This version of the form is not currently in use and is provided for reference only. Download this version of

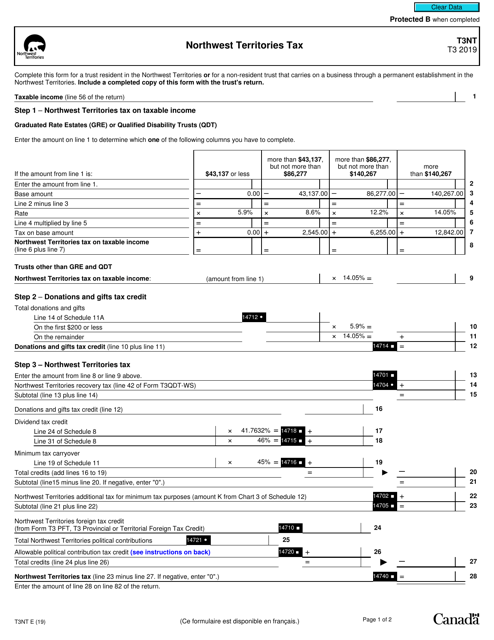

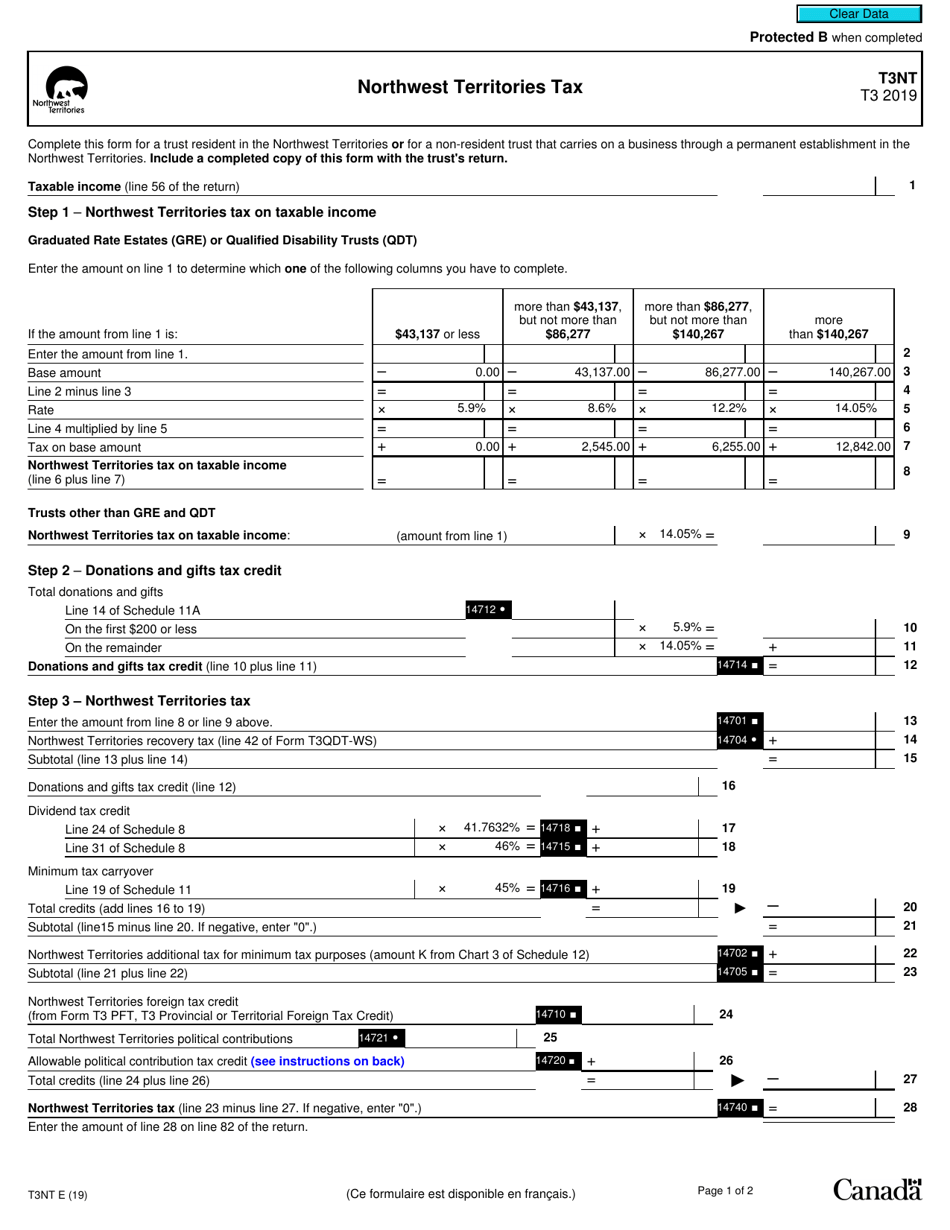

Form T3NT

for the current year.

