This version of the form is not currently in use and is provided for reference only. Download this version of

Form L301

for the current year.

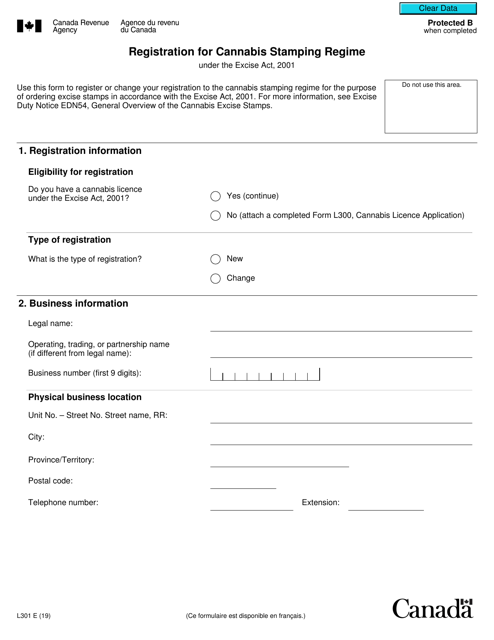

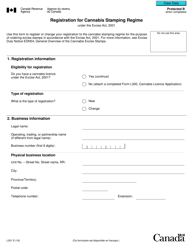

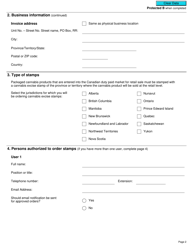

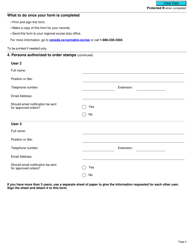

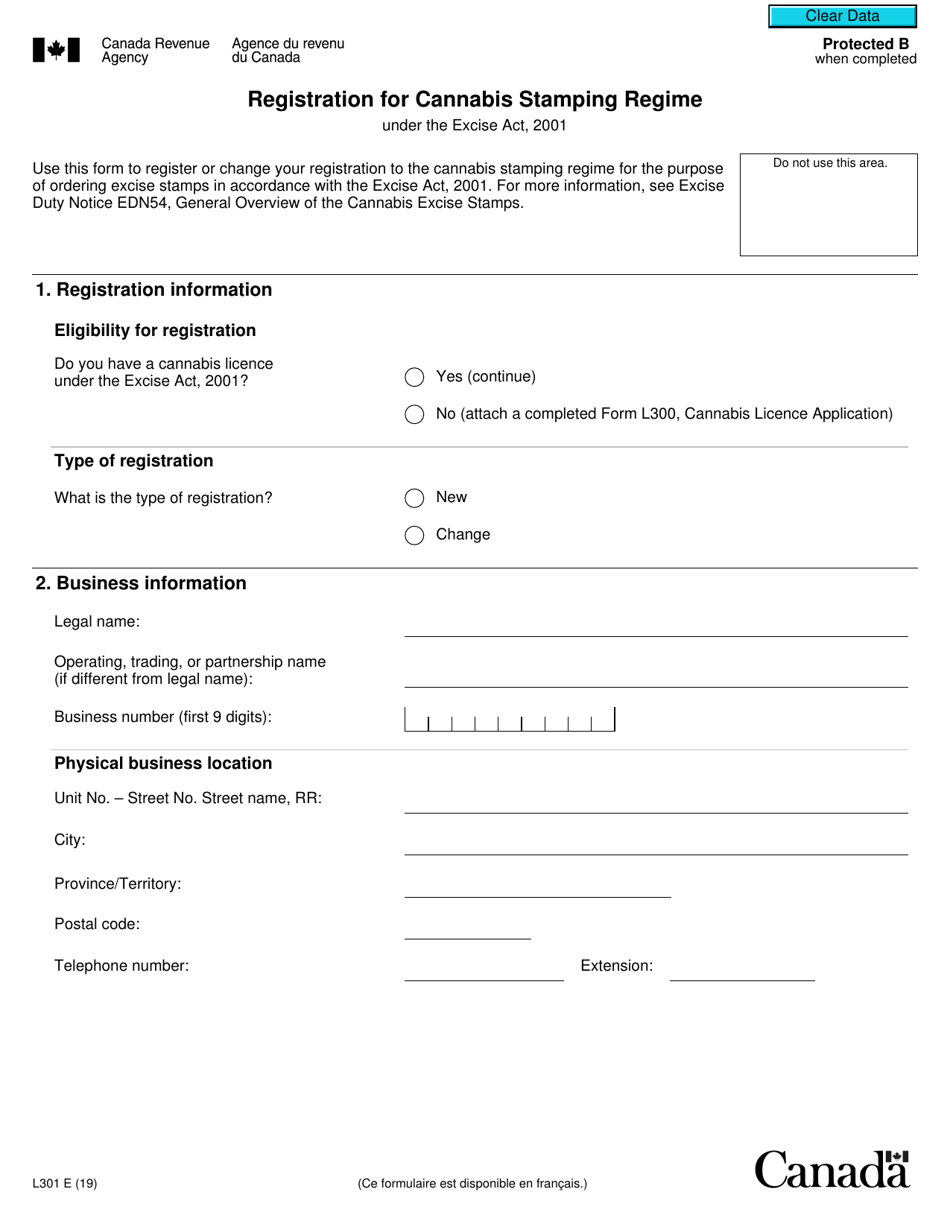

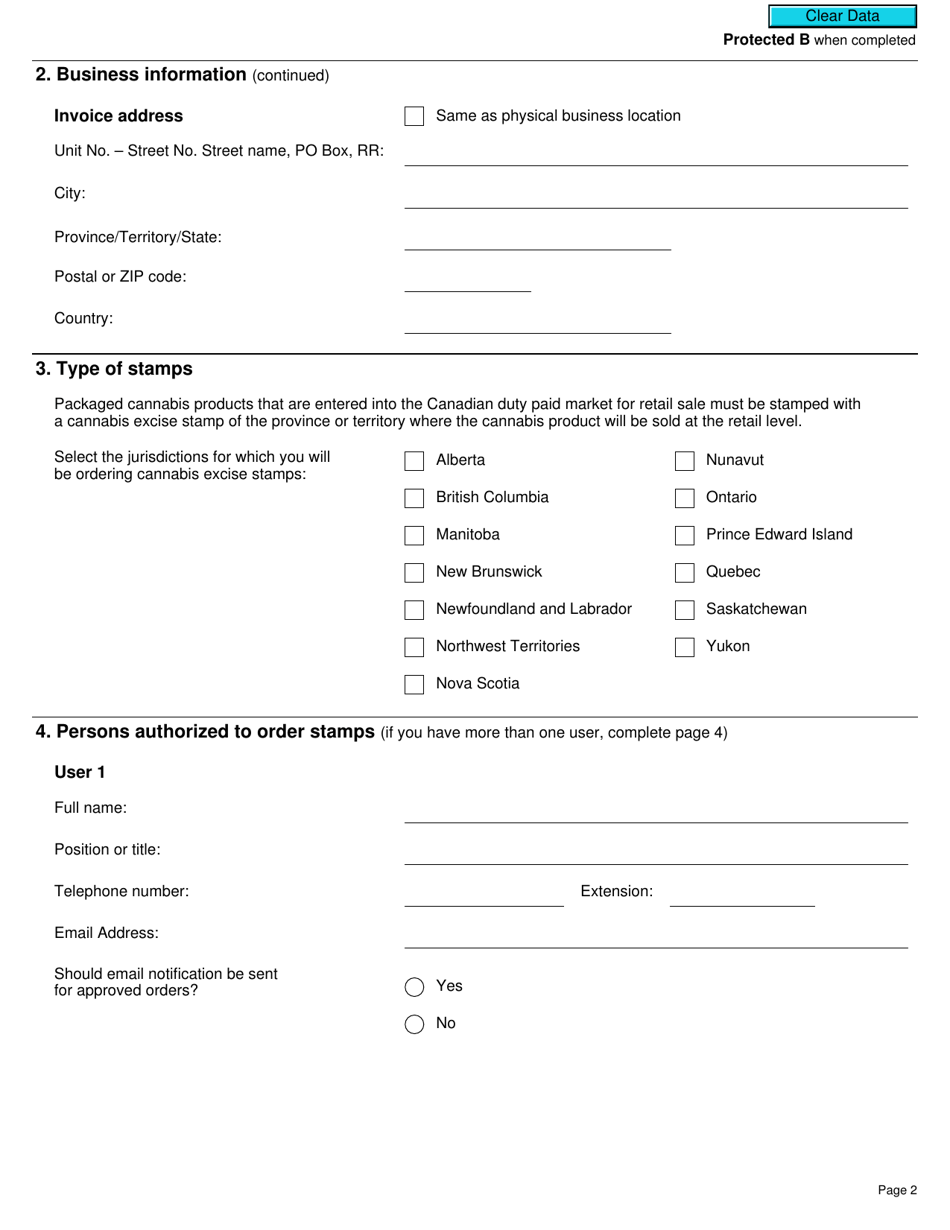

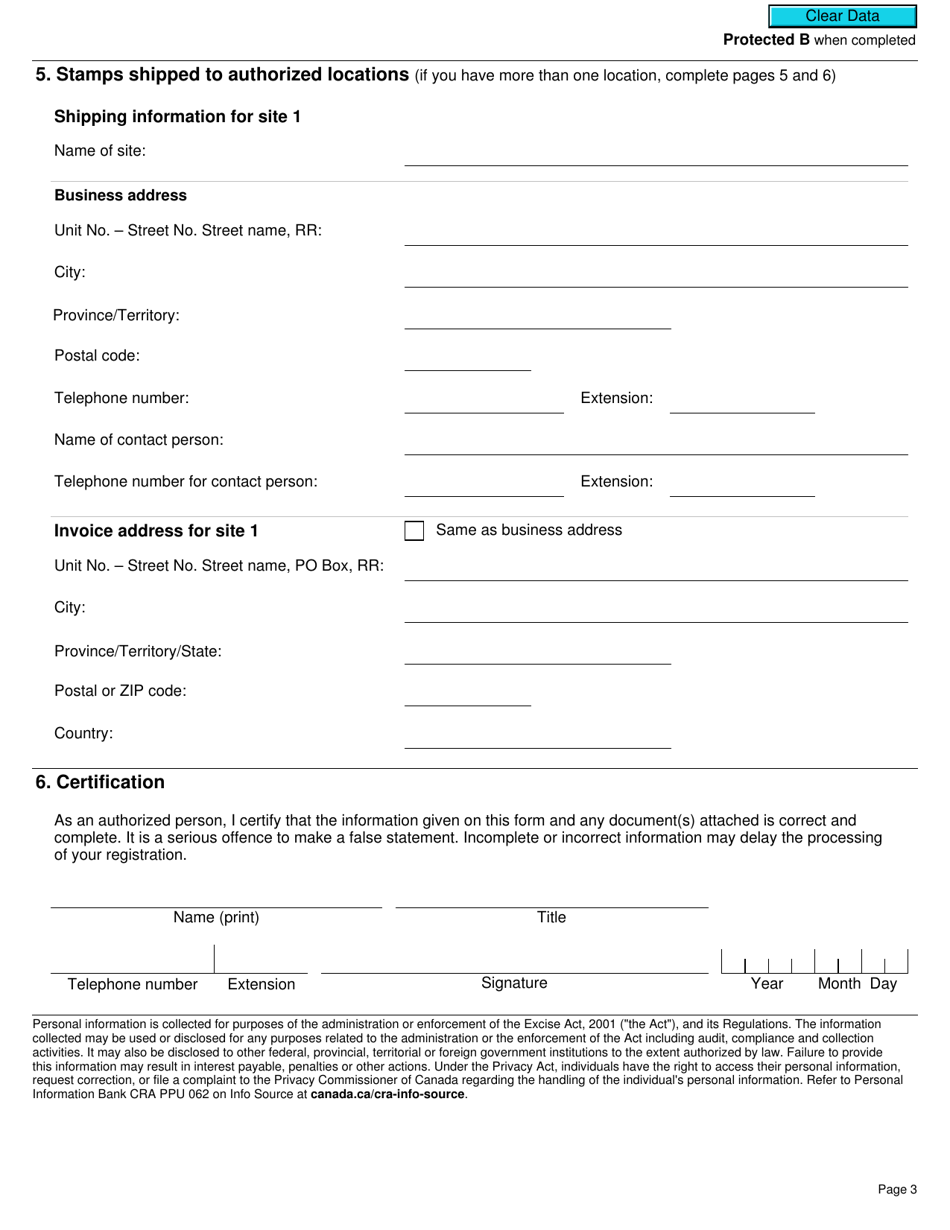

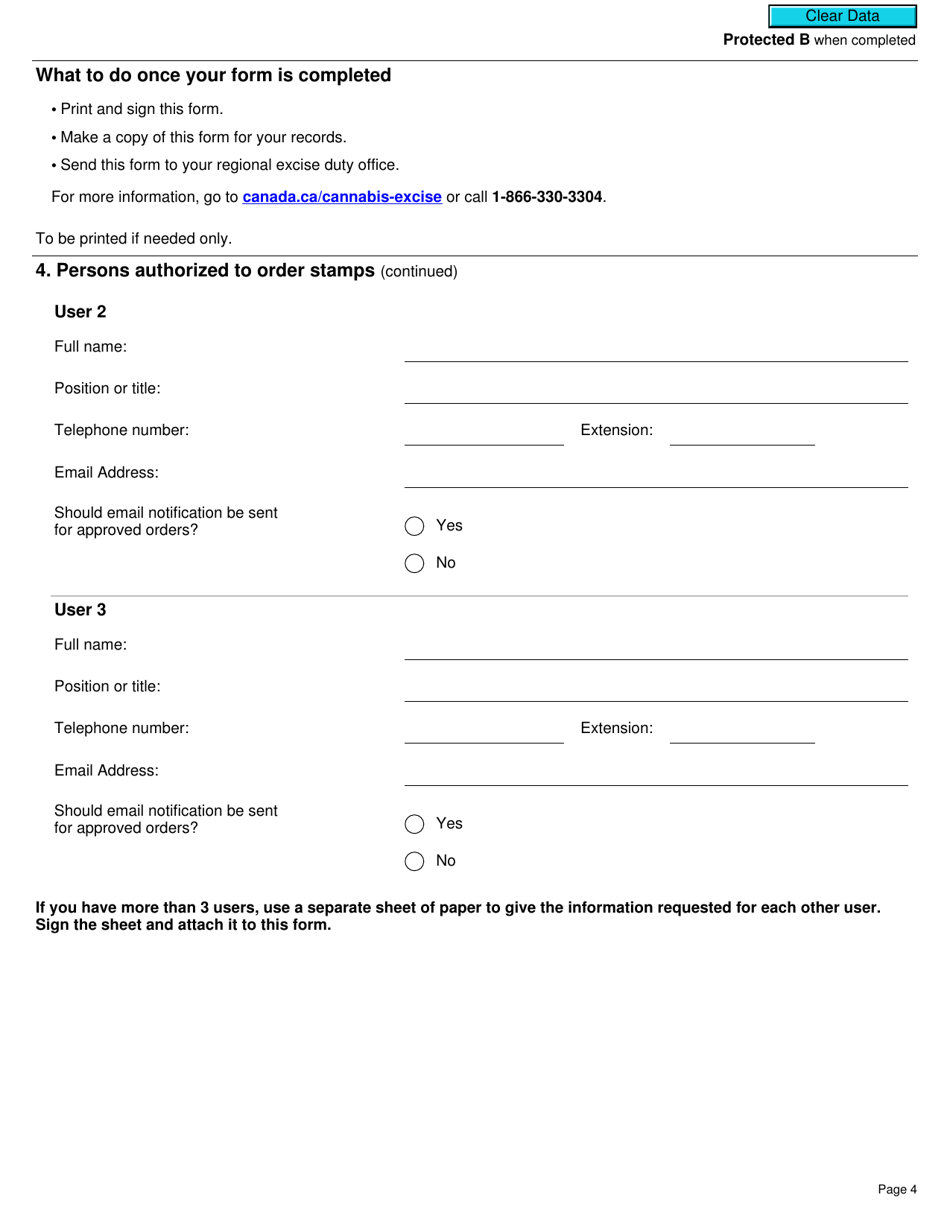

