This version of the form is not currently in use and is provided for reference only. Download this version of

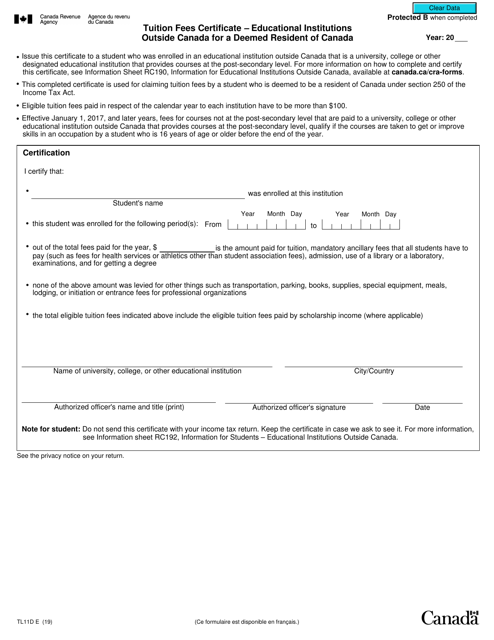

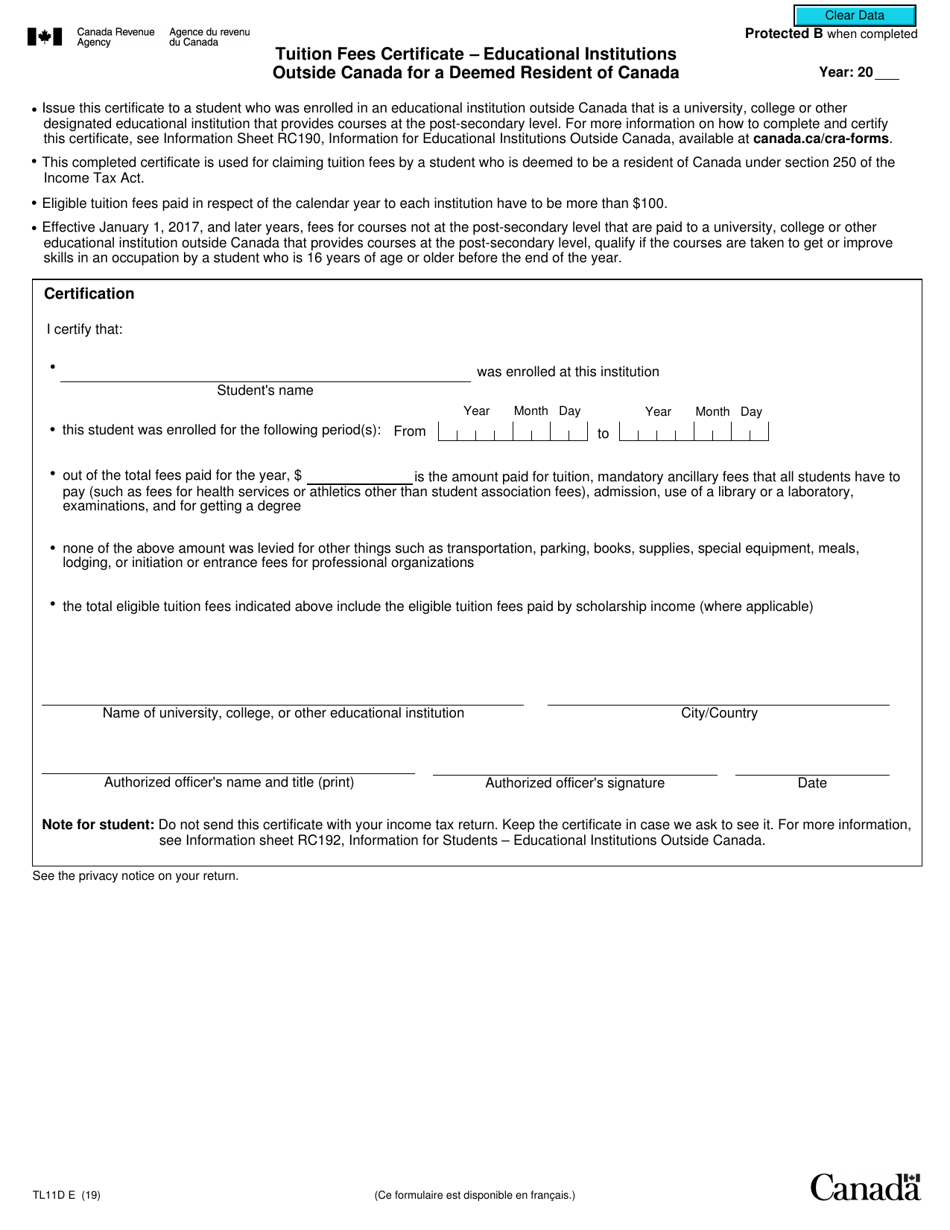

Form TL11D

for the current year.

Form TL11D Tuition Fees Certificate - Educational Institutions Outside Canada for a Deemed Resident of Canada - Canada

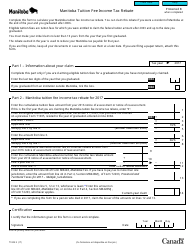

Form TL11D Tuition Fees Certificate - Educational Institutions Outside Canada for a Deemed Resident of Canada is used to claim a tax deduction for tuition fees paid to educational institutions outside of Canada for a student who is deemed to be a resident of Canada. This form helps in reducing the amount of income tax owed by the student.

The Form TL11D Tuition Fees Certificate is typically filed by educational institutions outside of Canada for a deemed resident of Canada.

FAQ

Q: What is the TL11D form?

A: The TL11D form is the Tuition Fees Certificate - Educational Institutions Outside Canada for a Deemed Resident of Canada form.

Q: Who is the TL11D form for?

A: The TL11D form is for individuals who are deemed residents of Canada and have paid tuition fees to educational institutions outside Canada.

Q: What is the purpose of the TL11D form?

A: The purpose of the TL11D form is to report the amount of tuition fees paid to educational institutions outside Canada for the purpose of claiming the tuition tax credit.

Q: What information is required on the TL11D form?

A: The TL11D form requires information such as the taxpayer's name, social insurance number, the institution's name and address, and the amount of tuition fees paid.

Q: How do I fill out the TL11D form?

A: To fill out the TL11D form, you need to enter your personal information, including your name and social insurance number, and provide details of the educational institution and the amount of tuition fees paid.

Q: When is the TL11D form due?

A: The TL11D form is due on or before April 30 of the year following the tax year for which the tuition fees were paid.

Q: Can I claim a tax credit for tuition fees paid to educational institutions outside Canada?

A: Yes, you can claim a tax credit for eligible tuition fees paid to educational institutions outside Canada, subject to certain conditions.

Q: What is the tuition tax credit?

A: The tuition tax credit is a non-refundable tax credit that can be claimed on eligible tuition fees paid to educational institutions outside Canada.

Q: What other documents do I need to submit with the TL11D form?

A: You may need to submit supporting documents such as receipts or certificates from the educational institution to verify the amount of tuition fees paid.