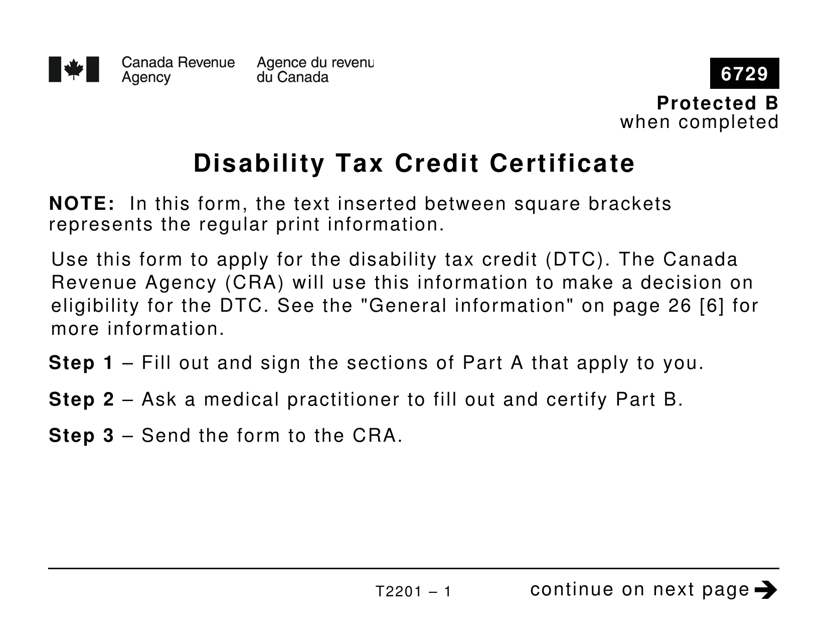

Form T2201 Disability Tax Credit Certificate - Large Print - Canada

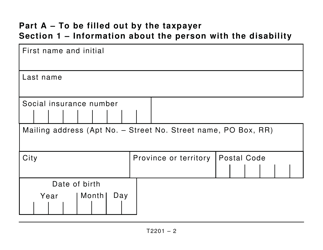

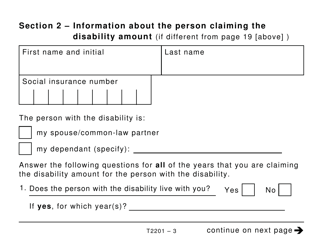

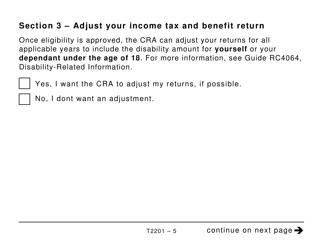

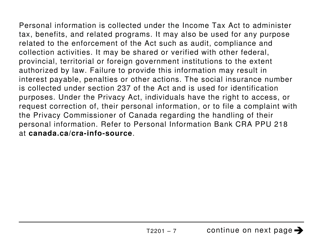

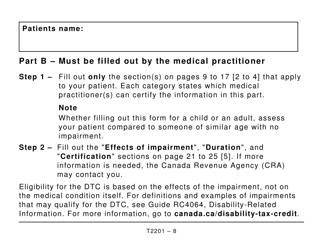

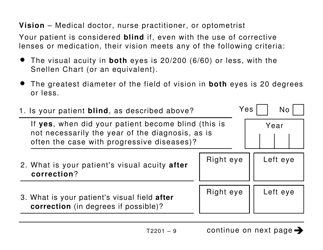

