This version of the form is not currently in use and is provided for reference only. Download this version of

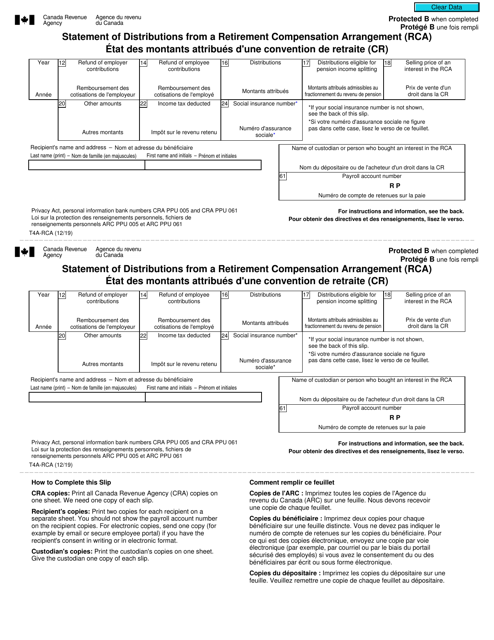

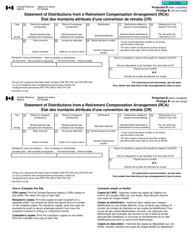

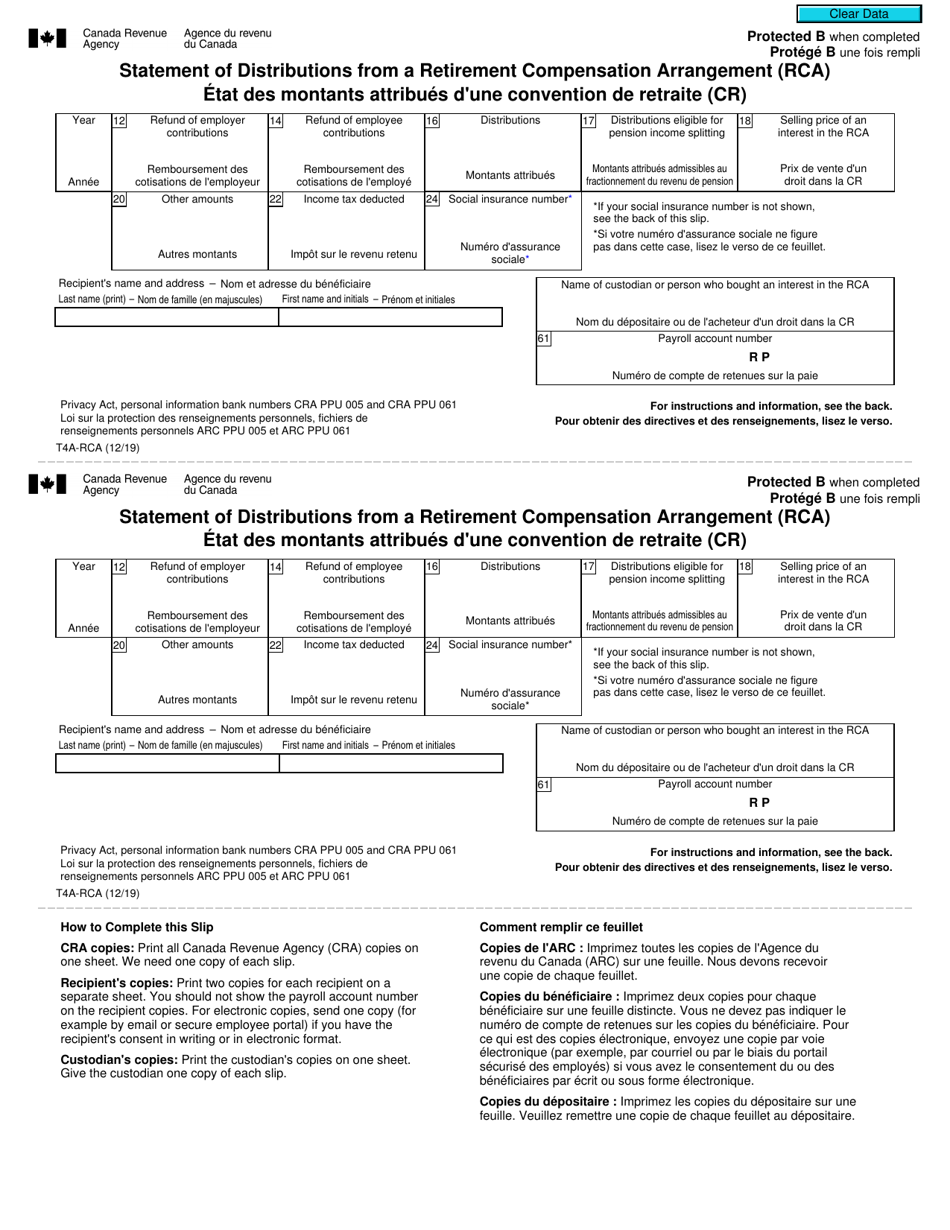

Form T4A-RCA

for the current year.

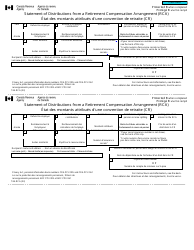

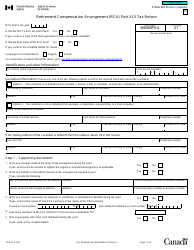

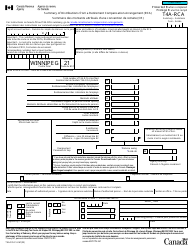

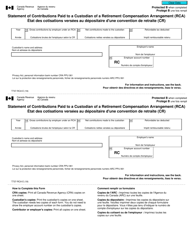

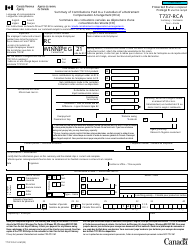

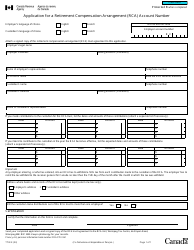

Form T4A-RCA Statement of Distributions From a Retirement Compensation Arrangement (Rca) - Canada (English / French)

Form T4A-RCA is used in Canada to report the distributions made from a Retirement Compensation Arrangement (RCA). It provides information about income received from an RCA, which is a type of retirement plan for individuals who receive benefits from an employer-sponsored arrangement. The form is used for taxation purposes to report these distributions to the Canada Revenue Agency (CRA). The form is available in both English and French languages.

The form T4A-RCA is filed by the payer of the distributions from a Retirement Compensation Arrangement (RCA) in Canada. The payer is usually the employer or the RCA administrator.

FAQ

Q: What is a T4A-RCA statement?

A: A T4A-RCA statement is a form used in Canada to report distributions from a Retirement Compensation Arrangement (RCA).

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a specialized pension plan for high-income earners in Canada.

Q: Who needs to file a T4A-RCA statement?

A: Employers who make distributions from a Retirement Compensation Arrangement (RCA) need to file a T4A-RCA statement.

