation or payment schedule.

Q: What happens if I don't submit the T7DR form on time?

A: Failure to submit the T7DR form on time may result in penalties and interest charges.

Q: Can I make changes to the T7DR form after submitting it?

A: If you need to make changes to the T7DR form after submitting it, you should contact the CRA for further assistance.

Q: Is there a penalty for late payment on the T7DR form?

A: Yes, there may be penalties and interest charges for late payment on the T7DR form.