This version of the form is not currently in use and is provided for reference only. Download this version of

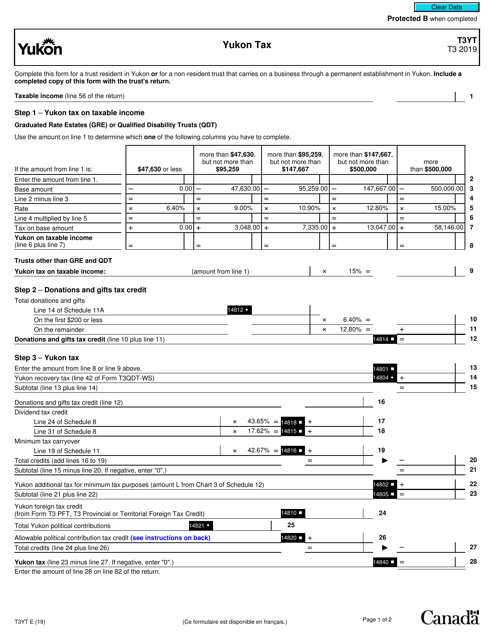

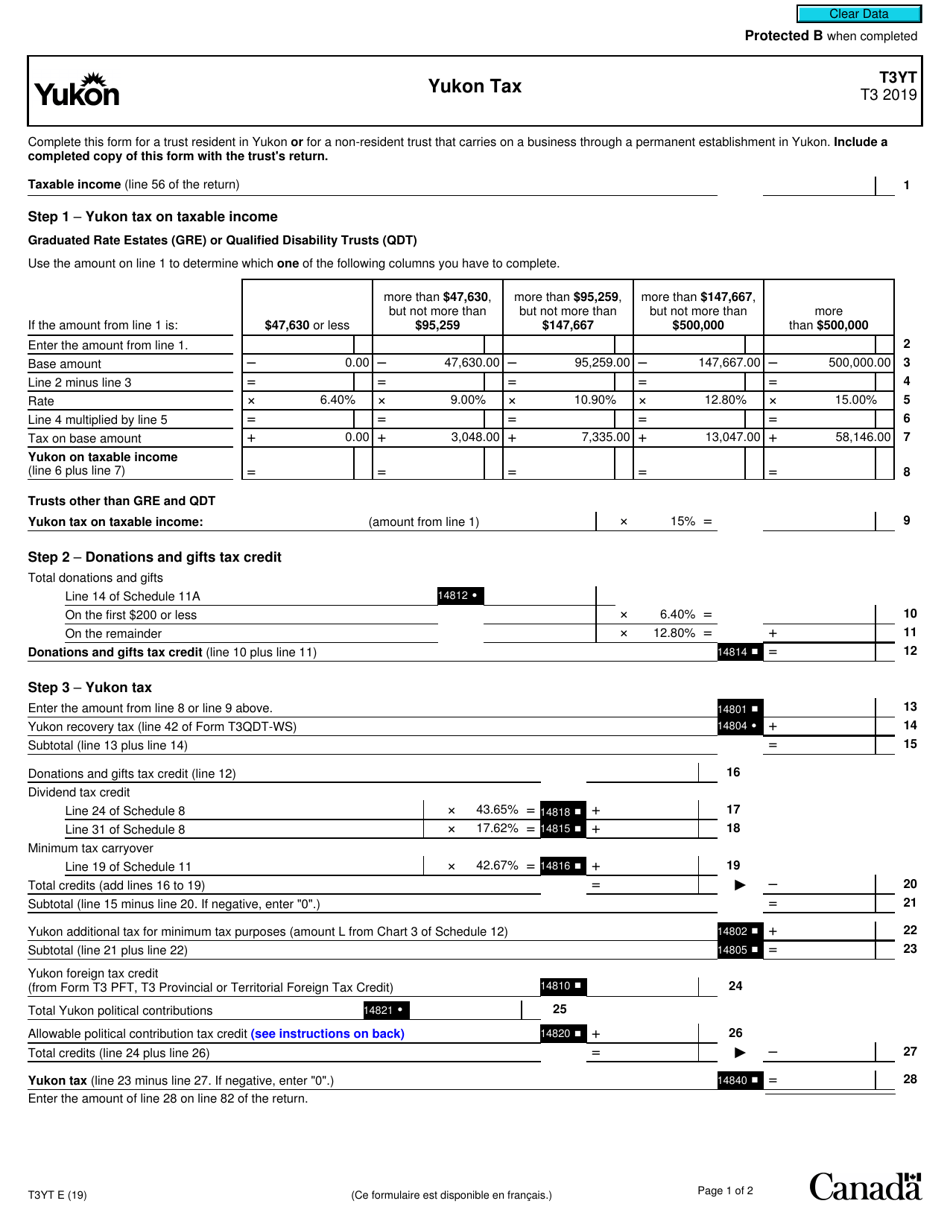

Form T3YT

for the current year.

