This version of the form is not currently in use and is provided for reference only. Download this version of

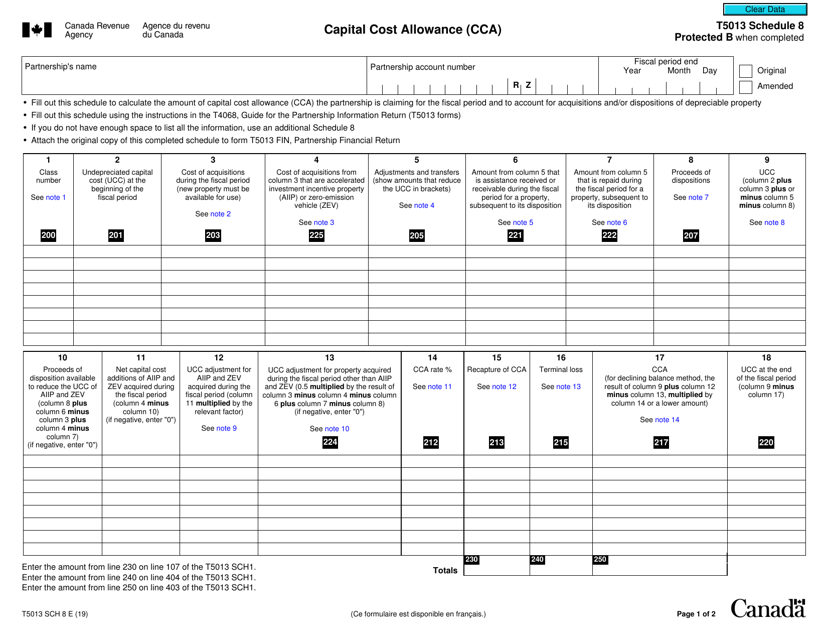

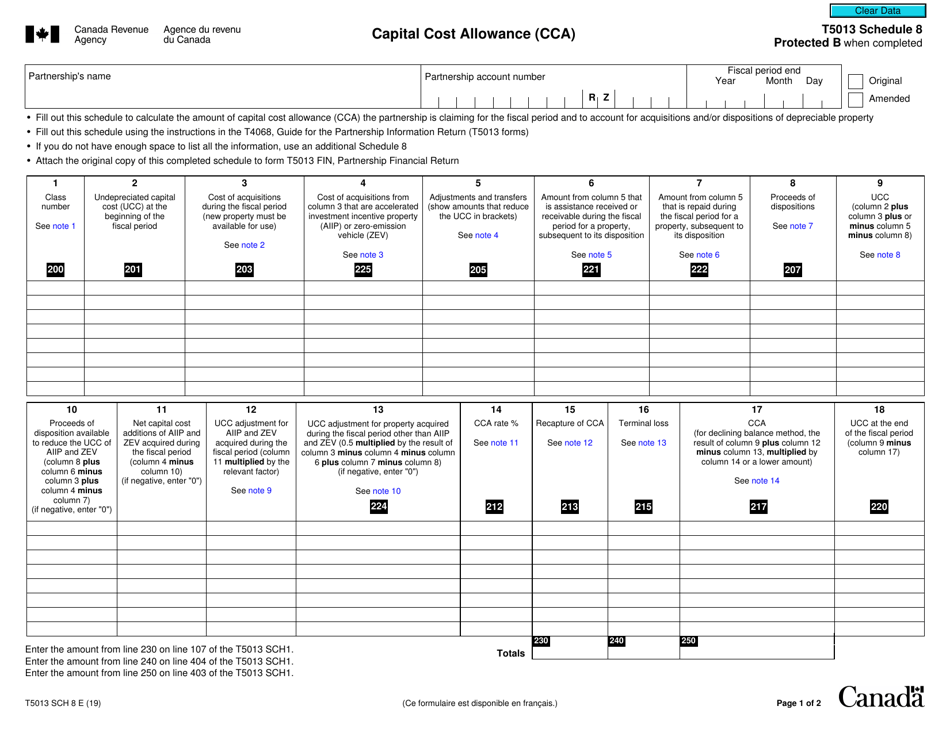

Form T5013 Schedule 8

for the current year.

