This version of the form is not currently in use and is provided for reference only. Download this version of

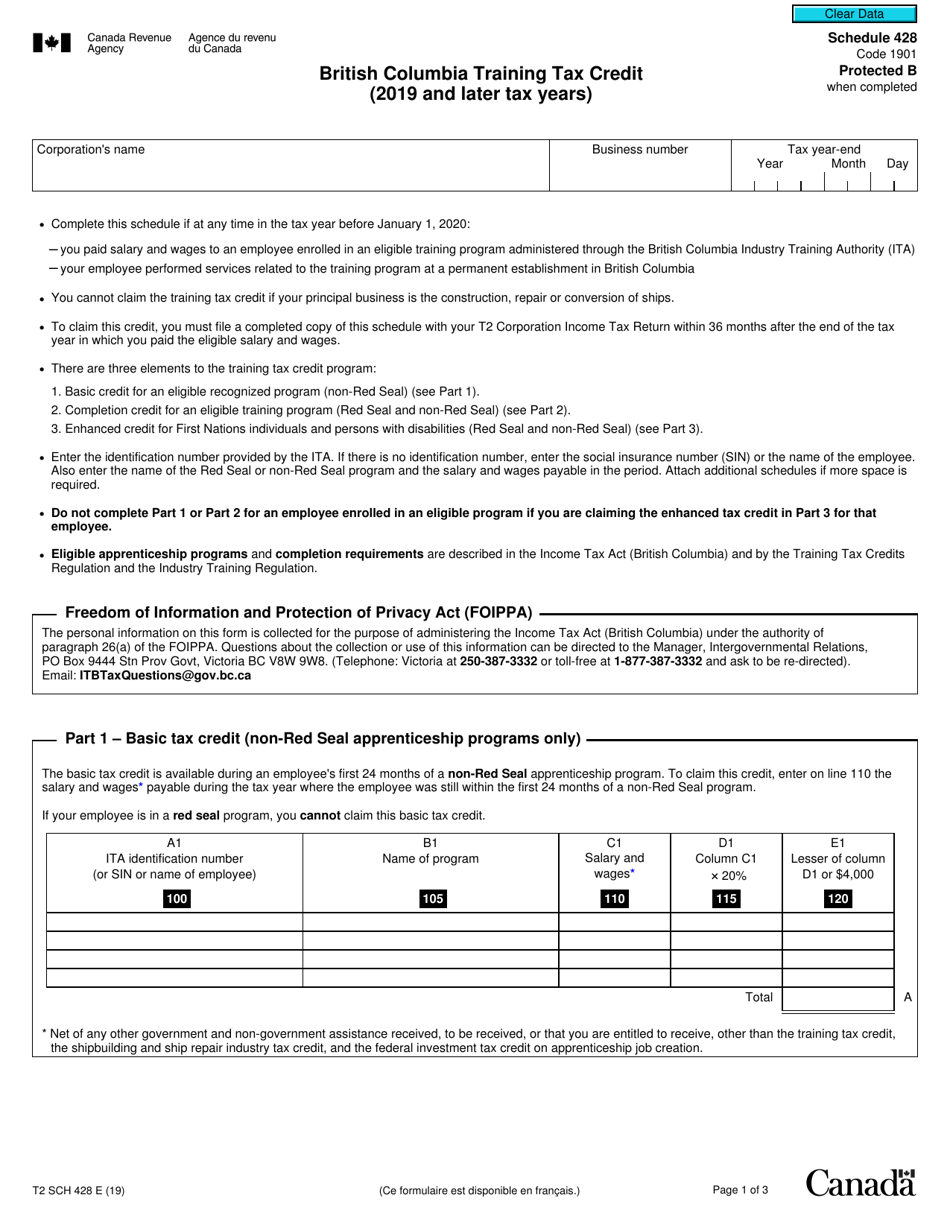

Form T2 Schedule 428

for the current year.

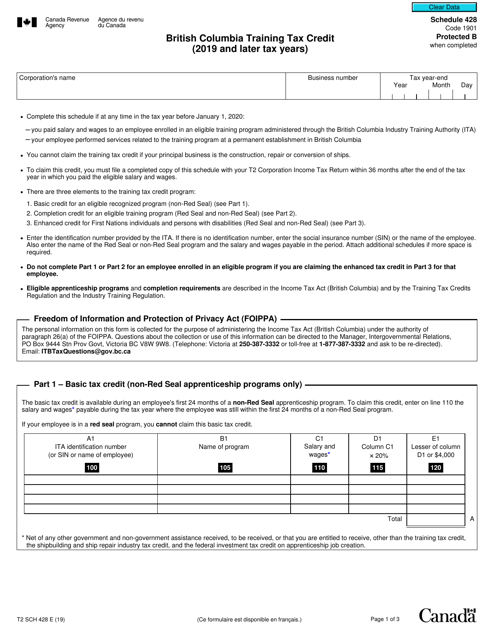

Form T2 Schedule 428 British Columbia Training Tax Credit (2019 and Later Tax Years) - Canada