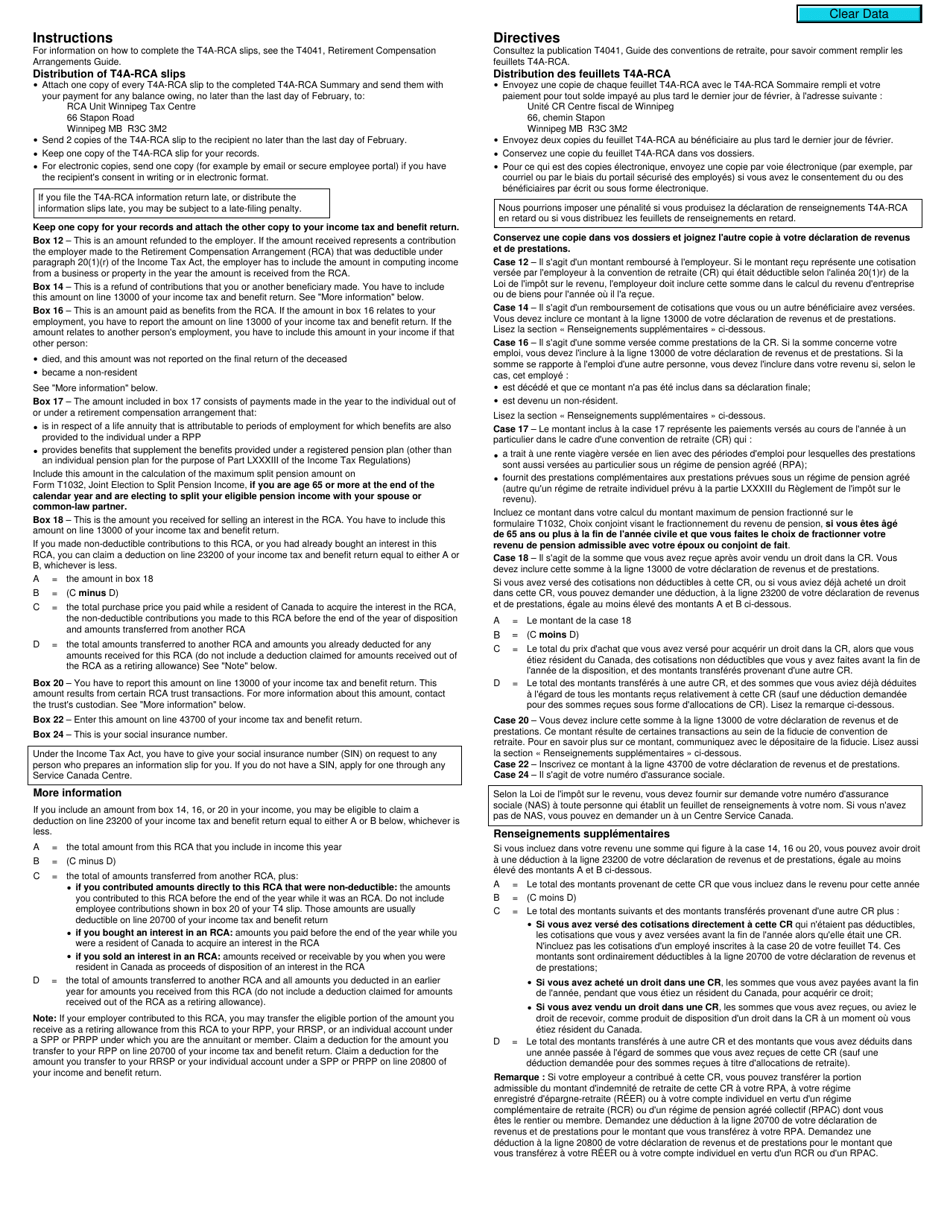

Q: What information is included in a T4A-RCA statement?

A: A T4A-RCA statement includes the details of the distributions made from the Retirement Compensation Arrangement (RCA), such as the recipient's name, social insurance number, and the amount distributed.

Q: What is the deadline to file a T4A-RCA statement?

A: The deadline to file a T4A-RCA statement is the last day of February following the calendar year in which the distributions were made.

Q: Are there penalties for late filing of a T4A-RCA statement?

A: Yes, there are penalties for late filing of a T4A-RCA statement. The penalty amount depends on the number of days the statement is late.

Q: Do I need to provide a T4A-RCA statement to the recipient?

A: Yes, you need to provide a copy of the T4A-RCA statement to the recipient.

Q: Is a T4A-RCA statement required for every distribution from an RCA?

A: Yes, a T4A-RCA statement is required for every distribution from a Retirement Compensation Arrangement (RCA).

Q: Can I submit a T4A-RCA statement electronically?

A: Yes, you can submit a T4A-RCA statement electronically through the CRA's Internet File Transfer (XML) or Web Forms services.