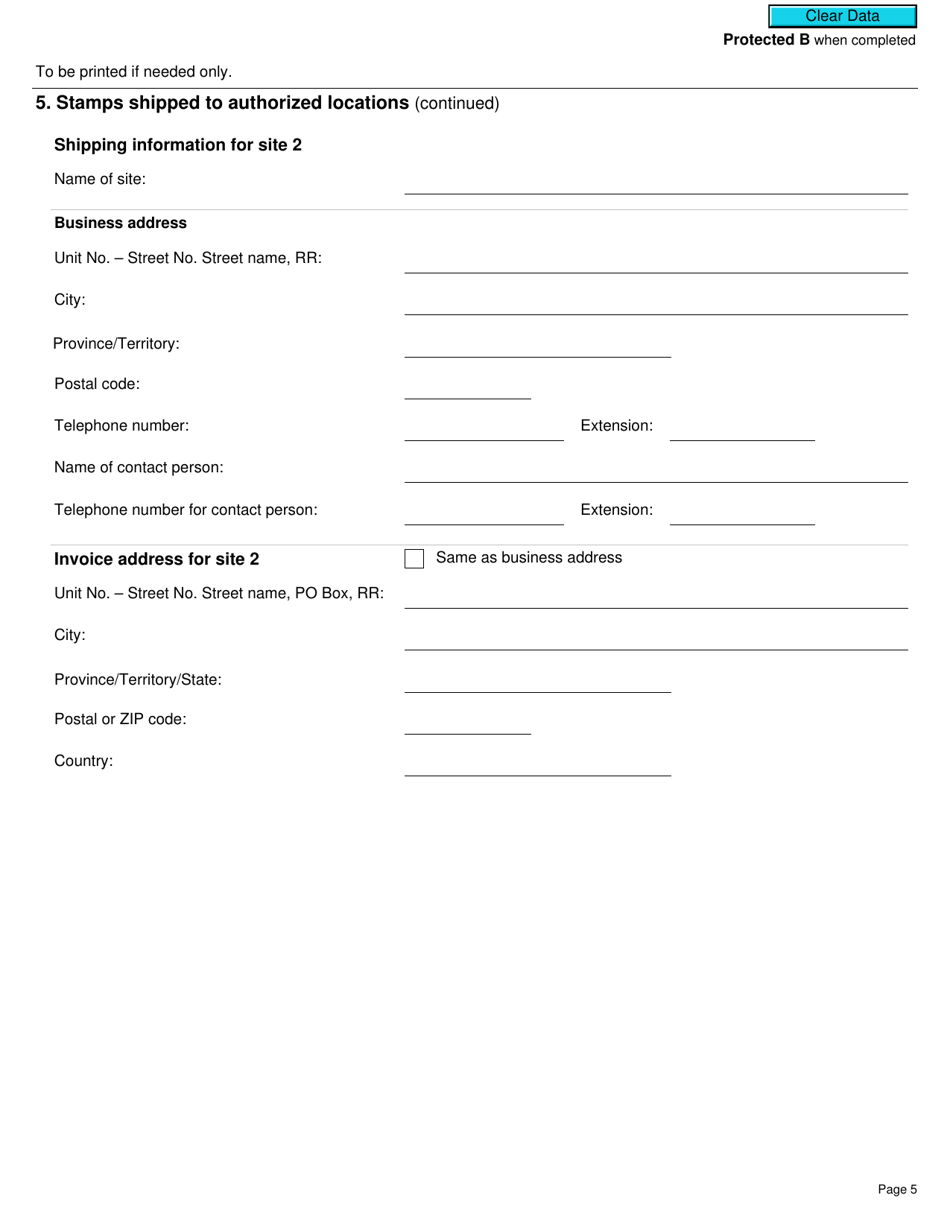

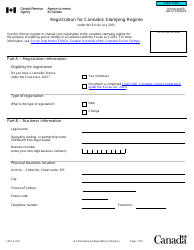

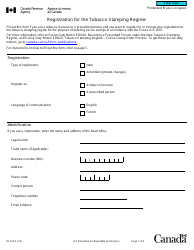

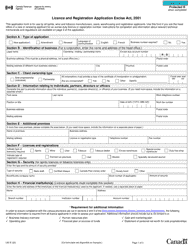

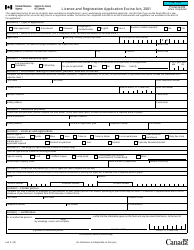

Form L301 Registration for Cannabis Stamping Regime Under the Excise Act, 2001 - Canada

Form L301 Registration for Cannabis Stamping Regime under the Excise Act, 2001 in Canada is used to register for the cannabis stamping regime. This