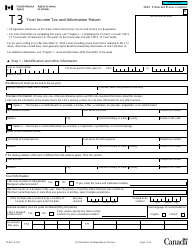

This version of the form is not currently in use and is provided for reference only. Download this version of

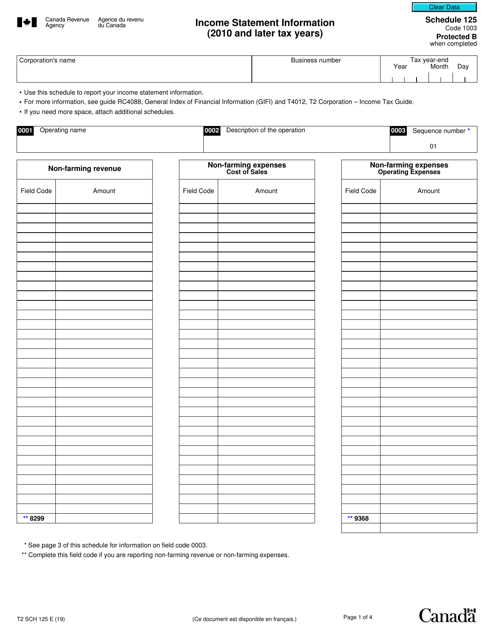

Form T2 Schedule 125

for the current year.

