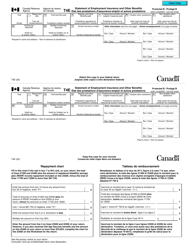

This version of the form is not currently in use and is provided for reference only. Download this version of

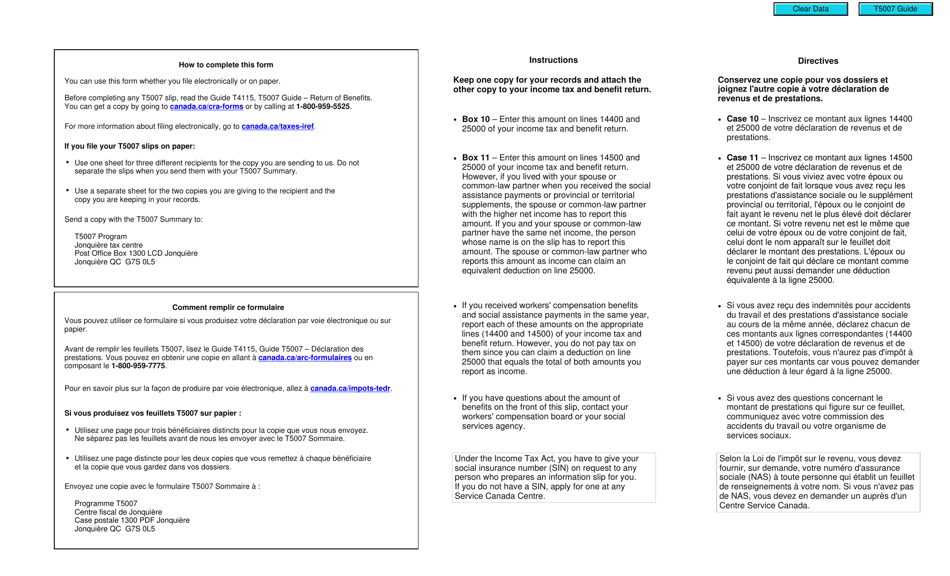

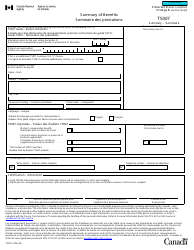

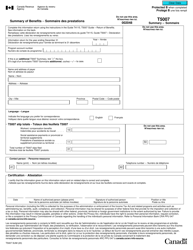

Form T5007

for the current year.