regime ensures that proper excise duty is paid on cannabis products in accordance with Canadian law.

The cannabis license holders or producers are responsible for filing the Form L301 Registration for the Cannabis Stamping Regime under the Excise Act, 2001 in Canada.

FAQ

Q: What is the Form L301?

A: Form L301 is the registration form for the Cannabis Stamping Regime under the Excise Act, 2001 in Canada.

Q: Who needs to fill out Form L301?

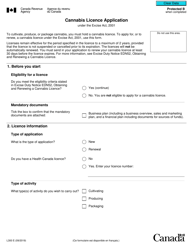

A: Businesses involved in the production, packaging, and distribution of cannabis products in Canada need to fill out Form L301.

Q: What is the purpose of the Cannabis Stamping Regime?

A: The Cannabis Stamping Regime helps the Canadian government track and regulate the production and distribution of cannabis products.

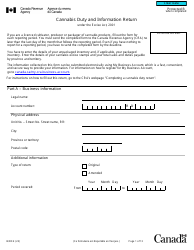

Q: Are there any fees associated with Form L301?

A: There are no fees associated with submitting Form L301.

Q: Are there any penalties for not registering under the Cannabis Stamping Regime?

A: Yes, businesses that fail to register under the Cannabis Stamping Regime may be subject to penalties and fines.

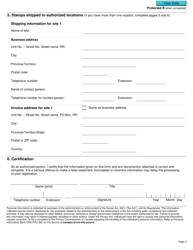

Q: Is the information provided on Form L301 confidential?

A: Yes, the information provided on Form L301 is treated as confidential and is protected under the federal Privacy Act.