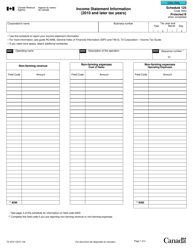

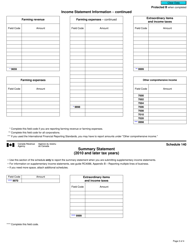

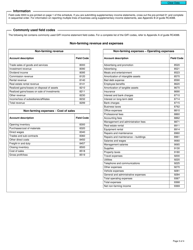

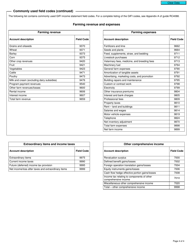

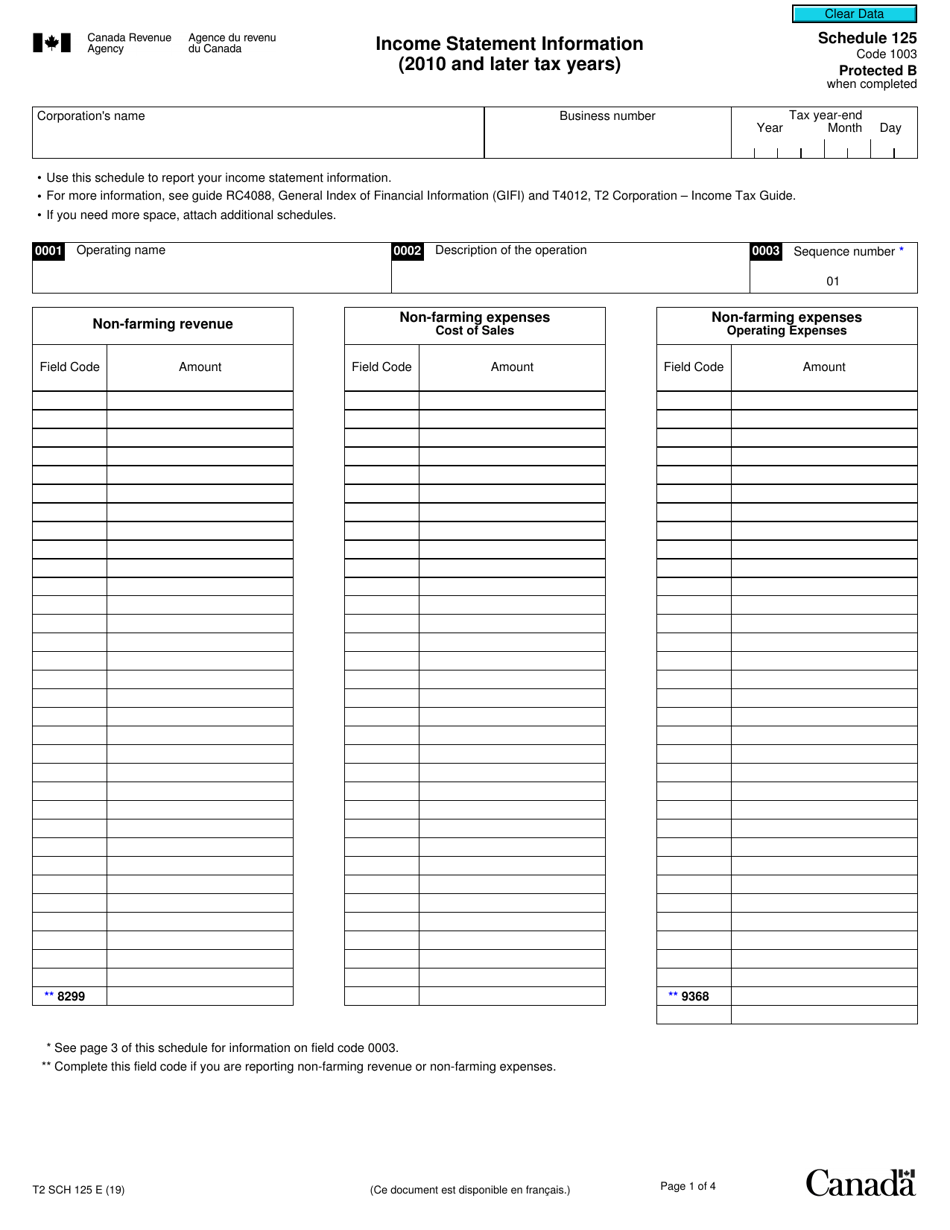

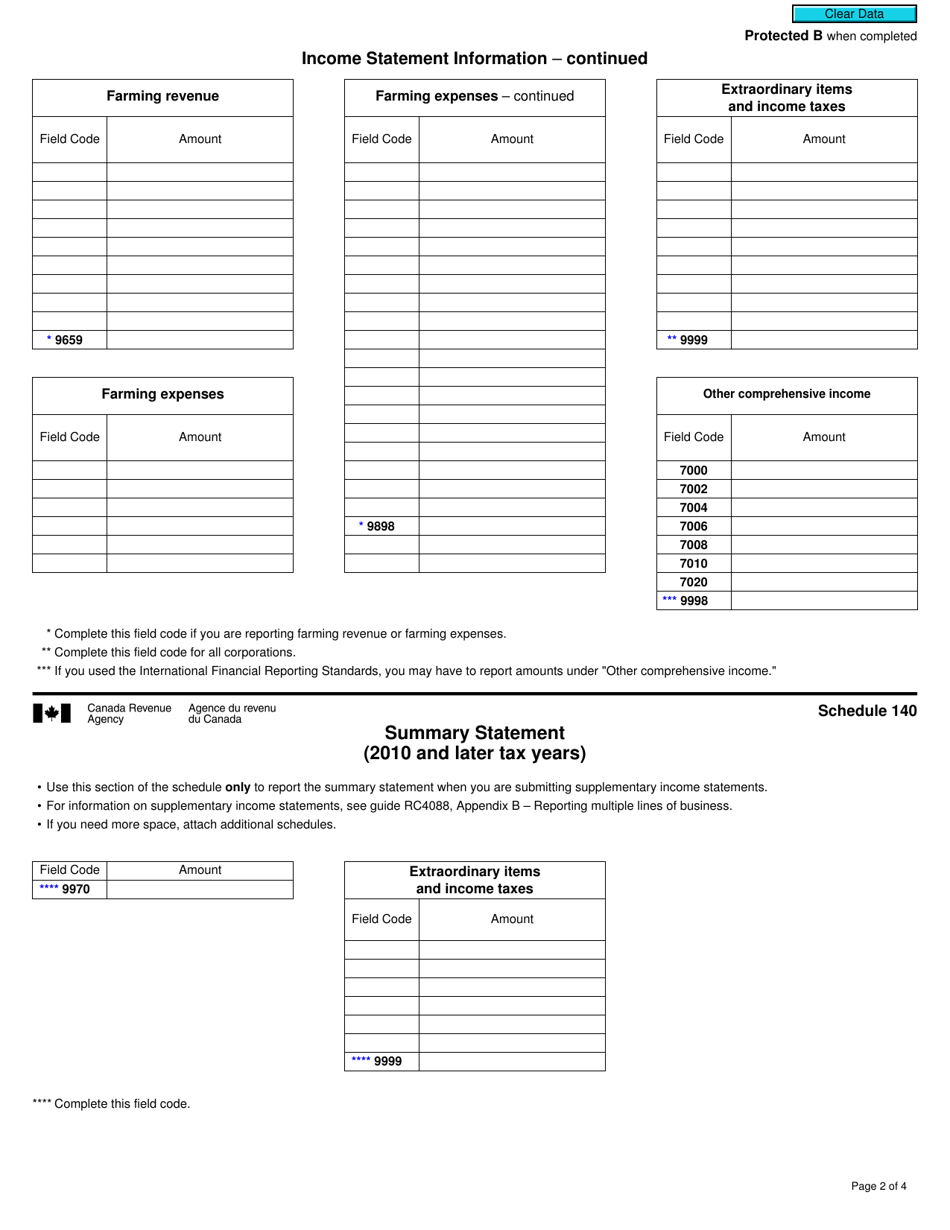

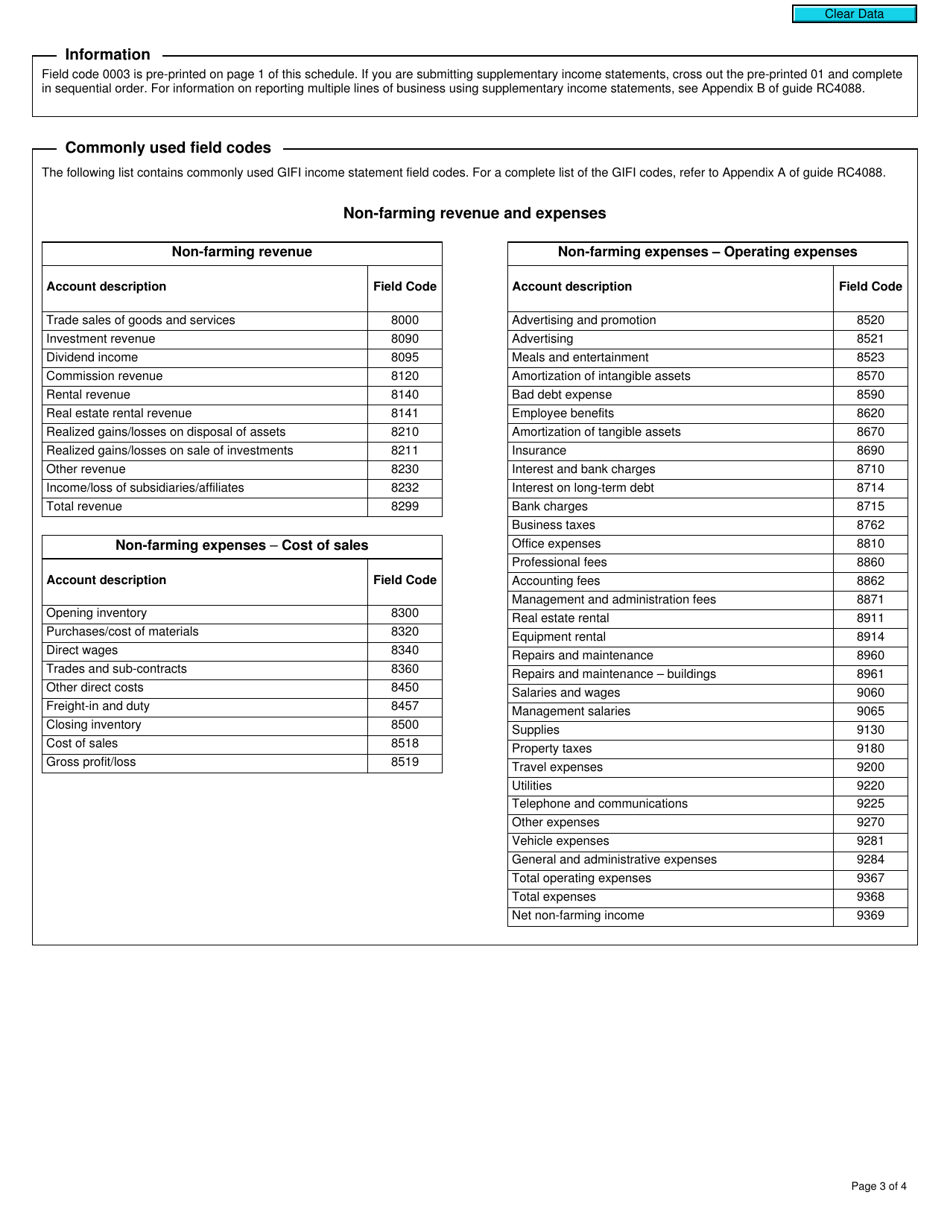

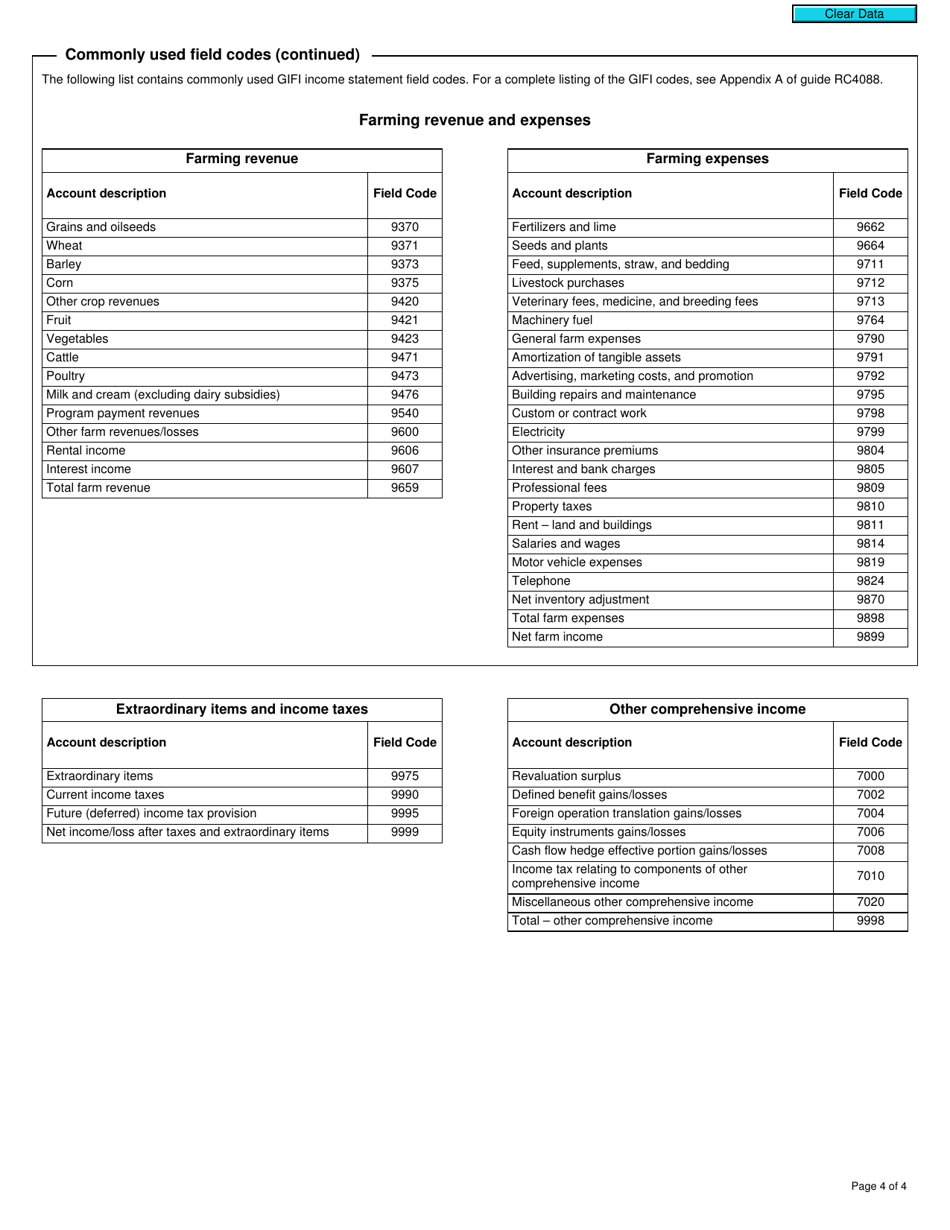

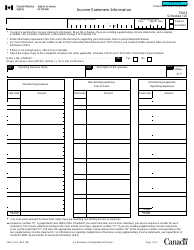

Form T2 Schedule 125 Income Statement Information (2010 and Later Tax Years) - Canada

Form T2 Schedule 125 is used by Canadian corporations to provide detailed information about their income statement for tax years 2010 and later. It helps calculate a company's taxable income and ensures compliance with Canada's tax laws.

The corporation filing the corporate tax return in Canada files the Form T2 Schedule 125 Income Statement Information.

FAQ

Q: What is Form T2 Schedule 125?

A: Form T2 Schedule 125 is a form used for reporting income statement information for Canadian corporations.

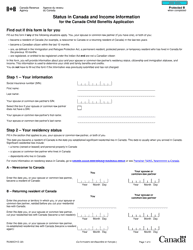

Q: What tax years is Form T2 Schedule 125 used for?

A: Form T2 Schedule 125 is used for tax years starting from 2010 and later.

Q: Who needs to fill out Form T2 Schedule 125?

A: Canadian corporations need to fill out Form T2 Schedule 125.

Q: What information is included in Form T2 Schedule 125?

A: Form T2 Schedule 125 includes income statement information, such as revenues, expenses, and net income.