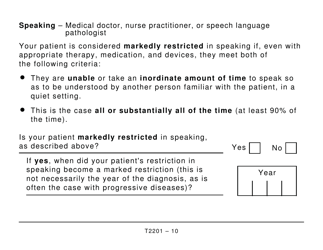

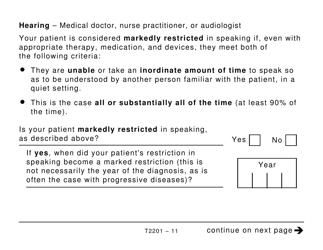

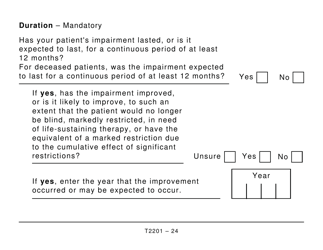

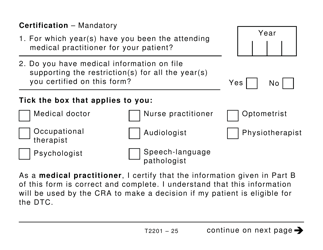

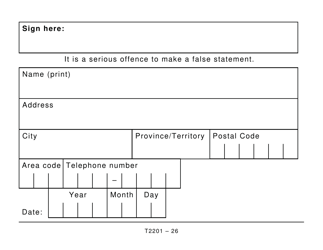

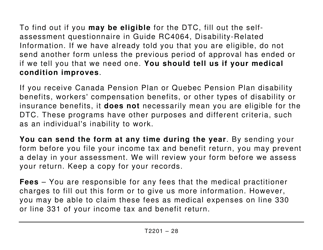

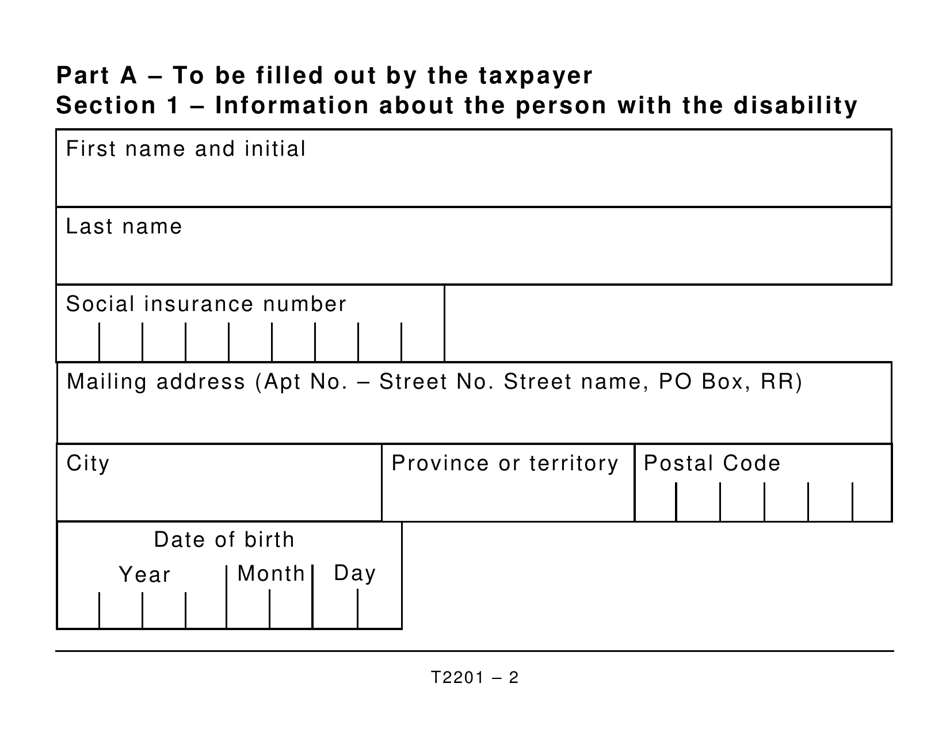

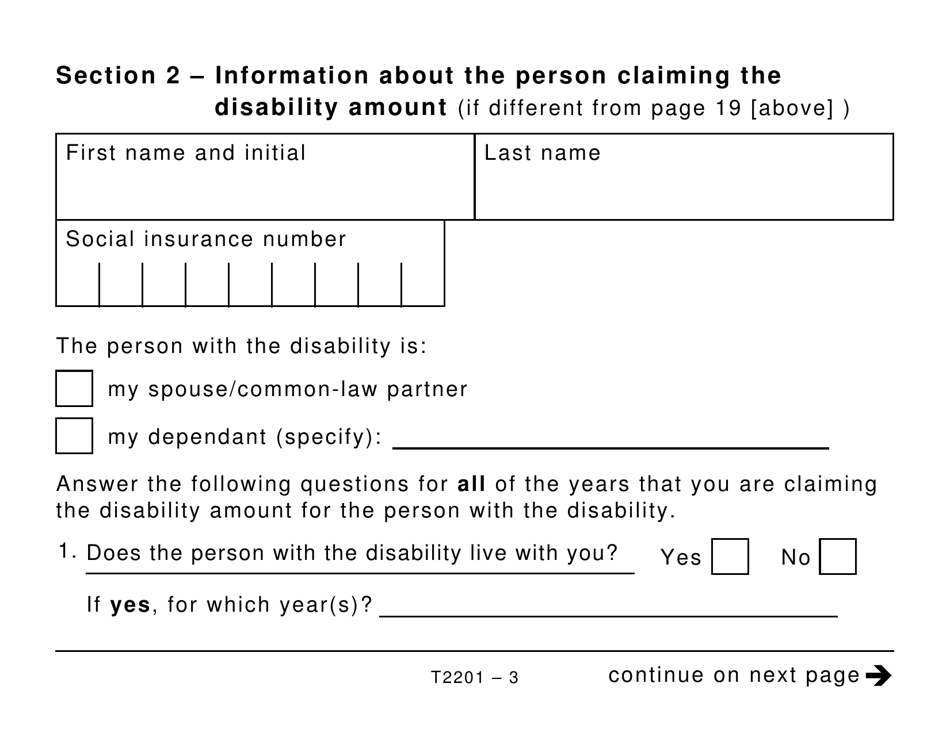

