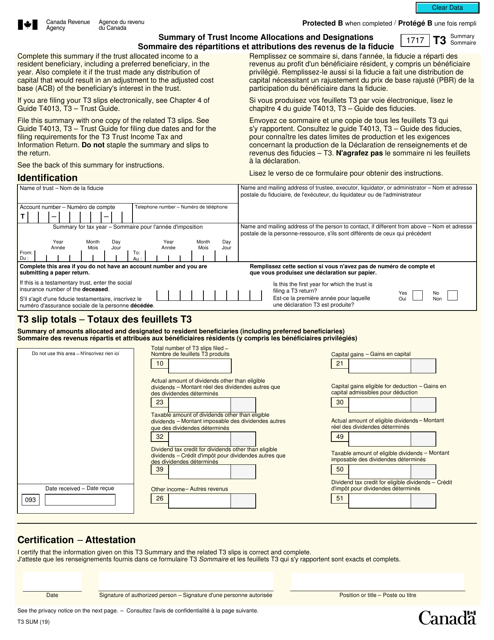

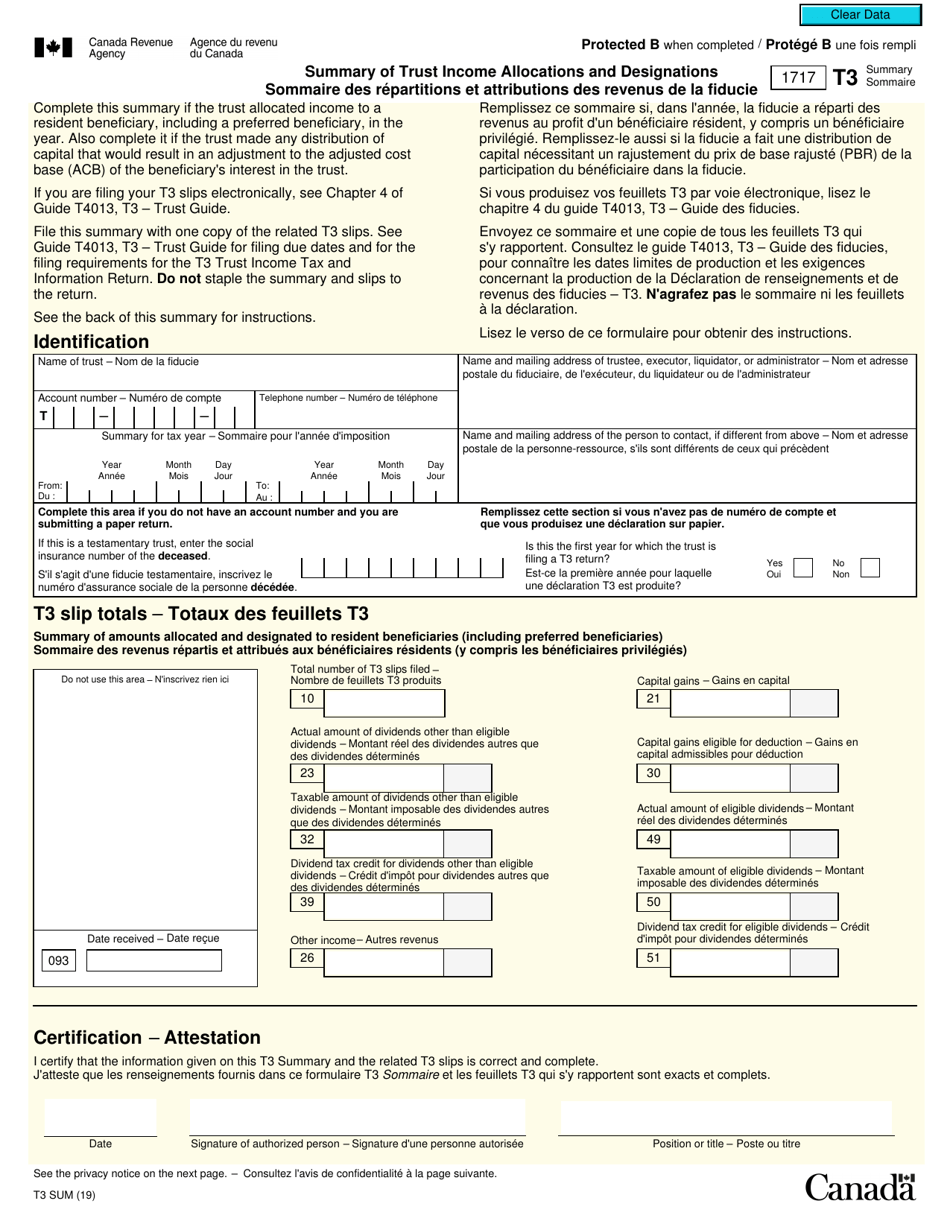

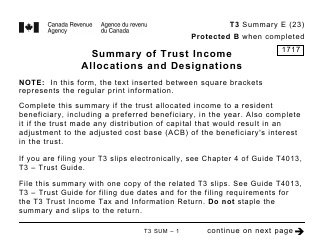

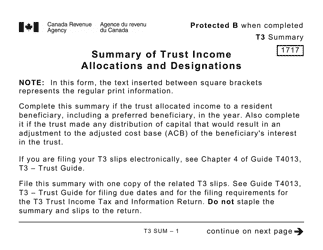

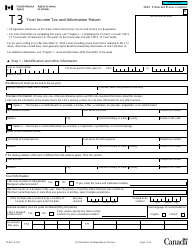

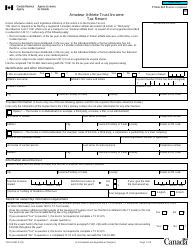

Form T3SUM Summary of Trust Income Allocations and Designations - Canada (English / French)

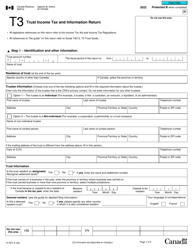

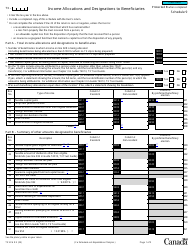

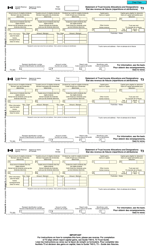

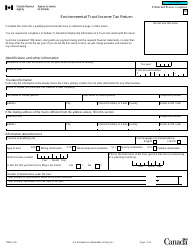

Form T3SUM Summary of Trust Income Allocations and Designations in Canada is used to summarize the income allocations and designations of a trust. This form is filed by the trustee of the trust to report the distribution of income to beneficiaries and to specify how the income is designated for tax purposes. It helps in reporting and calculating the taxable income of the trust and ensures compliance with the tax laws in Canada.

The Form T3SUM Summary of Trust Income Allocations and Designations in Canada is filed by the trust itself.

FAQ

Q: What is Form T3SUM?

A: Form T3SUM is a summary of trust income allocations and designations in Canada.

Q: Who needs to file Form T3SUM?

A: Trusts in Canada that have made income allocations and designations need to file Form T3SUM.

Q: What is the purpose of Form T3SUM?

A: The purpose of Form T3SUM is to report the allocation and designation of income earned by a trust in Canada.

Q: Is Form T3SUM available in both English and French?

A: Yes, Form T3SUM is available in both English and French versions.

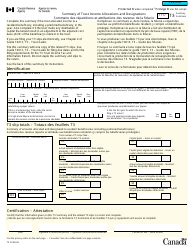

Q: What information is required to complete Form T3SUM?

A: To complete Form T3SUM, you will need information about the trust's income allocations and designations, as well as any supporting documentation.

Q: When is the deadline for filing Form T3SUM?

A: The deadline for filing Form T3SUM is within 90 days of the end of the trust's taxation year.

Q: What happens if I don't file Form T3SUM on time?

A: If you fail to file Form T3SUM on time, you may be subject to penalties and interest charges imposed by the CRA.