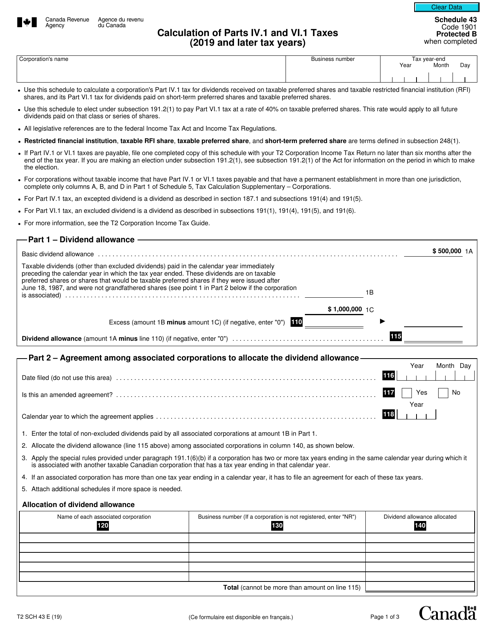

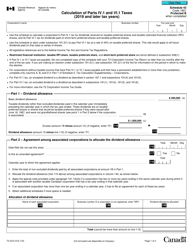

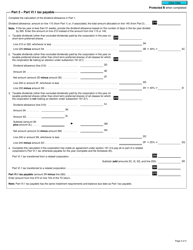

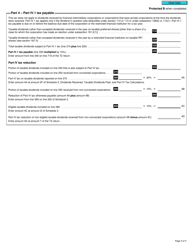

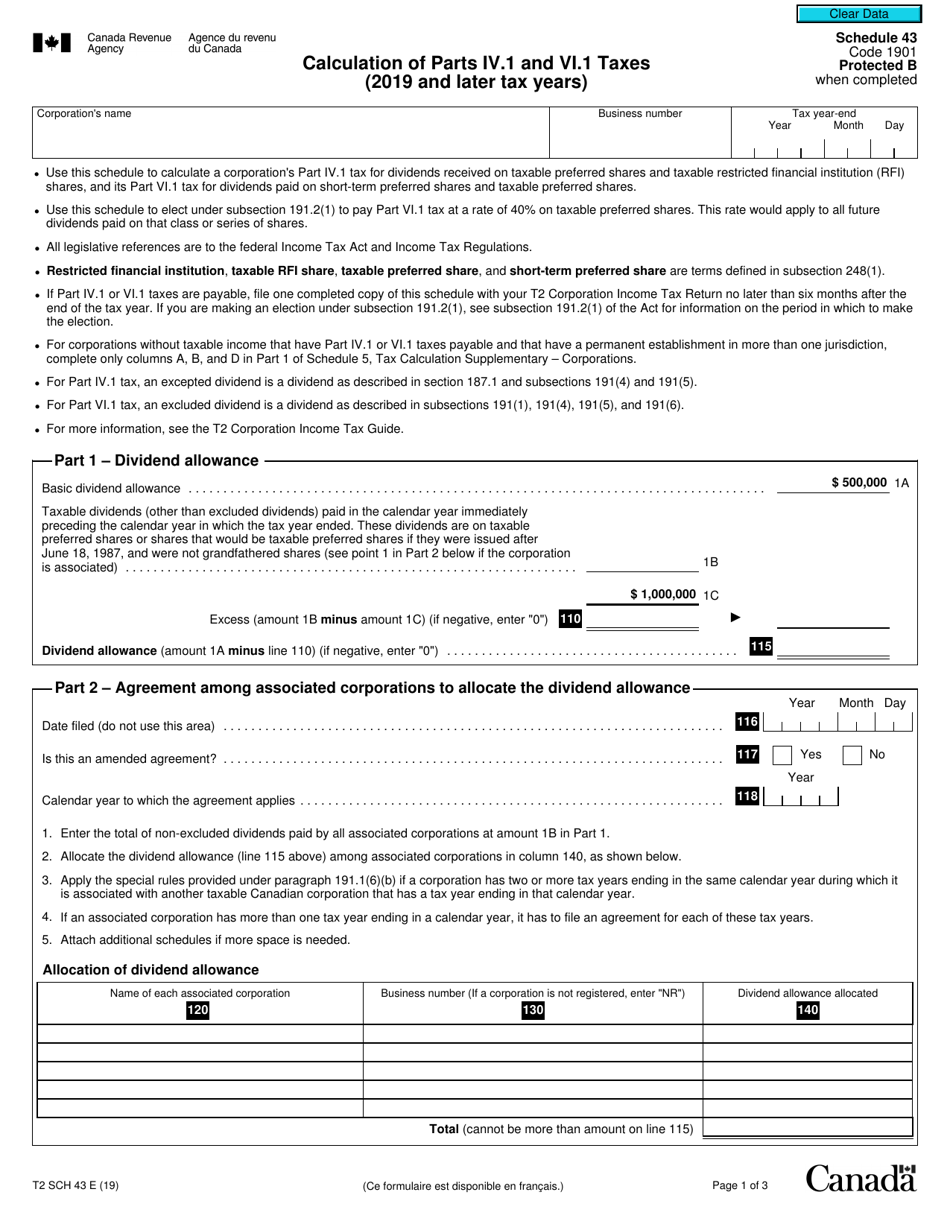

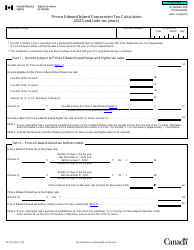

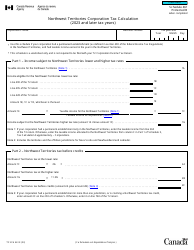

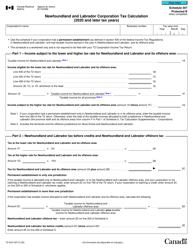

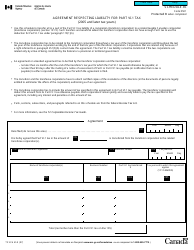

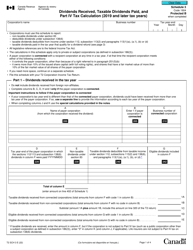

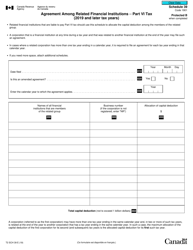

Form T2 Schedule 43 Calculation of Parts IV.1 and VI.1 Taxes (2019 and Later Tax Years) - Canada