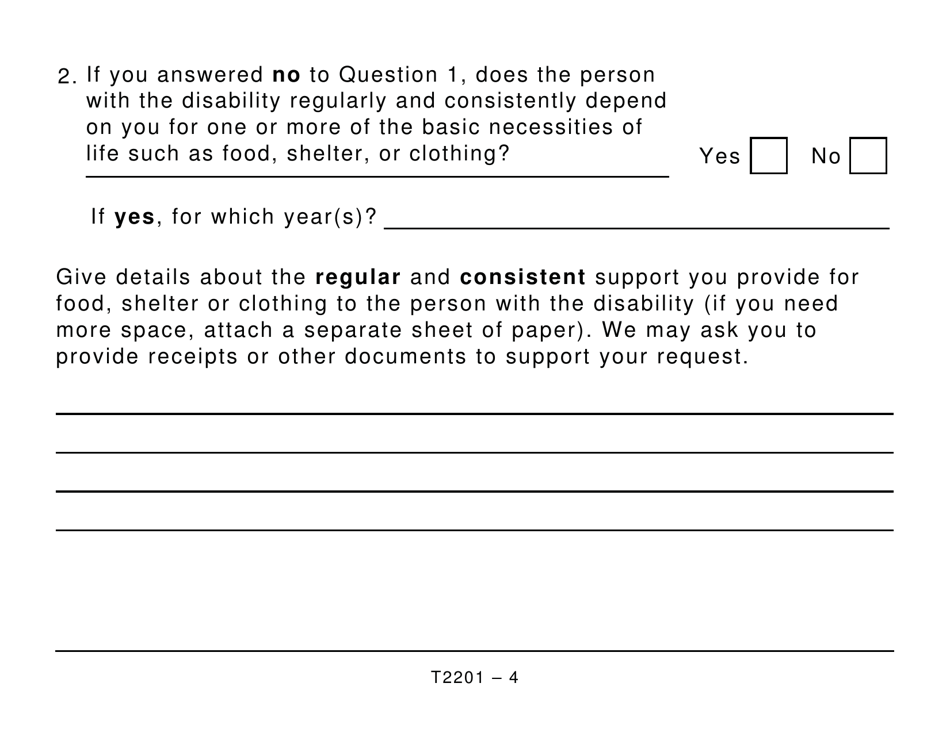

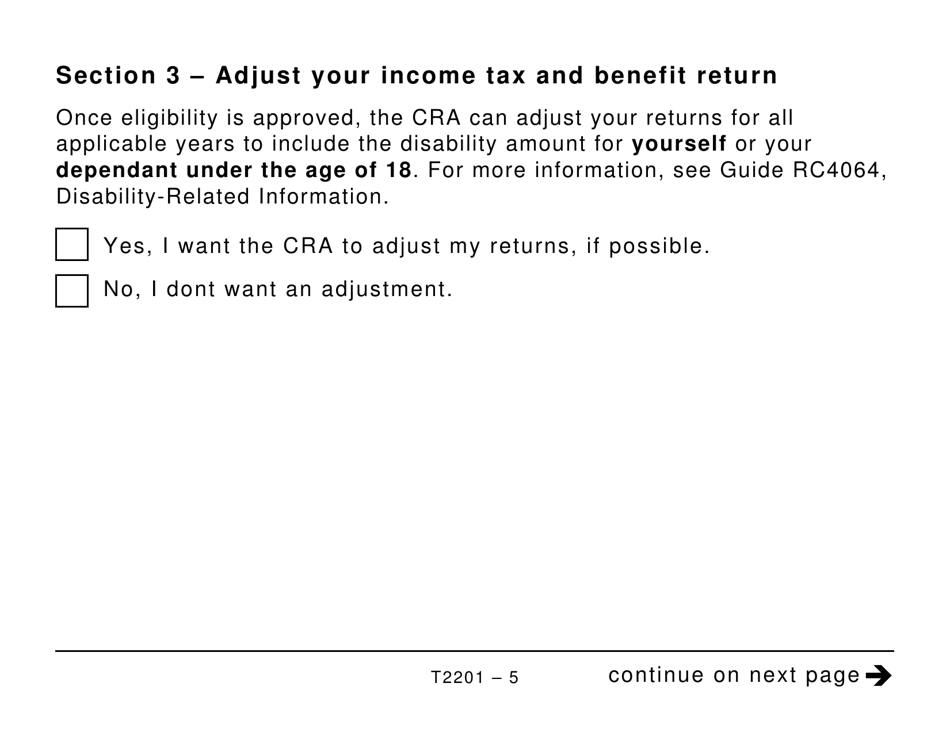

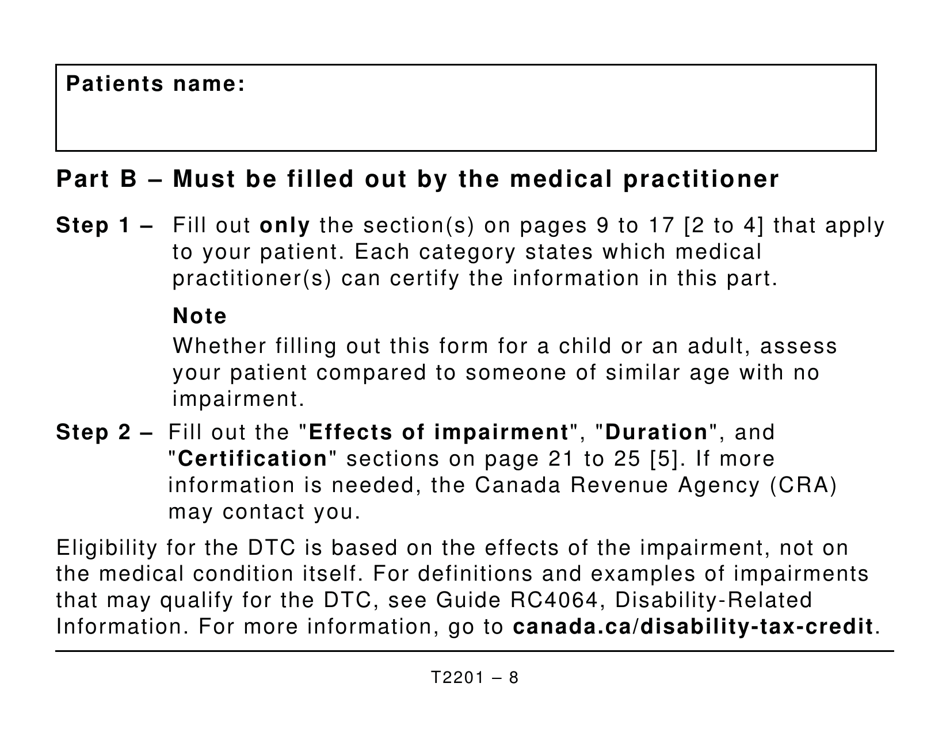

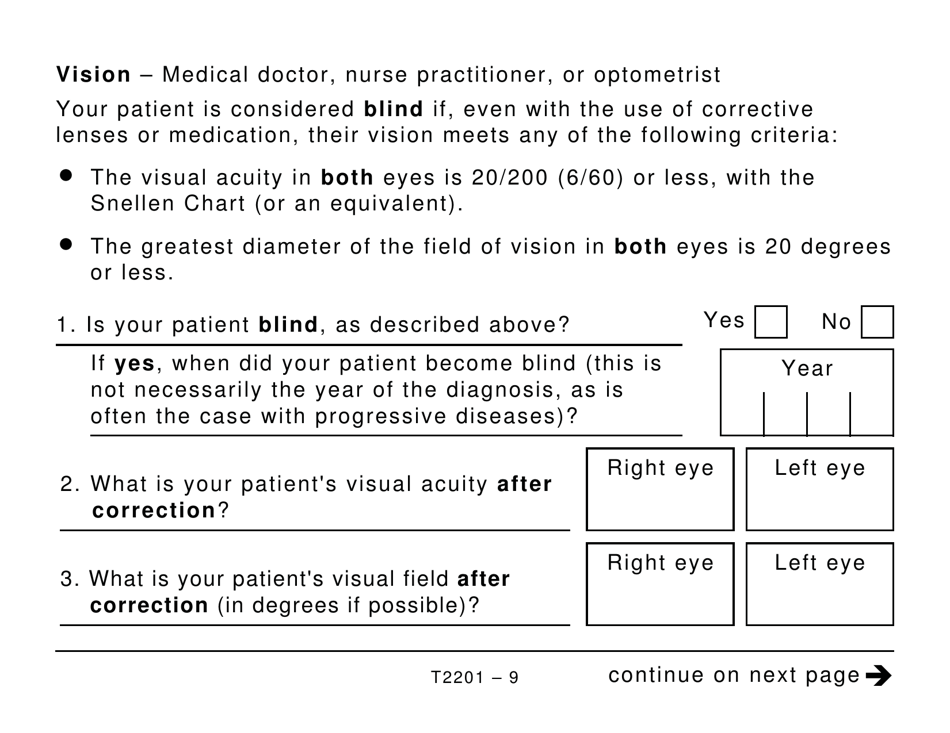

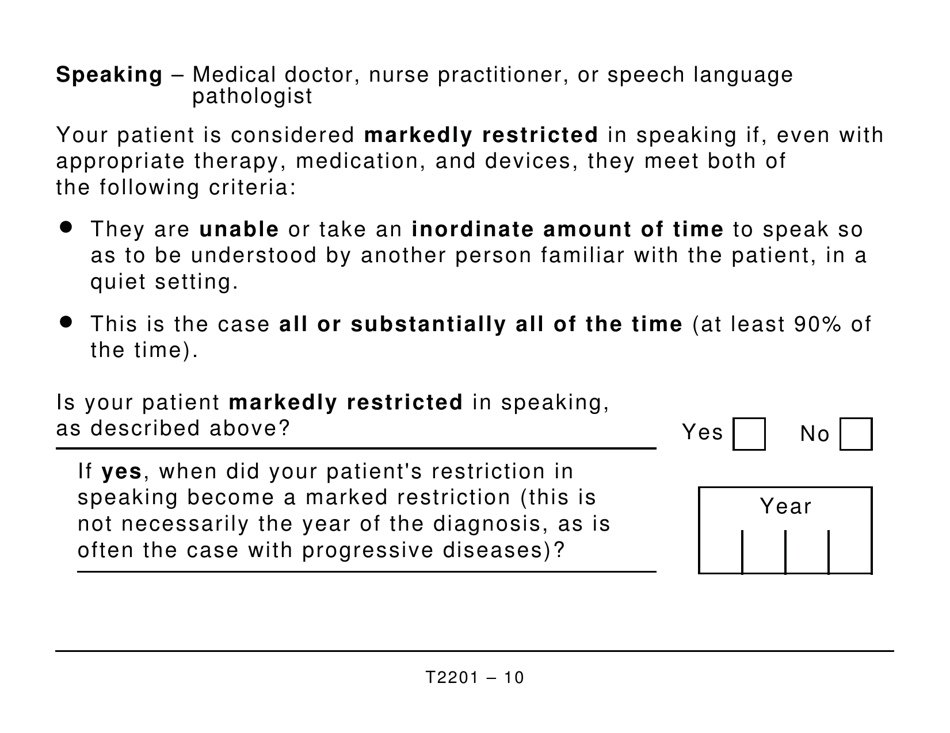

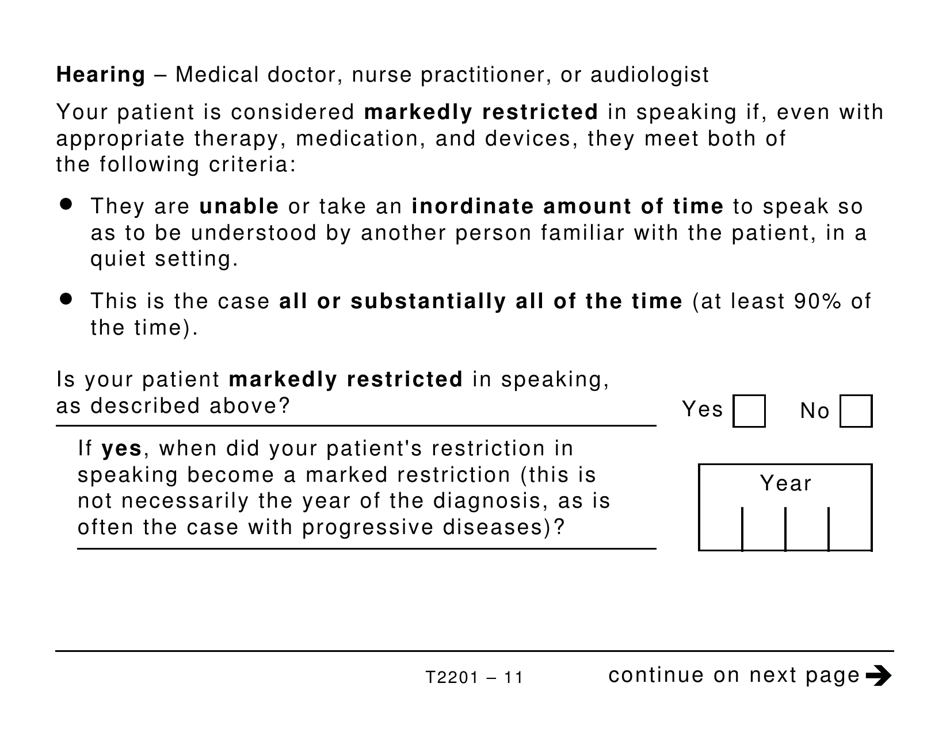

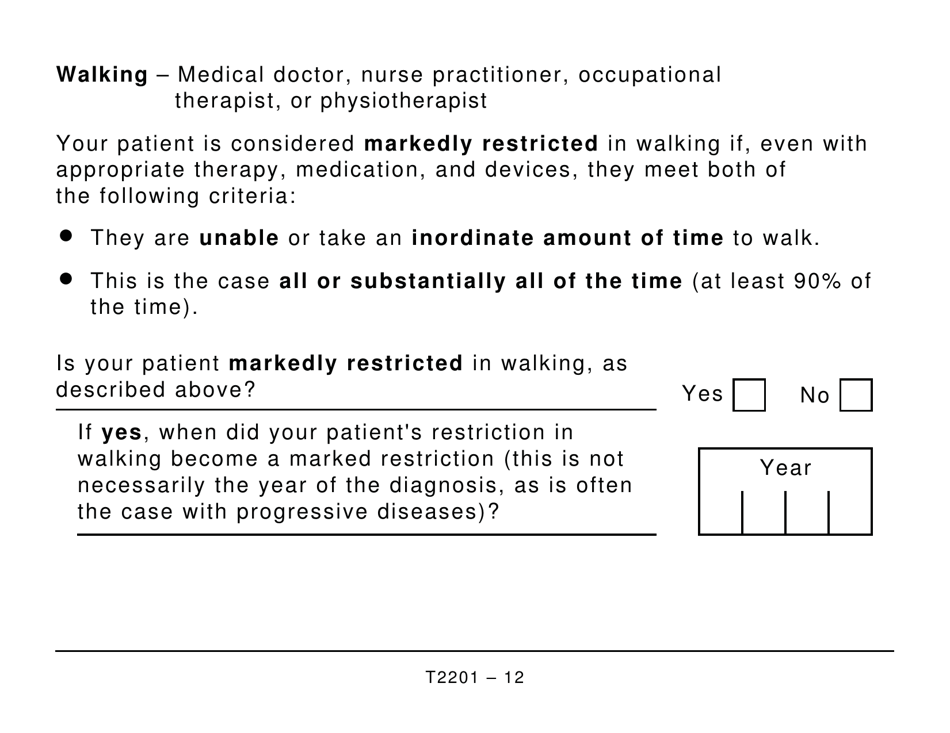

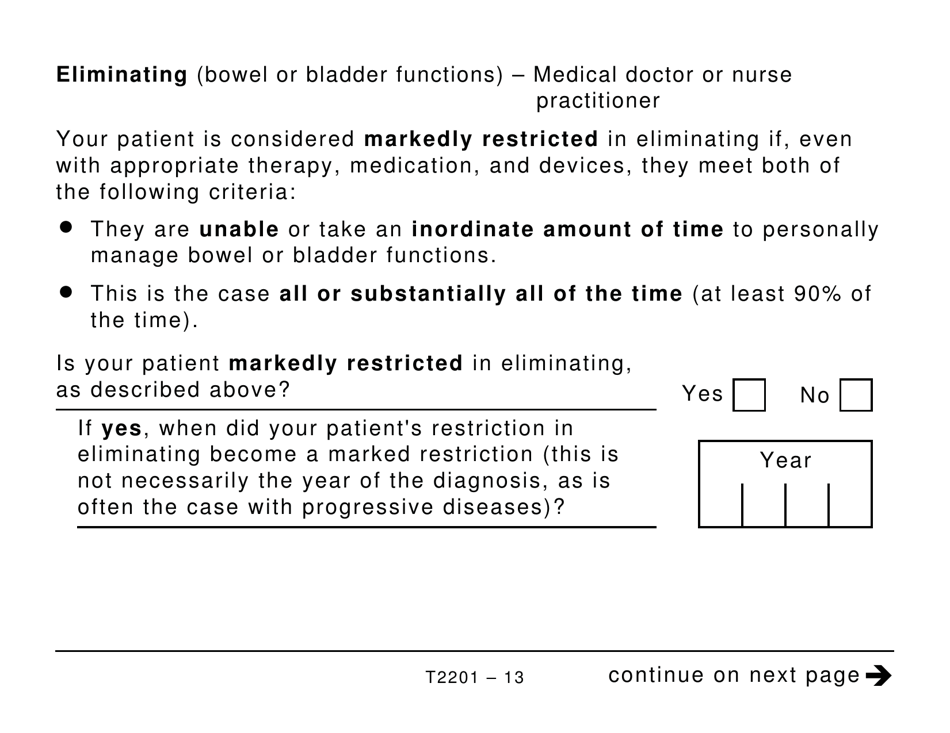

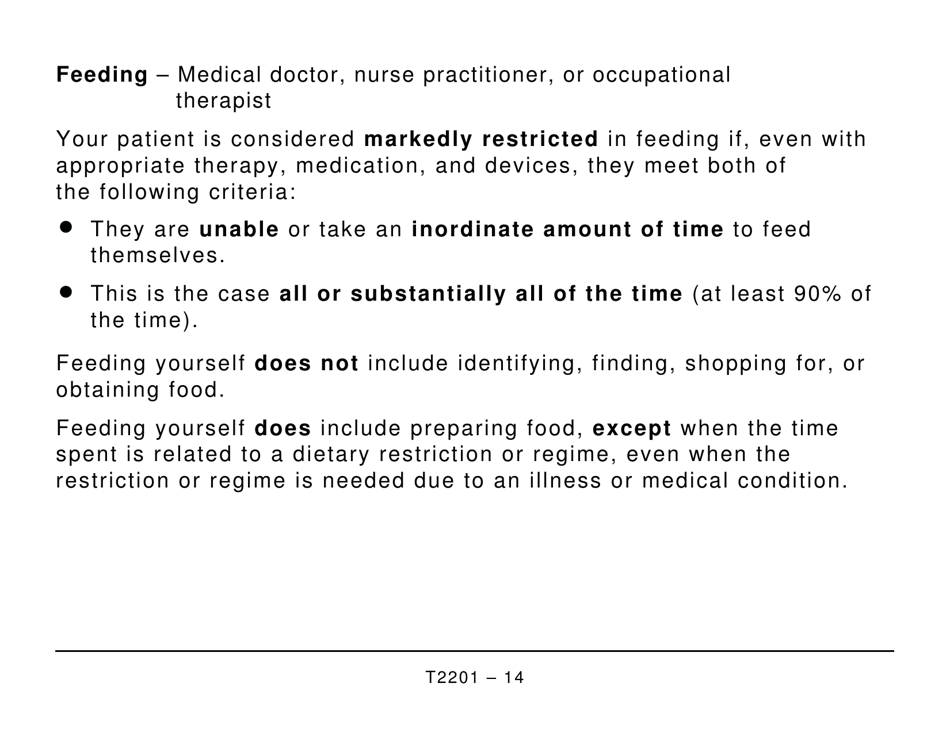

