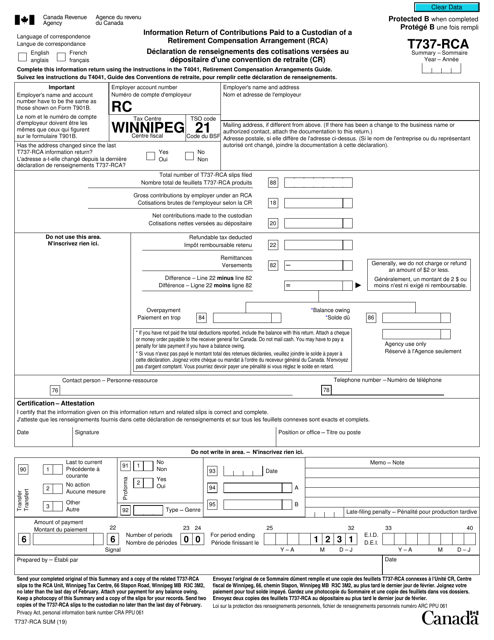

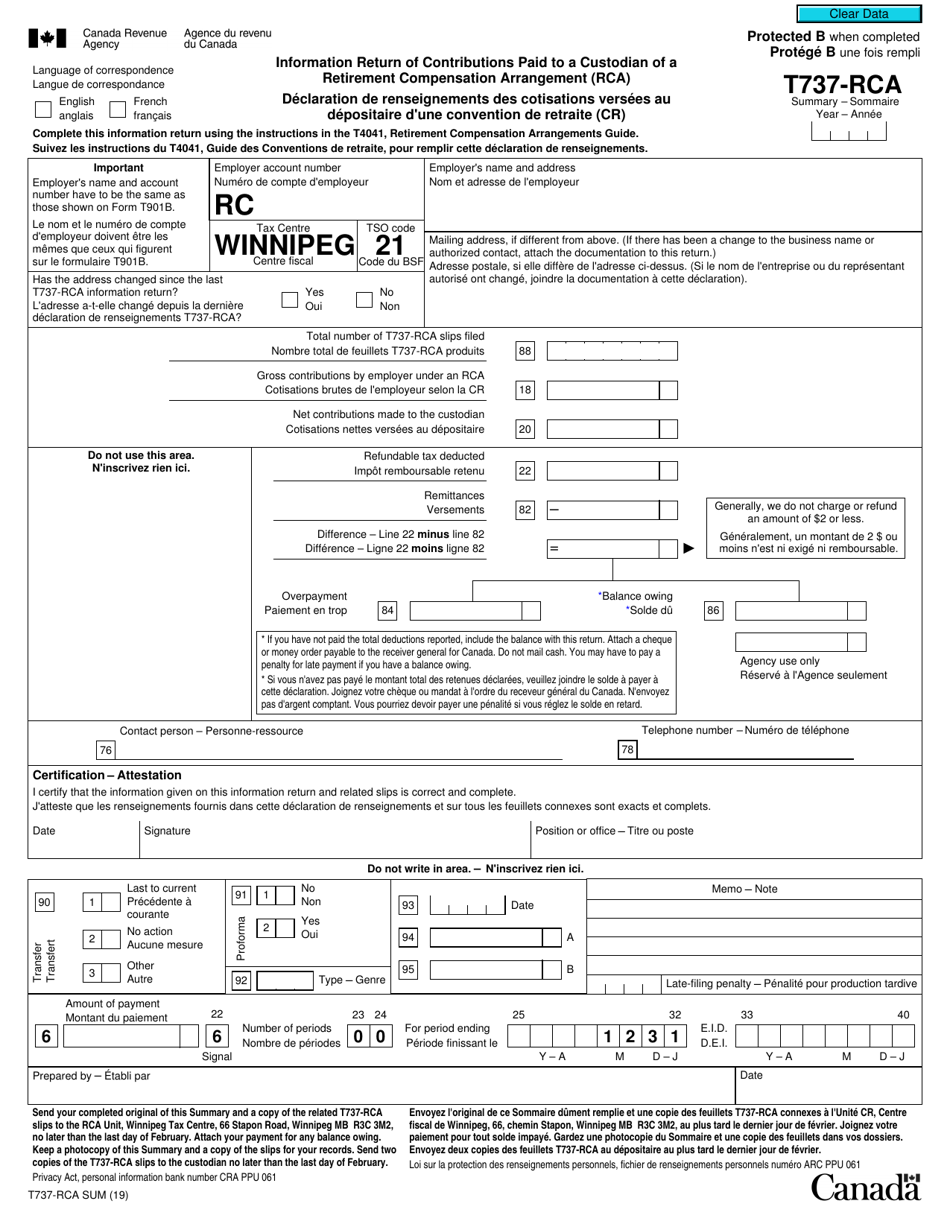

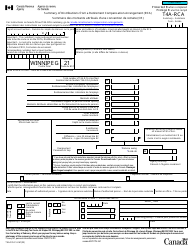

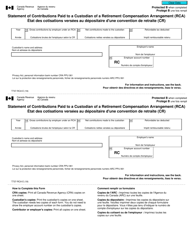

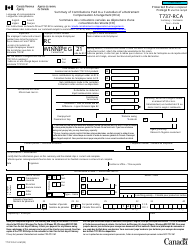

Form T737-RCASUM Information Return of Contributions Paid to a Custodian of a Retirement Compensation Arrangement (Rca) - Canada (English / French)

Form T737-RCASUM is used in Canada to report contributions paid to a custodian of a Retirement Compensation Arrangement (RCA). It is an information return that provides details about the contributions made to an RCA.

The Form T737-RCASUM is filed by the custodian of a Retirement Compensation Arrangement (RCA) in Canada. The form can be filled in either English or French.

FAQ

Q: What is Form T737-RCASUM?

A: Form T737-RCASUM is an information return for reporting contributions paid to a custodian of a Retirement Compensation Arrangement (RCA) in Canada.

Q: Who needs to file Form T737-RCASUM?

A: Custodians of Retirement Compensation Arrangements (RCAs) in Canada need to file Form T737-RCASUM.

Q: What information is required on Form T737-RCASUM?

A: Form T737-RCASUM requires information about contributions paid to a custodian of an RCA, including the name and address of the custodian, the RCA number, and the amount of contributions.

Q: When is Form T737-RCASUM due?

A: Form T737-RCASUM is due within 90 days after the end of each calendar year.