This version of the form is not currently in use and is provided for reference only. Download this version of

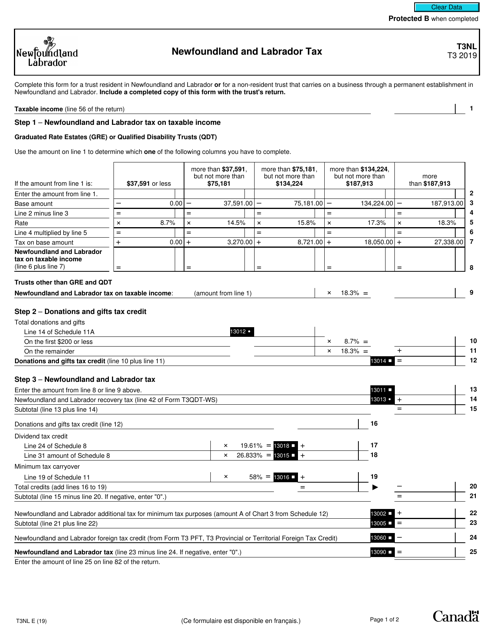

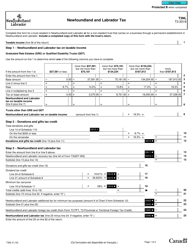

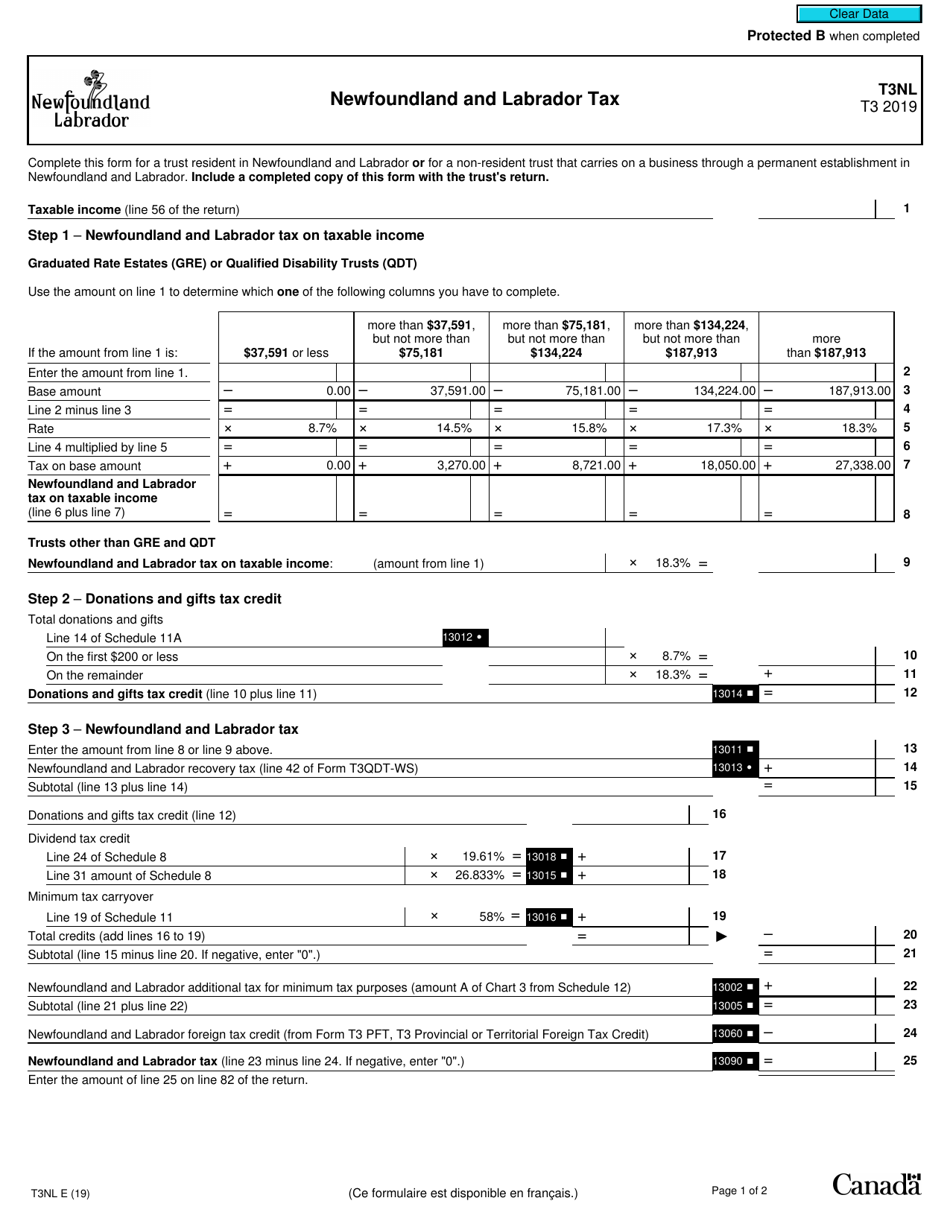

Form T3NL

for the current year.

Form T3NL Newfoundland and Labrador Tax - Canada

Form T3NL is the income tax return form specifically designed for residents of the province of Newfoundland and Labrador in Canada. It is used to report and calculate the income tax owing for individuals who are deemed residents of Newfoundland and Labrador for tax purposes.

The Form T3NL Newfoundland and Labrador Tax in Canada is filed by individuals or businesses who have taxable income from sources in Newfoundland and Labrador.

FAQ

Q: What is Form T3NL?

A: Form T3NL is the tax form used in Newfoundland and Labrador, Canada, to report provincial income tax.

Q: Who needs to fill out Form T3NL?

A: Residents of Newfoundland and Labrador who have taxable income or are claiming provincial tax credits need to fill out Form T3NL.

Q: When is the deadline to file Form T3NL?

A: The deadline to file Form T3NL is generally the same as the federal tax return deadline, which is April 30th of the following year, unless it falls on a weekend or holiday.

Q: What should I include when filing Form T3NL?

A: When filing Form T3NL, you should include information about your income, deductions, credits, and any other required documentation or schedules.

Q: Can I file Form T3NL electronically?

A: Yes, you can file Form T3NL electronically using the NETFILE system or through certified tax preparation software.

Q: Are there any tax credits specific to Newfoundland and Labrador?

A: Yes, Newfoundland and Labrador offers several tax credits such as the Seniors' Home Accessibility Tax Credit and the Newfoundland and Labrador Prescription DrugProgram Tax Credit.

Q: What if I have questions or need help filling out Form T3NL?

A: If you have questions or need assistance with Form T3NL, you can contact the Newfoundland and Labrador tax authorities or consult a tax professional.