This version of the form is not currently in use and is provided for reference only. Download this version of

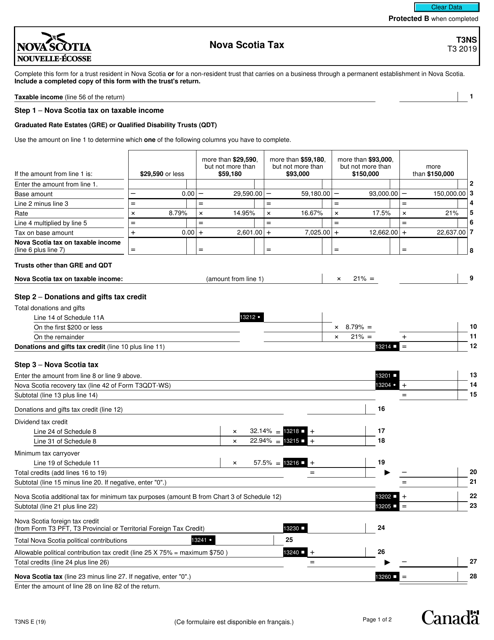

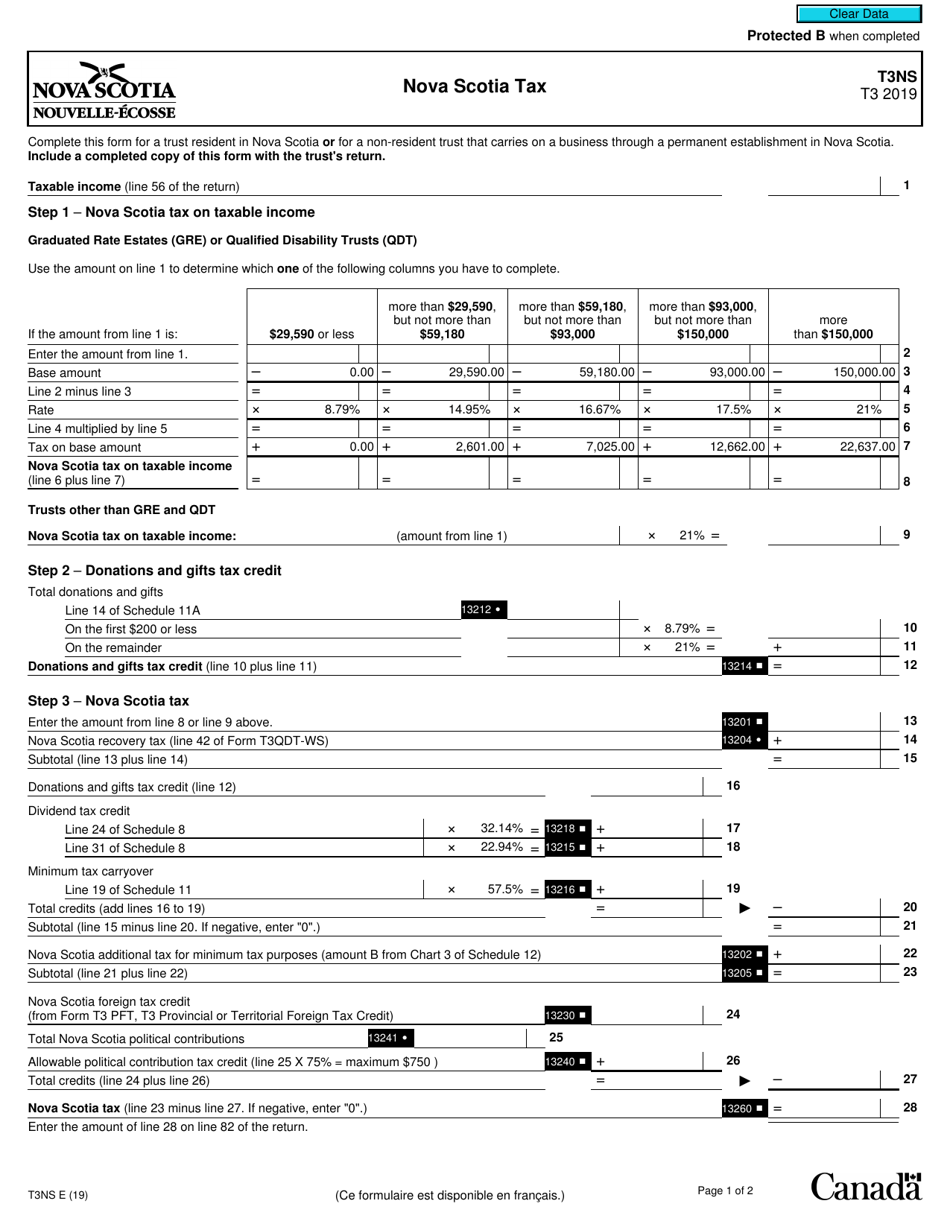

Form T3NS

for the current year.

Form T3NS Nova Scotia Tax - Canada

Form T3NS Nova Scotia Tax - Canada is used to report income earned in the province of Nova Scotia for tax purposes. It is specifically for individuals who are residents of Nova Scotia and have income from sources such as employment, business, or investments within the province.

The Form T3NS Nova Scotia Tax in Canada is typically filed by individuals who are residents of Nova Scotia for tax purposes.

FAQ

Q: What is Form T3NS?

A: Form T3NS is a tax form used in Nova Scotia, Canada.

Q: Who needs to fill out Form T3NS?

A: Form T3NS needs to be filled out by individuals who are residents of Nova Scotia for tax purposes.

Q: What information is required on Form T3NS?

A: Form T3NS requires information such as the taxpayer's personal details, income earned in Nova Scotia, deductions and credits, and any taxes owing.

Q: When is Form T3NS due?

A: Form T3NS is generally due on or before April 30 of each year, unless otherwise specified.

Q: What happens if I don't file Form T3NS?

A: Failure to file Form T3NS or reporting incorrect information can result in penalties and interest charges imposed by the CRA.

Q: Is Form T3NS used for federal taxes?

A: No, Form T3NS is specific to Nova Scotia provincial taxes and is separate from federal tax forms like the T1 General.

Q: Can I submit Form T3NS by mail?

A: Yes, Form T3NS can be submitted by mail to the CRA's tax center for the province or territory where you reside.