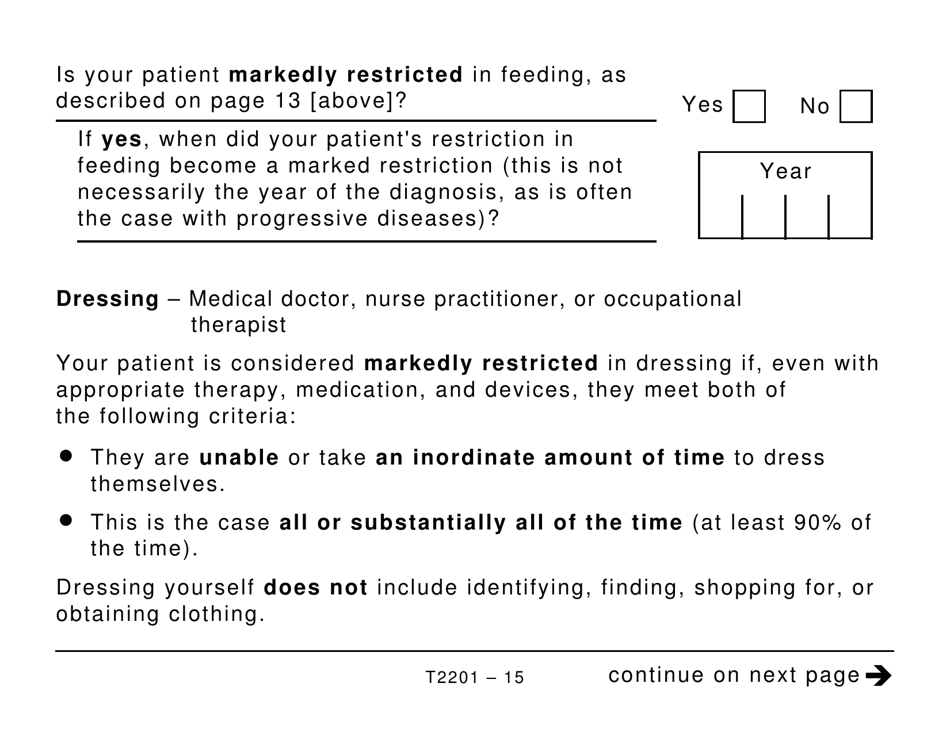

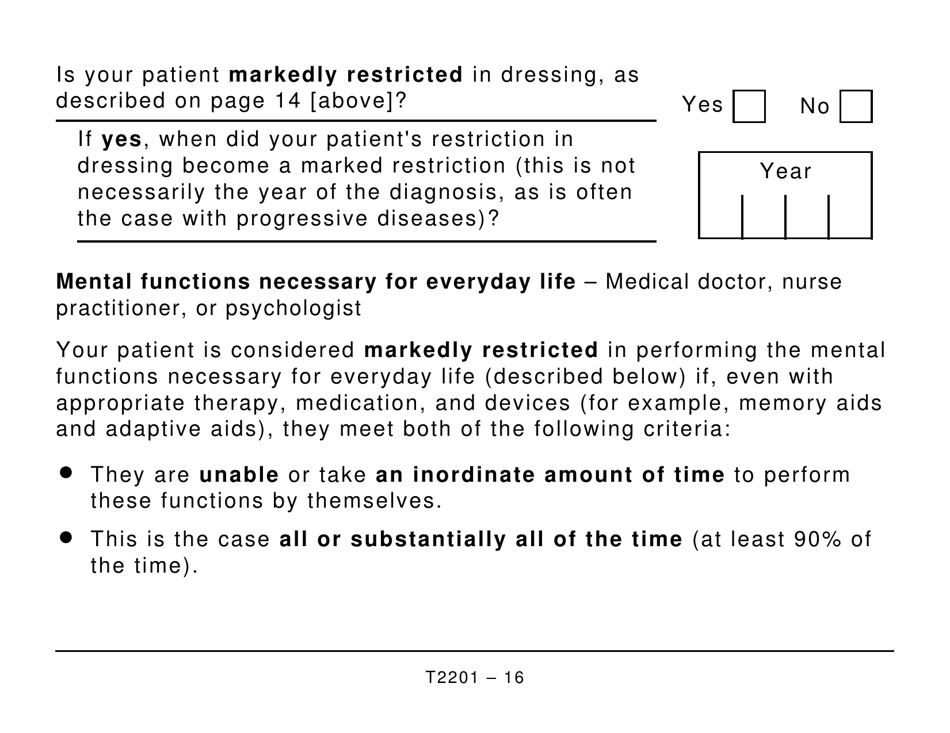

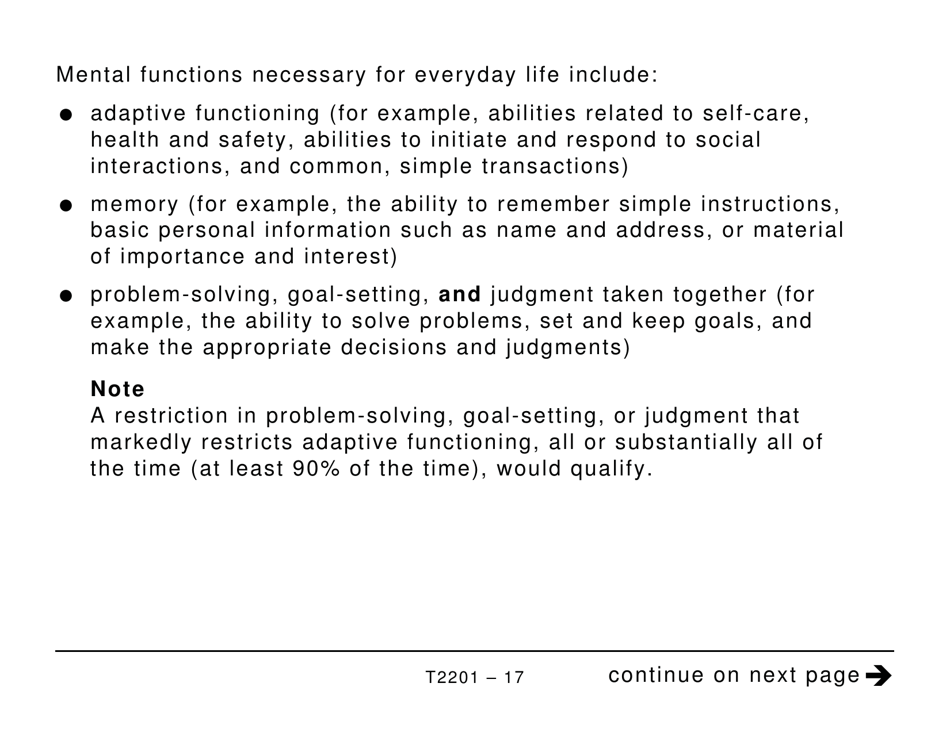

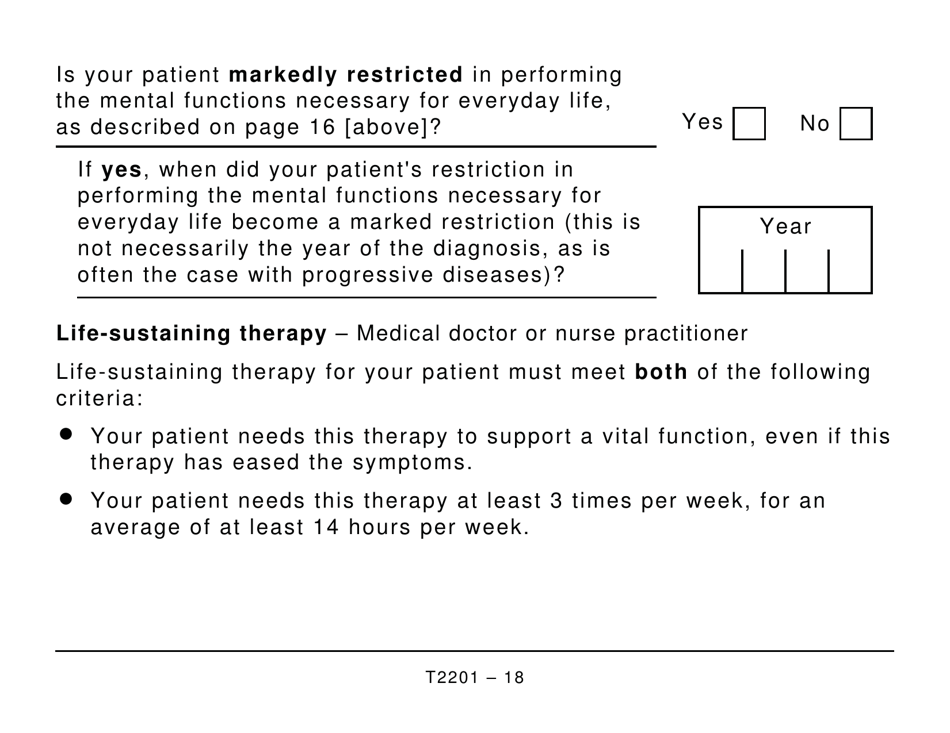

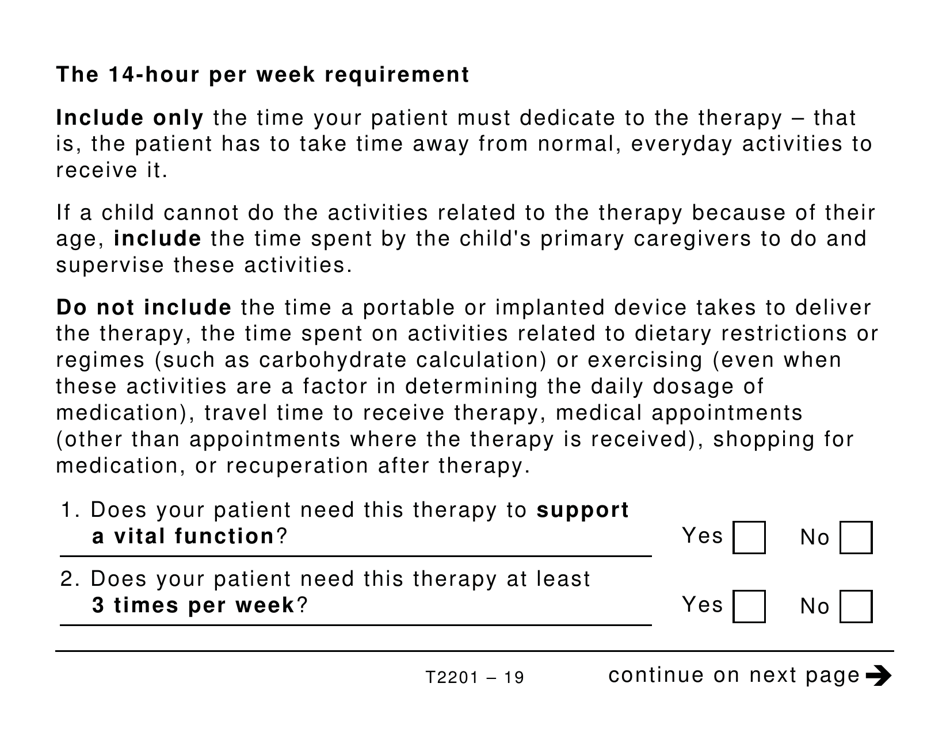

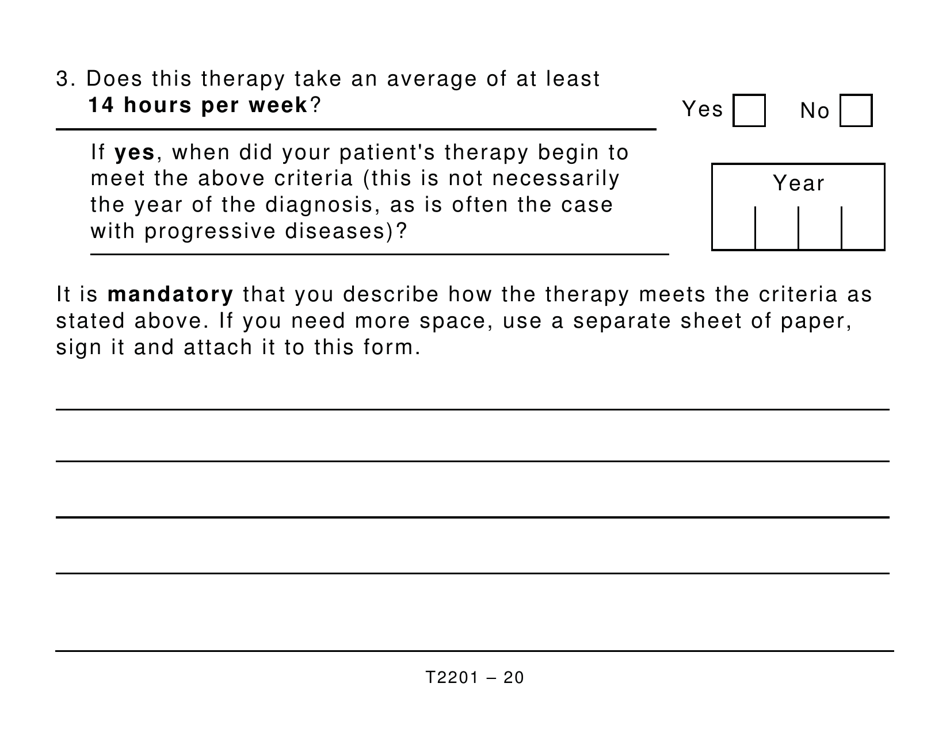

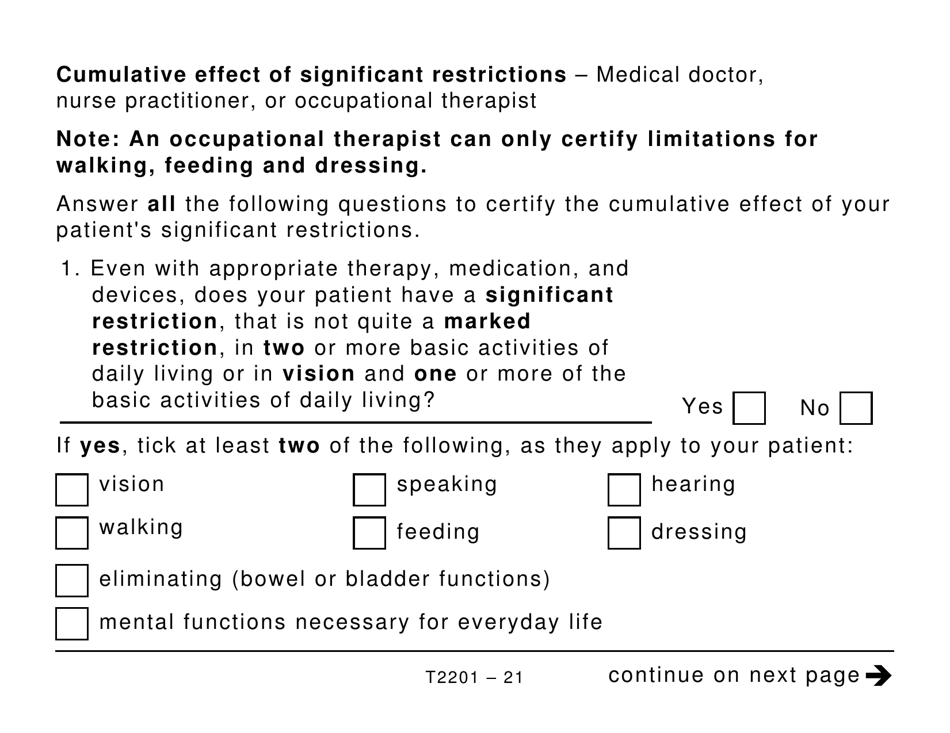

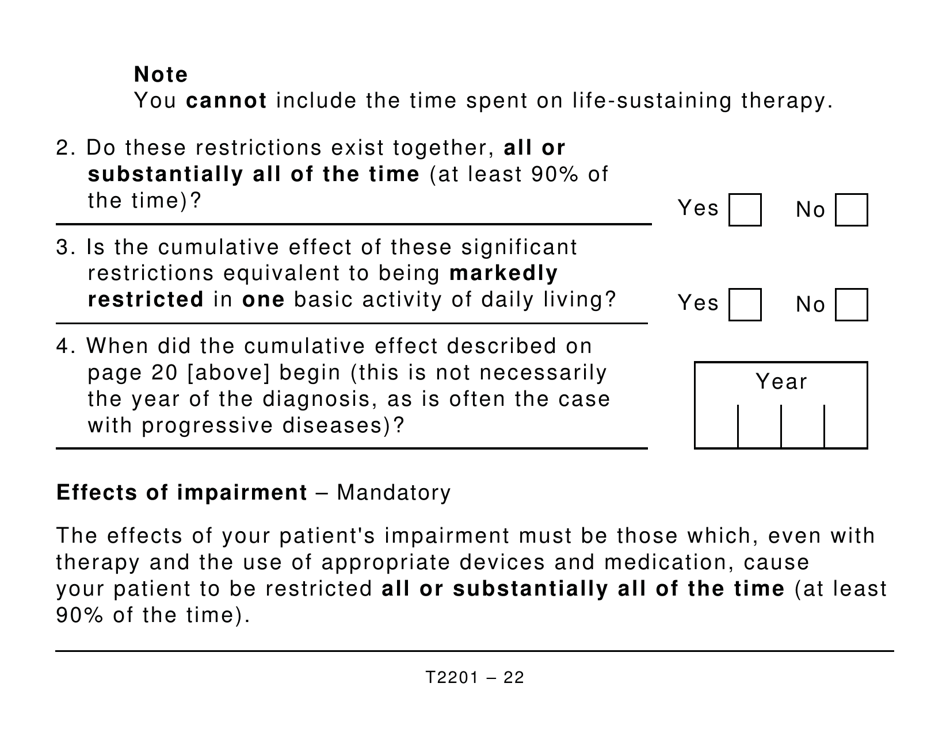

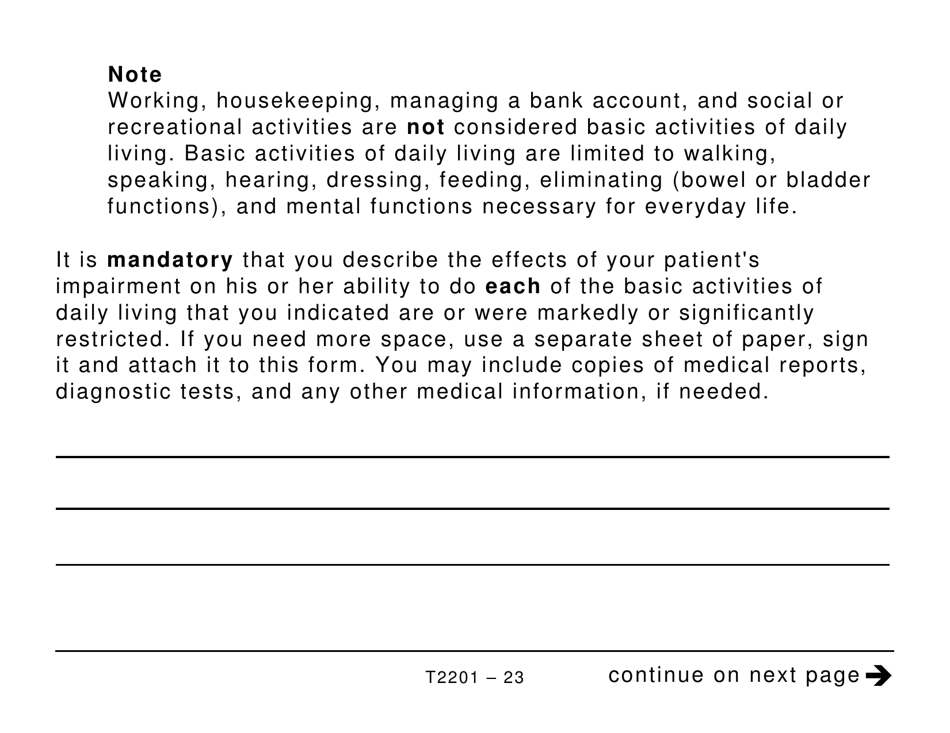

