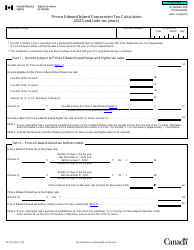

This version of the form is not currently in use and is provided for reference only. Download this version of

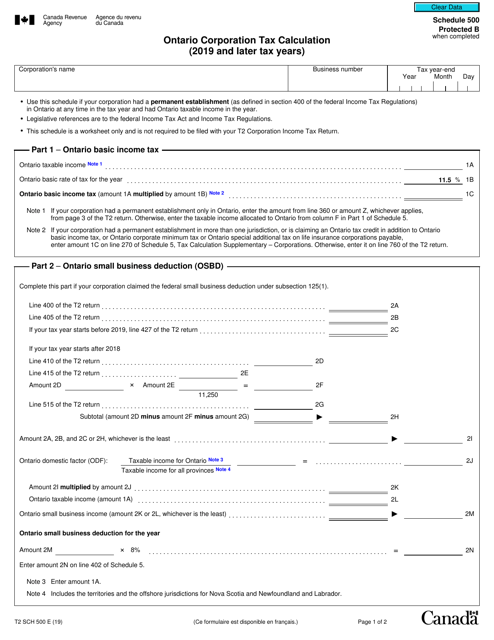

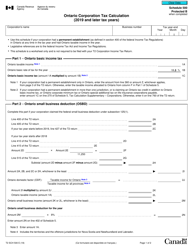

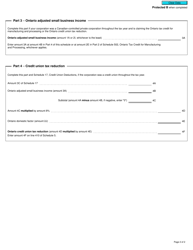

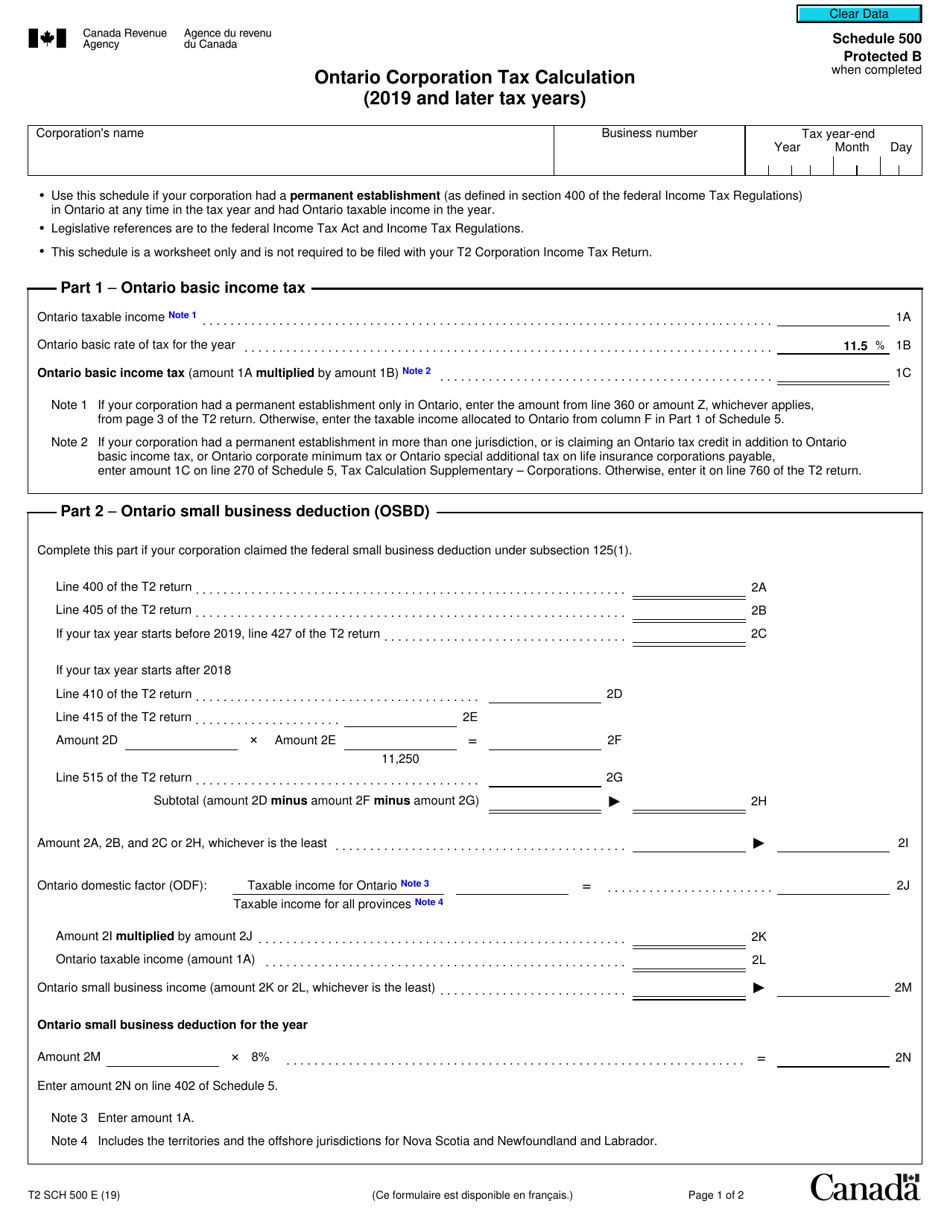

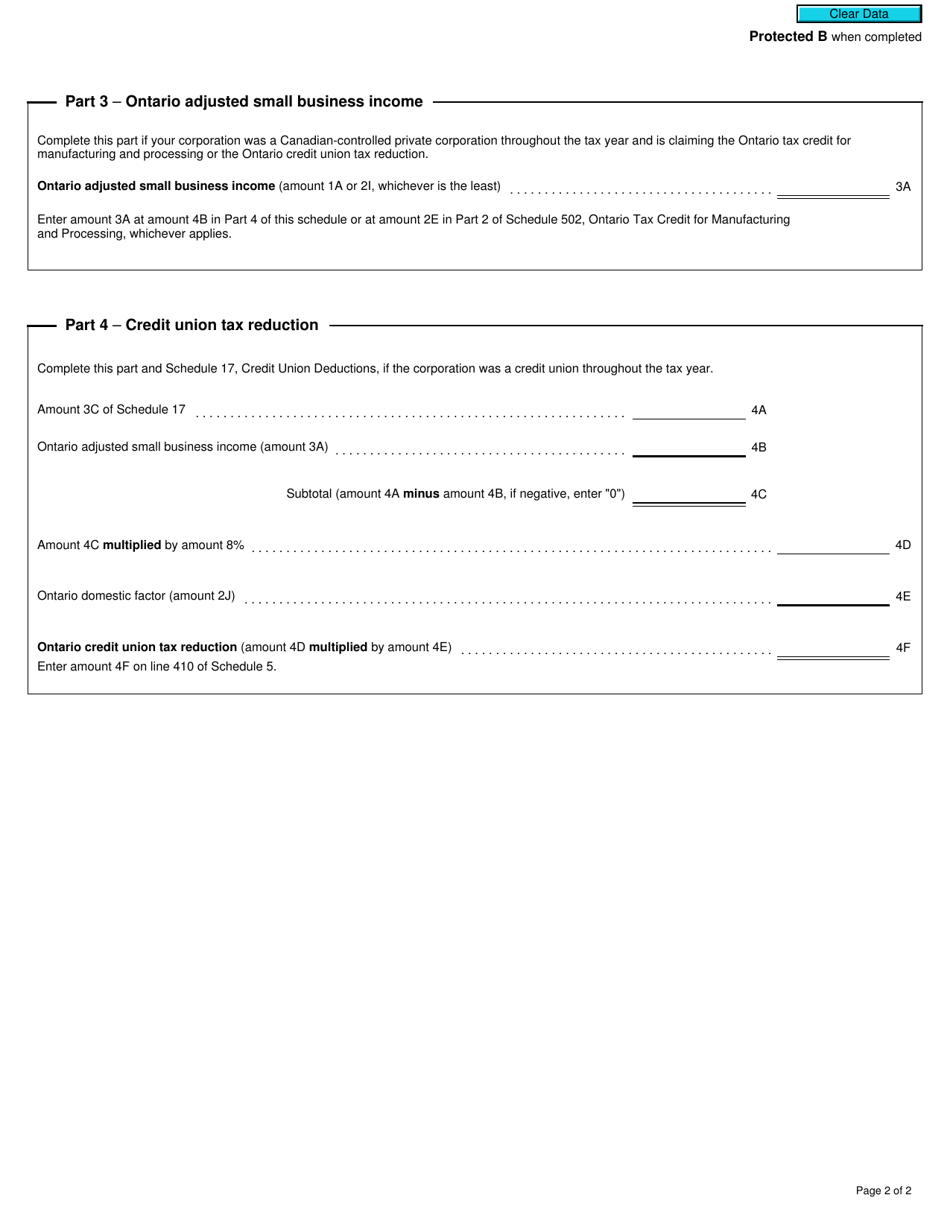

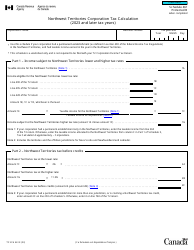

Form T2 Schedule 500

for the current year.

Form T2 Schedule 500 Ontario Corporation Tax Calculation (2019 and Later Tax Years) - Canada

Form T2 Schedule 500 is an Ontario-specific tax form used by corporations in Canada to calculate their Ontario Corporation Tax liability for the tax years 2019 and later. It helps corporations in Ontario accurately determine the amount of tax they owe to the Ontario government.

The Ontario corporations that are required to file their tax returns.

FAQ

Q: What is Form T2 Schedule 500?

A: Form T2 Schedule 500 is a tax calculation form for Ontario corporations in Canada.

Q: Who needs to file Form T2 Schedule 500?

A: Ontario corporations filing taxes in Canada need to file Form T2 Schedule 500.

Q: What does Form T2 Schedule 500 calculate?

A: Form T2 Schedule 500 calculates the tax owed by Ontario corporations for the given tax year.

Q: Which tax years is Form T2 Schedule 500 applicable for?

A: Form T2 Schedule 500 is applicable for tax years 2019 and later.

Q: Is Form T2 Schedule 500 specific to Ontario corporations?

A: Yes, Form T2 Schedule 500 is specific to Ontario corporations filing taxes in Canada.