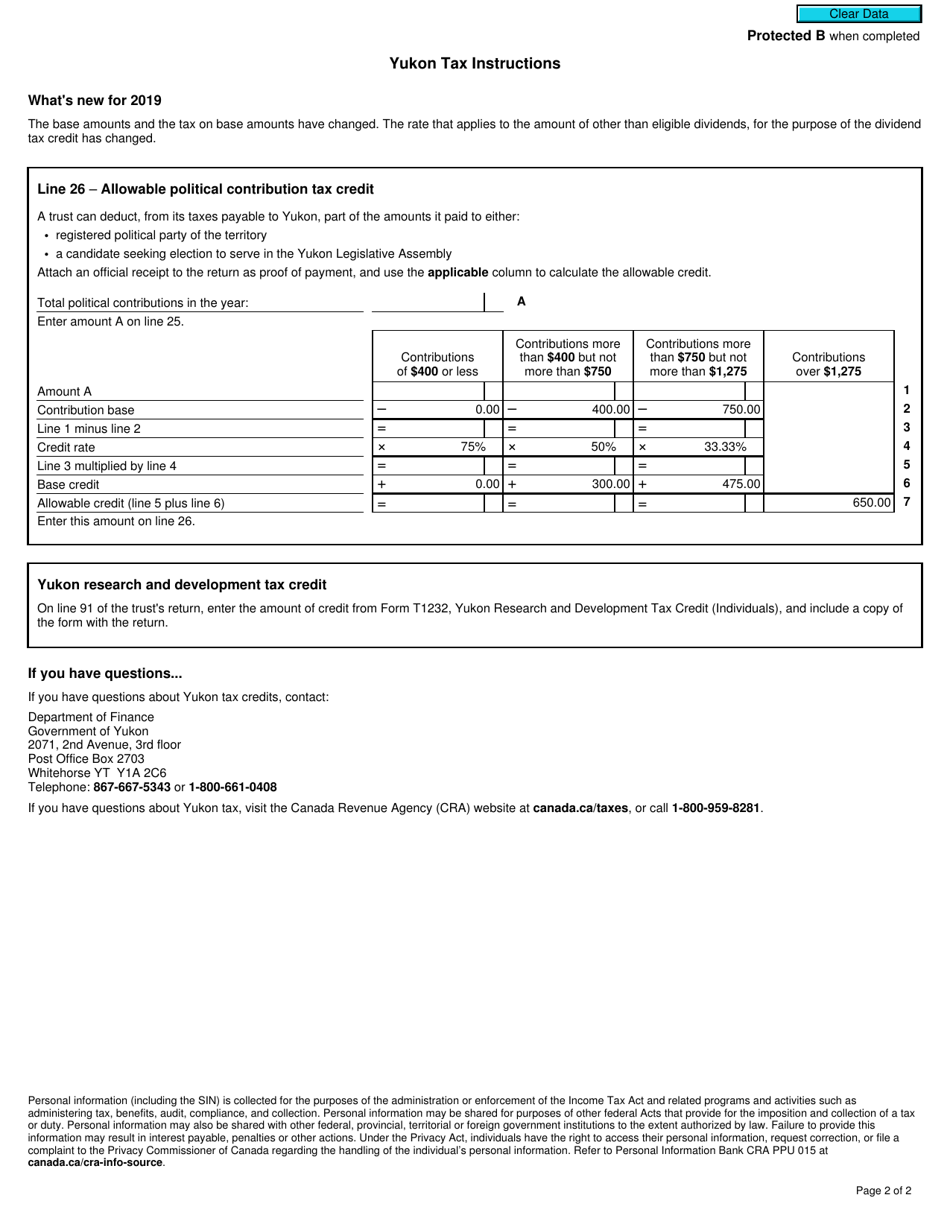

Form T3YT Yukon Tax - Canada

Form T3YT is used for reporting Yukon tax information in Canada. It is specifically used by individuals who are residents of Yukon to calculate and pay their provincial or territorial taxes.

The form T3YT Yukon Tax in Canada is filed by individuals who are residents of Yukon and have taxable income in that territory.

FAQ

Q: What is Form T3YT Yukon Tax?

A: Form T3YT Yukon Tax is a tax form used by individuals or corporations in Yukon, Canada to report their income and calculate their tax liability.

Q: Who needs to file Form T3YT Yukon Tax?

A: Residents of Yukon, Canada who have earned income or have a tax liability in the region are required to file Form T3YT Yukon Tax.

Q: What type of income is reported on Form T3YT Yukon Tax?

A: Form T3YT Yukon Tax is used to report various types of income, including employment income, business income, rental income, capital gains, and other sources of income.

Q: When is the deadline to file Form T3YT Yukon Tax?

A: The deadline to file Form T3YT Yukon Tax is generally April 30th of each year. However, it is important to check with the Canada Revenue Agency for any specific deadline changes.

Q: Are there any penalties for late filing of Form T3YT Yukon Tax?

A: Yes, there may be penalties for late filing of Form T3YT Yukon Tax. It is important to file your taxes on time to avoid potential penalties and interest charges.

Q: Can I claim deductions and credits on Form T3YT Yukon Tax?

A: Yes, you can claim eligible deductions and credits on Form T3YT Yukon Tax. This may include expenses related to your employment or business, as well as certain tax credits for individuals.

Q: Do I need to include supporting documents with Form T3YT Yukon Tax?

A: You may need to include supporting documents, such as receipts or other proof of income or expenses, when filing Form T3YT Yukon Tax. It is always a good idea to keep records of your income and expenses.