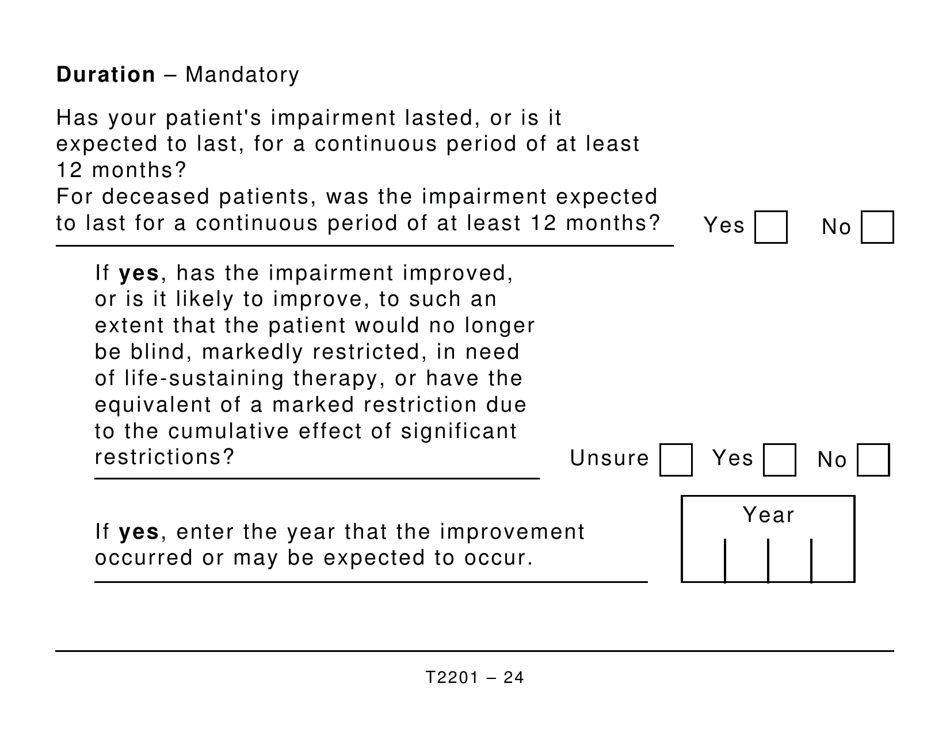

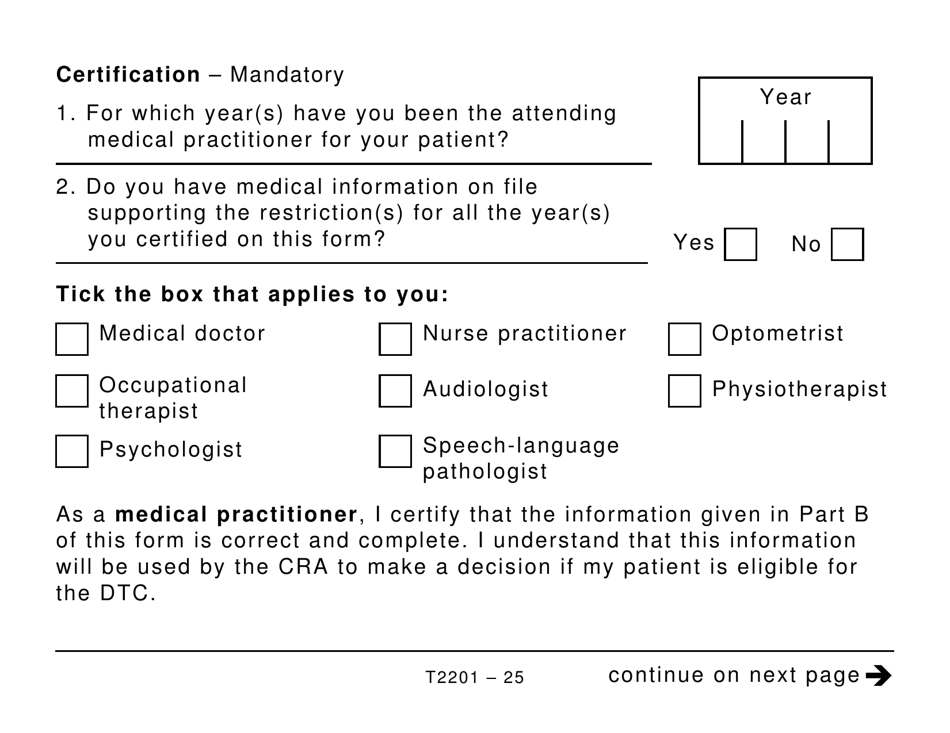

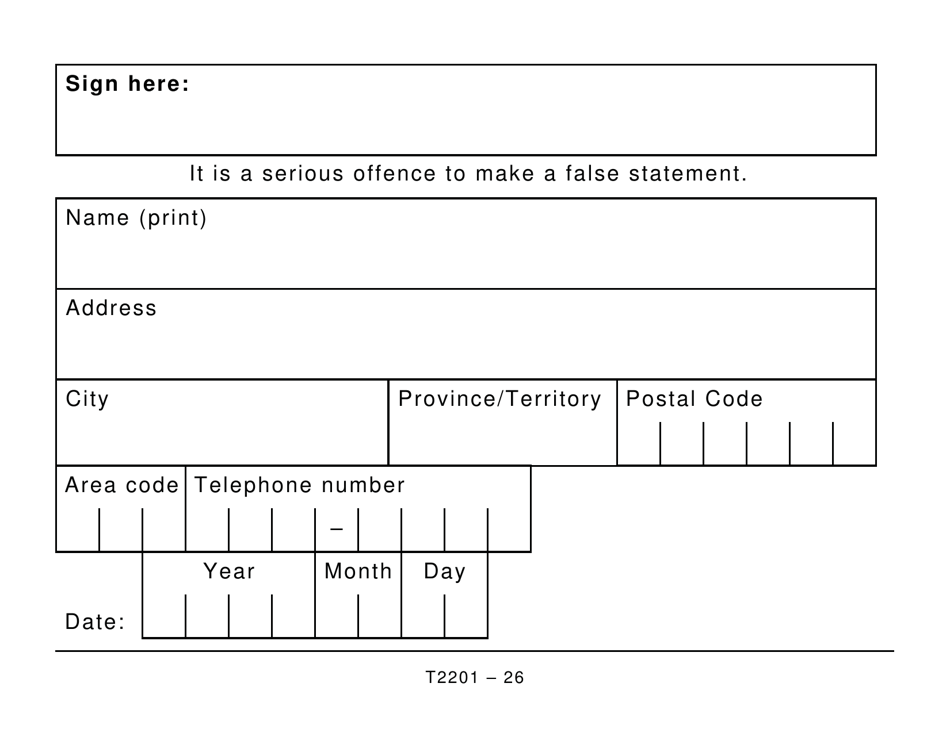

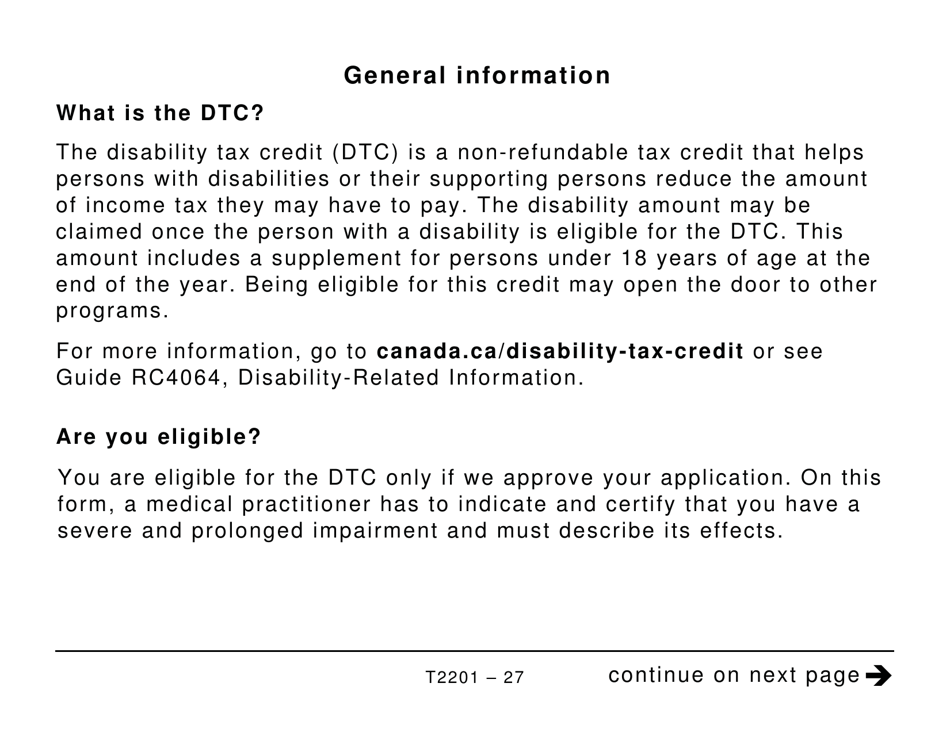

Form T2201 Disability Tax Credit Certificate - Large Print is a document used in Canada for individuals with disabilities to apply for the Disability Tax Credit (DTC). The