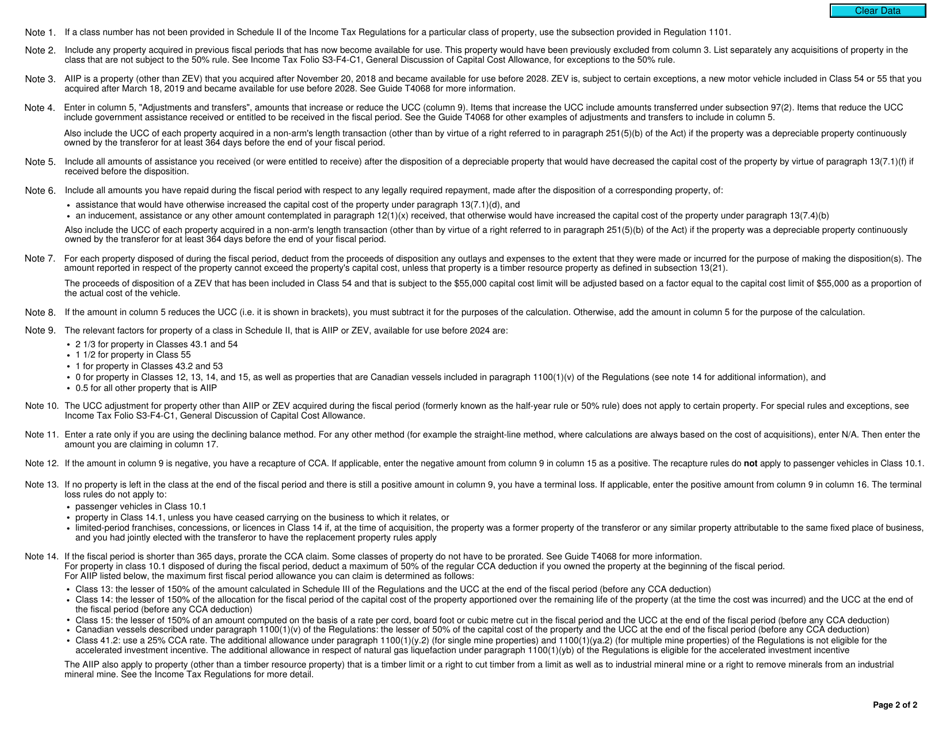

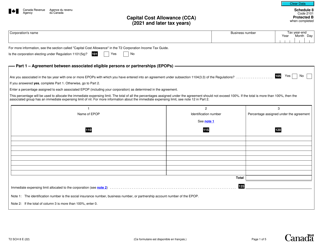

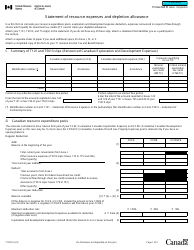

Form T5013 Schedule 8 Capital Cost Allowance (Cca) - Canada

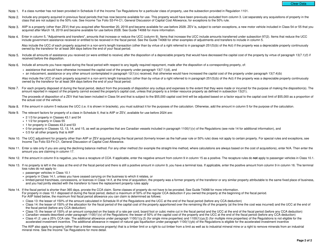

Form T5013 Schedule 8 Capital Cost Allowance (CCA) in Canada is used to report the depreciation expense on capital assets for partnerships. It is used to calculate the deduction allowed for wear and tear or obsolescence of assets used in business operations.

The Form T5013 Schedule 8 Capital Cost Allowance (CCA) is filed by partnerships in Canada.

FAQ

Q: What is Form T5013 Schedule 8?

A: Form T5013 Schedule 8 is a tax form used in Canada to calculate and report capital cost allowance (CCA) for businesses.

Q: What is capital cost allowance (CCA)?

A: Capital cost allowance (CCA) is a tax deduction that allows Canadian businesses to recover the cost of certain assets over time.

Q: Who needs to file Form T5013 Schedule 8?

A: Form T5013 Schedule 8 is used by partnerships in Canada to report the capital cost allowance (CCA) for their business assets.

Q: What information is required on Form T5013 Schedule 8?

A: Form T5013 Schedule 8 requires information about the partnership's business assets, including the asset class, description, cost, and CCA claimed.

Q: What is the purpose of filing Form T5013 Schedule 8?

A: The purpose of filing Form T5013 Schedule 8 is to calculate and report the capital cost allowance (CCA) for a partnership's business assets, which reduces the partnership's taxable income.

Q: Is Form T5013 Schedule 8 the same as Form T2125?

A: No, Form T5013 Schedule 8 is specifically for partnerships in Canada, while Form T2125 is used by self-employed individuals to report business income and expenses.

Q: When is the deadline for filing Form T5013 Schedule 8?

A: The deadline for filing Form T5013 Schedule 8 is usually 5 months after the end of the partnership's fiscal year.

Q: What happens if I don't file Form T5013 Schedule 8?

A: Failure to file Form T5013 Schedule 8 or reporting incorrect information may result in penalties and interest charges imposed by the Canada Revenue Agency (CRA).

Q: Can I claim capital cost allowance (CCA) on all business assets?

A: No, not all business assets are eligible for capital cost allowance (CCA). The eligibility and rates for CCA vary depending on the type of asset and its classification.