Form T3NT Northwest Territories Tax - Canada

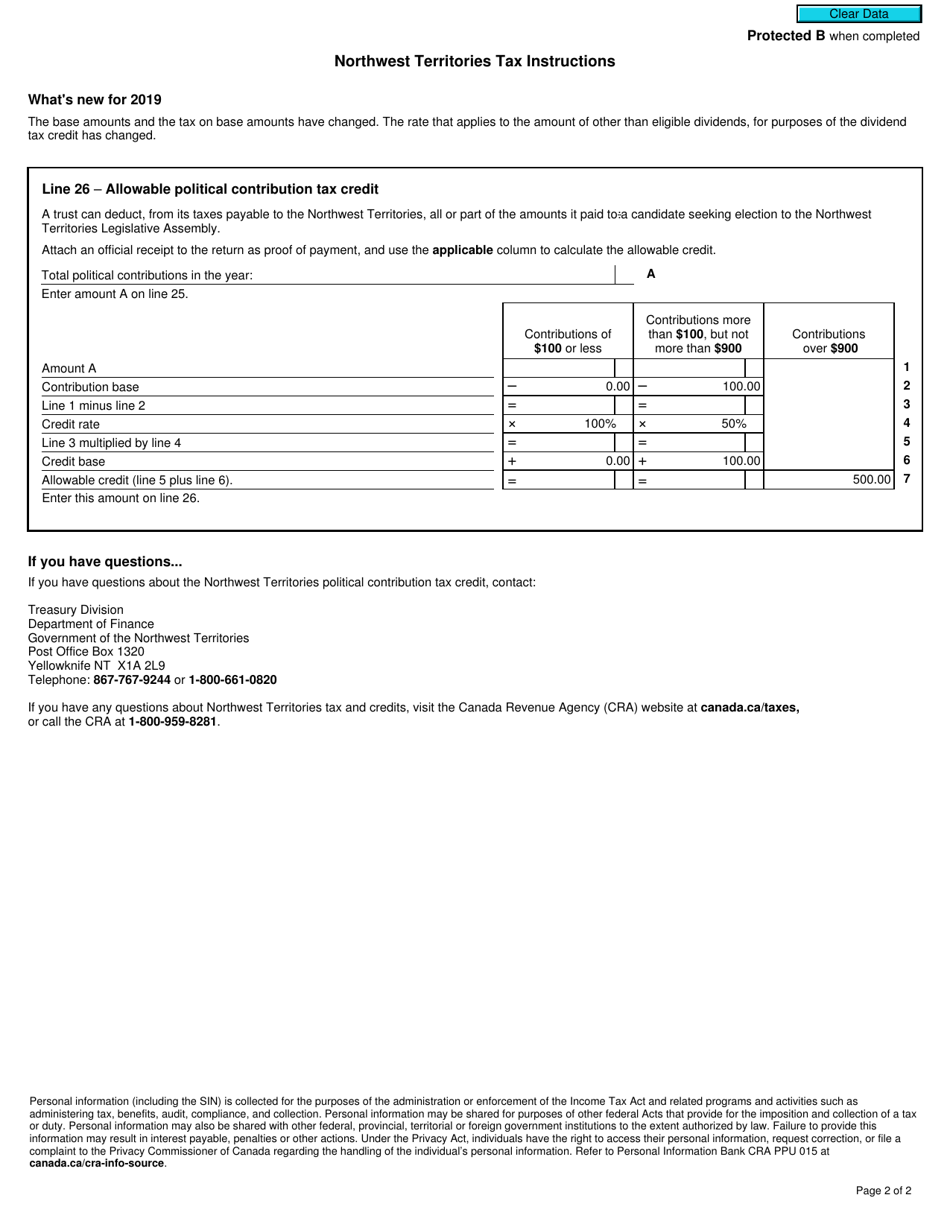

Form T3NT is the tax form used in the Northwest Territories, Canada for reporting and paying taxes on income earned in that region. It is specifically designed for individuals or businesses who are residents of the Northwest Territories and need to file their taxes accordingly.

The Form T3NT Northwest Territories Tax - Canada is generally filed by individuals who are residents of the Northwest Territories in Canada and have a tax liability in that province.

FAQ

Q: What is Form T3NT?

A: Form T3NT is a tax form used in the Northwest Territories of Canada.

Q: Who needs to file Form T3NT?

A: Residents of the Northwest Territories who have taxable income need to file Form T3NT.

Q: What is the purpose of Form T3NT?

A: Form T3NT is used to report and pay provincial taxes owed to the Northwest Territories.

Q: When is the deadline to file Form T3NT?

A: The deadline to file Form T3NT is typically April 30th of each year.

Q: What happens if I don't file Form T3NT?

A: If you don't file Form T3NT, you may face penalties and interest on any taxes owed.

Q: What other forms do I need to file along with Form T3NT?

A: You may also need to file your federal income tax return and any other applicable forms along with Form T3NT.

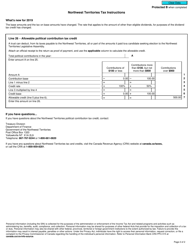

Q: How do I calculate the taxes owed on Form T3NT?

A: The tax owed on Form T3NT is based on the taxable income earned in the Northwest Territories and the provincial tax rates.

Q: Can I claim deductions or credits on Form T3NT?

A: Yes, you may be eligible to claim deductions or credits on Form T3NT. Consult the instructions or a tax professional for more information.