DTC is a non-refundable tax credit that can reduce the amount of income tax payable for eligible individuals with disabilities. The large print version of the form is specifically designed for individuals who have visual impairments or difficulty reading standard-sized print.

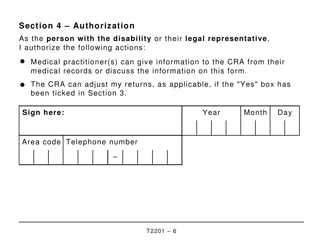

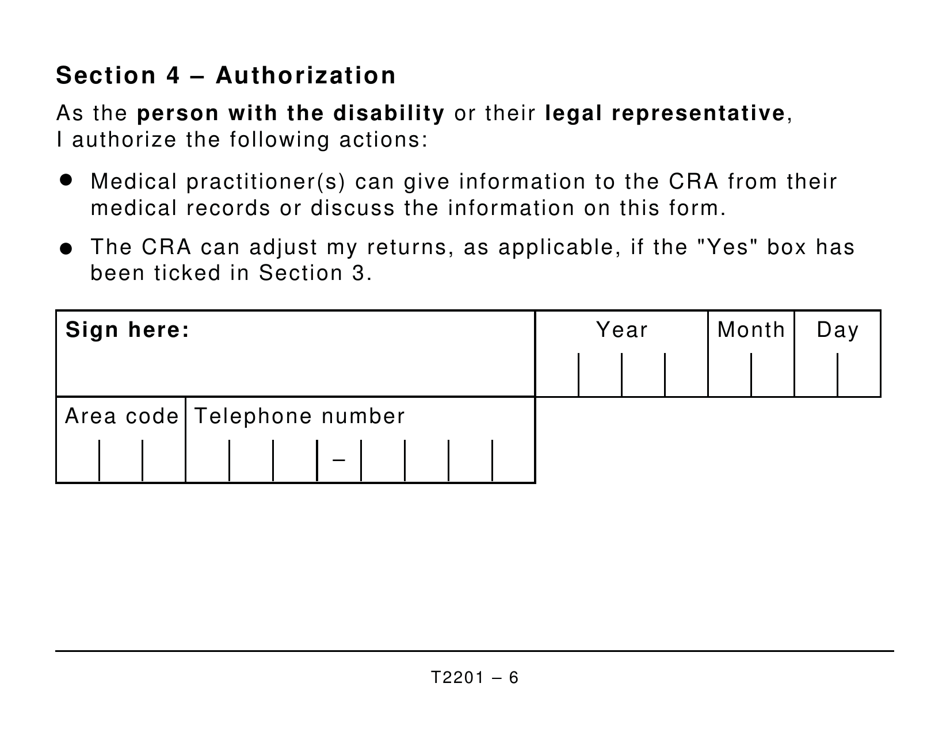

The Form T2201 Disability Tax Credit Certificate - Large Print in Canada is typically filed by individuals with disabilities themselves or by their authorized representatives such as legal guardians or power of attorney.

FAQ

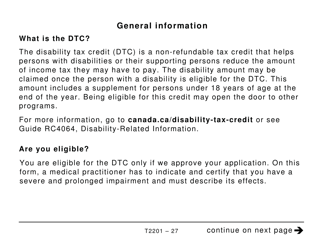

Q: What is Form T2201?

A: Form T2201 is a Disability Tax Credit Certificate in Canada.

