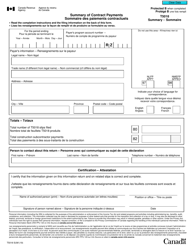

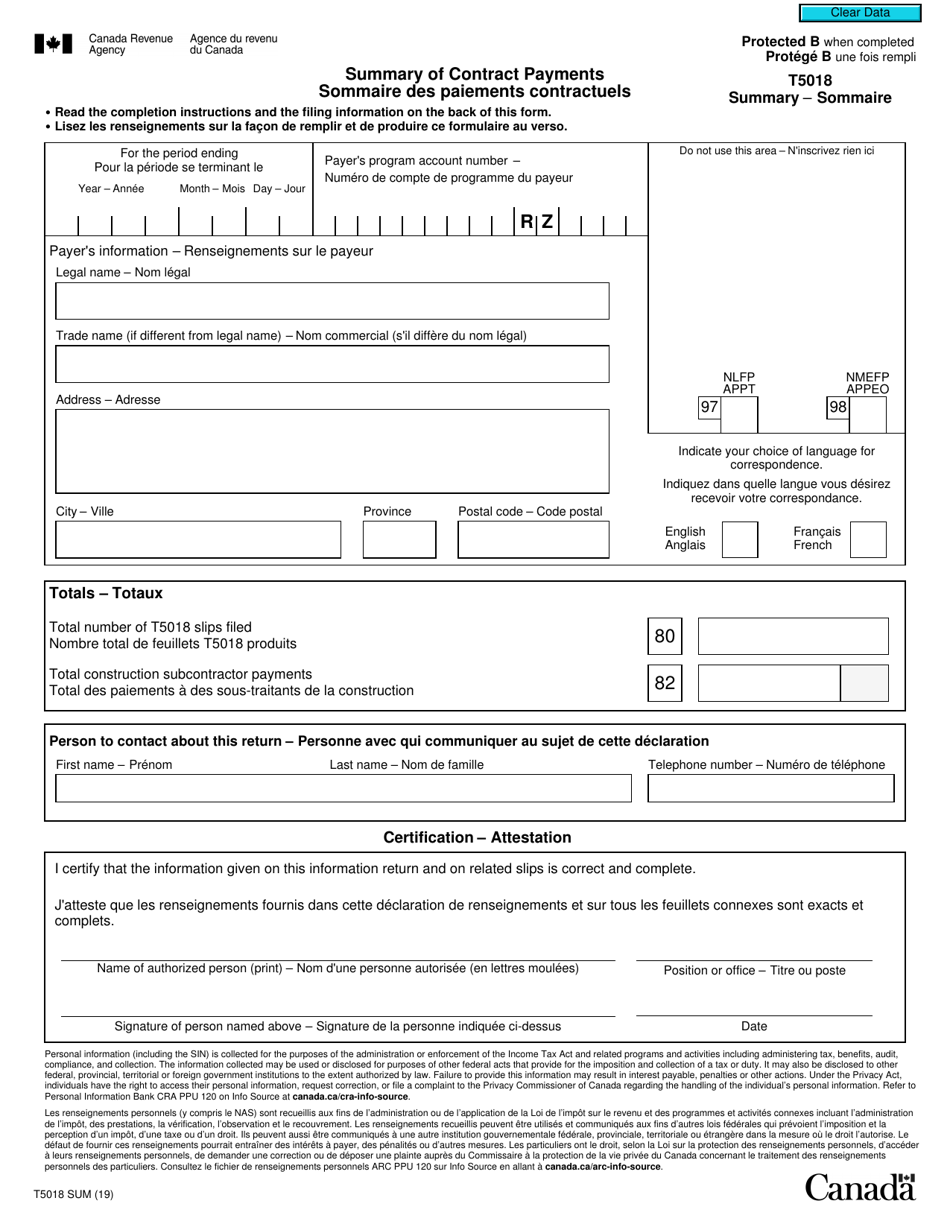

Form T5018SUM Summary of Contract Payments - Canada (English / French)

Form T5018SUM, also known as the Summary of Contract Payments, is used by businesses in Canada to report payments made to subcontractors for construction activities. This form is used to provide a summary of all the contract payments made during the fiscal year. It helps the Canada Revenue Agency (CRA) track and verify payments made to subcontractors for tax purposes.

The contractor or subcontractor is responsible for filing Form T5018SUM - Summary of Contract Payments in Canada.

