This version of the form is not currently in use and is provided for reference only. Download this version of

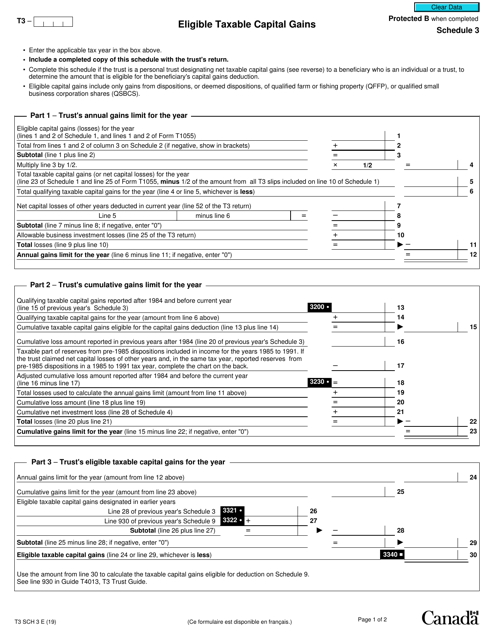

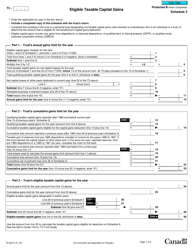

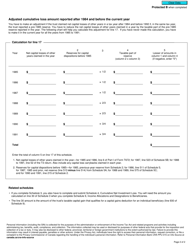

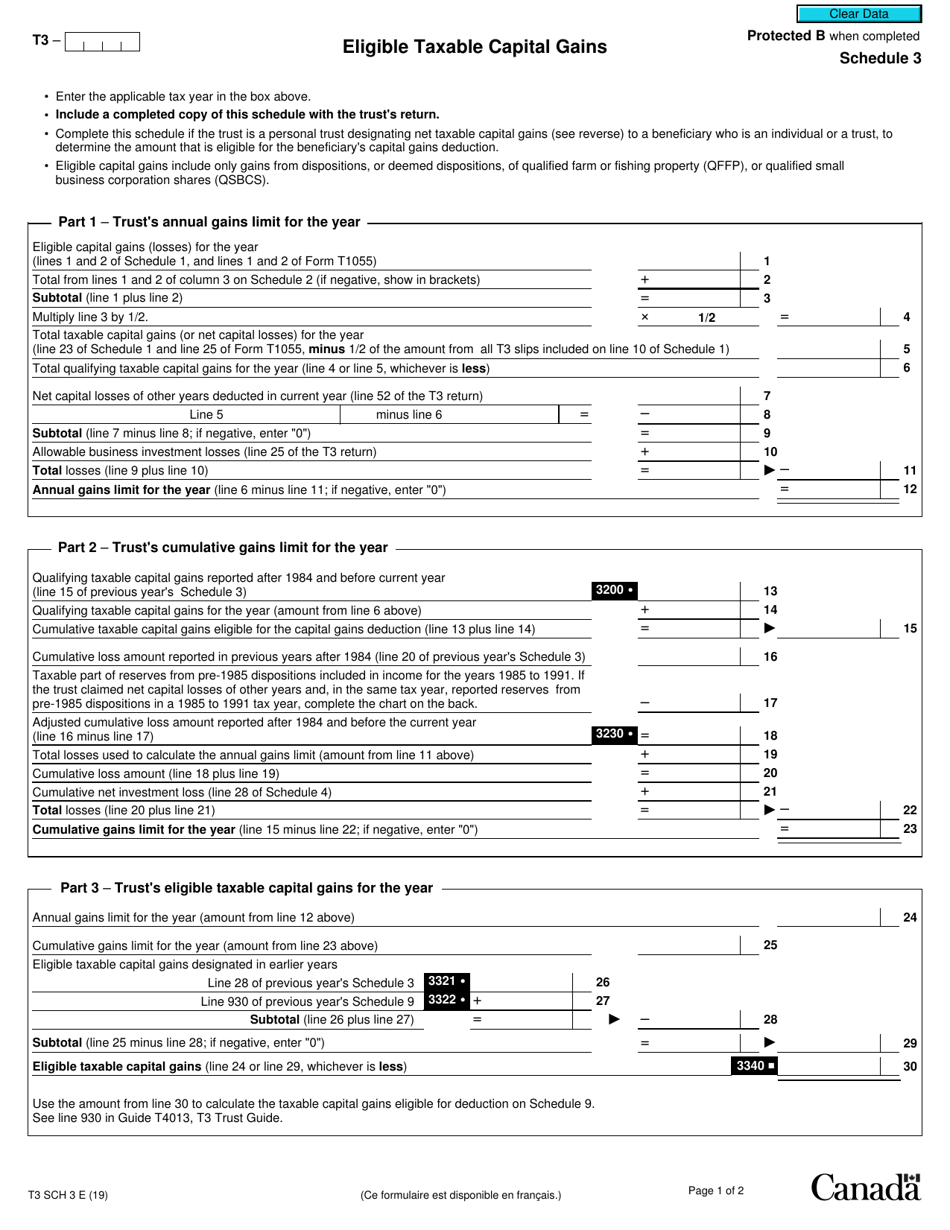

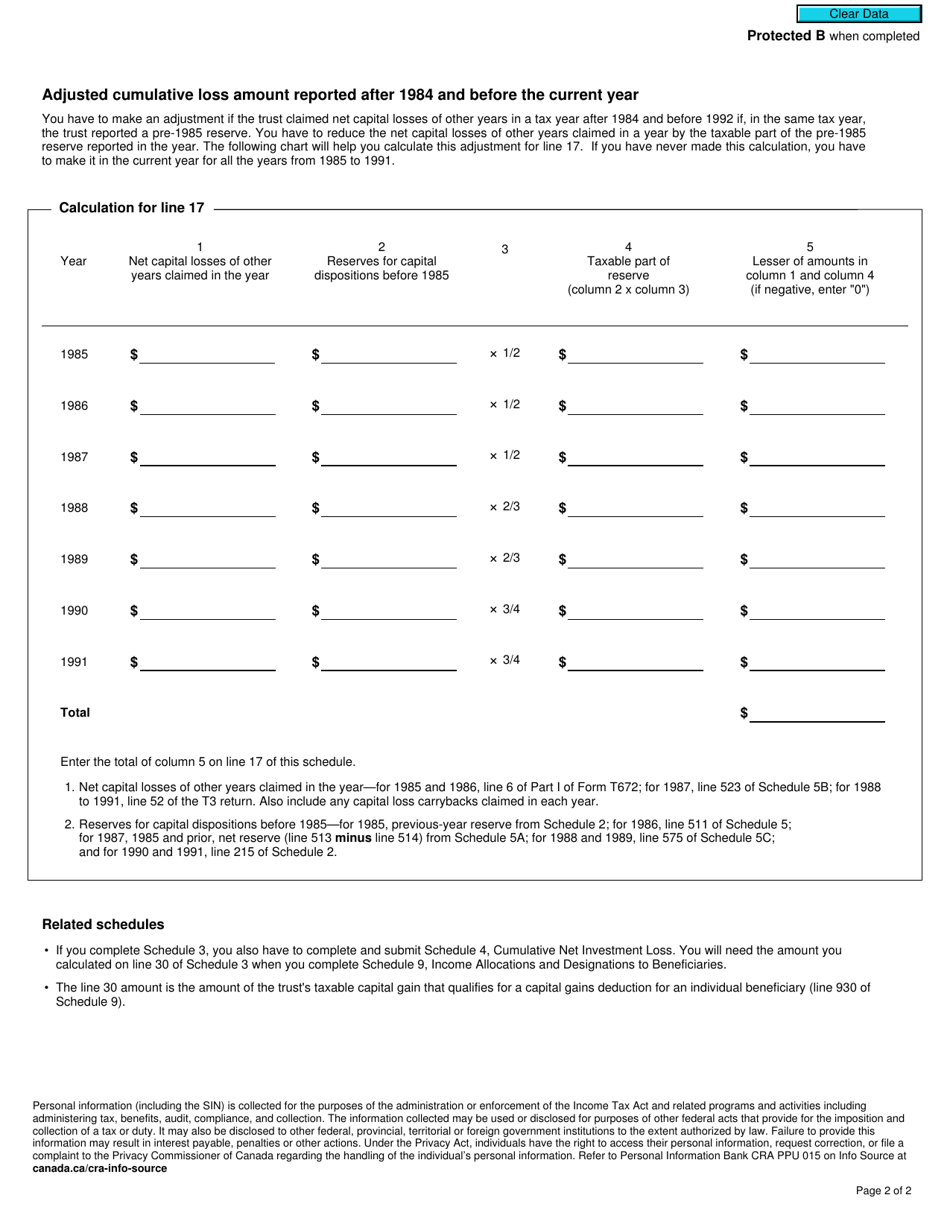

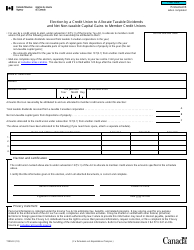

Form T3 Schedule 3

for the current year.

Form T3 Schedule 3 Eligible Taxable Capital Gains - Canada

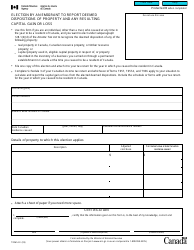

Form T3 Schedule 3 Eligible Taxable Capital Gains in Canada is used to report the eligible taxable capital gains earned by a trust. It is a specific tax form for trusts in Canada to calculate and report their taxable capital gains in an eligible format.

The individual who has incurred eligible taxable capital gains in Canada files the Form T3 Schedule 3.

FAQ

Q: What is Form T3 Schedule 3?

A: Form T3 Schedule 3 is a tax form used in Canada to report eligible taxable capital gains.

Q: What are eligible taxable capital gains?

A: Eligible taxable capital gains refer to the profits made from the sale of certain investments, like real estate or stocks, that are subject to tax in Canada.

Q: What information is required on Form T3 Schedule 3?

A: Form T3 Schedule 3 requires you to provide details about the transactions that resulted in the eligible taxable capital gains, including the date of sale, cost base, and proceeds of disposition.

Q: Who needs to file Form T3 Schedule 3?

A: Individuals or businesses in Canada who have realized eligible taxable capital gains during the tax year must file Form T3 Schedule 3.

Q: Is there a deadline for filing Form T3 Schedule 3?

A: Yes, Form T3 Schedule 3 must be filed along with your annual tax return by the tax filing deadline, which is typically April 30th for most individuals.