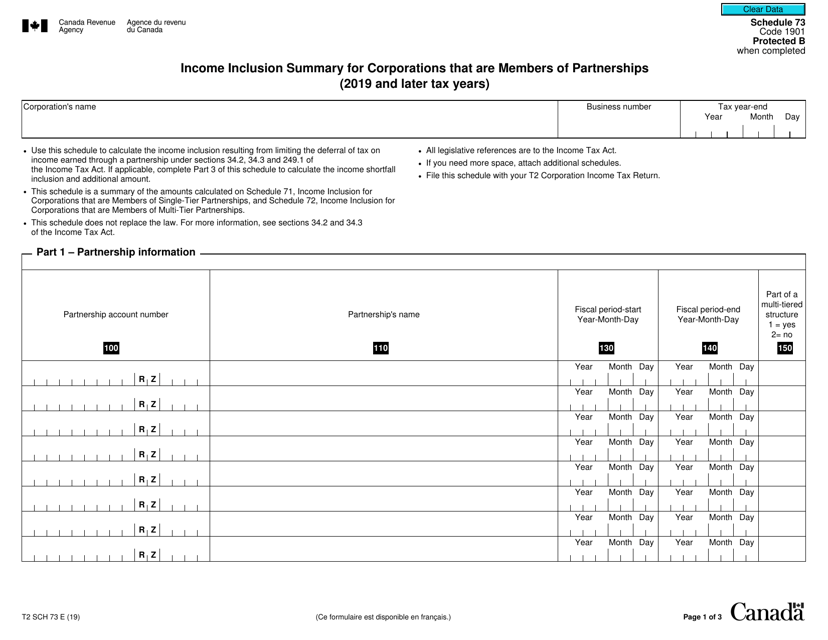

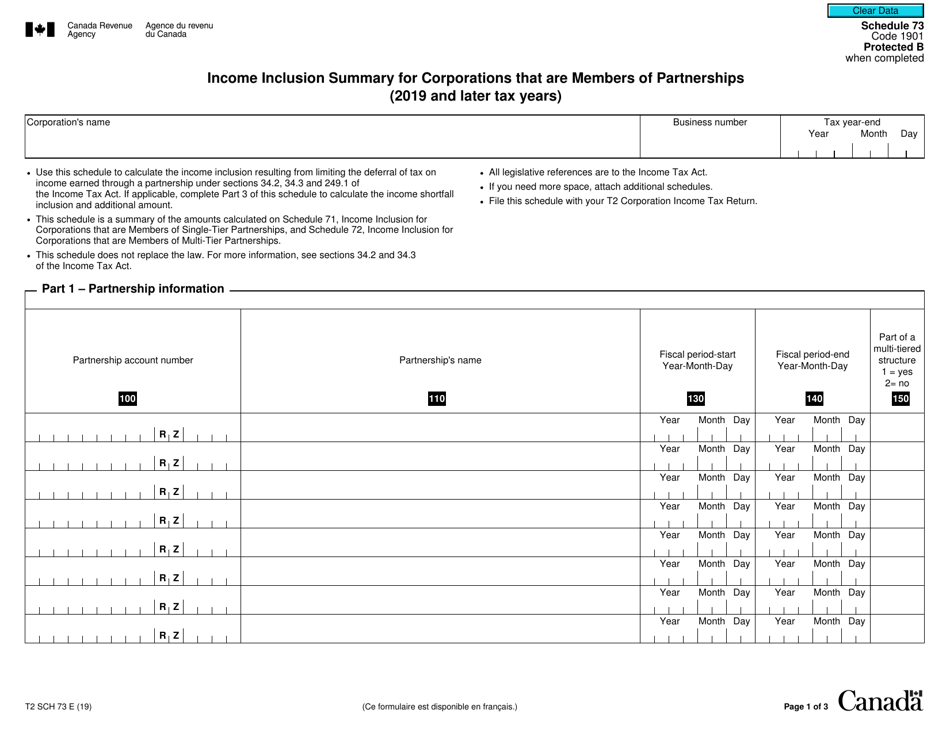

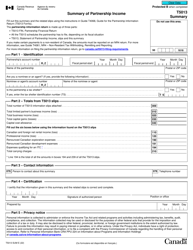

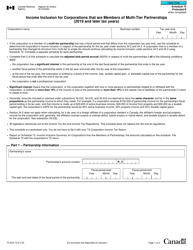

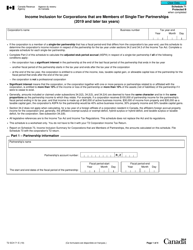

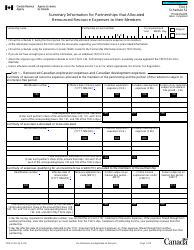

Form T2 Schedule 73 Income Inclusion Summary for Corporations That Are Members of Partnerships (2019 and Later Tax Years) - Canada

