This version of the form is not currently in use and is provided for reference only. Download this version of

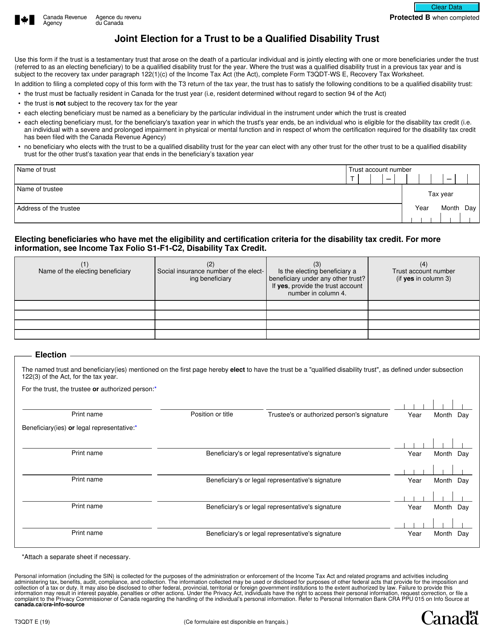

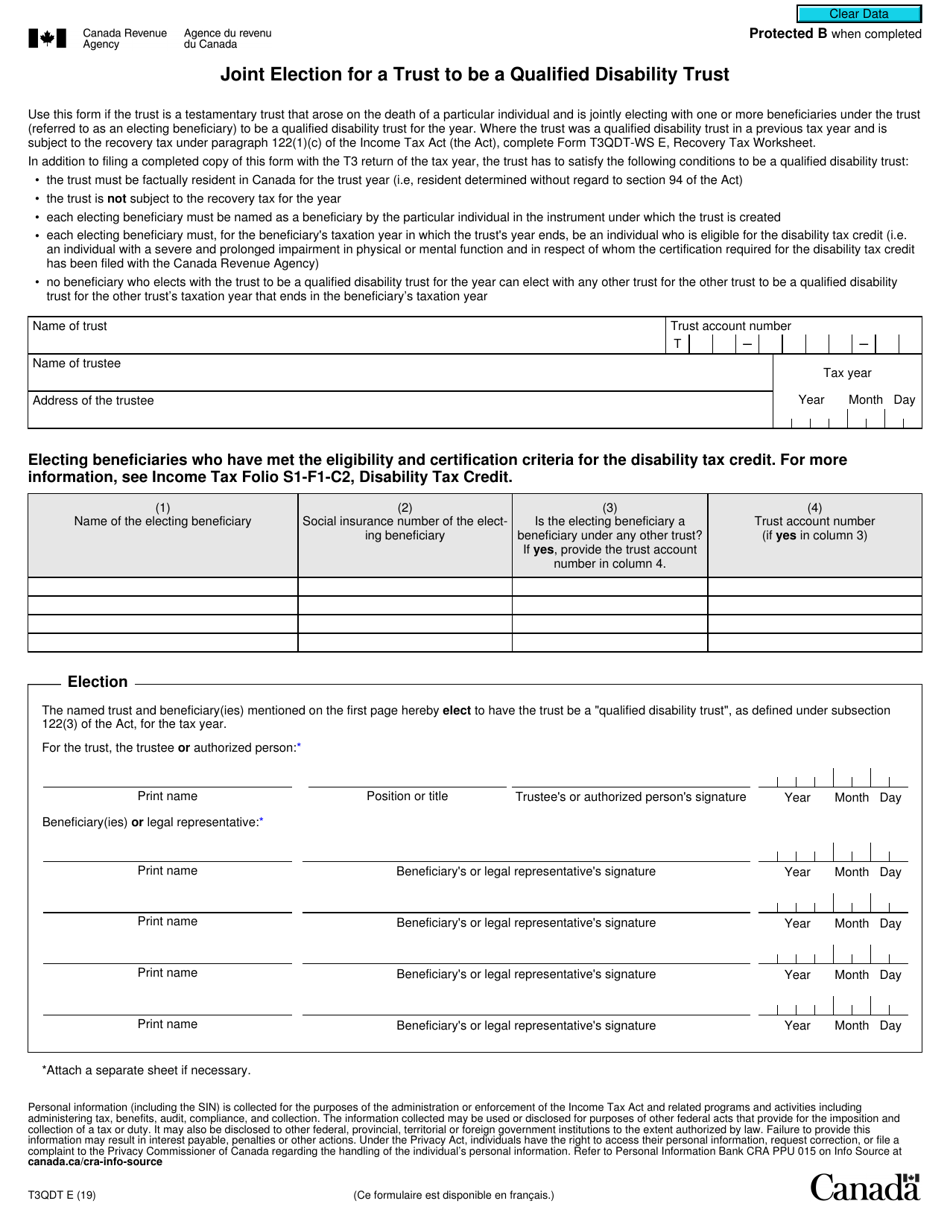

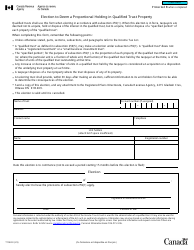

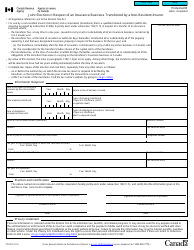

Form T3QDT

for the current year.

Form T3QDT Joint Election for a Trust to Be a Qualified Disability Trust - Canada

Form T3QDT, Joint Election for a Trust to Be a Qualified Disability Trust, is used in Canada for a trust to elect to be designated as a Qualified Disability Trust (QDT). This designation allows certain tax benefits for the trust and its beneficiaries who have a disability.

The beneficiary of the trust, or their legal representative, files the Form T3QDT Joint Election for a Trust to Be a Qualified Disability Trust in Canada.

FAQ

Q: What is Form T3QDT?

A: Form T3QDT is a Joint Election for a Trust to Be a Qualified Disability Trust in Canada.

Q: What is a Qualified Disability Trust?

A: A Qualified Disability Trust is a type of trust that is eligible for certain tax advantages.

Q: Who can use Form T3QDT?

A: Form T3QDT is used by a trust that meets specific criteria to elect to be treated as a Qualified Disability Trust.

Q: What are the requirements for a trust to be considered a Qualified Disability Trust?

A: To be considered a Qualified Disability Trust, the trust must meet certain conditions related to the beneficiary's disability and income.

Q: What are the tax advantages of being a Qualified Disability Trust?

A: A Qualified Disability Trust may be eligible for certain tax benefits, such as the ability to claim the basic personal amount and other tax credits.