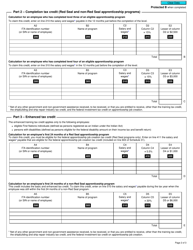

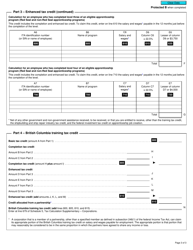

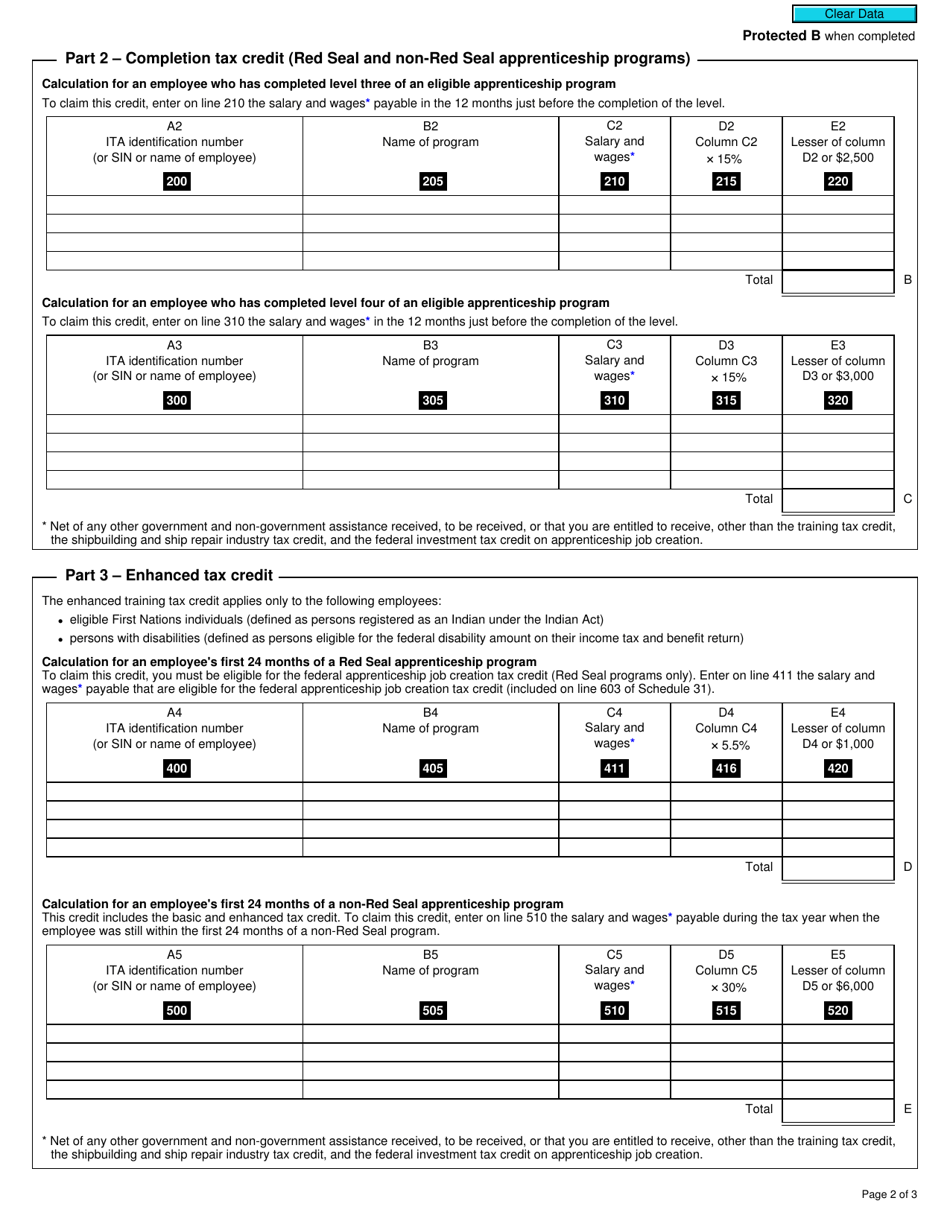

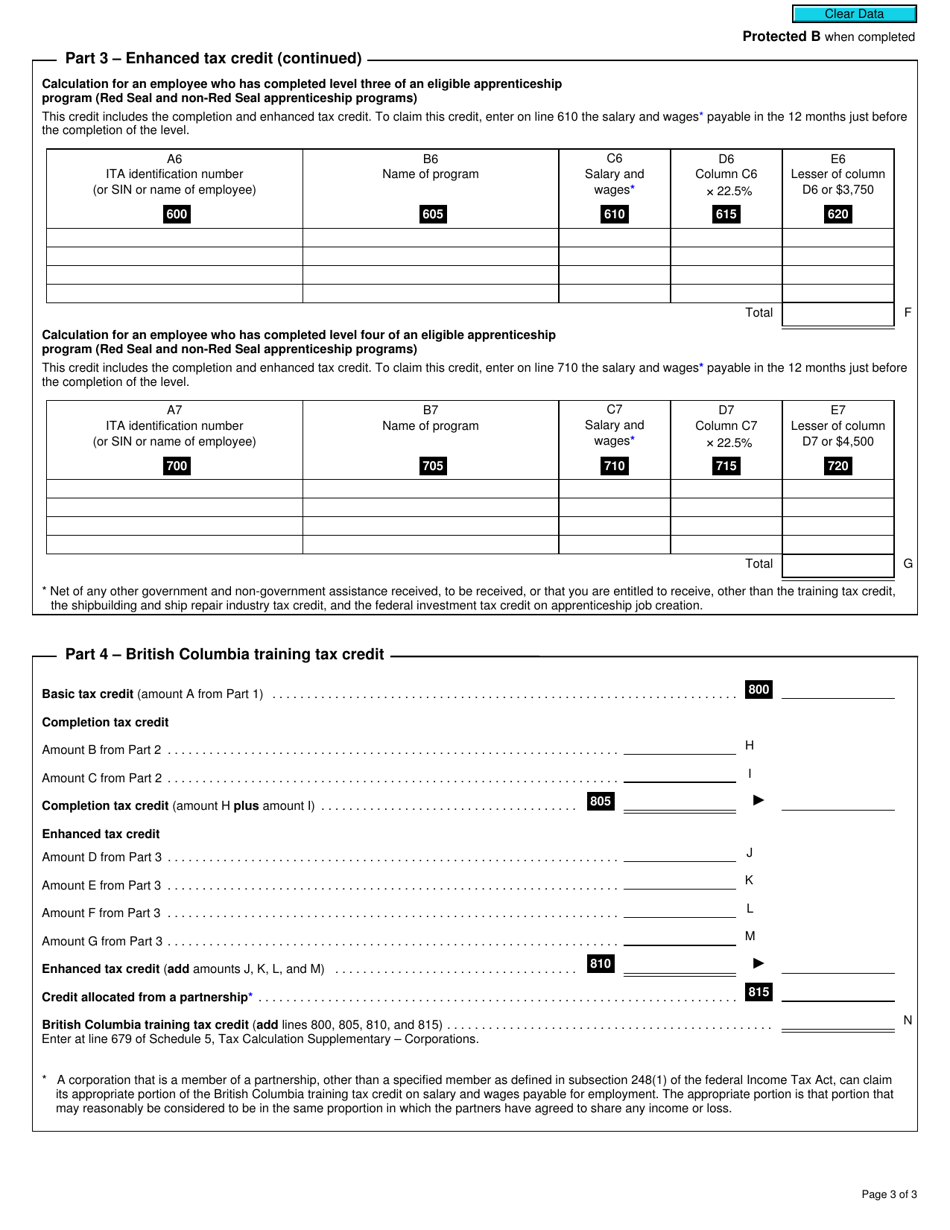

Form T2 Schedule 428 is for claiming the British Columbia Training Tax Credit in Canada. This tax credit is available for businesses that incur eligible training expenditures in British Columbia after 2018.

The Form T2 Schedule 428 British Columbia Training Tax Credit is filed by corporations in British Columbia, Canada.

FAQ

Q: What is the T2 Schedule 428 British Columbia Training Tax Credit?

A: The T2 Schedule 428 British Columbia Training Tax Credit is a form used to claim a tax credit for eligible training expenses incurred in British Columbia.

Q: Who is eligible for the T2 Schedule 428 British Columbia Training Tax Credit?

A: Corporations and other eligible entities that have incurred eligible training expenses in British Columbia may be eligible for this tax credit.

Q: What are eligible training expenses?

A: Eligible training expenses include wages, fees, and salaries paid to individuals for providing training services in British Columbia.

Q: Are all training expenses eligible for the tax credit?

A: No, only certain training expenses incurred in British Columbia are eligible for this tax credit.

Q: How can I claim the T2 Schedule 428 British Columbia Training Tax Credit?

A: You can claim this tax credit by completing and attaching the T2 Schedule 428 to your corporate income tax return.