FAQ

Q: What is Form T5018SUM?

A: Form T5018SUM is a summary of contract payments in Canada.

Q: What is the purpose of Form T5018SUM?

A: The purpose of Form T5018SUM is to report payments made to subcontractors by the payer.

Q: Who needs to file Form T5018SUM?

A: Payers who made payments to subcontractors for construction activities need to file Form T5018SUM.

Q: What information is required on Form T5018SUM?

A: Form T5018SUM requires information such as the payer's name, address, and business number, total contract payments made, and details of subcontractors.

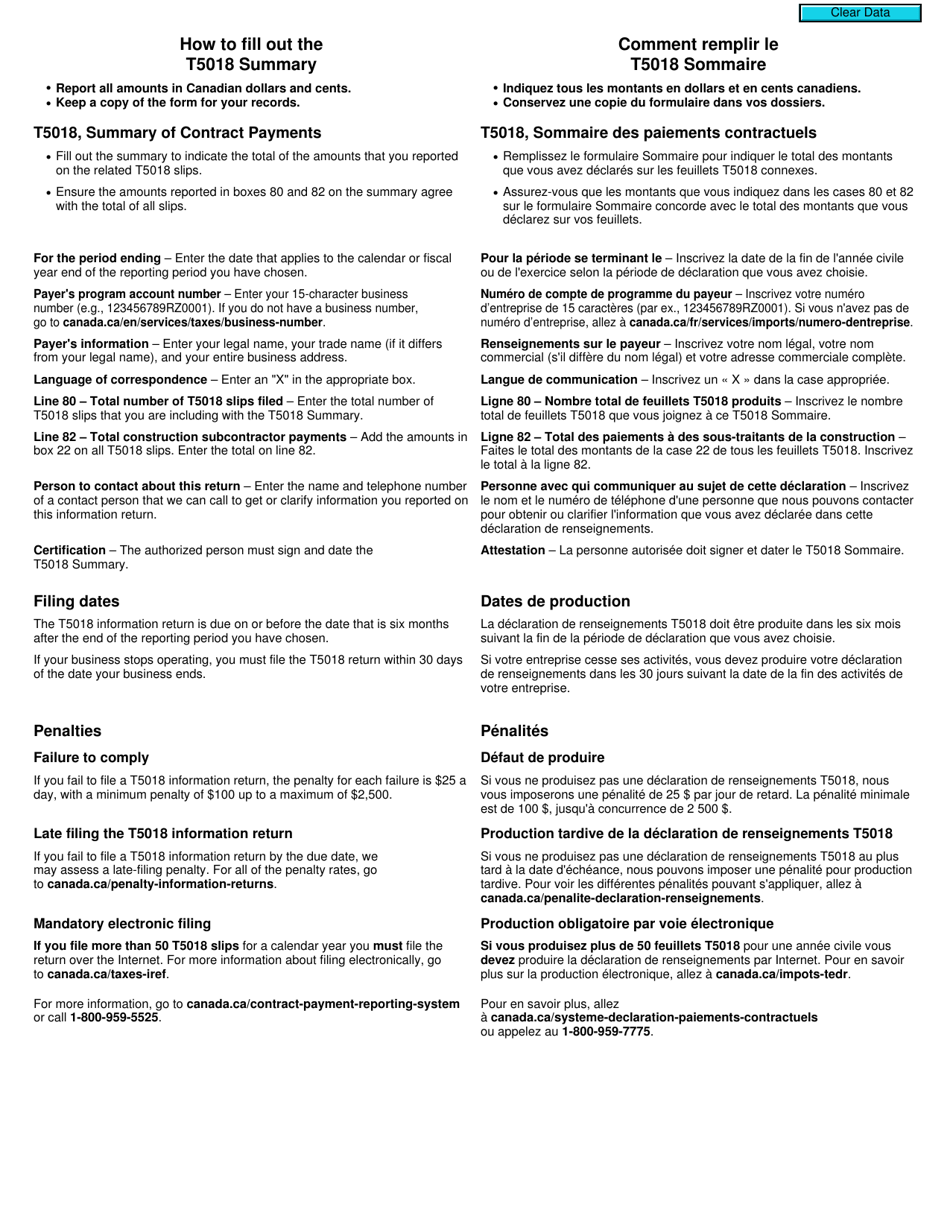

Q: When is Form T5018SUM due?

A: Form T5018SUM is due on or before the last day of February following the calendar year in which the payments were made.