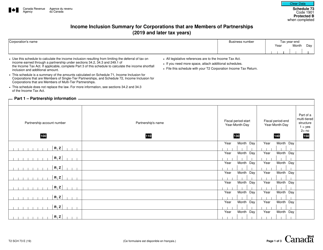

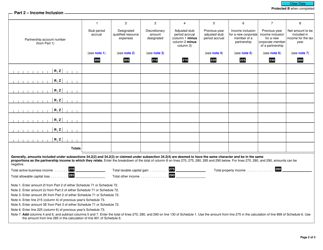

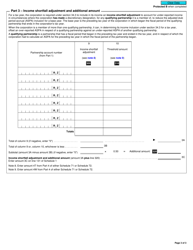

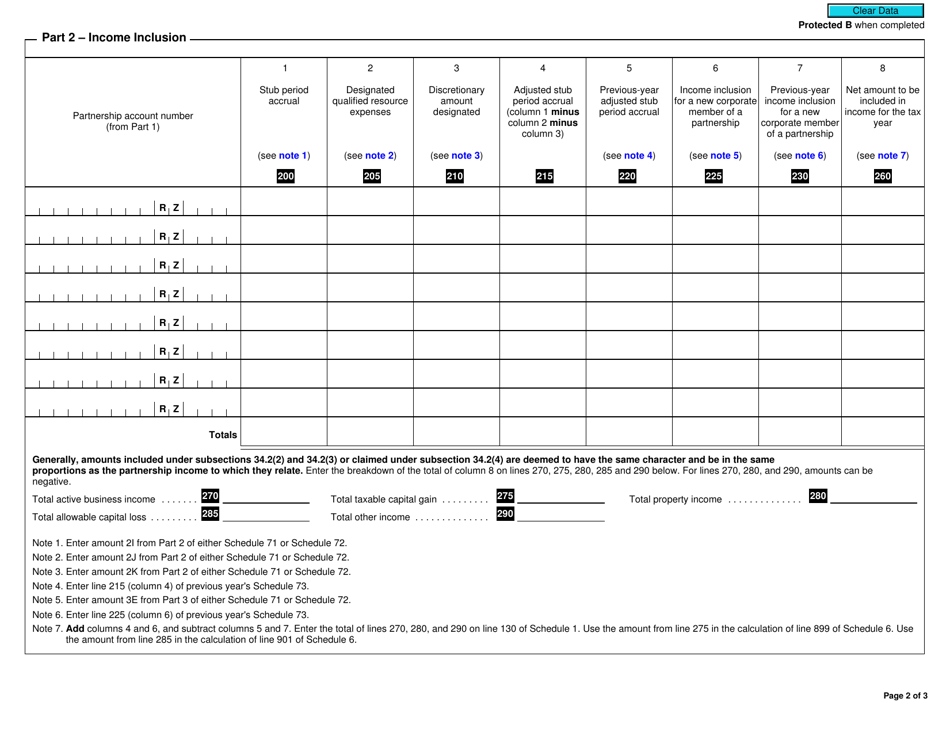

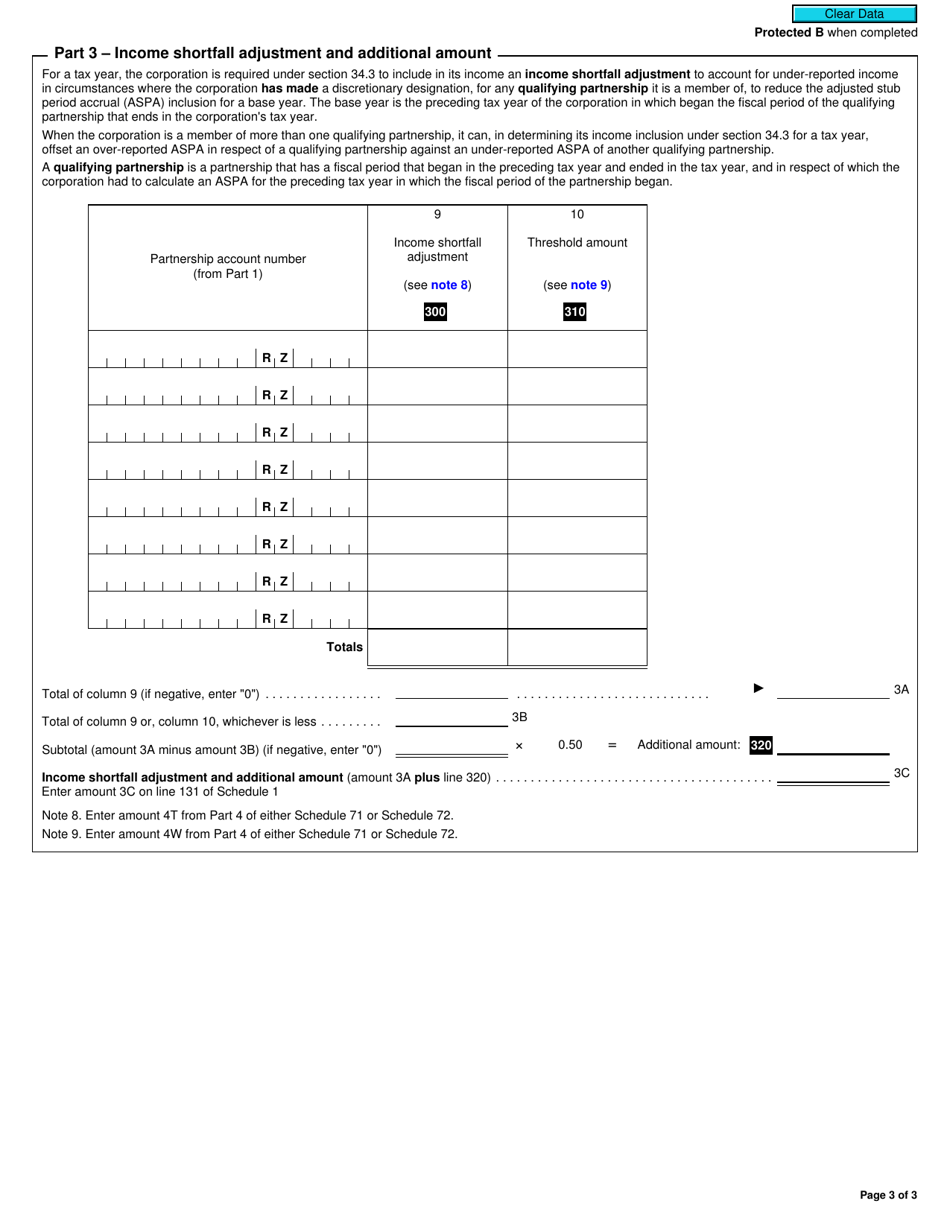

Form T2 Schedule 73 Income Inclusion Summary for Corporations That Are Members of Partnerships (2019 and Later Tax Years) in Canada is used to report income and deductions for corporations that are members of partnerships. It helps calculate the income and deductions that need to be reported on the corporation's tax return.

The Form T2 Schedule 73 Income Inclusion Summary is filed by corporations that are members of partnerships in Canada.

FAQ

Q: What is Form T2 Schedule 73?

A: Form T2 Schedule 73 is an Income Inclusion Summary for Corporations That Are Members of Partnerships in Canada.

Q: Who needs to file Form T2 Schedule 73?

A: Corporations that are members of partnerships in Canada need to file Form T2 Schedule 73.

Q: What is the purpose of Form T2 Schedule 73?

A: The purpose of Form T2 Schedule 73 is to report the income inclusion for corporations that are members of partnerships.

Q: For which tax years is Form T2 Schedule 73 applicable?

A: Form T2 Schedule 73 is applicable for the 2019 tax year and later tax years in Canada.