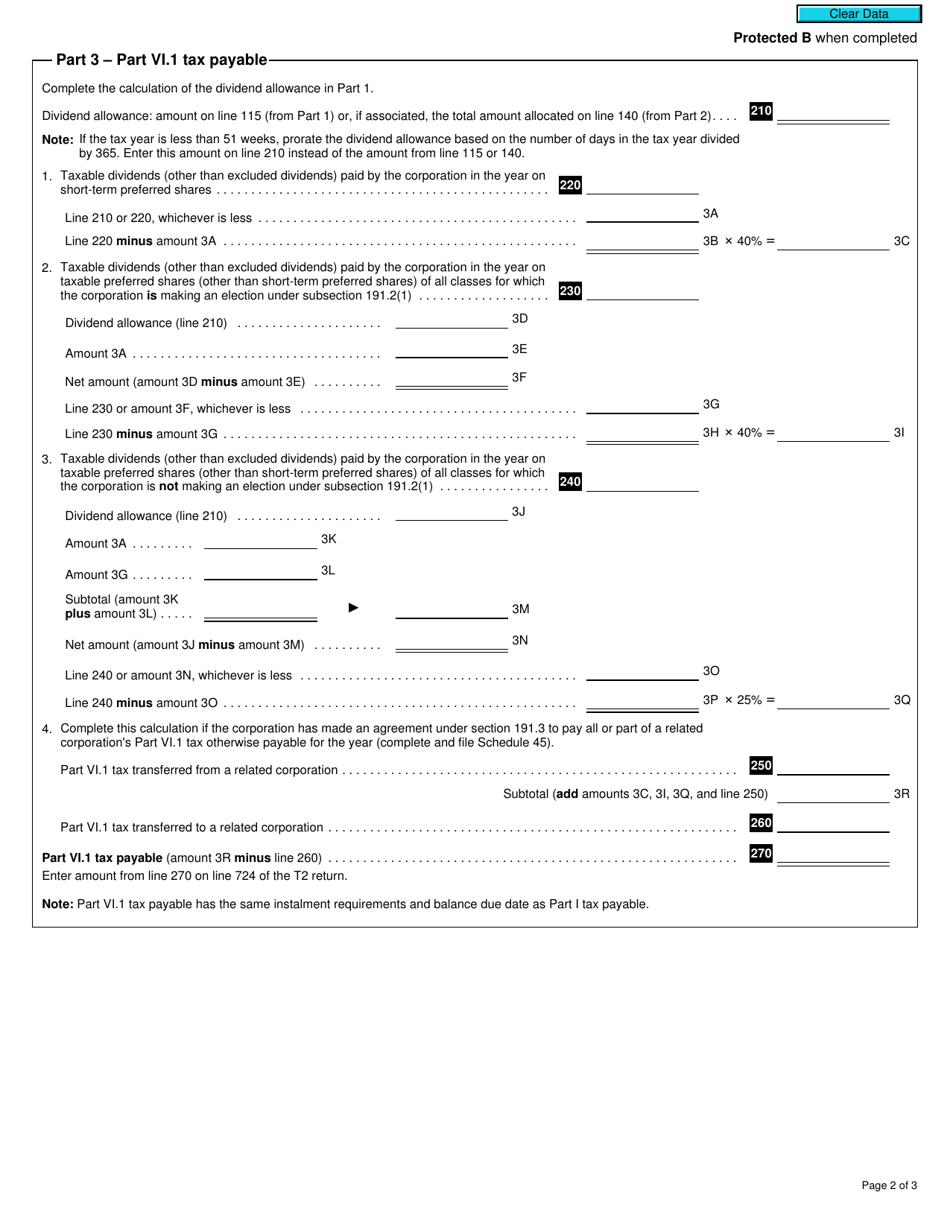

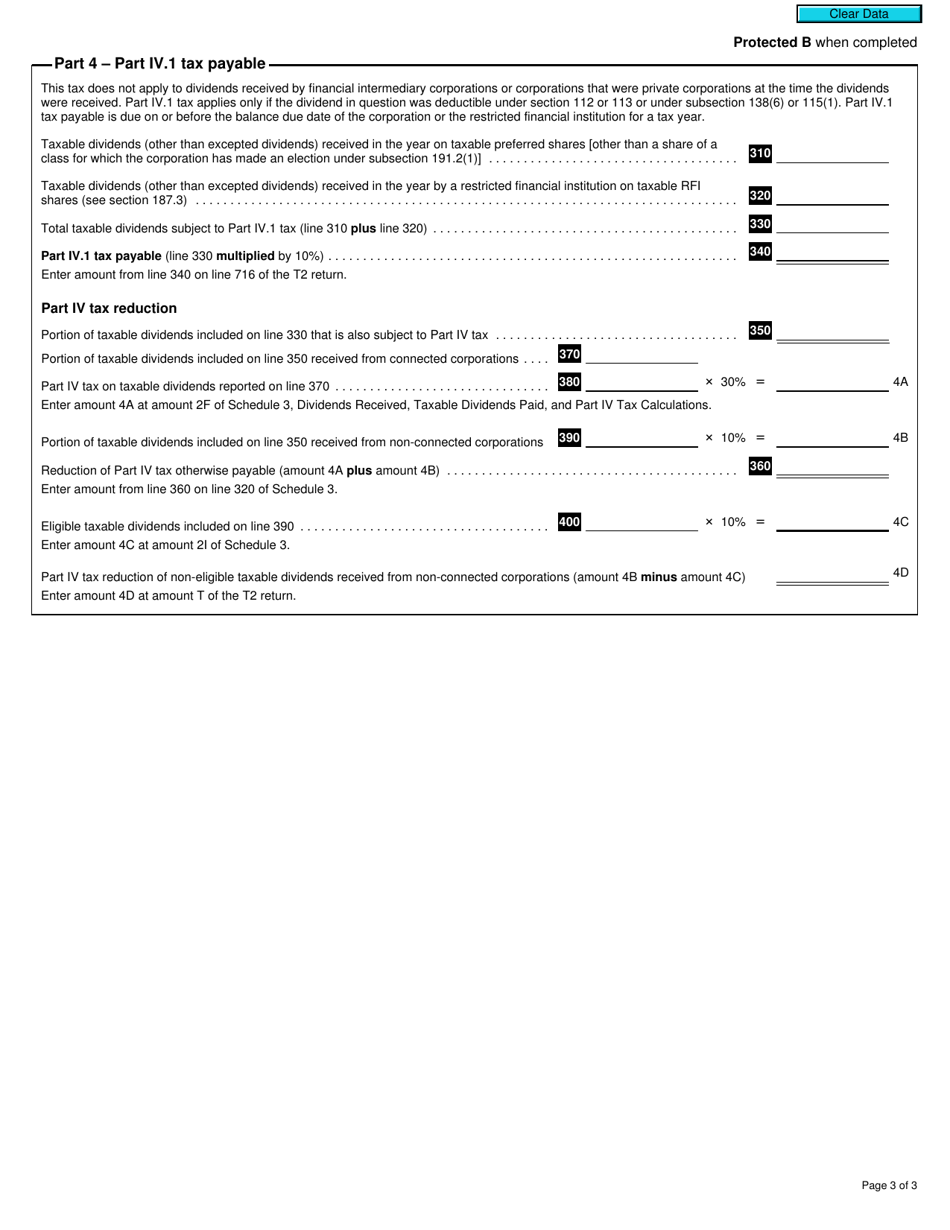

Form T2 Schedule 43 - Calculation of Parts IV.1 and VI.1 Taxes (2019 and Later Tax Years) in Canada is used to calculate the taxes for specific parts of the Canadian corporate income tax return, specifically for Parts IV.1 and VI.1. The form helps businesses determine the amount of tax owed or any credits they may be eligible for.

The Form T2 Schedule 43 Calculation of Parts IV.1 and VI.1 Taxes is filed by Canadian corporations.

FAQ

Q: What is Schedule 43?

A: Schedule 43 is a form used in Canada to calculate Parts IV.1 and VI.1 taxes for tax years 2019 and later.

Q: What are Parts IV.1 and VI.1 taxes?

A: Parts IV.1 and VI.1 taxes are specific types of taxes in Canada's tax system.

Q: Who needs to fill out Schedule 43?

A: Individuals or businesses in Canada who are required to pay Parts IV.1 and VI.1 taxes need to fill out Schedule 43.

Q: What is the purpose of Schedule 43?

A: The purpose of Schedule 43 is to calculate the amount of Parts IV.1 and VI.1 taxes owed for a given tax year.

Q: Can I use Schedule 43 for tax years other than 2019 and later?

A: No, Schedule 43 is specifically for tax years 2019 and later.

Q: Are there any penalties for not filling out Schedule 43 correctly?

A: Yes, there can be penalties for not filling out Schedule 43 correctly. It's important to ensure accuracy when completing the form.

Q: What should I do if I have questions about Schedule 43?

A: If you have questions about Schedule 43, you should consult with a tax professional or contact the Canada Revenue Agency for assistance.