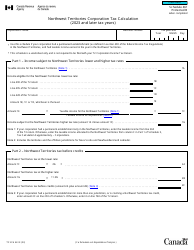

This version of the form is not currently in use and is provided for reference only. Download this version of

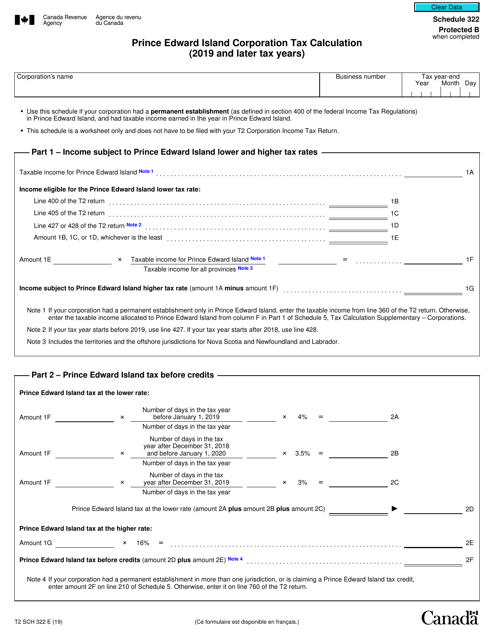

Form T2 Schedule 322

for the current year.

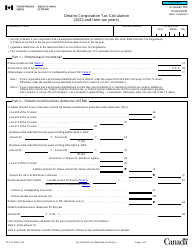

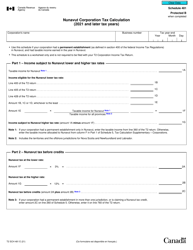

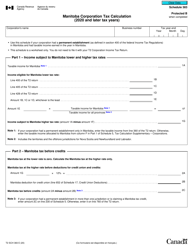

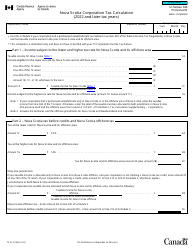

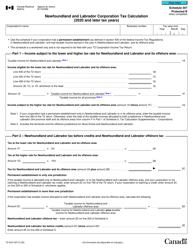

Form T2 Schedule 322 Prince Edward Island Corporation Tax Calculation (2019 and Later Tax Years) - Canada

Form T2 Schedule 322 is used by Prince Edward Island corporations in Canada to calculate their corporation tax for the tax years 2019 and later. It helps businesses determine the amount of tax they need to pay to the government based on their income and other relevant factors.

The Prince Edward Island corporations filing their taxes for 2019 and later tax years are required to submit Form T2 Schedule 322 for their tax calculations.

FAQ

Q: What is Form T2 Schedule 322?

A: Form T2 Schedule 322 is a tax calculation form for Prince Edward Island corporations for tax years 2019 and later.

Q: Who needs to fill out Form T2 Schedule 322?

A: Prince Edward Island corporations for tax years 2019 and later need to fill out Form T2 Schedule 322.

Q: What is the purpose of Form T2 Schedule 322?

A: The purpose of Form T2 Schedule 322 is to calculate the corporation tax for Prince Edward Island corporations.

Q: Are there any specific changes for tax years 2019 and later?

A: Yes, Form T2 Schedule 322 is specifically for tax years 2019 and later. It may have changes compared to previous versions.

Q: Do I need any other forms or documents when filing Form T2 Schedule 322?

A: You may need to include other forms and documents depending on your corporation's situation. It's best to consult the CRA or a tax professional for specific requirements.