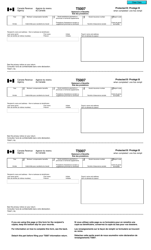

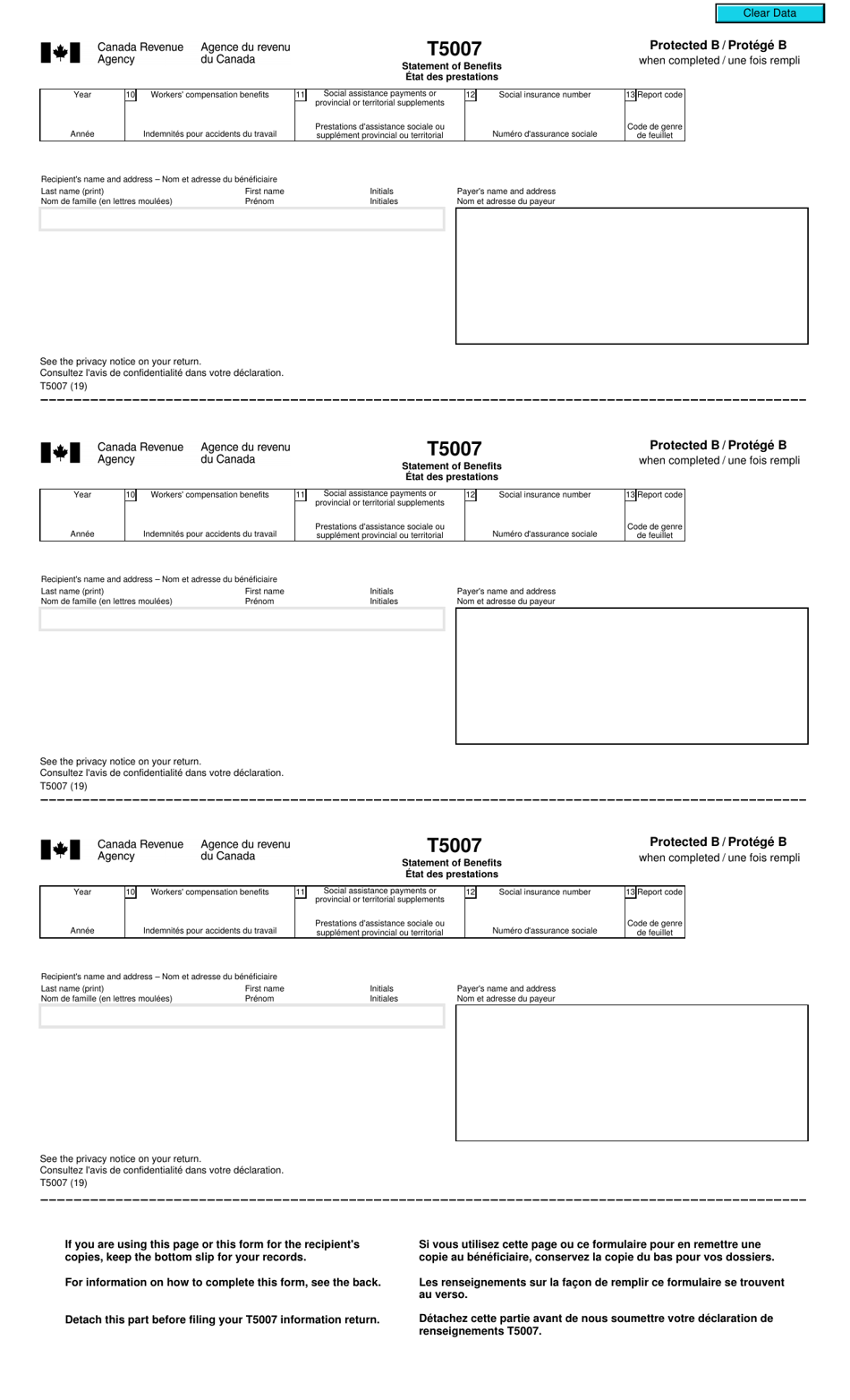

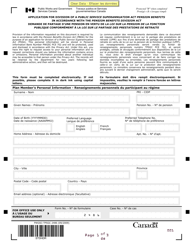

Form T5007 Statement of Benefits - Canada (English / French)

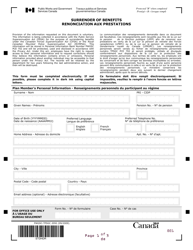

Form T5007 Statement of Benefits is a document used in Canada to report certain types of government benefits received by individuals. It provides information on the amount of benefits received in a tax year and is used for income reporting purposes, such as filing income tax returns.

The Form T5007 Statement of Benefits in Canada is filed by the government agency that provides the benefits, such as Employment and Social Development Canada (ESDC) or the Canada Revenue Agency (CRA).

FAQ

Q: What is the Form T5007?

A: The Form T5007 is a statement of benefits issued by the Canadian government.

Q: What is the purpose of Form T5007?

A: The purpose of Form T5007 is to report and provide information about certain benefits received by individuals.

Q: What benefits are reported on Form T5007?

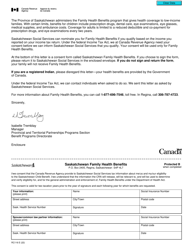

A: Form T5007 reports benefits such as workers' compensation, social assistance, and other government assistance programs.

Q: Who receives Form T5007?

A: Individuals who have received taxable benefits from the Canadian government may receive Form T5007.

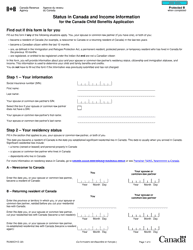

Q: Do I need to report the amount on Form T5007 on my tax return?

A: Yes, the amount reported on Form T5007 needs to be reported on your tax return as taxable income.

Q: What should I do if I don't receive Form T5007?

A: If you don't receive Form T5007, you should contact the government agency that provided the benefits to request a copy.

Q: Can I request a replacement Form T5007?

A: Yes, if you lost or misplaced your original Form T5007, you can request a replacement from the government agency that provided the benefits.