This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 341

for the current year.

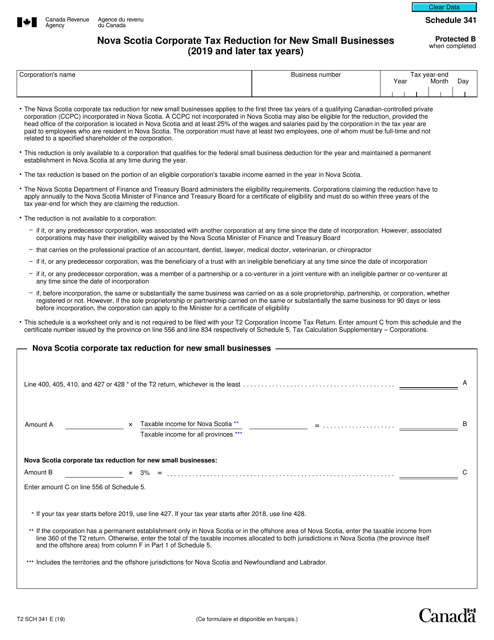

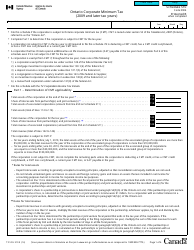

Form T2 Schedule 341 Nova Scotia Corporate Tax Reduction for New Small Businesses (2019 and Later Tax Years) - Canada

Form T2 Schedule 341 is a tax form used in Nova Scotia, Canada for the purpose of claiming corporate tax reduction for new small businesses starting in the year 2019 and beyond. It allows eligible businesses to apply for a reduction in their corporate income tax payable.

The form T2 Schedule 341 is filed by Nova Scotia small businesses in Canada that are eligible for corporate tax reduction for new small businesses in tax years 2019 and later.

FAQ

Q: What is T2 Schedule 341?

A: T2 Schedule 341 is a form used for claiming Nova Scotia Corporate Tax Reduction for New Small Businesses in Canada.

Q: What is the purpose of T2 Schedule 341?

A: The purpose of T2 Schedule 341 is to allow new small businesses in Nova Scotia to claim a reduction in their corporate tax.

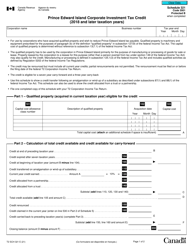

Q: Who is eligible to claim the Nova Scotia Corporate Tax Reduction?

A: New small businesses operating in Nova Scotia are eligible to claim the tax reduction.

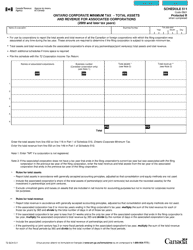

Q: What are the requirements to qualify as a new small business?

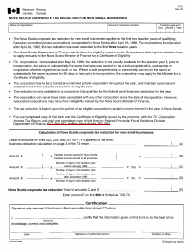

A: To qualify as a new small business, the corporation must have started its commercial activities after December 31, 2018, and before January 1, 2024.

Q: How much reduction can be claimed through T2 Schedule 341?

A: The reduction is equal to the corporate income tax otherwise payable by the corporation in the year multiplied by the applicable percentage.

Q: What is the applicable percentage for the tax reduction?

A: For tax years ending in 2019, the applicable percentage is 10%. For tax years ending in 2020 and later, the applicable percentage is 5%.