Q: Who is eligible to use Form T2201?

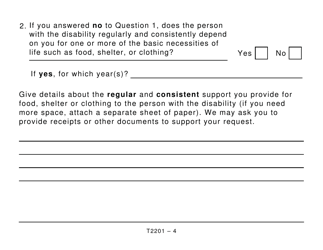

A: Individuals with disabilities or their supporting persons can use Form T2201.

Q: What is the purpose of Form T2201?

A: Form T2201 is used to apply for the Disability Tax Credit in Canada.

Q: Can I submit Form T2201 electronically?

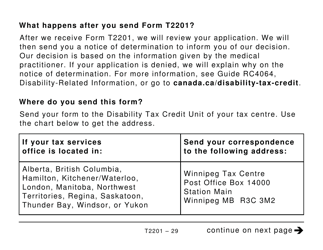

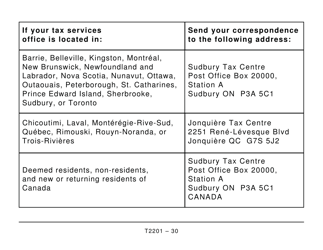

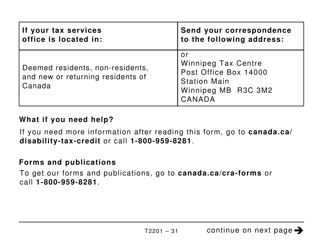

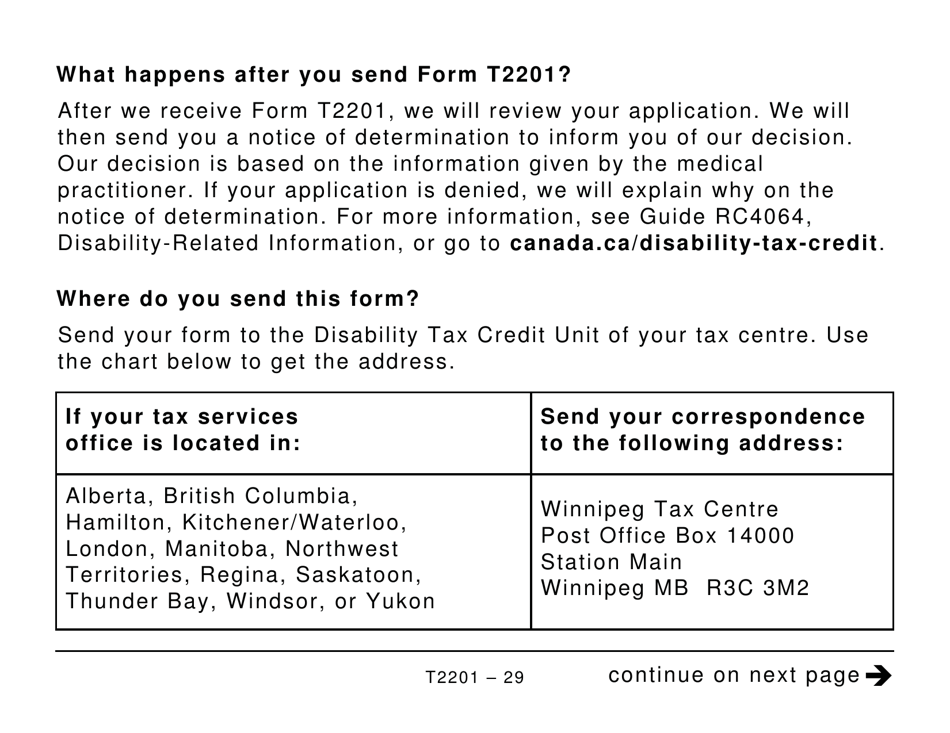

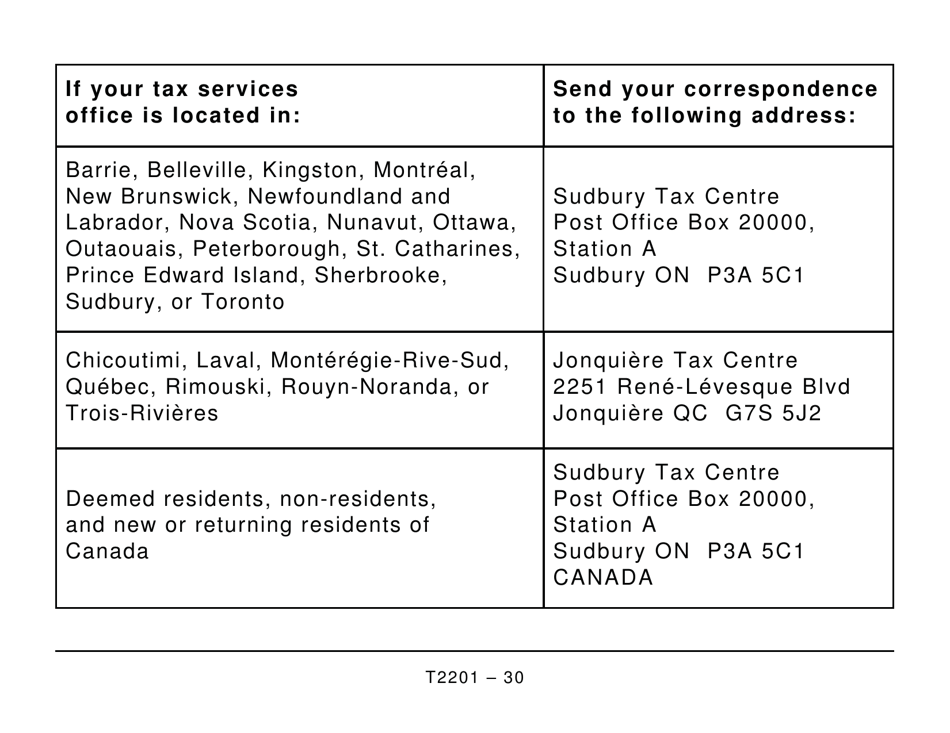

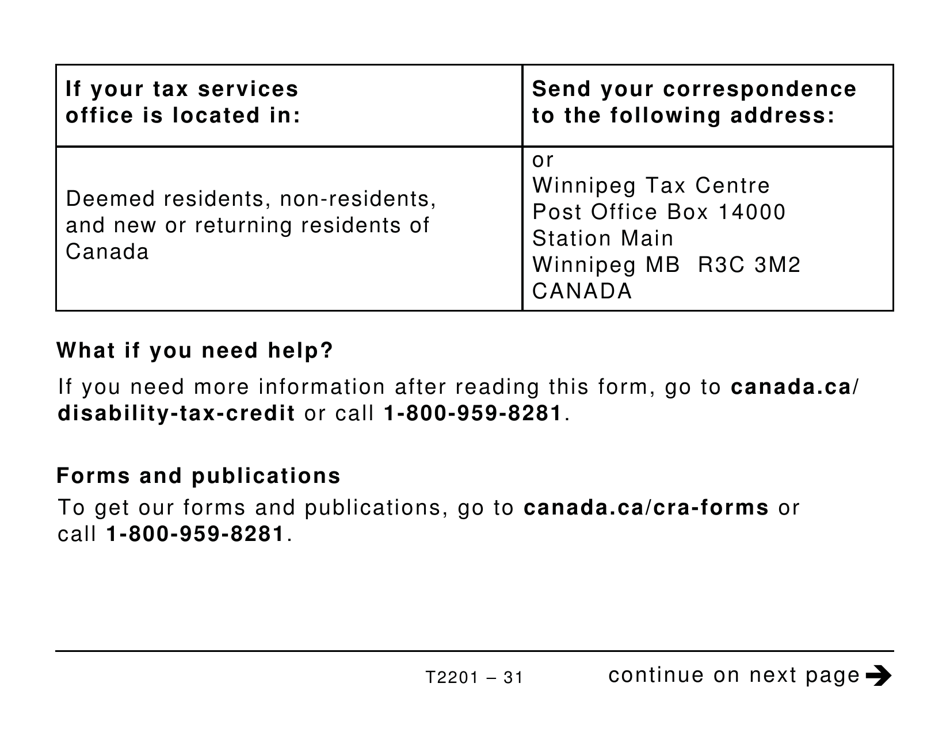

A: No, Form T2201 cannot be submitted electronically. It must be mailed or delivered to the CRA.

Q: What documents should be attached to Form T2201?

A: You may need to attach supporting documents, such as medical certificates, to Form T2201.

Q: What is the benefit of the Disability Tax Credit?

A: The Disability Tax Credit provides a non-refundable tax credit to individuals with disabilities or their supporting persons.

Q: What can the Disability Tax Credit be used for?

A: The Disability Tax Credit can be used to reduce the amount of income tax payable or to claim other tax credits, grants, or benefits.

Q: What if my Form T2201 is denied?

A: If your Form T2201 is denied, you have the right to appeal the decision with the CRA.

Q: Is there a deadline to submit Form T2201?

A: There is no specific deadline to submit Form T2201, but it is recommended to apply as soon as possible to start benefiting from the Disability Tax Credit.