This version of the form is not currently in use and is provided for reference only. Download this version of

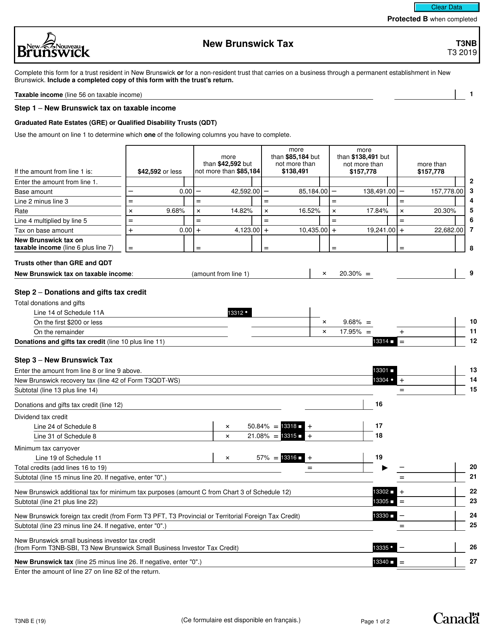

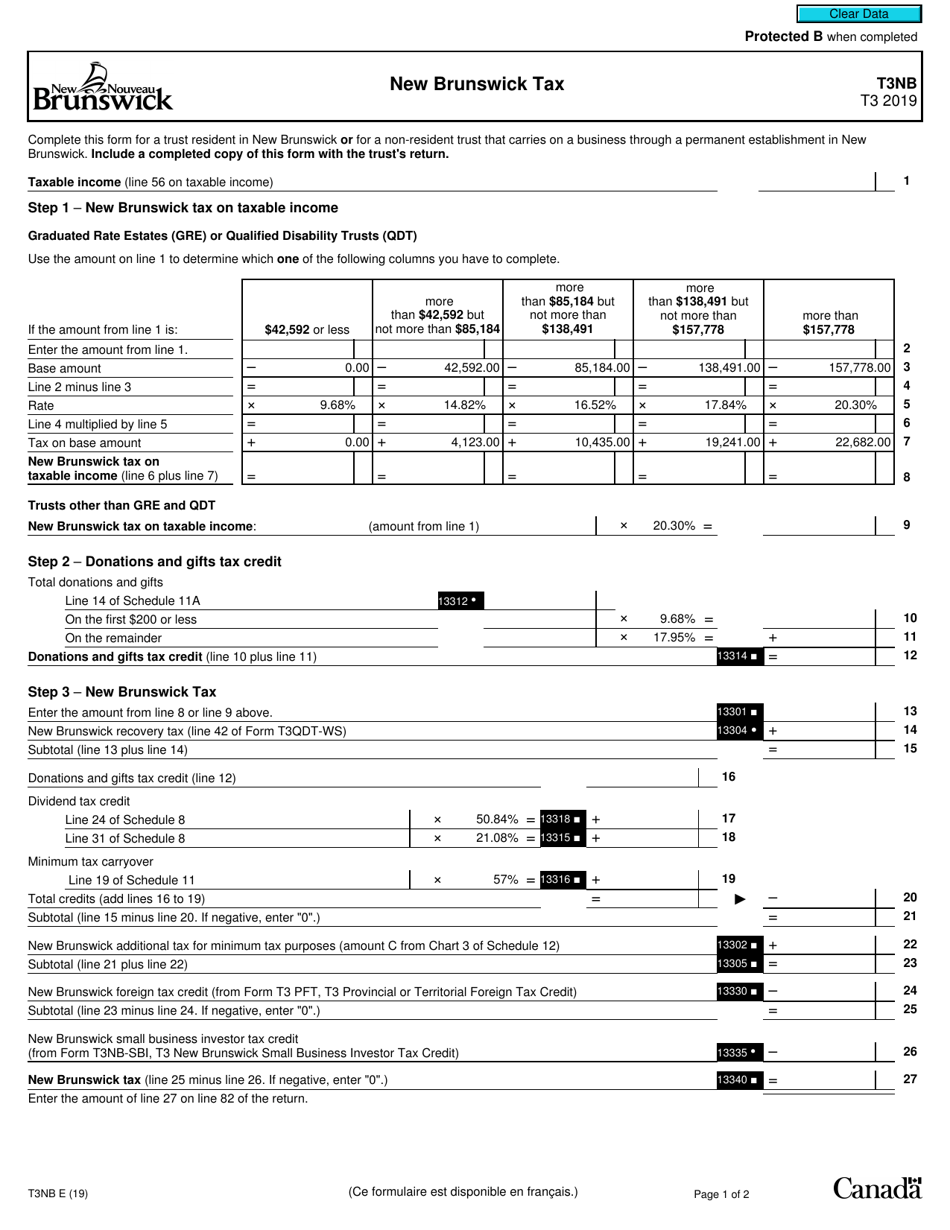

Form T3NB

for the current year.

Form T3NB New Brunswick Tax - Canada

Form T3NB, also known as the New Brunswick Tax Return, is used by residents of the province of New Brunswick in Canada to report their income, deductions, and credits for tax purposes. It is specifically designed to calculate and determine the amount of provincial tax owed to the province of New Brunswick.

The Form T3NB New Brunswick Tax in Canada is filed by individuals or businesses who are residents of New Brunswick and have tax obligations in the province.

FAQ

Q: What is Form T3NB?

A: Form T3NB is a tax form used in New Brunswick, Canada.

Q: Who is required to file Form T3NB?

A: Individuals and businesses who are residents of New Brunswick and have income that is subject to provincial tax are required to file Form T3NB.

Q: What is the purpose of Form T3NB?

A: Form T3NB is used to report and calculate provincial income tax owed to the province of New Brunswick.

Q: When is Form T3NB due?

A: Form T3NB is generally due on or before April 30th of the year following the tax year.

Q: Are there any penalties for late filing of Form T3NB?

A: Yes, there may be penalties for late filing of Form T3NB. It is important to file your tax return on time to avoid these penalties.